Philippines Renewable Energy Market Size, Share, Trends and Forecast by Type, End User, and Region 2026-2034

Philippines Renewable Energy Market Summary:

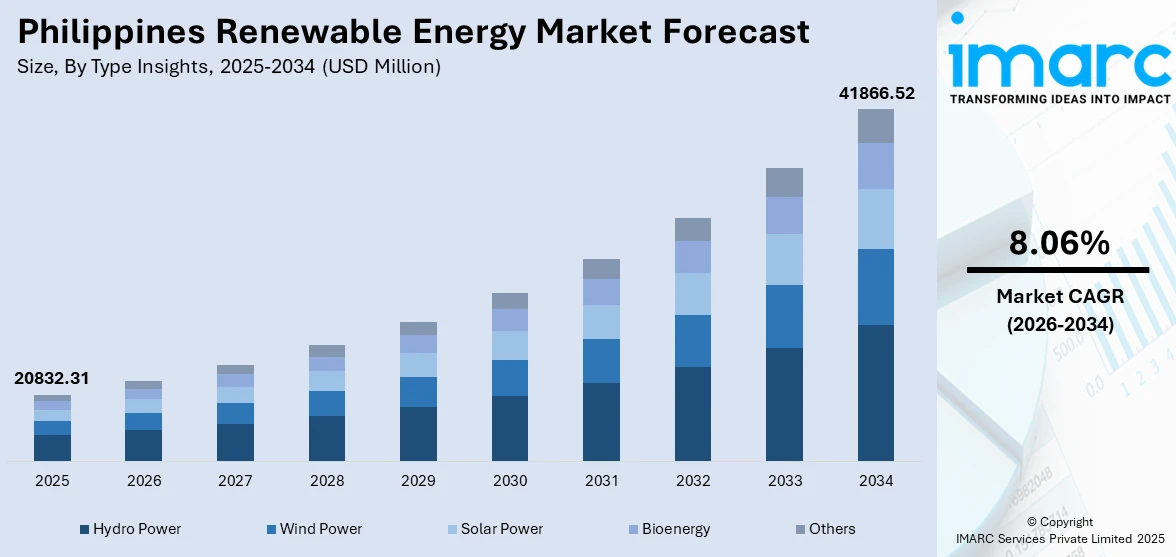

The Philippines renewable energy market size was valued at USD 20,832.31 Million in 2025 and is projected to reach USD 41,866.52 Million by 2034, growing at a compound annual growth rate of 8.06% from 2026-2034.

The Philippines renewable energy market is experiencing notable growth driven by the government's ambitious renewable energy targets. Accelerated investment inflows from international energy companies, supported by the removal of foreign ownership restrictions in solar, wind, hydro, and ocean energy projects, are transforming the competitive landscape. Declining technology costs, particularly for solar installations, are making renewable energy more cost-competitive with conventional thermal power sources, encouraging broader adoption across industrial, residential, and commercial sectors.

Key Takeaways and Insights:

- By Type: Hydro power dominates the market with a share of 41% in 2025, driven by the Philippines' extensive river systems and established large-scale hydroelectric infrastructure that provides reliable baseload generation capacity for the national grid.

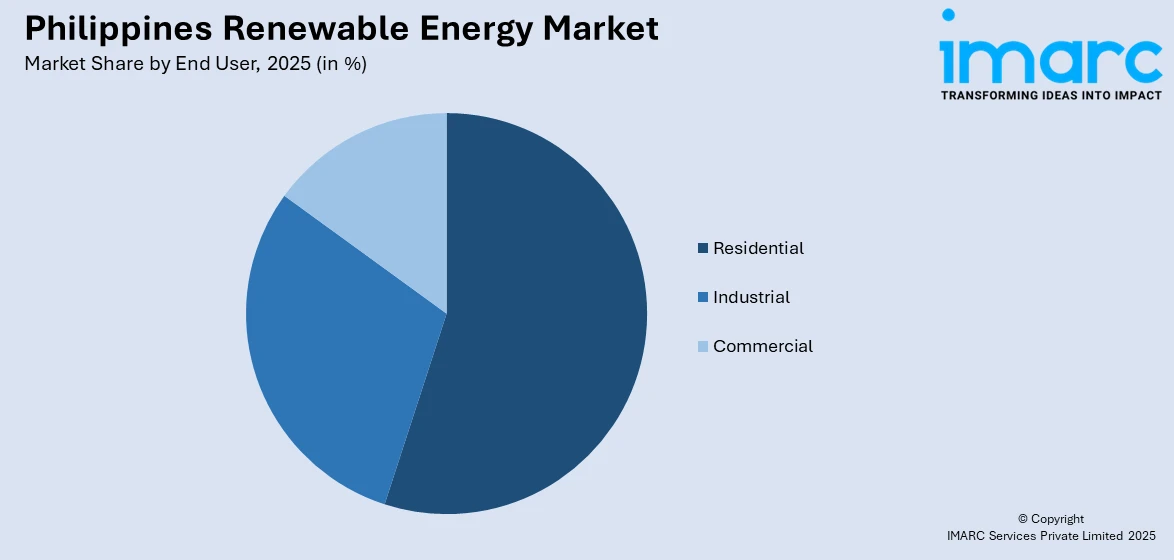

- By End User: Residential leads the market with a share of 33% in 2025, propelled by expanding rooftop solar adoption through the net metering program, rising electricity costs encouraging household self-generation, and increasing environmental awareness among individuals.

- By Region: Luzon represents the largest segment with a market share of 59% in 2025, owing to the presence of industrial facilities and population centers in Metro Manila and surrounding provinces, superior transmission infrastructure, and the highest number of committed renewable energy projects.

- Key Players: The Philippines renewable energy market exhibits dynamic competitive intensity, with domestic conglomerates and international energy developers actively expanding portfolios through project development and strategic partnerships.

To get more information on this market Request Sample

The Philippine renewable energy sector is undergoing a significant transformation as the country accelerates its clean energy transition. With a growing focus on sustainability and reducing carbon emissions, the Philippines is rapidly scaling up its renewable energy capacity. Government initiatives are attracting substantial investments in solar, wind, and battery storage projects. These efforts are aligned with the nation’s goal to achieve a cleaner, more resilient energy grid while addressing the environmental impacts of fossil fuels. A notable example of this transformation is the $3.4-billion MTerra Solar Project, launched in 2024 in Nueva Ecija and Bulacan, which aimed to become the world’s largest integrated solar and battery storage facility. Once completed, it will power over 2 million homes and reduce carbon emissions by 4.3 million metric tons annually, highlighting the Philippines’ commitment to sustainable energy solutions and climate goals.

Philippines Renewable Energy Market Trends:

Technological Advancements in Renewable Energy

Innovations in renewable energy technologies is playing a pivotal role in driving down the costs of energy production, making large-scale adoption increasingly feasible for the Philippines. Advancements in solar panel efficiency, wind turbine designs, and geothermal systems are significantly improving the viability of renewable energy. For instance, the rapid development of energy storage technologies has addressed challenges related to the intermittent nature of renewables, improving reliability and efficiency. A notable example is the launch of Sungrow’s MG5/6/8/10RL residential storage product at Solar & Storage Live Philippines in 2025, designed to meet the growing energy needs of Southeast Asian households. These technological innovations foster investor confidence and support the continued expansion of the renewable energy market in the Philippines.

Private Sector Investment

Both local and international investors recognize the profitability and long-term viability of renewable energy projects, especially as fossil fuel prices remain volatile and unsustainable. Public-private partnerships (PPP) are essential in launching various renewable initiatives, ranging from solar farms to wind energy plants. For example, in 2026, ACEN launched its 60 MW San Manuel Solar project in Pangasinan, Northern Luzon, marking the company’s first solar facility in the region. Featuring over 108,000 photovoltaic panels, the project will generate 94 GWh of electricity annually, powering about 55,000 households. This type of private sector involvement accelerates large-scale investments, contributing significantly to the growth of the nation’s renewable energy capacity and aligning with its broader climate and energy security goals.

Rising Electricity Prices from Conventional Sources

The growing costs of traditional energy sources, particularly fossil fuels, is making renewable energy solutions more attractive in the Philippines. With the volatility of coal and natural gas prices, electricity costs have become increasingly unpredictable. In contrast, renewable energy technologies, such as solar and wind, offer more stable and decreasing cost trends due to advancements in technology and economies of scale. To capitalize on the cost-efficiency of renewables and mitigate the impact of rising energy costs, the Philippines launched the "10 Million Solar Rooftop Challenge" in 2024, aiming to install 10 GW of clean energy through solar rooftops nationwide. This initiative invited various sectors to join the effort, promoting affordable, reliable electricity and addressing rising energy costs. The challenge highlights the country’s abundant solar potential and calls for a shift toward renewable energy amidst high electricity prices.

Market Outlook 2026-2034:

The Philippines renewable energy market demonstrates strong growth potential throughout the forecast period, underpinned by ambitious national targets and structural policy support. The market generated a revenue of USD 20,832.31 Million in 2025 and is projected to reach a revenue of USD 41,866.52 Million by 2034, growing at a compound annual growth rate of 8.06% from 2026-2034. This growth reflects the commitment of the Philippines to increasing its renewable energy capacity, creating opportunities for investment, and contributing to global sustainability goals in line with its national energy transition strategy.

Philippines Renewable Energy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Hydro Power |

41% |

|

End User |

Residential |

33% |

|

Region |

Luzon |

59% |

Type Insights:

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

Hydro power dominates with a market share of 41% of the total Philippines renewable energy market in 2025.

Hydro power represents the largest segment owing to the country's abundant water resources, particularly from its many rivers and mountainous regions. The Philippines has a long history of harnessing hydro power, with established plants providing a significant portion of the country’s energy needs. Hydro power plants offer reliable, consistent power generation, making them a crucial part of the nation’s strategy to transition to renewable energy while reducing dependence on fossil fuels.

Moreover, hydro power benefits from a strong policy and regulatory framework that supports its development. With increasing investments in hydro power projects, the Philippines continues to expand its capacity for clean energy generation. For instance, in 2025, the Philippines and JICA launched a nationwide hydro power inventory project to identify large-scale sites for pumped storage and impoundment hydropower. This three-year initiative supported the country’s renewable energy goals of 35% by 2030 and 50% by 2040. The project aimed to enhance energy security, reduce fossil fuel dependence, and provide crucial data for future energy projects, with completion expected by 2028.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Residential

- Commercial

Residential exhibits a clear dominance with a 33% share of the total Philippines renewable energy market in 2025.

Residential holds the biggest market share, driven by the growing individual awareness and government incentives. Homeowners increasingly embrace solar panels, energy storage solutions, and small-scale wind turbines as a means to lower energy bills while reducing their carbon footprint. With power shortages and rising electricity prices, the shift towards renewable energy at the residential level offers greater energy independence and resilience, attracting more people families to invest in sustainable energy solutions for long-term savings.

Moreover, the rise of green financing options and favorable government policies, like tax incentives and net metering programs, is making renewable energy solutions more accessible for homeowners. For example, in 2025, the Philippines announced the launch of the 6.5 MW Ning Ning Solar Rooftop Project, slated for 2025 in the Naic suburb of Manila. Funded by a $12 million grant from the UN Green Climate Fund, it will provide sustainable power to nearly 2,000 social housing units, reducing energy costs and promoting a net-zero energy community.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon leads with a market share of 59% of the total Philippines renewable energy market in 2025.

Luzon dominates the market due to its economic prominence and population density. As the country's most developed and industrialized island, Luzon is home to key urban centers like Metro Manila, where energy demand is highest. The region also hosts a large share of renewable energy infrastructure, including solar, wind, and hydropower plants, contributing significantly to the nation's renewable energy generation and meeting the growing power needs of its industries and residents.

Additionally, Luzon benefits from favorable government policies and investment incentives aimed at boosting renewable energy production. The region is attracting numerous renewable energy projects owing to its advanced infrastructure, access to financing, and proximity to both energy users and suppliers. For example, in 2026, DENZAI International Holdings and PC1 Group secured renewable energy projects in Vietnam and the Philippines. Their partnership includes the development of a 58.5 MW onshore wind farm in Camarines Sur, located on Luzon Island. This project marks a significant step in advancing renewable energy in the Philippines.

Market Dynamics:

Growth Drivers:

Why is the Philippines Renewable Energy Market Growing?

Strategic Infrastructure Optimization through Hybrid Energy Initiatives

The Philippines renewable energy market growth is significantly propelled by the optimization of existing infrastructure through government-backed auction programs. These initiatives encourage hybrid energy solutions that maximize resource efficiency while providing long-term investment security. For instance, in 2025, Scatec and Aboitiz Renewables were awarded a 20-year Power Purchase Agreement (PPA) for a 68 MW floating solar project at the Magat reservoir in Isabela. Part of the Department of Energy’s Green Energy Auction Program, this project integrates solar power with existing hydropower facilities, demonstrating how innovative technology and clear regulatory frameworks are essential in meeting the nation’s ambitious clean energy targets.

Expansion of Regional Solar Infrastructure

The rapid growth of the Philippines renewable energy market is driven by large-scale private investments targeting high-potential regional corridors. By decentralizing power generation, these projects enhance local energy security and significantly contribute to national decarbonization targets. A notable development in 2025 was Peak Energy’s announcement of its 65 MWp solar project in Isabela, Cagayan Valley. Expected to be operational by the first half of 2027, the facility was projected to generate over 68,000 MWh of clean energy annually, powering approximately 23,000 homes while reducing CO₂ emissions by 37,000 tons. Such private-led initiatives are instrumental in scaling the country's green transition and meeting the rising demand for sustainable electricity.

Government Initiatives

The Philippine government has implemented numerous policies to encourage the transition to renewable energy. These include incentives such as tax holidays, feed-in tariffs, auctions, and renewable portfolio standards. Directly applying these regulatory frameworks and auction-based incentives, the Philippines' Department of Energy launched the 4th Green Energy Auction (GEA-4) in 2025 to add 9.38 GW of renewable energy capacity. The auction included ground-mounted and floating solar, wind, and solar paired with battery energy storage systems (BESS). Such auction-based initiatives ensure a more favorable investment climate, offering long-term stability and reducing financial risks for developers.

Market Restraints:

What Challenges the Philippines Renewable Energy Market is Facing?

Grid Infrastructure Constraints Limiting Renewable Integration Capacity

The national transmission network in the Philippines faces significant capacity limitations, hindering the seamless integration of new renewable energy projects. These infrastructure constraints restrict the ability to efficiently transmit electricity generated from renewable sources, such as wind, solar, and hydropower, to areas with high demand. As a result, despite the growing potential of renewable energy, the grid's limitations impede its full integration into the national energy mix.

Archipelagic Geography Creating Transmission and Distribution Challenges

The Philippines' archipelagic structure, spread across over seven thousand islands, presents significant challenges for developing a unified transmission infrastructure. Limited inter-island connectivity exacerbates congestion risks and the potential curtailment of renewable energy generation, especially for projects located in remote areas. This fragmented grid system complicates the efficient distribution of renewable energy, hindering the country's efforts to fully harness its clean energy potential and meet growing demand.

High Electricity Prices Impacting Project Economics and User Affordability

The Philippines has some of the highest electricity prices in Southeast Asia, which significantly impacts both project economics and user affordability. High tariffs increase operational costs for industrial users of renewable energy, making it more expensive to transition to green power. For project developers, the elevated electricity prices create challenges in securing competitive power purchase agreements, complicating the financial viability of new renewable energy projects and hindering broader market growth.

Competitive Landscape:

The Philippines renewable energy market exhibits dynamic competitive intensity characterized by the presence of established domestic conglomerates expanding their clean energy portfolios alongside international developers entering through strategic partnerships and foreign direct investment (FDI). Market dynamics reflect differentiated positioning across technology segments, with leading players securing capacity through green energy auctions while developing proprietary project pipelines. The removal of foreign ownership restrictions is intensifying competition by enabling wholly foreign-owned entities to participate in renewable energy development, bringing international expertise, technology, and financing capabilities that complement domestic market knowledge.

Recent Developments:

- December 2025: The Philippines launched its first 1 MW floating solar farm at the Carmen Copper mine in Cebu, marking a major leap toward sustainable energy. The farm spans three hectares, with 8,540 solar panels, and powers 10% of the mine's energy needs. This project supported the country’s goal of achieving 50% renewable energy capacity by 2040 and can scale up to 50 MW.

- November 2025: The Philippines launched its first offshore wind auction, offering 3.3GW of capacity for delivery between 2028-2030. The auction focused on fixed-bottom projects with 20-year contracts, centered around Pambujan and Sta. Clara ports. This marked a significant step in the country's clean energy transition, with coordinated planning across developers and government agencies.

Philippines Renewable Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Hydro Power, Wind Power, Solar Power, Bioenergy, Others |

| End Users Covered | Industrial, Residential, Commercial |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines renewable energy market size was valued at USD 20,832.31 Million in 2025.

The Philippines renewable energy market is expected to grow at a compound annual growth rate of 8.06% from 2026-2034 to reach USD 41,866.52 Million by 2034.

Hydro power dominates the market with a share of 41% in 2025, driven by the country's extensive river systems, established large-scale hydroelectric infrastructure, and the technology's ability to provide reliable baseload generation.

Key factors driving the Philippines renewable energy market include the increasing profitability and long-term viability of projects, especially as fossil fuel prices remain volatile. Public-private partnerships, like ACEN’s 60 MW San Manuel Solar project, accelerate large-scale investments, supporting energy security and climate goals.

Major challenges include significant capacity limitations that hinder the seamless integration of new renewable energy projects, the archipelagic geography creating transmission difficulties across islands, and high electricity prices affecting project economics and user affordability

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)