Philippines Real Estate Market Size, Share, Trends, and Forecast by Property, Business, Mode, and Region, 2026-2034

Philippines Real Estate Market Size and Share:

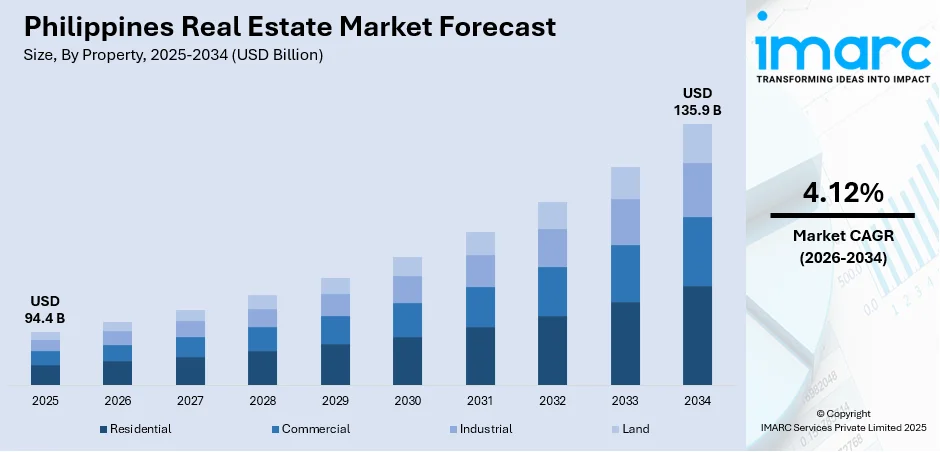

The Philippines real estate market size reached USD 94.4 Billion in 2025. Looking forward, the market is expected to reach USD 135.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.12% during 2026-2034. The market is experiencing strong growth, driven by urbanization, infrastructure development, and rising foreign investments fueling the demand across various segments, including residential, commercial, and industrial properties.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 94.4 Billion |

| Market Forecast in 2034 | USD 135.9 Billion |

| Market Growth Rate (2026-2034) | 4.12% |

Key Trends of Philippines Real Estate Market:

Urbanization and Expanding Middle Class

The Philippines real estate market share is undergoing a significant transformation, driven by rapid urbanization and the expansion of the middle-class population. For instance, as per industry reports, in 2024, 56.43 Million individuals in Philippines, accounting for 48.7% of the total population, reside in urban areas. Cities like Metro Manila, Cebu, and Davao are observing accelerating demand for residential and commercial properties. The homeownership is leading growth of affordable and mid-range housing projects as these are being prioritized by the rising middle class. Developers are responding with innovative housing solutions that include vertical developments and gated communities, to cater the needs of urban residents. Simultaneously, the influx of professionals into urban areas is driving the demand for co-living spaces and rental properties. This trend is also motivating mixed-use developments, where residential units are merged with retail, office, and recreational spaces, which are reflecting the need for convenience in urban living. Urbanization is further hiked by government policies which promote sustainable development, attracting foreign investors into the Philippine real estate landscape.

To get more information on this market, Request Sample

Infrastructure Expansion and Connectivity

The aggressive infrastructure development of "Build, Build, Build" program is altering the real estate market by Philippine governments. According to the Philippines real estate market analysis, the property demand in peripheral regions is making previously underdeveloped areas more accessible with investments made in transportation networks, including railways, highways, and airports. The connectivity between major cities and suburban areas, encouraging real estate developers to explore new opportunities are improved by these projects. Residential and commercial developments are clustering around transit-oriented locations which ensure convenience for commuters and businesses alike. Infrastructure improvements are elevating property values and attracting multinational corporations seeking prime office spaces in well-connected hubs. Additionally, the rise of Special Economic Zones (SEZs) around these projects is bolstering industrial real estate growth, providing a hike to logistics, warehousing, and manufacturing facilities. For instance, as per industry reports, in 2024, the U.S. and Philippines announced numerous bilateral economic ventures, encompassing Luzon Economic Corridor in March, which aims to boost infrastructure in Philippines.

Emergence of Mixed-Use and Transit-Oriented Developments

One of the most significant trends influencing the Philippines property market is the increasing demand for mixed-use and transit-oriented developments. These developments combine residential, commercial, and recreational areas into one master-planned setting—usually near transportation terminals. In Metro Manila and other major urban hubs such as Cebu and Davao, traffic congestion and long travel times have driven developers to provide communities in which residents can live, work, and have access to basic services without having to travel far. These master-planned developments tie in with government-supported infrastructure initiatives such as the North-South Commuter Railway and the Metro Manila Subway, which will enhance linkage between major urban and suburban areas. Local developers are also applying international urban planning concepts to Philippine conditions, including using climate-resilient designs to mitigate flooding and typhoons. This change improves livability but also attracts investors and end-users who pursue long-term convenience, work-life balance, and greater retention of property value in rapidly expanding urban areas, which further contributes to the Philippines real estate market growth.

Growing Demand for Sustainable and Affordable Housing

Another major trend shaping the Philippines real estate market is growing demand for sustainable as well as affordable housing. With climate change impacting the archipelago in the form of intensifying typhoons and sea level rise, property developers today are focusing on green construction practices, flood-resilient design, and energy-efficient technologies. Green certifications for buildings are gaining traction, particularly in high-density areas like Makati and Bonifacio Global City, where environmentally conscious buyers are willing to invest in smart, sustainable living. At the same time, the government’s push for affordable housing, such as through programs under the Department of Human Settlements and Urban Development (DHSUD), is prompting both public and private sector collaboration, which further fuels the Philippines real estate market demand. Developers are answering back by building vertical dwellings in the outskirts of metropolitan areas such as Cavite, Laguna, and Bulacan—areas that provide good value and proximity to Metro Manila. This two-pronged demand for sustainability and affordability is indicative of wider societal trends, such as the increasing power of younger buyers who care about both the environment and affordability.

Growth Drivers of Philippines Real Estate Market:

Thriving BPO Sector and Urban Housing Demand

The sustained growth of the Business Process Outsourcing (BPO) sector in the Philippines has had a profound impact on real estate development, especially in cities. Metro Manila, Cebu, Iloilo, and Davao have emerged as key destinations for BPO companies, drawing an uninterrupted stream of young working professionals and overseas migrant workers in search of job opportunities. This population growth around business districts has led to increasing demand for condominiums, rental apartments, and co-living facilities around or inside business hubs. The developers are meeting this with high-density residential properties with amenities specific to the BPO workforce, including 24/7 security, access to transport, and closeness to commercial outlets. On top of that, most of these workers like to reside near their workplaces because of the traffic conditions in the country, making demand in urban city centers even stronger. This is also likely to carry forward as the BPO industry evolves into IT, healthcare, and finance, which all need increased office and residential support infrastructure.

Real Estate Digitalization and PropTech Adoption

The other key growth driver of the Philippine real estate industry is the increase in adoption of digital technologies and PropTech solutions. The pandemic hastened the transition to online platforms for property listings, virtual tours, and remote transactions, which made real estate more accessible and efficient for buyers and sellers. This technology shift is especially advantageous in a geographically restrictive and congested country where it is not always feasible to travel for viewing properties. Property developers, brokers, and investors are currently utilizing technology to engage a broadened spectrum of customers, including international buyers and young tech-savvy consumers. Virtual display suites, recommendation systems driven by artificial intelligence, and online payment systems are facilitating more remote assessment and investment in property anywhere in the nation—or globe. The increasing use of technology within real estate business is enhancing the customer experience and building trust and transparency in an otherwise paper-based and people-driven market.

Foreign Filipino Workers and Remittance-Driven Investment

The steady supply of remittances from Overseas Filipino Workers (OFWs) is crucial in keeping real estate demand in the Philippines stable. Various OFWs invest their hard-earned earnings in buying homes for their families or investing in real estates as a mode of financial security. Real estate is usually considered as a fixed and tangible asset that captures their years of experience working abroad, and several developers particularly target this segment by providing payment schemes compliant with OFW cash flow. Properties in urbanized locations such as Metro Manila, Cebu, and Davao are particularly preferable because of their rental yield and proximity to job centers, schools, and commercial centers. Furthermore, OFW purchases tend to seek out gated communities or condominium projects with good amenities and security provisions, which suit lifestyle as well as long-term investment purposes. This steady supply of capital from overseas sustains residential demand and propels mid-range and high-rise development schemes all over the country.

Opportunities of Philippines Real Estate Market:

Growing Demand in Growing Provincial Cities

With Manila growing congested and pricier, investors and developers are now focusing on promising provincial cities that are in the process of emerging. Areas like Iloilo, Bacolod, Cagayan de Oro, and General Santos are also experiencing a consistent surge in the demand for residential and commercial properties as infrastructure is being improved, economic activity boosts, and government services decentralize. These cities have cheaper land, reduced operating expenses, and an emerging middle class, which make them viable places for both end-users and investors. Most companies are also moving out of or expanding beyond Metro Manila to access regional talent and lower overhead, necessitating office buildings, employee housing, and retail complexes. Local governments here are actively promoting development through incentives as well as urban planning initiatives. For real estate movers, early entry into these markets offers a chance to gain a solid hold of position before the competition increases.

Increased Interest in Tourism-Focused Developments

The Philippines as a tropical archipelago of globally famous beaches, dive sites, and cultural landmarks offers a rare opportunity for tourism-fueled real estate. Places such as Palawan, Siargao, Bohol, and La Union are attracting more domestic and foreign visitors, driving demand for vacation homes, boutique hotels, and short-term rental units. Investors are taking advantage of the trend to develop condotels, villas, and hospitality projects that cater to eco-tourism and lifestyle tourism markets. Local governments are also promoting sustainable tourism growth, which creates opportunities for projects that balance environmental stewardship with profit opportunities. The transition in work culture to remote or hybrid arrangements has also resulted in the emergence of "workcation" destinations where professionals look for properties that have the potential to combine work and leisure. For investors and developers alike, supporting the nation's strengths in tourism represents an attractive path to long-term returns as well as portfolio diversification.

Hidden Potential in Industrial and Logistics Real Estate

The growth of e-commerce and reshoring of manufacturing operations are generating immense opportunities for industrial and logistics-centric real estate space in the Philippines. Demand for new-age warehouses, distribution facilities, and industrial parks is increasing, particularly around crucial transport corridors and ports like Batangas, Subic, and Clark. As logistics firms look for strategic locations to cut delivery time and save costs, industrial land on the outskirts of cities is coming into focus. Additionally, local and international manufacturers are looking at facilities in the country to diversify supply chains and prevent over-reliance on other markets in Asia. The trend is driving developers to go beyond residential and commercial spaces and invest in logistics centers, cold stores, and intelligent industrial parks. With demand for effective supply chain infrastructure on the rise, the industrial property segment is shaping up to be one of the most exciting, yet underpenetrated, sectors in the Philippine market.

Government Initiatives of Philippines Real Estate Market:

Build, Better, More Infrastructure Program

The Philippine government's drive to build infrastructure, or "Build, Better, More," is a follow-up of previous efforts to upgrade the nation's transport, utility, and public facility infrastructure. It is a key driver of real estate development by making places more accessible and unleashing the potential of once underdeveloped or inaccessible areas. Large-scale projects like railway systems, toll highways, bridges, and airports are not only intended to alleviate traffic jams within urban areas but also link secondary cities and rural provinces with major economic centers. The construction of the North-South Commuter Railway and new expressways in Luzon, for example, is supposed to spur residential and commercial development along their corridors. Increased connectivity reduces the cost of transportation, decreases commutes, and increases investor confidence in areas that were otherwise deemed too far or risky. When these projects are finished, land prices appreciate, and further developers are motivated to invest in new communities and mixed-use sectors.

Incentives for Socialized and Affordable Housing

To relieve the nation's housing backlog and make homeownership more inclusive, the Philippines government has implemented various programs that facilitate socialized and affordable housing. Government agency-led programs seek to provide low-income earners with access to homes through reduced loans, liberal financing terms, and collaboration with private developers. These programs are most effective in the urban and peri-urban settings where informal settlements and congested conditions prevail. Local government units can also be encouraged to free land and adopt zoning regulations favoring mass housing projects. Furthermore, participants in government-sponsored housing programs are also provided with tax incentives, streamlined permit processing, and access to government-secured financing, which encourages them to venture into the low-cost housing sector. Such initiatives add to social well-being and form a solid, long-term demand pool for the real estate industry, particularly where private housing alternatives are otherwise out of reach for the majority of locals.

Digitalization and Real Estate Process Reforms

The Philippines government has also been driving digitalization and administrative reforms in real estate-related transactions for easier business facilitation. Through initiatives of national and local government agencies, land titling, building permit applications, and payment for real property taxes are slowly being brought online. These reforms seek to curb red tape, enhance transparency, and facilitate real estate transactions for local and foreign investors. In Metro Manila and some pilot cities, government offices are incorporating geographic information systems (GIS) and electronic land records to make property documentation easier and fewer titles duplicated or forged. These innovations are particularly significant in a nation where split land ownership records and manual procedures have conventionally hindered the development of real estate. Through the adoption of technology and policy streamlining, the government is in fact committed to establishing a more investor-friendly environment and increasing confidence in the nation's property market systems.

Challenges of Philippines Real Estate Market:

Land Ownership Limitations and Fragmented Titling System

One of the traditional issues in the Philippine property market is that land ownership law is complicated and the titling system for land is fragmented. Foreign ownership prohibitions restrict outright land purchase to Filipino nationals or Filipino majority-owned corporations, so joint ventures or lengthy leases are the only potentially fruitful avenues for most foreign investors. This limitation retards foreign direct investment and hinders large-scale development. Furthermore, the titling of land is frequently beset by conflicting claims, antiquated records, and sluggish bureaucracy. Provincial areas also often have ancestral land claims or settler settlements that cause ambiguity regarding land legality and status. Developers frequently have to spend a lot of time and money to resolve conflicts or establish ownership prior to embarking on projects. These administrative and legal barriers not only cause delays in construction but also bring in financial risk, thus requiring proper due diligence and local alliances to facilitate the land acquisition process in the nation.

Infrastructure Deficiencies and Regional Development Imbalance

Even though infrastructure is increasing, there are still deficiencies, especially in areas away from major cities. Most rural and secondary towns do not have the dependable roads, utilities, and mass transit infrastructure in place to accommodate long-term property development. Limited access to clean water, reliable electricity, and internet services can diminish the appeal of projects to investors and prospective buyers alike. The disparity between advanced major cities such as Metro Manila and backward provincial areas provides an unbalanced platform, where only selected sites are seen as feasible for long-term investment. Infrastructure constraints are often a reason for the developers who want to venture into new territories, leading to increased construction expenses and extended project durations. Although government-driven infrastructure development guarantees future enhancements, development can be sluggish as a result of budget limitations, political changes, or project postponements. Until these gaps are filled more consistently across the nation, the complete potential of real estate development in under-urbanized regions is hard to achieve.

Increasing Construction Expenses and Supply Chain Disruptions

Unstable material and labor costs are some of the biggest challenges to real estate development in the Philippines. Project budgets are usually difficult to manage for developers with unstable costs of steel, cement, and imported fittings. Other factors that contribute to the uncertainty include supply chain disruptions from around the world, exchange rate fluctuations, and local transportation issues. Smaller builders are particularly exposed since they do not have the volume to demand bulk rates or absorb unexpected rises in operating costs. Besides material prices, access to qualified building labor is an issue, especially in regional regions where training and manpower are scarce. Such issues have the potential to result in delays, decreased productivity, or deteriorated profitability. With the growing competition in the industry, handling these cost pressures becomes critically vital to sustainable growth. Real estate operators have to implement more strategic sourcing, effective design, and more intimate relationships with their suppliers to offset these risks.

Philippines Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

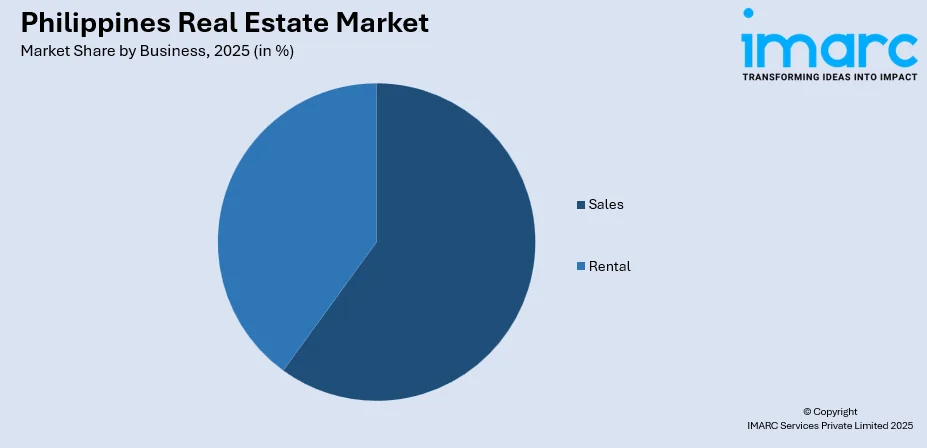

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the mode have also been provided in the report. This includes online and offline.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Real Estate Market News:

- In November 2024, Eton Solutions announced the launch of a specialized Fund Accounting Platform for Private Equity, Real Estate, and Fund of Funds firms. Built on the cloud native AtlasFive® platform, the solution integrates AI to enhance fund management, compliance, and operational efficiency. With over USD 936 billion in assets managed, Eton aims to streamline global fund operations.

- In October 2024, Capital Corp Merchant Banking, announced substantial investment proposal for a mega township development venture in Philippines. This project highlights the firm's efforts to aid revolutionizing and sustainable real estate and infrastructure development globally.

Philippines Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Retail |

| Modes Covered | Online, Offline |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines real estate market was valued at USD 94.4 Billion in 2025.

The Philippines real estate market is projected to exhibit a CAGR of 4.12% during 2026-2034.

The Philippines real estate market is expected to reach a value of USD 135.9 Billion by 2034.

The Philippines real estate market trends are moving in the direction of mixed-use projects that incorporate commercial, retail, and residential space. Demand is rising for sustainable, smart buildings in urban centers like Metro Manila and Cebu. Affordable housing initiatives, infrastructure projects, and growing interest from foreign investors are also reshaping the residential and commercial property landscape.

Growing household incomes, infrastructural development, and fast urbanization are the main drivers of the Philippine real estate industry. Government housing programs and foreign investor interest boost demand. Growing middle-class aspirations and overseas remittances support residential growth, while commercial development benefits from improved transport links and digital transformation, reshaping property dynamics nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)