Philippines Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Philippines Private Equity Market Overview:

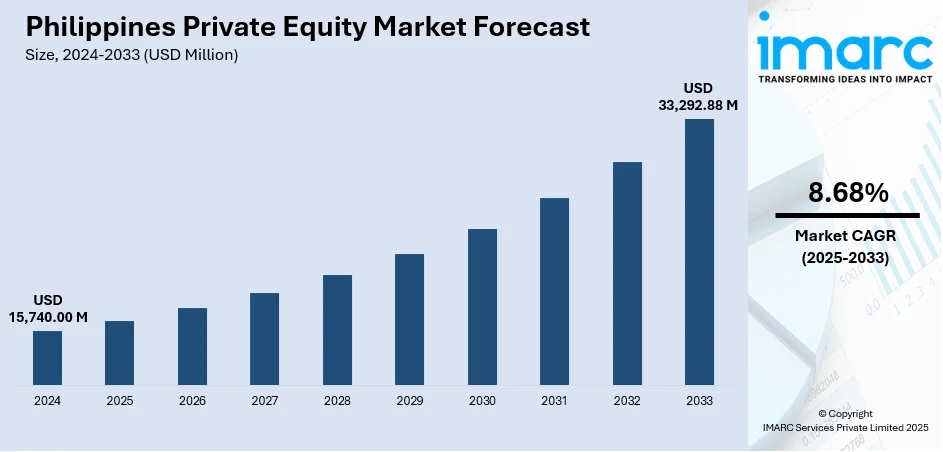

The Philippines private equity market size reached USD 15,740.00 Million in 2024. The market is projected to reach USD 33,292.88 Million by 2033, exhibiting a growth rate (CAGR) of 8.68% during 2025-2033. The market is gaining momentum, propelled by rising investor interest and supportive policy reforms, including foreign ownership liberalization and tax incentives under infrastructure programs. Fund managers are adopting diverse strategies from growth equity and venture capital to infrastructure and buyouts tailored to key regional and sectoral needs. Emphasis on innovation, digital services, sustainability, and fintech is reshaping investment activity across regions. Together, these trends are enhancing the Philippines private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15,740.00 Million |

| Market Forecast in 2033 | USD 33,292.88 Million |

| Market Growth Rate 2025-2033 | 8.68% |

Philippines Private Equity Market Trends:

Institutional Engagement Transforms Market Dynamics

In December 2024, institutional engagement received a visible boost when the Government Service Insurance System (GSIS) announced a major infrastructure divestment payout following its Air Trunk investment via Macquarie’s regional fund. This development highlights an important shift: domestic pension funds are increasingly deploying capital into private equity vehicles with long horizons. As GSIS recovers its original equity and realizes returns, the credibility of private equity as a viable asset class is strengthening in the Philippines. Institutional investors are signaling readiness to participate in mid-sized infrastructure and technology‑adjacent deals, aligning with broader economic modernization plans. Their involvement is deepening market liquidity, improving pricing discipline, and supporting longer-hold strategies that favour operational value creation over quick exits. With more clarity on policy frameworks and clearer investment channels, institutional capital is becoming a foundational pillar of the ecosystem. In short, this prominent move by GSIS is a catalyst that reinforces the Philippines private equity market growth narrative, marking a turning point in institutional trust and sustained capital inflows.

To get more information on this market, Request Sample

Mid‑Market Momentum Builds Sector Resilience

In May 2024 institutional investors and regulators marked a milestone with the government’s Build Better More infrastructure announcement, setting the backdrop for mid-market activity. Private equity firms began increasingly targeting domestic mid-sized companies in consumer, fintech, healthcare, and logistics sectors, recognizing them as engines of growth driven by structural changes in the Philippine economy. This segment benefits from favorable reforms, improving access to energy and digital infrastructure, and rising consumer demand. A key statistic highlights that deal volume in the Philippines reached hundreds of transactions in 2024 across sectors including energy, financial services, and technology. Private equity investors are focusing on mid-market opportunities where operational improvements and scaling are possible within a clearer regulatory environment. The sector’s maturation is supported by growing institutional interest, a more robust policy framework, and rising confidence in long-term value creation. In this context, the deepening of mid‑market engagement is a strategic shift toward more predictable deal flow and sustainable returns. These developments reflect evolving Philippines private equity market trends, as the ecosystem increasingly prioritizes structured, sector-aligned investments.

Technology Drives New Growth Opportunities

In July 2025, the sources released a major update revealing how digital payments are playing an increasingly larger role in daily life across the Philippines. This increasing adoption of digital tools is creating new opportunities for investors considering tech-intensive businesses. Fintech, online retail, health care, and education technology are attracting more spotlight since they leverage technology to address local issues and reach many individuals rapidly. Private equity companies are funding startups and fast-growing firms that can scale quickly and introduce innovative solutions to the market. Meanwhile, government initiatives for improved internet connectivity and financial inclusion are facilitating success for the firms. The mix of high demand, innovation, and policy encouragement is fostering a vibrant investment climate. Technology is evidently becoming an integral aspect of how the market is evolving, supporting the construction of a more vibrant economy in which new concepts can gain traction and deliver value for investors and communities both.

Philippines Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on fund type.

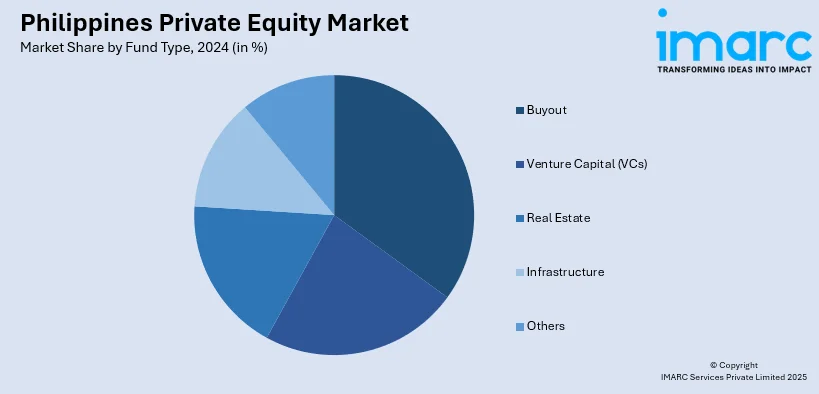

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Private Equity Market News:

- July 2025: Cerberus Capital Management further strengthens its position in the Philippines, with aggressive expansion into the reopening of Agila Subic Shipyard and the construction of new projects for logistics, energy, and transportation infrastructure. Following the recent meeting between U.S. President Donald Trump and President Ferdinand Marcos Jr., Cerberus will have an opportunity to leverage all that the Philippine government has to offer as it rides the significant swell of the country's potential as a regional hotspot for industrial and logistics operations.

- February 2025: The CP Group of Thailand and the Maharlika Investment Corporation have partnered to establish a private equity fund to invest in agriculture, digital technology, and renewable energy in the Philippines. The fund seeks to fund activities that enhance food security, promote digital technologies, and increase sustainable energy ventures. The venture is set to be launched in the next few months and seeks to enhance the major sectors crucial for the economic growth of the country.

Philippines Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines private equity market on the basis of fund type?

- What is the breakup of the Philippines private equity market on the basis of region?

- What are the various stages in the value chain of the Philippines private equity market?

- What are the key driving factors and challenges in the Philippines private equity market?

- What is the structure of the Philippines private equity market and who are the key players?

- What is the degree of competition in the Philippines private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines private equity market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)