Philippines Plant Based Food Market Size, Share, Trends and Forecast by Type, Source, Distribution Channel, and Region, 2025-2033

Philippines Plant Based Food Market Overview:

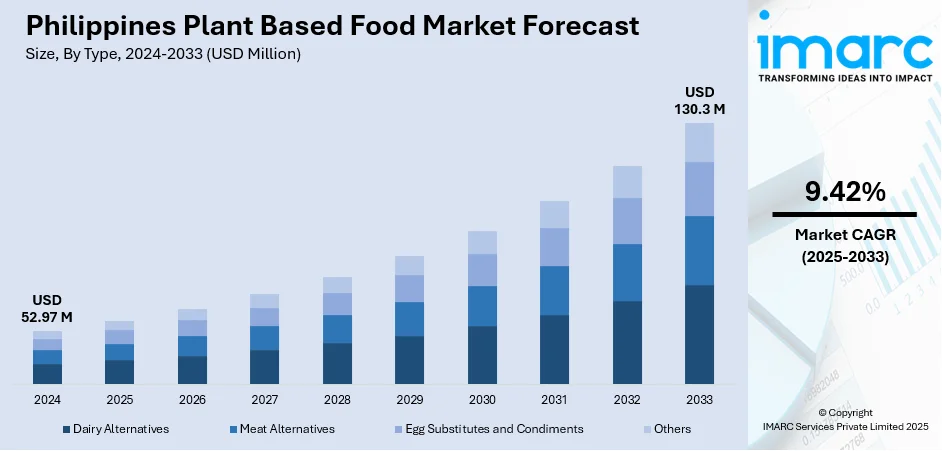

The Philippines plant based food market size reached USD 52.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 130.30 Million by 2033, exhibiting a growth rate (CAGR) of 9.42% during 2025-2033. At present, people are increasingly placing a priority on health and well-being in their food choices. Moreover, environmental consciousness is influencing consumerism in the Philippines, thereby catalyzing the demand for vegan food. Apart from this, the rising availability of vegan food products via retail channels and e-commerce sites is expanding the Philippines plant based food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.97 Million |

| Market Forecast in 2033 | USD 130.30 Million |

| Market Growth Rate 2025-2033 | 9.42% |

Philippines Plant Based Food Market Trends:

Increasing Health and Well-being Awareness

The Philippines plant-based food industry is experiencing robust growth as people are increasingly placing a priority on health and well-being in their food choices. More people are being mindful of the relationship between diet and chronic diseases like obesity, diabetes, and heart disease that are common in the country. Consequently, individuals are looking for food products with less cholesterol, saturated fat, and calories yet still provide vital nutrients. Plant-based foods are seen as a healthier alternative to conventional animal-based foods in line with the larger trend towards preventive medicine. Social media, health initiatives, and online influencers are constantly spreading the word about plant-based diets, further making it attractive to younger populations. This mindset change is driving the adoption of plant-based food products in cities, where consumers are testing meat alternatives, plant-based milk, and other new food solutions as part of a growing transition towards health-conscious living. In 2025, Ascott Limited became the first company to introduce a plant-based target in the country. It collaborated with the sustainability NGO Lever Foundation to pledge that 20% of its menu will be plant-based by this year, increasing to 30% by 2027, at its 17 locations throughout the country.

To get more information on this market, Request Sample

Increasing Environmental and Sustainability Issues

Environmental consciousness is increasingly influencing consumerism in the Philippines, catalyzing the demand for plant-based food. As problems like deforestation, climate change, and depletion of resources attract greater attention, consumers become increasingly aware about the environmental impact of animal agriculture. Plant-based options are being marketed as environment friendly alternatives reducing greenhouse gases, water use, and land use. Younger generations, especially Millennials and Gen Z, are moving toward aligning consumption patterns with principles of sustainability and ethical living. Corporate social responsibility, public campaigns by governments, and awareness raised by non-governmental organizations are further scaling up this change by advocating sustainable diets as a part of climate action plans. Food industry firms are responding by introducing plant-based product lines and emphasizing green-friendly branding. This synchronization among consumer sensitization and business efforts is consistently strengthening plant-based food uptake as an eco-friendly option in the Philippine market. In 2025, 7-Eleven in Philippines started offering products and meals presenting plant-based meat and fish from Indonesia’s Green Rebel Foods. Initially launched to promote the Catholic Lenten fasting season, the partnership has now grown to encompass more than 2,000 stores nationwide, tapping into the Filipino interest in plant-based meat.

Growth of Foodservice and Retail Availability

Availability of plant-based offerings is steadily rising in the Philippines via foodservice platforms, supermarkets, and the internet, simplifying exposure and adoption for consumers. Major quick-service chains and café companies are launching plant-based options to meet shifting consumer tastes, enabling higher visibility and securing mainstream acceptance, thereby impelling Philippines plant based food market growth. They are also allotting increasing shelf space to plant-based meat, dairy alternatives, and snacks, aided by appealing packaging and marketing campaigns. Online platforms are also driving accessibility by providing nationwide delivery, subscription, and promotion packages, drawing both urban and rural consumers. Global plant-based brands continue to enter the Philippine market by partnering with local distributors, while local manufacturers innovate with locally inspired flavors to address local tastes. IMARC group predicts that the Philippines e-commerce market is projected to attain USD 75.59 Billion by 2033.

Philippines Plant Based Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, source, and distribution channel.

Type Insights:

- Dairy Alternatives

- Meat Alternatives

- Egg Substitutes and Condiments

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dairy alternatives, meat alternatives, egg substitutes and condiments, and others.

Source Insights:

- Soy

- Almond

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes soy, almond, wheat, and others.

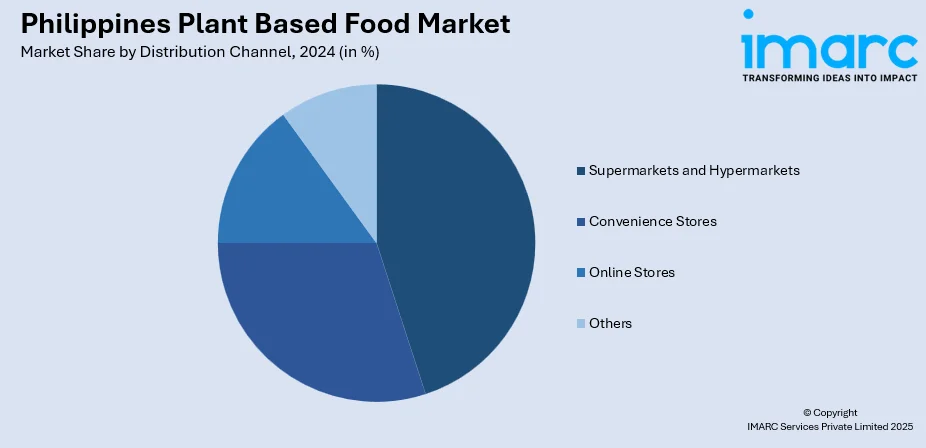

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Plant Based Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dairy Alternatives, Meat Alternatives, Egg Substitutes and Condiments, Others |

| Sources Covered | Soy, Almond, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines plant based food market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines plant based food market on the basis of type?

- What is the breakup of the Philippines plant based food market on the basis of source?

- What is the breakup of the Philippines plant based food market on the basis of distribution channel?

- What is the breakup of the Philippines plant based food market on the basis of region?

- What are the various stages in the value chain of the Philippines plant based food market?

- What are the key driving factors and challenges in the Philippines plant based food market?

- What is the structure of the Philippines plant based food market and who are the key players?

- What is the degree of competition in the Philippines plant based food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines plant based food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines plant based food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines plant based food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)