Philippines Pharmacovigilance Market Size, Share, Trends and Forecast by Service Provider, Product Life Cycle, Type, Process Flow, Therapeutic Area, End Use, and Region, 2026-2034

Philippines Pharmacovigilance Market Overview:

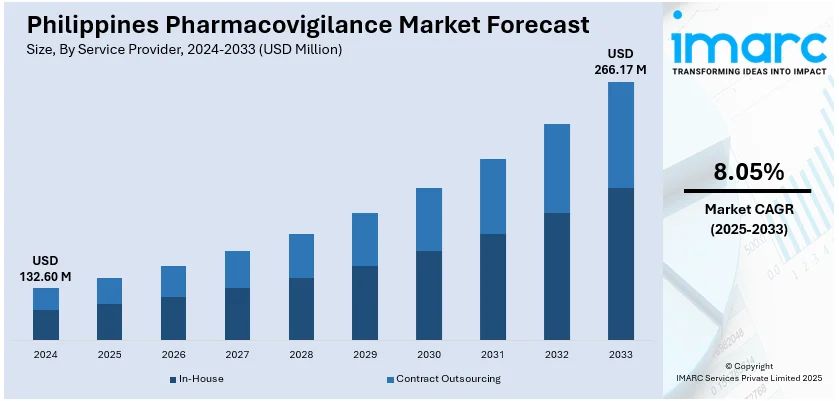

The Philippines pharmacovigilance market size reached USD 38.25 Million in 2025. The market is projected to reach USD 91.22 Million by 2034, exhibiting a growth rate (CAGR) of 9.08% during 2026-2034. The market is expanding with stricter regulatory standards, rising patient safety awareness, and adoption of digital monitoring tools. Additionally, outsourcing of safety services and growing clinical trials continue to strengthen Philippines pharmacovigilance market share across pharmaceutical and healthcare sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 38.25 Million |

| Market Forecast in 2034 | USD 91.22 Million |

| Market Growth Rate 2026-2034 | 9.08% |

Philippines Pharmacovigilance Market Trends:

Rising Regulatory Focus and Compliance

The Philippines pharmacovigilance market growth is strongly shaped by increasing regulatory attention on drug safety and monitoring practices. Health authorities in the country are steadily aligning local requirements with international standards set by agencies such as the World Health Organization (WHO) and the International Council for Harmonisation (ICH). This move is driving companies to adopt more structured reporting systems and integrate advanced monitoring tools for better detection of adverse drug reactions. Pharmaceutical firms, clinical research organizations, and healthcare providers are investing in digital platforms that streamline case reporting and ensure compliance with safety obligations. Alongside this, collaborations with global pharmacovigilance service providers are becoming more common, giving local players access to specialized knowledge and scalable resources. These initiatives are not only strengthening drug safety systems but also enhancing transparency and accountability in the healthcare industry. As patient safety awareness continues to rise, regulators are expected to enforce stricter penalties for non-compliance, which further accelerates the adoption of proactive surveillance measures. This regulatory-driven environment is emerging as one of the key forces supporting long-term growth and modernization in the sector, making pharmacovigilance a central pillar of pharmaceutical operations in the Philippines.

To get more information on this market, Request Sample

Expanding Digital Solutions and Outsourcing

A major trend shaping the Philippines pharmacovigilance sector is the rapid adoption of digital solutions combined with growing reliance on outsourcing. Local pharmaceutical companies are recognizing the benefits of using artificial intelligence, automation, and cloud-based systems to manage large volumes of safety data more effectively. These technologies reduce manual errors, improve reporting accuracy, and allow real-time monitoring of adverse events, creating a more reliable safety ecosystem. At the same time, many firms are partnering with specialized outsourcing providers that offer cost-effective pharmacovigilance services, ranging from case processing to risk management planning. This trend is particularly valuable for mid-sized and emerging companies that face resource limitations yet must meet stringent safety standards. The outsourcing model not only brings financial efficiency but also provides access to trained professionals with global expertise. Additionally, the expanding clinical trials landscape in the Philippines is fueling the demand for stronger pharmacovigilance infrastructure, pushing both local and international stakeholders to strengthen their presence in the market. Collectively, these factors are accelerating innovation, increasing competitiveness, and positioning digital adoption and outsourcing as crucial drivers of growth in the national pharmacovigilance market.

Philippines Pharmacovigilance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on service provider, product life cycle, type, process flow, therapeutic area, and end use.

Service Provider Insights:

- In-House

- Contract Outsourcing

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes in-house and contract outsourcing.

Product Life Cycle Insights:

- Pre-Clinical

- Phase I

- Phase II

- Phase III

- Phase IV

A detailed breakup and analysis of the market based on the product life cycle have also been provided in the report. This includes pre-clinical, phase I, phase II, phase III, and phase IV.

Type Insights:

- Spontaneous Reporting

- Intensified ADR Reporting

- Targeted Spontaneous Reporting

- Cohort Event Monitoring

- EHR Mining

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes spontaneous reporting, intensified ADR reporting, targeted spontaneous reporting, cohort event monitoring, and EHR mining.

Process Flow Insights:

- Case Data Management

- Case Logging

- Case Data Analysis

- Medical Reviewing and Reporting

- Signal Detection

- Adverse Event Logging

- Adverse Event Analysis

- Adverse Event Review and Reporting

- Risk Management System

- Risk Evaluation System

- Risk Mitigation System

A detailed breakup and analysis of the market based on the process flow have also been provided in the report. This includes case data management (case logging, case data analysis, and medical reviewing and reporting), signal detection (adverse event logging, adverse event analysis, and adverse event review and reporting), and risk management system (risk evaluation system and risk mitigation system).

Therapeutic Area Insights:

- Oncology

- Neurology

- Cardiology

- Respiratory Systems

- Others

A detailed breakup and analysis of the market based on the therapeutic area have also been provided in the report. This includes oncology, neurology, cardiology, respiratory systems, and others.

End Use Insights:

.jpeg)

- Pharmaceuticals Companies

- Biotechnology Companies

- Medical Device Companies

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes pharmaceuticals companies, biotechnology companies, medical device companies, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Pharmacovigilance Market News:

- October 2023: The FDA Philippines launched the VigiMobile App to enhance adverse drug reaction reporting. The initiative supported pharmacovigilance efforts, improved medicine and vaccine safety monitoring, and strengthened public participation, positively impacting the Philippines pharmacovigilance market by boosting transparency, responsiveness, and regulatory capacity.

Philippines Pharmacovigilance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | In-House, Contract Outsourcing |

| Product Life Cycles Covered | Pre-Clinical, Phase I, Phase II, Phase III, Phase IV |

| Types Covered | Spontaneous Reporting, Intensified ADR Reporting, Targeted Spontaneous Reporting, Cohort Event Monitoring, EHR Mining |

| Process Flows Covered |

|

| Therapeutic Areas Covered | Oncology, Neurology, Cardiology, Respiratory Systems, Others |

| End Uses Covered | Pharmaceuticals Companies, Biotechnology Companies, Medical Device Companies, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines pharmacovigilance market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines pharmacovigilance market on the basis of service provider?

- What is the breakup of the Philippines pharmacovigilance market on the basis of product life cycle?

- What is the breakup of the Philippines pharmacovigilance market on the basis of type?

- What is the breakup of the Philippines pharmacovigilance market on the basis of process flow?

- What is the breakup of the Philippines pharmacovigilance market on the basis of therapeutic area?

- What is the breakup of the Philippines pharmacovigilance market on the basis of end use ?

- What is the breakup of the Philippines pharmacovigilance market on the basis of region?

- What are the various stages in the value chain of the Philippines pharmacovigilance market?

- What are the key driving factors and challenges in the Philippines pharmacovigilance market?

- What is the structure of the Philippines pharmacovigilance market and who are the key players?

- What is the degree of competition in the Philippines pharmacovigilance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines pharmacovigilance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines pharmacovigilance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines pharmacovigilance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)