Philippines Pharmaceutical Market Size, Share, Trends, and Forecast by Prescription Therapeutic Category, Therapeutic Category, and Region, 2026-2034

Philippines Pharmaceutical Market Overview:

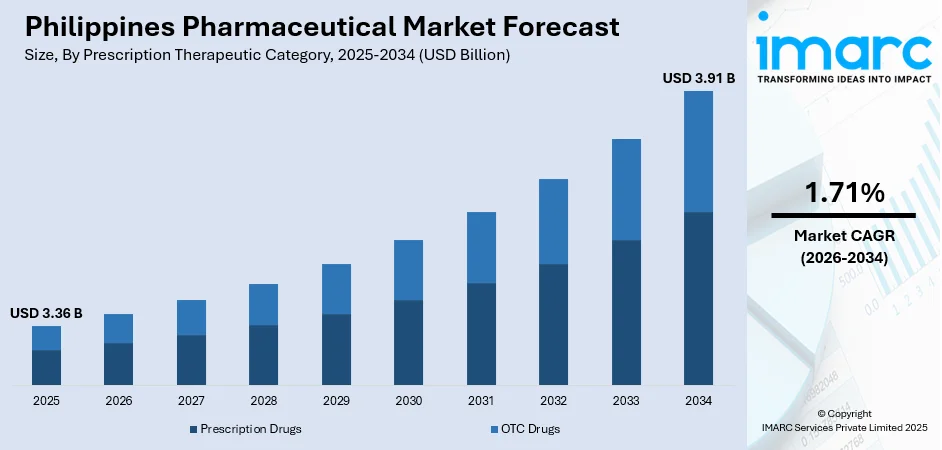

The Philippines pharmaceutical market size reached USD 3.36 Billion in 2025. Looking forward, the market is expected to reach USD 3.91 Billion by 2034, exhibiting a growth rate (CAGR) of 1.71% during 2026-2034. The market is expanding steadily, driven by rising healthcare needs, improved access to medicines, and growing demand for both prescription and over-the-counter drugs. Government healthcare reforms increased local manufacturing, and digital health adoption is further fueling growth. These developments collectively shape the evolving landscape of the Philippines pharmaceutical market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.36 Billion |

| Market Forecast in 2034 | USD 3.91 Billion |

| Market Growth Rate 2026-2034 | 1.71% |

Key Trends of Philippines Pharmaceutical Market:

Rising Healthcare Expenditure

Healthcare expenditure in the Philippines is on a steady rise, fueled by increased government funding, private sector investments, and out-of-pocket spending by individuals. In line with this, industry reports state that medical inflation in the nation elevated to 19.3% during 2024. The Philippine government has greatly increased its health budget in recent years, with a focus on strengthening public healthcare facilities, subsidizing necessary drugs, and funding universal healthcare programs. For instance, as per industry reports, in 2024, the government of Philippines approved an expansion of budget at USD 514.44 Million for Health Facilities Enhancement Program. This represents a 6.6% increase as compared to the 2023 funds. This financial support is enabling the procurement of advanced pharmaceutical products and the adoption of innovative medical technologies. Private healthcare providers are also playing a vital role by expanding their services and investing in high-quality pharmaceutical products to cater to a growing middle-class population. Additionally, consumer spending on healthcare is increasing, as individuals prioritize health and wellness. This trend is particularly evident in urban areas where higher disposable incomes are driving the demand for premium medications and wellness products.

To get more information on this market, Request Sample

Growing Geriatric Population

The Philippines is experiencing a demographic shift, with a growing geriatric population requiring extensive healthcare and pharmaceutical interventions. For instance, as per the United Nations Population Fund, around 6% of the total Philippines population is aged 65 years or more than that. These adults are comparatively more prone to both degenerative and chronic disorders encompassing arthritis, hypertension, or diabetes, significantly boosting the need for personalized treatments as well as long-term medications. This trend has incentivized pharmaceutical firms to actively emphasize on formulating age-catered products, enveloping developments customized for geriatric patients. Additionally, the healthcare system is adapting to cater to this demographic, with geriatric care centers and age-friendly medical facilities on the rise. Government policies and programs, such as subsidies for senior citizens and free healthcare initiatives for geriatric, are also contributing to the growth of the pharmaceutical market.

Growth Drivers of Philippines Pharmaceutical Market:

Expansion of Universal Health Care (UHC)

The implementation of the Universal Health Care (UHC) Act in the Philippines is playing a vital role in expanding access to medicines and healthcare services nationwide. Under this law, the government has also shifted more funds towards public health services so that more people are insured, and more essential medicines are available. UHC also facilitates health system reforms focused on increasing the efficiency of the services and inclusiveness to underprivileged communities. The change in the policy is increasing not only the affordability of treatment but also boosting the demand for pharmaceuticals. As Filipinos enjoy more government-supported care, the UHC Act becomes a potent driver of increase and fairness in the national drug industry.

Urbanization and Lifestyle-Related Diseases

The ongoing urbanization in the Philippines, paired with evolving lifestyle habits, has contributed to a notable increase in non-communicable diseases such as diabetes, hypertension, heart disease, and obesity. These conditions are often linked to sedentary routines, poor dietary choices, and heightened stress levels in urban settings. As a result, the demand for chronic disease management medications is on the rise. Long-term therapies, regular medical monitoring, and preventive pharmaceutical products are becoming essential in daily healthcare routines. This trend is pushing pharmaceutical companies to diversify their product offerings and develop long-term treatment solutions. The growing burden of lifestyle-related illnesses is a key driver shaping the future of the country’s drug market.

Advancements in Local Manufacturing

The growth of local pharmaceutical manufacturing in the Philippines is being fueled by government support, policy incentives, and technological improvements. These advancements are enabling companies to scale production, enhance quality, and meet rising domestic demand. By producing drugs locally, the industry reduces reliance on imports, cuts transportation costs, and ensures better control over pricing and supply chain logistics. This move also increases resilience against global disruptions, such as those experienced during the pandemic. Furthermore, local manufacturing allows faster market entry for new products and promotes innovation through research collaborations. These developments are critical in improving medicine availability, affordability, and overall healthcare outcomes across the country.

Opportunities of Philippines Pharmaceutical Market:

Growth of Over-the-Counter (OTC) and Wellness Products

There is a noticeable rise in consumer preference for self-care and preventive health solutions in the Philippines, leading to increased demand for over-the-counter (OTC) drugs and wellness products. Filipinos are increasingly purchasing vitamins, supplements, herbal remedies, and non-prescription medications to manage minor ailments without visiting healthcare professionals. This shift is driven by greater health awareness, busy lifestyles, and rising healthcare costs. For pharmaceutical companies, this presents a major opportunity to introduce innovative, easy-to-use, and affordable OTC offerings. Branding, convenience in packaging, and strategic retail placement play key roles in market penetration. As wellness becomes a mainstream concern, this segment is expected to grow steadily, expanding the industry's consumer base and product diversification.

Digital Health and E-Pharmacy Platforms

The rapid adoption of digital technologies in the healthcare sector is boosting the Philippines pharmaceutical market growth. Telemedicine services, e-pharmacy platforms, and mobile health applications are transforming how patients access medications and consultations. These digital channels offer enhanced convenience, especially in remote or underserved areas, where physical access to pharmacies may be limited. They also streamline prescription fulfillment and enable faster, more personalized care through digital records and AI-driven tools. As internet and smartphone penetration increases across the country, more consumers are turning to online platforms for their health needs. This digital transformation is expanding pharmaceutical reach while improving patient engagement and healthcare delivery efficiency.

Regional Market Penetration

Significant growth potential exists beyond the highly saturated Metro Manila region, particularly in underserved areas across Visayas and Mindanao. These regions are witnessing improving logistics networks and expanding healthcare infrastructure, which are making pharmaceutical distribution more efficient and widespread. In addition, government health outreach programs and local partnerships are helping raise awareness about available treatments and preventive care. By tapping into these emerging markets, pharmaceutical companies can access new customer segments while reducing overdependence on urban centers. Tailoring marketing strategies and product availability to local needs further enhances success. Regional expansion not only diversifies revenue streams but also contributes to more inclusive healthcare access across the Philippine archipelago.

Government Initiatives of Philippines Pharmaceutical Market:

Support for Local Pharmaceutical Hubs

The Philippine government is actively supporting the establishment of specialized pharmaceutical zones to boost local drug manufacturing and attract foreign and domestic investment. Initiatives like the Victoria Industrial Park in Tarlac serve as dedicated pharmaceutical hubs, offering strategic incentives and infrastructure to promote research, innovation, and production. These economic zones aim to reduce the country’s reliance on imported medicines while strengthening self-sufficiency in drug supply. By fostering collaboration between manufacturers, research institutions, and regulatory agencies, these hubs help streamline processes and encourage advanced manufacturing techniques. This approach is expected to enhance product quality, create local jobs, and position the Philippines as a competitive player in the regional pharmaceutical supply chain.

Enhanced Drug Price Regulation

To ensure equitable healthcare access, the Philippine government continues to implement and expand drug pricing reforms through the Maximum Drug Retail Price (MDRP) policy. This initiative places price ceilings on a wide range of essential medicines, including treatments for chronic and life-threatening conditions, which is driving the Philippines pharmaceutical market demand. By regulating costs, the government aims to reduce the financial burden on low- to middle-income Filipinos, limiting out-of-pocket expenses for essential therapies. Regular policy updates and stakeholder consultations help refine the list of covered medicines. This regulatory effort supports not only affordability but also encourages better treatment adherence, especially for long-term care patients. The MDRP policy remains a central mechanism in promoting public health equity across the country.

Promotion of Public-Private Partnerships (PPPs)

Public-private partnerships (PPPs) are becoming a crucial strategy in enhancing the Philippines’ pharmaceutical and healthcare infrastructure. These collaborations involve joint efforts between government agencies and private sector stakeholders in areas such as vaccine manufacturing, hospital development, and medicine distribution. PPPs help bridge resource and capacity gaps, accelerate the deployment of new technologies, and improve logistics efficiency. By pooling expertise and investment, these initiatives promote innovation and expand access to high-quality care in both urban centers and remote regions. The government’s growing emphasis on PPPs is also fostering greater trust between sectors and creating sustainable models for healthcare delivery. This approach enhances resilience, especially during public health emergencies or supply disruptions.

Challenges of Philippines Pharmaceutical Market:

Regulatory Delays and Bureaucracy

The Philippine pharmaceutical market continues to face significant challenges due to slow regulatory procedures and bureaucratic inefficiencies. Prolonged timelines for drug registration, product approval, and licensing create barriers for companies looking to introduce innovative therapies. These delays can stall the entry of life-saving medications, ultimately affecting patient care and market responsiveness. Inconsistent policies and shifting compliance requirements further complicate the process, especially for international pharmaceutical firms unfamiliar with the local landscape. The lack of streamlined digital systems and limited coordination among regulatory bodies add to the inefficiencies. As a result, companies may hesitate to invest in or expand within the market, hindering both innovation and competitive growth in the healthcare sector.

High Dependence on Imports

The Philippine pharmaceutical sector relies heavily on imported active pharmaceutical ingredients (APIs) and finished medicines, making it vulnerable to external market fluctuations. According to the Philippines pharmaceutical market analysis, this dependence exposes the industry to global supply chain disruptions, geopolitical instability, and currency volatility, which can lead to pricing uncertainties and product shortages. Events such as the COVID-19 pandemic have highlighted the risks of limited local production capacity, as border closures and export restrictions disrupted the flow of essential drugs. Additionally, high importation costs can be passed on to consumers, affecting medicine affordability. Strengthening local manufacturing capabilities remains a critical need to ensure a stable, self-reliant pharmaceutical ecosystem and reduce the country’s exposure to global uncertainties.

Intellectual Property and Generic Competition

Intellectual property (IP) protection remains a complex issue in the Philippines pharmaceutical landscape. While efforts have been made to strengthen IP regulations, enforcement remains inconsistent, making it difficult for companies to fully protect patented products. This lack of robust protection discourages multinational firms from launching high-investment drugs locally. Moreover, the widespread availability of low-cost generic alternatives, while beneficial for affordability, creates pricing pressure on original products. This competition can shrink profit margins, reducing funds available for research and development. Balancing affordable access to essential drugs with fair protection for pharmaceutical innovation is a continuing challenge. Improving IP enforcement is key to attracting global players and supporting long-term investment in new therapies.

Philippines Pharmaceutical Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on prescription therapeutic category and therapeutic category.

Prescription Therapeutic Category Insights:

- Prescription Drugs

- Branded

- Generics

- OTC Drugs

The report has provided a detailed breakup and analysis of the market based on the prescription therapeutic category. This includes prescription drugs (Branded, Generics) and OTC drugs.

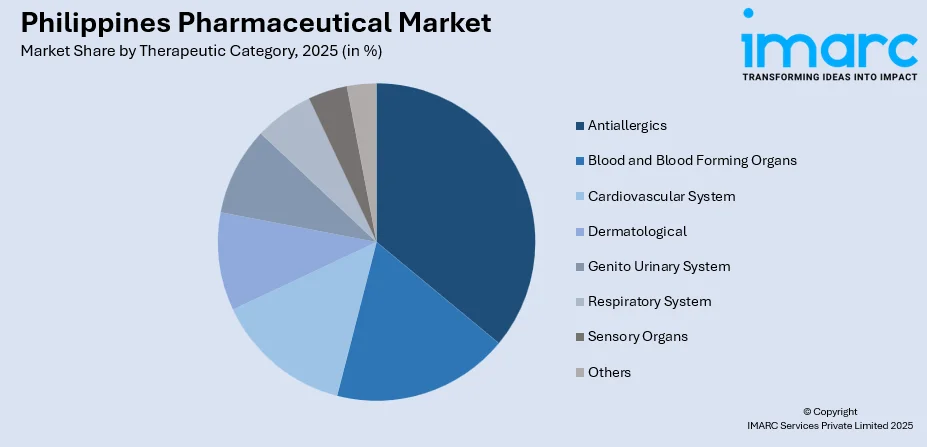

Therapeutic Category Insights:

- Antiallergics

- Blood and Blood Forming Organs

- Cardiovascular System

- Dermatological

- Genito Urinary System

- Respiratory System

- Sensory Organs

- Others

A detailed breakup and analysis of the market based on the therapeutic category have also been provided in the report. This includes antiallergics, blood and blood forming organs, cardiovascular system, dermatological, genito urinary system, respiratory system, sensory organs, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Astellas Pharma Inc.

- AstraZeneca

- Medinova Pharmaceutical Inc

- Multicare Pharmaceuticals Philippines, Inc

- Nurturemed Pharma Inc.

- Otsuka (Philippines) Pharmaceutical, Inc

- Takeda Pharmaceutical Company Limited

- The Cathay Drug Company Inc

- Unilab, Inc.

- Vendiz Pharmaceuticals, Inc.

Philippines Pharmaceutical Market News:

- In May 2025, the Philippine Economic Zone Authority (PEZA), in partnership with the Food and Drug Administration (FDA), officially inaugurated the country’s first pharmaceutical economic zone in Barangay Baculong, Victoria, Tarlac. PEZA Director General Tereso O. Panga stated that the 30-hectare Victoria Industrial Park (VIP) is envisioned to evolve into a vibrant center for investment, innovation, medical research, and inclusive development.

- In March 2025, Sole Pharma, a prominent European pharmaceutical manufacturer, announced its entry into the Southeast Asian market, responding to the rising demand for premium health supplements in the Philippines. Filipino consumers can now access Sole Pharma’s science-based, high-quality formulations through major retailers including Mercury Drug, Watson’s, Rose Pharmacy, and Allgreen RX, as well as via its official Lazada and Shopee online stores.

- In August 2024, Delex Pharma International Inc. introduced a robust lineup of 11 new pharmaceutical products, positioning the company for substantial expansion across diverse therapeutic segments. This strategic rollout underscores Delex Pharma’s dedication to meeting urgent healthcare demands in the Philippines, with a focus on areas such as critical care, oncology, anesthesia, anti-infectives, women’s health, and medical devices.

- In October 2023, Venus Remedies received marketing approval from the Philippines for six key chemotherapy drugs, including bortezomib, cisplatin, doxorubicin, docetaxel, fluorouracil, and paclitaxel.

- In November 2023, Robinsons Retail Holdings Inc. (RRHI), a subsidiary of the Gokongwei Group, was cleared by the Philippine Competition Commission (PCC) for its acquisition of Rose Pharmacy Inc. The acquisition enables RRHI to utilize both its synergies and scale to bolster a comprehensive product assortment, greater consumer service, and provide better value to its users in the Philippines.

Philippines Pharmaceutical Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Prescription Therapeutic Categories Covered |

|

| Therapeutic Categories Covered | Antiallergics, Blood and Blood Forming Organs, Cardiovascular System, Dermatological, Genito Urinary System, Respiratory System, Sensory Organs, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Companies Covered | Astellas Pharma Inc., AstraZeneca, Medinova Pharmaceutical Inc, Multicare Pharmaceuticals Philippines, Inc, Nurturemed Pharma Inc., Otsuka (Philippines) Pharmaceutical, Inc, Takeda Pharmaceutical Company Limited, The Cathay Drug Company Inc, Unilab, Inc., Vendiz Pharmaceuticals, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines pharmaceutical market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pharmaceutical market in the Philippines was valued at USD 3.36 Billion in 2025.

The Philippines pharmaceutical market is projected to exhibit a CAGR of 1.71% during 2026-2034.

The Philippines pharmaceutical market is projected to reach a value of USD 3.91 Billion by 2034.

The pharmaceutical landscape in the Philippines is shaped by surging demand for affordable generics, expanding over-the-counter (OTC) and herbal remedies, and a growing reliance on digital and online pharmacy services. Increased consumer health awareness, rapid adoption of telemedicine and mobile health apps, and government-led regulatory reforms also support market evolution and accessibility.

The growth is driven by rising healthcare expenditures backed by universal healthcare rollout, increasing chronic and age-related diseases, and sustained government support for domestic generic drug production. Efforts to improve regulatory approvals, promote manufacturing zones, and expand access to essential medicines further boost industry expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)