Philippines Petrochemicals Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2026-2034

Philippines Petrochemicals Market Overview:

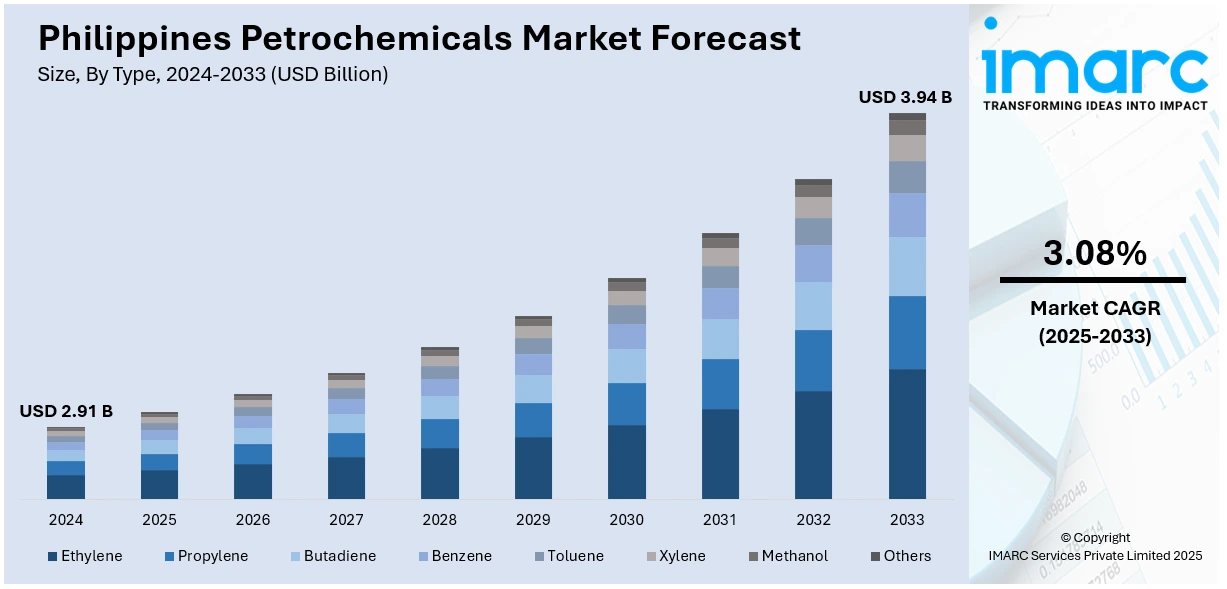

The Philippines petrochemicals market size reached USD 2.91 Billion in 2025. The market is projected to reach USD 3.94 Billion by 2034, exhibiting a growth rate (CAGR) of 3.08% during 2026-2034. The Philippines petrochemicals market is experiencing steady growth, driven by growing demand from construction, packaging, auto, and consumer goods sectors. Rising urbanization, infrastructure, and e-commerce growth are driving consumption of polymers, resins, and specialty chemicals in various applications. Sustainability efforts and adoption of renewable feedstocks are transforming the industry scenario as well. With robust domestic consumption and continued industrial developments, the industry is well-suited for long-term growth, further consolidating the Philippines petrochemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.91 Billion |

| Market Forecast in 2034 | USD 3.94 Billion |

| Market Growth Rate 2026-2034 | 3.08% |

Philippines Petrochemicals Market Trends:

Heightened Demand from Infrastructure Development and Construction

The Philippines continues to witness fast-paced development of infrastructure and real estate, creating high demand for petrochemical products like plastics, resins, and man-made materials in construction. State-led infrastructure projects and private real estate developments are driving the consumption of polymers, coatings, and specialty chemicals needed in the latest building applications. With the growth of urbanization, the dependency on light, strong, and inexpensive materials becomes more and more vital. This change in structure facilitates long-term Philippines petrochemicals market growth as industries turn to effective solutions for rising demands. Infrastructure modernization also amplifies downstream sectors such as automotive, packaging, and consumer goods, which further boost the base of applications. Petrochemicals are also increasingly finding applications in insulation, flooring, and piping systems, enhancing their contribution to sustainable and energy-saving construction methods. The synchronization of infrastructure growth with industrial demand underlines one of the most critical Philippines petrochemicals market trends for the upcoming decade.

To get more information on this market, Request Sample

Growing Use of Packaging and Consumer Products

The increasing middle-class population in the Philippines and changing consumer habits are contributing substantially to growing demand for consumer products and packaging materials. Flexible packaging, PET bottles, and lightweight containers are essential elements of the retail and food industries, which keep growing through advancing trade and e-commerce penetration. Petrochemicals are the backbone of such industries, providing flexibility, resistance, and affordability in packaging technologies. Mounting demand for convenience foods, drinks, and personal care products is fueling consistent Philippines petrochemicals market growth as packaging applications continue to diversify. Additionally, efforts on sustainable packaging are driving innovation in the creation of recyclable and bio-based solutions, opening avenues for innovation in petrochemical applications. Increased reliance on plastics and other associated materials in consumer-driven industries justifies one of the major Philippines petrochemicals market trends, where the need for high-quality, safe, and efficient packaging is a prevailing growth driver determining industrial strategies and product development in the nation.

Growing Integration of Renewable and Sustainable Solutions

The Philippines' petrochemicals sector is gradually adopting a transition to sustainability, following global movements focusing on circular economy principles. Increasing awareness about environmental effects is compelling businesses to embrace bio-based feedstocks, recyclable plastics, and energy-efficient technologies. Firms are spending on innovations to minimize carbon footprints, aligning with long-term environmental priorities while advancing industrial competitiveness. Such a shift is anticipated to make a substantial contribution towards Philippines petrochemicals market growth because demand is moving in the direction of cleaner and sustainable options. Pressure for renewable options also comes from consumer demand for environmentally friendly products and policy support for resource efficiency. The integration of sustainable technologies in manufacturing and end-use processes is one of the revolutionary Philippines petrochemicals market trends, with industries walking on a tightrope between economic prosperity and ecological responsibility. The convergence of sustainability with petrochemical production is set to define the sector’s evolution, strengthening its role in the country’s industrial ecosystem.

Philippines Petrochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- Ethylene

- Propylene

- Butadiene

- Benzene

- Toluene

- Xylene

- Methanol

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes ethylene, propylene, butadiene, benzene, toluene, xylene, methanol, and others.

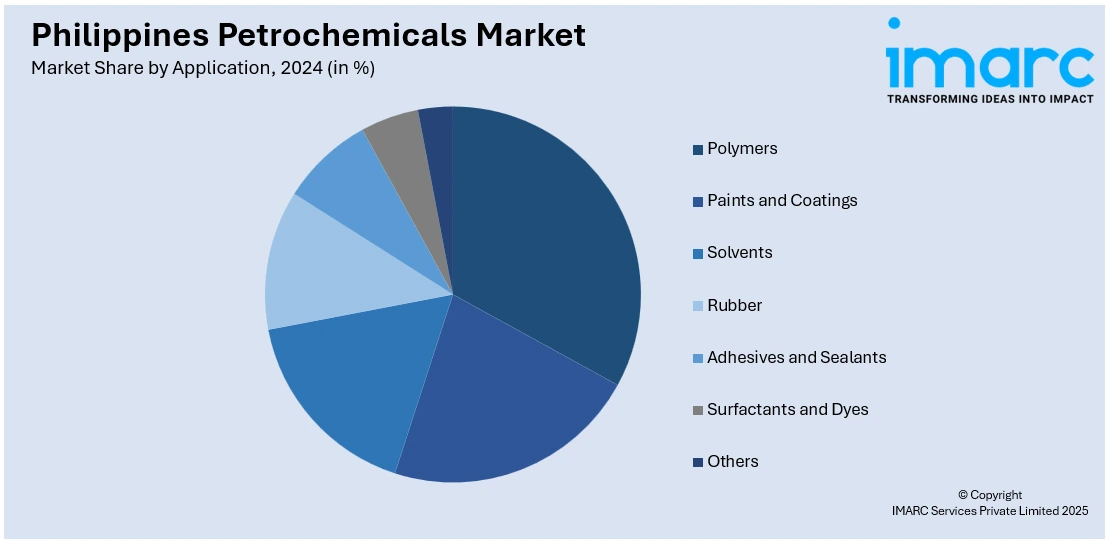

Application Insights:

- Polymers

- Paints and Coatings

- Solvents

- Rubber

- Adhesives and Sealants

- Surfactants and Dyes

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes polymers, paints and coatings, solvents, rubber, adhesives and sealants, surfactants and dyes, and others.

End Use Industry Insights:

- Packaging

- Automotive and Transportation

- Construction

- Electrical and Electronics

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes packaging, automotive and transportation, construction, electrical and electronics, healthcare, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Petrochemicals Market News:

- In March 2024, JG Summit Olefins Corporation expanded petrochemical capacity in the Philippines to strengthen domestic supply and value chains. The move addresses rising industrial demand for petrochemical products, supporting sectors such as construction, packaging, and manufacturing while reducing reliance on imports and fostering sustainable market growth.

Philippines Petrochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ethylene, Propylene, Butadiene, Benzene, Toluene, Xylene, Methanol, Others |

| Applications Covered | Polymers, Paints and Coatings, Solvents, Rubber, Adhesives and Sealants, Surfactants and Dyes, Others |

| End Use Industries Covered | Packaging, Automotive and Transportation, Construction, Electrical and Electronics, Healthcare, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines petrochemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines petrochemicals market on the basis of type?

- What is the breakup of the Philippines petrochemicals market on the basis of application?

- What is the breakup of the Philippines petrochemicals market on the basis of end use industry?

- What is the breakup of the Philippines petrochemicals market on the basis of region?

- What are the various stages in the value chain of the Philippines petrochemicals market?

- What are the key driving factors and challenges in the Philippines petrochemicals market?

- What is the structure of the Philippines petrochemicals market and who are the key players?

- What is the degree of competition in the Philippines petrochemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines petrochemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines petrochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines petrochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)