Philippines Plant-Based Meat Market Size, Share, Trends and Forecast by Product Type, Source, Meat Type, Distribution Channel, and Region, 2025-2033

Philippines Plant-Based Meat Market Overview:

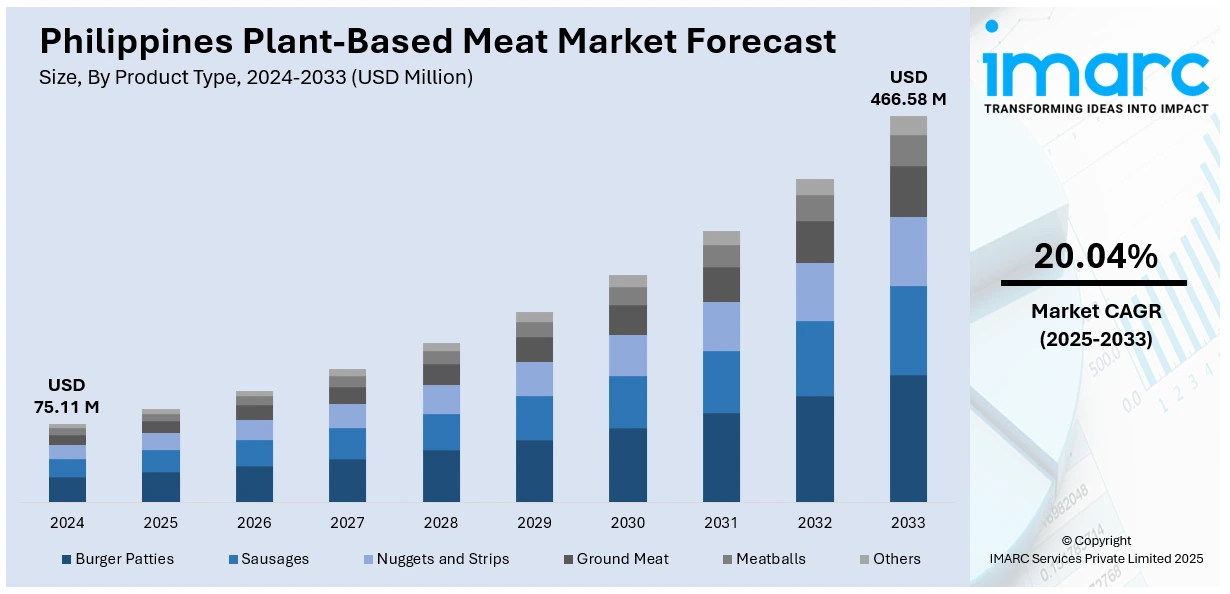

The Philippines plant-based meat market size reached USD 75.11 Million in 2024. Looking forward, the market is expected to reach USD 466.58 Million by 2033, exhibiting a growth rate (CAGR) of 20.04% during 2025-2033. The market is fueled by increasing awareness about health, environmental issues, and changing dietary habits among Filipino consumers. Local food producers and startups are experimenting with native materials, such as jackfruit, and mung beans, to develop meat alternatives that suit Filipino palates to further escalate the demand for plant-based meat. Growing demand for vegan-friendly restaurants, food trends on social media, and green living movements further contribute to the Philippines plant-based meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 75.11 Million |

| Market Forecast in 2033 | USD 466.58 Million |

| Market Growth Rate 2025-2033 | 20.04% |

Philippines Plant-Based Meat Market Trends:

Growing Consumer Consciousness and Cultural Resilience

Over the past few years, the Philippines has witnessed a noteworthy trend among city consumers towards food preferences that are both health‑sensitive and environmentally conscience, and this has prepared the ground for plant‑based meat options to find momentum. Filipino families, particularly in urban centers such as Metro Manila, Cebu, and Davao, are increasingly willing to try alternatives to the usual pork, beef, or chicken, especially when these alternatives are designed to replicate favorite local dishes such as adobo, sisig, or sisig-inspired wraps. The plant‑based protein local adaptation translates to formulations being designed to replicate the savory, umami flavor profiles to which Filipino tastes are accustomed, combining soy or mung‑bean textures with familiar marinades such as vinegar, garlic, and black pepper. Furthermore, the nation's expanding middle class, coupled with youth and travel‑versed demographics, are driving demand for products that resonate with international lifestyle trends yet remain consistent with local flavors. Foodservice establishments like cafés, bistros, and fast‑casual restaurants are adapting by adding plant‑based nuggets, burger patties, and "tocino"‑style strips to menu specials presented as updated versions of favorite staples, which also contributes to the Philippines plant-based meat market growth.

To get more information on this market, Request Sample

Local Production Innovation and Ingredient Sourcing

One peculiar feature of the Philippines' plant-based meat industry is the way producers utilize local agricultural resources to develop their products. Local businessmen and startups are innovating with local inputs such as jackfruit, banana heart, coconut, and mung beans, as raw materials, selecting these due to their availability, affordability, and firm root in Philippine food culture. Jackfruit, for example, is one subsistence delicacy that is already well-known, and innovative plant‑based producers take advantage of this recognition by converting it into shredded "meat" textures for palabok or lumpiang gulay. Such endogenous ingredient preferences not only diminish dependency on foreign soy or pea protein but also decrease supply‑chain vulnerabilities and appeal to local sustainability narratives. In addition, most of these producers focus on minimal-processing techniques, whereby the plant fibers acquire some familiar attributes, e.g., the mild chewiness of banana heart or the fibrous stringiness of young coconut, so that they are both a novelty food and a reinterpretation of comfort foods. Through local sourcing and manufacture, these new businesses not only prove culturally relevant but also promise rural economic empowerment through the creation of value-added applications for farmers' current crops.

Market Channels and Consumer Experiential Engagement

Distribution and retailing strategies for plant‑based meat in the Philippines exhibit unique patterns emphasizing experiential consumption and community involvement, apart from supermarket shelves. Retail channels are not limited to conventional grocery and health stores but also encompass weekend markets, pop‑up events, and food fairs that feature innovative plant‑based brand products and artisan fare. These events invite in‑person engagement with consumers, who can taste plant‑based "sisig" bites or burger substitutes utilizing well‑known local spices. The pop‑up format aligns with the Filipino love for social food discovery, sustaining small producers' ability to solicit feedback and craft brand narratives of sustainability, wellness, and family recipes. At the same time, social media and e-commerce direct‑to‑consumer platforms dominate reaching younger, tech‑aware consumers in urban and provincial centers. Brands tend to position their communications in terms of "the next generation of Filipino food," appealing to nationalism and interest in seeing how heritage dishes can change. Online ordering, sometimes paired with fresh ingredients or cooking packets, also promotes home preparation and discovery. Restaurants and cloud kitchens further help by introducing fusion foods such as plant‑based "sisig tacos" or "adobo sliders," making the idea mainstream through known flavors.

Philippines Plant-Based Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, source, meat type, and distribution channel.

Product Type Insights:

- Burger Patties

- Sausages

- Nuggets and Strips

- Ground Meat

- Meatballs

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes burger patties, sausages, nuggets and strips, ground meat, meatballs, and others.

Source Insights:

- Soy

- Wheat

- Peas

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes soy, wheat, peas, and others.

Meat Type Insights:

- Chicken

- Beef

- Pork

- Others

A detailed breakup and analysis of the market based on the meat type have also been provided in the report. This includes chicken, beef, pork, and others.

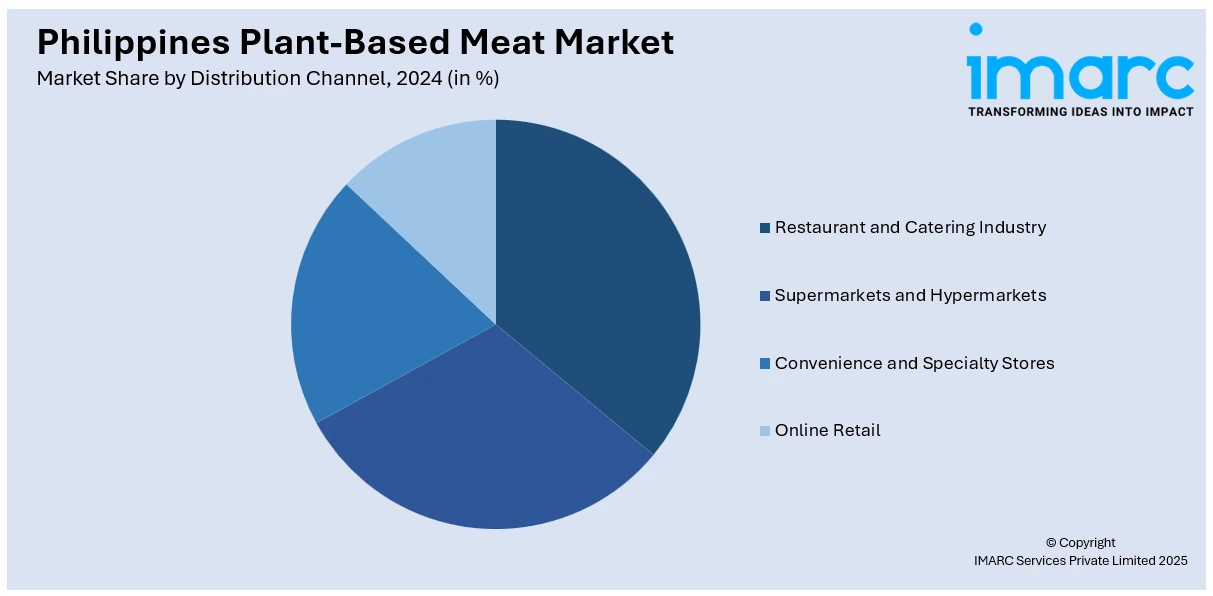

Distribution Channel Insights:

- Restaurant and Catering Industry

- Supermarkets and Hypermarkets

- Convenience and Specialty Stores

- Online Retail

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes restaurant and catering industry, supermarkets and hypermarkets, convenience and specialty stores, and online retail.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which includes Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Plant-Based Meat Market News:

- In July 2025, Green Rebel Foods, a leader in plant-based meat from Indonesia, launched two products at 7-Eleven Philippines, available as retail items and as components of in-store meals.

Philippines Plant-Based Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Burger Patties, Sausages, Nuggets and Strips, Ground Meat, Meatballs, Others |

| Sources Covered | Soy, Wheat, Peas, Others |

| Meat Types Covered | Chicken, Beef, Pork, Others |

| Distribution Channels Covered | Restaurant and Catering Industry, Supermarkets and Hypermarkets, Convenience and Specialty Stores, Online Retail |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines plant-based meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines plant-based meat market on the basis of product type?

- What is the breakup of the Philippines plant-based meat market on the basis of source?

- What is the breakup of the Philippines plant-based meat market on the basis of meat type?

- What is the breakup of the Philippines plant-based meat market on the basis of distribution channel?

- What is the breakup of the Philippines plant-based meat market on the basis of region?

- What are the various stages in the value chain of the Philippines plant-based meat market?

- What are the key driving factors and challenges in the Philippines plant-based meat market?

- What is the structure of the Philippines plant-based meat market and who are the key players?

- What is the degree of competition in the Philippines plant-based meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines plant-based meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines plant-based meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines plant-based meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)