Philippines RegTech Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Application, End User, and Region, 2025-2033

Philippines RegTech Market Overview:

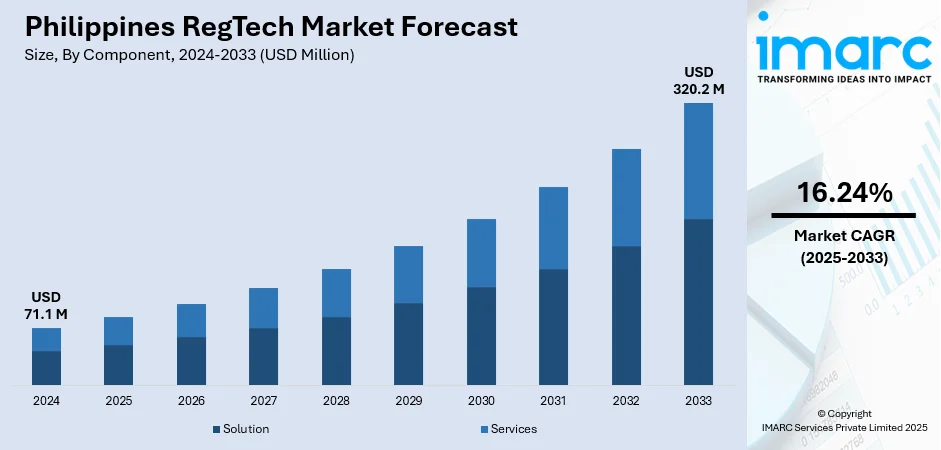

The Philippines RegTech market size reached USD 71.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 320.20 Million by 2033, exhibiting a growth rate (CAGR) of 16.24% during 2025-2033. The fintech growth and investor inflows in Philippines are driving the demand for RegTech solutions. With digital transactions growing and compliance standards tightening, institutions are increasingly depending on RegTech to safeguard operations, manage risks in real time, and sustain innovation thus influencing the Philippines RegTech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 71.10 Million |

| Market Forecast in 2033 | USD 320.20 Million |

| Market Growth Rate 2025-2033 | 16.24% |

Philippines RegTech Market Trends:

Growth of Digital Finance and Fintech Adoption

The Philippine financial sector is undergoing a significant transformation driven by the rapid rise of digital banking, mobile wallets, and online lending, which is resulting in a financial ecosystem marked by faster, more frequent, and increasingly complex transactions. This rapid growth, although advantageous for client ease and market development, is also increasing the risks of fraud, cyber threats, and compliance violations. Organizations are facing pressure to implement technologies that can conduct real-time risk evaluations and ensure regulatory compliance across various digital platforms. RegTech solutions offer adaptable, effective, and trustworthy methods to tackle these issues, guaranteeing that financial entities stay safe and adhere to regulations while they innovate. The nation’s youthful, tech-savvy populace, along with robust governmental efforts to promote financial inclusion, are further accelerating the adoption of these solutions. A significant instance is Tonik Digital Bank’s incorporation of the Philippine National ID (PhilSys ID) in 2025 for opening accounts and associated services. Utilizing the recently launched PhilSys API, Tonik streamlined its Know-Your-Customer (KYC) procedure, allowing identity checks in under ten seconds. This progress not only simplifies onboarding but also enhances security protocols and broadens access to underrepresented segments of the population. The example highlights how RegTech integration improves operational efficiency while strengthening regulatory compliance and trust. This ongoing digital transformation, supported by innovation, regulatory pressure, and financial inclusion efforts, is contributing to the Philippines RegTech market growth.

To get more information on this market, Request Sample

Investor Interest and Capital Inflows into Fintech

The Philippine fintech sector is becoming a focal point for both local and international investors, attracted by the country’s sizable user base and rising adoption of digital financial services. This influx of capital is enabling swift innovation and growth, but it has also brought heightened expectations from regulators, stakeholders, and global partners who demand that startups maintain robust compliance frameworks. RegTech solutions act as essential resources in this context, enabling fintech companies to adhere to strict regulatory requirements while sustaining growth and innovation. They enable organizations to automate compliance procedures, track risks in real time, and minimize the chances of expensive breaches or fines, guaranteeing that investor trust aligns with operational integrity. An important illustration of this trend is Salmon, a fintech and BSP-supervised bank, which obtained $88 million in financing in 2025 to expand its credit and digital banking offerings. This record-breaking fundraising, consisting of a $60 million Nordic bond drawdown and $28 million in equity from worldwide investors, highlights the growing global interest in Philippine fintech opportunities. The magnitude of these investments underscores both the sector's growth prospects and the growing need for sophisticated compliance technologies to protect operations. By incorporating RegTech into their operations, companies can fulfill the dual objectives of regulatory compliance and swift expansion, establishing a feedback loop where investment drives growth, and RegTech guarantees the durability and sustainability of that expansion.

Philippines RegTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, application, and end user.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Mode Insights:

- Cloud-Based

- On-Premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-Sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

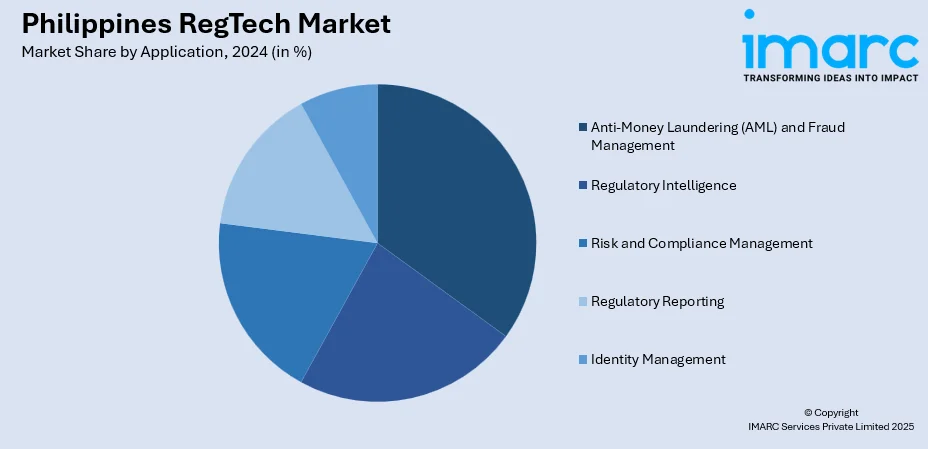

Application Insights:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes anti-money laundering (AML) and fraud management, regulatory intelligence, risk and compliance management, regulatory reporting, and identity management.

End User Insights:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banks, insurance companies, fintech firms, IT and telecom, public sector, energy and utilities, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines RegTech Market News:

- In March 2025, Sumsub launched its Reusable Digital Identity suite, including Sumsub ID and Reusable KYC, to reduce repetitive KYC checks. These tools enable users to reuse verified identity documents across 4,000+ platforms, cutting onboarding time by up to 50% and boosting conversion rates by 30%. The solution is GDPR-compliant and targets sectors like fintech, banking, and crypto.

- In November 2024, the Association of Bank Compliance Officers (ABCOMP) partnered with RegTech firm Tookitaki to fight financial crime in the Philippines. The collaboration combined Tookitaki’s ASEAN-wide Anti-Financial Crime insights with ABCOMP’s local expertise. This joint effort aimed to strengthen the country's financial system through shared intelligence and proactive measures.

Philippines RegTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Anti-Money Laundering (AML) and Fraud Management, Regulatory Intelligence, Risk and Compliance Management, Regulatory Reporting, Identity Management |

| End Users Covered | Banks, Insurance Companies, FinTech Firms, IT and Telecom, Public Sector, Energy and Utilities, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines RegTech market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines RegTech market on the basis of component?

- What is the breakup of the Philippines RegTech market on the basis of deployment mode?

- What is the breakup of the Philippines RegTech market on the basis of enterprise size?

- What is the breakup of the Philippines RegTech market on the basis of application?

- What is the breakup of the Philippines RegTech market on the basis of end user?

- What is the breakup of the Philippines RegTech market on the basis of region?

- What are the various stages in the value chain of the Philippines RegTech market?

- What are the key driving factors and challenges in the Philippines RegTech market?

- What is the structure of the Philippines RegTech market and who are the key players?

- What is the degree of competition in the Philippines RegTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines RegTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines RegTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines RegTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)