Philippines Potato Chips Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Philippines Potato Chips Market Overview:

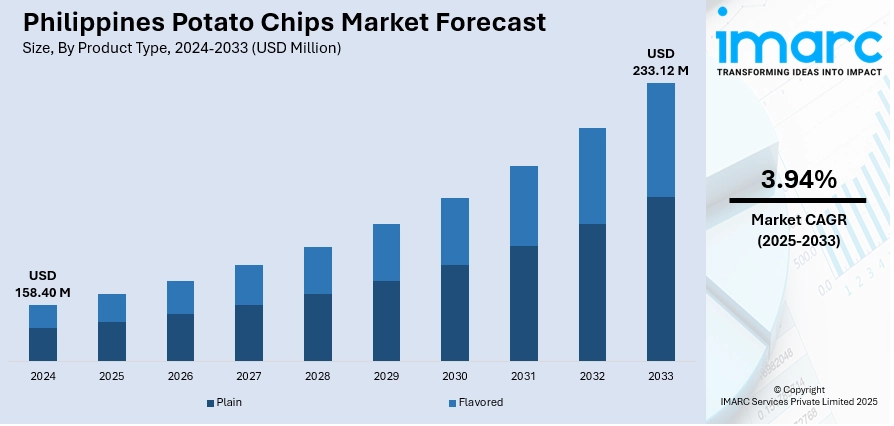

The Philippines potato chips market size reached USD 158.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 233.12 Million by 2033, exhibiting a growth rate (CAGR) of 3.94% during 2025-2033. The potato chips market in Philippines is growing due to rising demand for premium snacks, international brand influence, and enhanced retail and e-commerce networks. These factors drive product innovation, improve accessibility, and expand consumer choices, resulting in higher purchase frequency and fueling Philippines potato chips market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 158.40 Million |

| Market Forecast in 2033 | USD 233.12 Million |

| Market Growth Rate 2025-2033 | 3.94% |

Philippines Potato Chips Market Trends:

Entry of International Brands and Product Diversification

The entry of international brands in the Philippines is impelling the market growth, bringing new product benchmarks, flavor advancements, and competitive changes. These foreign newcomers carry a reputation for excellence and frequently set themselves apart via distinctive flavor profiles, high-quality ingredients, and attractive packaging. Their presence elevates consumer expectations and expands the overall market by attracting curious and experience-driven buyers who seek alternatives to local offerings. International brands also motivate local producers to innovate and expand their product ranges owing to increased competition. This establishes a more vibrant market setting, where flavor diversity, quality, and brand narratives are crucial for attracting consumer attention. Additionally, these brands often collaborate with major retail chains for distribution, enhancing their visibility and accessibility. As a result, consumer choices broaden, and the frequency of snack purchases may rise due to the availability of more appealing and novel options. The influence of global branding also fosters stronger consumer trust, especially among the middle and upper classes, who are more willing to try imported products. This shift contributes not only to increased sales but also to the long-term premiumization and segmentation of the potato chips market in the Philippines. In line with this trend, in 2024, Singapore's FairPrice Group launched its award-winning potato chips in the Philippines, available in 7 flavors like Original, Truffle, and BBQ. The chips, made from 100% fresh potatoes, were sold in 70 supermarkets across Metro Manila.

To get more information on this market, Request Sample

Expanding Retail and E-Commerce Distribution

The ongoing enhancement of retail infrastructure is contributing to the Philippines potato chips market growth by improving product accessibility and availability. The swift growth of contemporary retail formats, such as supermarkets, hypermarkets, and convenience store chains, are improving product availability, not just in urban centers but also in rural areas. The expansion of organized retail is enhancing inventory control, diversifying product ranges, and increasing the visibility of chip brands via specialized snack sections and prominent displays. Moreover, the rise of e-commerce sites and food delivery options are creating novel avenues for producers, allowing them to connect with buyers even during non-peak times. Online discounts, package offers, and the ease of home delivery simplify regular chip purchases for consumers. The e-commerce sector in the Philippines reached USD 24.53 Billion in 2024, with forecasts indicating it will hit USD 75.59 Billion by 2033, showing a compound annual growth rate (CAGR) of 14.02% from 2025 to 2033, as per the IMARC Group. This significant digital transformation enables brands to access new consumer segments while leveraging data analytics to monitor individual behavior and improve their strategies.

Philippines Potato Chips Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plain

- Flavored

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plain and flavored.

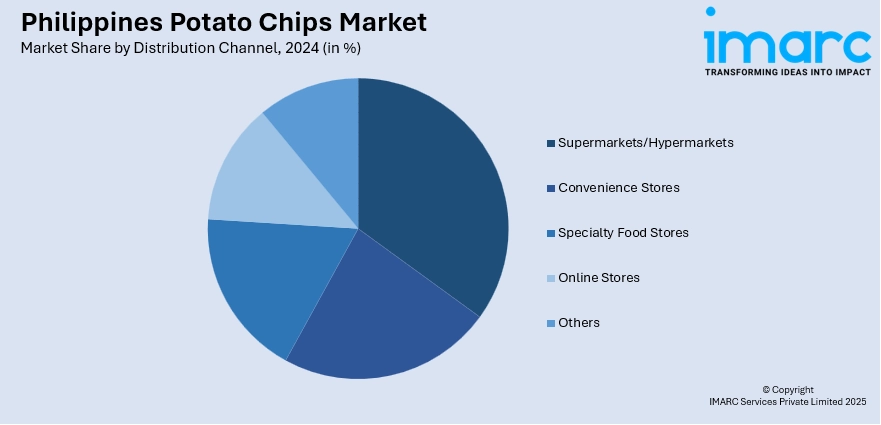

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty food stores, online stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Potato Chips Market News:

- In May 2025, TGI Fridays Philippines launched its Bistro To Share (B.T.S.) concept, which includes shareable dishes like Truffle Sweet Potato Chips and Tostada Nachos. The B.T.S. bundles allow customers to customize their meal with appetizers, salads, and entrées, perfect for group dining.

- In October 2024, 7-Eleven Philippines launched its private label 7-Select Potato Chips in a canister format, offering flavors like seaweed, cheese, and BBQ. The move marked a new step in their snack product offerings.

Philippines Potato Chips Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plain, Flavored |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Speciality Store, Online, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines potato chips market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines potato chips market on the basis of product type?

- What is the breakup of the Philippines potato chips market on the basis of distribution channel?

- What is the breakup of the Philippines potato chips market on the basis of region?

- What are the various stages in the value chain of the Philippines potato chips market?

- What are the key driving factors and challenges in the Philippines potato chips market?

- What is the structure of the Philippines potato chips market and who are the key players?

- What is the degree of competition in the Philippines potato chips market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines potato chips market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines potato chips market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines potato chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)