Philippines Retail Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Philippines Retail Market Overview:

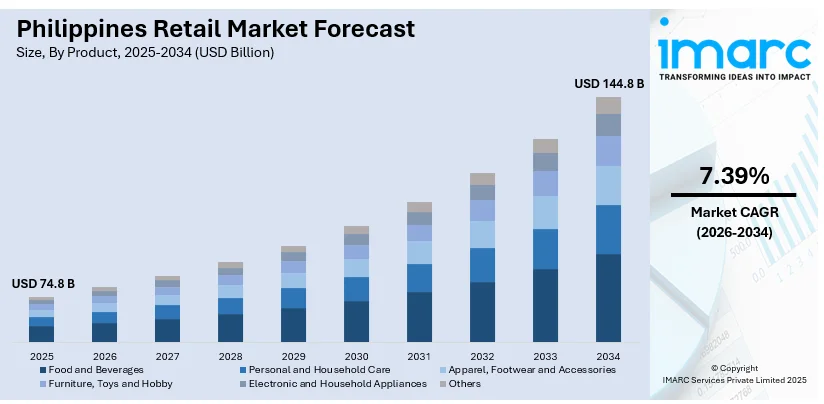

The Philippines retail market size reached USD 74.8 Billion in 2025. Looking forward, the market is expected to reach USD 144.8 Billion by 2034, exhibiting a growth rate (CAGR) of 7.39% during 2026-2034. The market is composed of growth, driven by increasing consumer spending, expansion of modern retail formats, and e-commerce, with key players like SM Retail and Puregold leading the way, despite challenges from inflation and counterfeit products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 74.8 Billion |

| Market Forecast in 2034 | USD 144.8 Billion |

| Market Growth Rate (2026-2034) | 7.39% |

Key Trends of Philippines Retail Market:

Rising demand for packaged and ready-to-eat (RTE) food

Increased demand for convenience food items is one of the key drivers of the Philippines' strong growth in the retail market. These foods, requiring little preparation, have become increasingly popular, especially among time-starved consumers and the rising number of working women, who prefer to opt for such foods as processed meats and poultry over the traditional home-cooked foods. The increasing urbanization and changing lifestyles in the Philippines have contributed to the growing demand for packaged and ready-to-eat food items. Consumers are seeking products that offer convenience, quality, and variety to cater to their fast-paced lives. This trend has led to an increase in the sales of packaged snacks, frozen meals, and other convenience food items across various retail channels in the country. Major retailers are expanding their offerings in this segment to meet the evolving consumer preferences and capitalize on the lucrative growth opportunities. The rising disposable incomes and increasing exposure to global food trends have also influenced Filipino consumers' inclination towards packaged and ready-to-eat food options, driving the expansion of the retail market in the Philippines.

To get more information of this market Request Sample

Increase in demand for branded goods

The Philippines retail market share is particularly experiencing a significant rise and key participants are now seizing the optimistic growth rates in various retail categories. Also, the Philippines has the potential to surpass other Southeast Asian neighbors in the retail e-commerce segment. Regarding the retail trade increase, it could be attributed to the improvement in the supply and distribution of the different products and services that are to be devoured by the consumers. The rising purchasing power of the middle-income group and the population’s enhancement of its buying power for branded products due to higher income can be attributed to the increase in consumption of branded products in apparel, cosmetics, footwear, watches, drinks, and food products. The middle and the upper-middle class in the Philippines have grown rapidly over the years with an increasing number of consumers considered to be rich making the market a promising one for brands considered to be luxurious and premium. Retailers are thus planning to several full-fledged branded products to this new upper-class segment and improve their status through multi-format outlets and flagship stores. The easy availability and high visibility of luxury marketing and global brands have compounded the Philippines' need for distinguished markings on their retail.

Growth Drivers of Philippines Retail Market:

Urban Growth and Retail Experience Transformation

Metro Manila, Cebu, and Davao's fast-paced urban growth is further fueling the Philippines' retail sector. Expanding middle-class communities, mall saturation, and mixed-use properties are transforming the way Filipinos shop. Retail venues are no longer mere transactional centers—they are turning into lifestyle centers, with dining, entertainment, and community activities coexisting alongside retail experiences. From pop-up shops that highlight local designers to experiential brand experiences woven in the context of mall promenades, consumers seek more sensory indulgences as they shop. Retailers are answering back with the incorporation of in-store cafes, interactive digital signage, and hybrid areas where customers can shop products alongside cultural events and food festivals. Locally authentic features such as "pasalubong" corners, highlighting regional snacks and craftwork, establish emotional connections with consumers while supporting local products. This convergence away from simple convenience toward shared and edited experiences is driving foot traffic, extending dwell time, and building more enduring brand loyalty, which powers retail market growth through differentiated, compelling customer interactions.

E‑Commerce Integration and Omni‑Channel Innovation

Leveraging the Philippines' increasing digital connectivity, retail companies are effectively combining online and offline experiences to reach more tech-savvy customers. Retailers are infusing the shopper experience with frictionless omnichannel capabilities, where customers can order online and pick up in stores, shop digital catalogs in stores to validate availability, or even make purchases through messenger apps. Social commerce and live-stream shopping events have created rapid brand discovery among Filipino shoppers, particularly those looking for boutique or artisanal products not available in mainstream stores. Furthermore, regional vendors can reach urban markets through e-commerce platforms while city-based brands can penetrate provincial areas without physical presence. Retailers support this by offering localized payment options, from cash-on-delivery to mobile wallets and by leveraging social media to promote flash sales or new product drops. The inclusion of digital convenience in traditional store strategies assists retailers in expanding quicker, streamlining inventories, and addressing customers one-to-one, opening shopping to more geographic, demographic, and economic segments across the archipelago.

Local Entrepreneurship and Lifestyle‑Based Retail Niches

The vibrant Philippines retail market demand is also being fueled by an explosion of local entrepreneurship and lifestyle-driven store concepts. Small and indigenous brands, particularly in wellness, beauty, and gourmet food categories are leveraging carefully crafted pop-up stores, concept stores, and kiosks at malls to catch on through storytelling, community affiliation, and local authenticity. Such themes as "coffee lover's nook," Filipino craftsmanship, or "sustainable living" feature curated offerings that speak to cultural identity and values-driven lifestyles. Marketplace and collaboration hub formats foster local brand partnerships, where one may sell handcrafted skin care in tandem with organic candles or heritage snacks, which is driving experiential discovery and cross-promotion. In-store workshops or interactive events, e.g., latte art classes, craft demonstrations, or plant care clinics, are also common among many brands, forging emotional connections and encouraging repeat visits. This bottom-up innovation is not just broadening retail portfolios but empowering local producers and designers to grow at lower overhead. By linking retail expansion to lifestyle trends and local authenticity, the Philippine retail market continues to grow both in depth and breadth.

Opportunities of Philippines Retail Market:

Coastal and Provincial Expansion: Leveraging Regional Retail Potential

The region’s extensive archipelagic geography poses a strong challenge for Philippines retail market growth via regional and coastal expansion. Although the country's major cities like Metro Manila and Cebu are retail hubs, numerous retail opportunities exist in underpenetrated provincial capitals and resort towns throughout Luzon, Visayas, and Mindanao. These markets are starting to draw investment in contemporary retail forms like suburban malls, outdoor lifestyle centers, and specialty stores aimed at tapping local sensibilities and tourism-fueled demand. Particularly in coastal and island economies, there is a hunger for selectively assembled goods from tropical-themed fashion and beachwear to local specialties and artisanal work, that strike a balance between tourist popularity and day-to-day utility. Retailers can collaborate with place-based cooperatives or local-centered brands to build store fronts or stand-alone pop-ups that showcase place-based identity, whereby tourists and locals alike can find Bahay Kubo-themed handicrafts, indigenous spices, or handmade home furnishings. With growing inter-island connectivity via improved transport services as well as regional air links, these retail efforts become more feasible, providing entrepreneurs an opportunity to develop dedicated customer bases beyond traditional urban areas.

Collaborative Retail Hubs and Micro-Market Ecosystems

Another fecund prospect, according to the Philippines retail market analysis, is creating collaborative, micro-market retail spaces that lift local entrepreneurship. Rather than traditional mall leases, retail developers and real estate managers can enable curated market zones like mini-malls, plazas, or open-air retail zones, where heterogeneous small businesses, start-ups, and creative merchants share space alongside each other. These hubs can highlight lifestyle, wellness, food, beauty, and handicraft categories, encouraging discovery and experimentation. For instance, a "Creator's Alley" in a city center could support boutique candle-makers, herbal shampoo artists, and plant-care boutiques within shared floorspace. This shared facility reduces overhead for emerging brands yet offers them high footfall visibility and offers variety to consumers in one location. These micro-markets also drive community interaction in the form of themed pop-ups, workshops, and holiday bazaars that keep the space active and in step with neighborhood celebrations and cultural calendars. By allowing multiple brands to co-mingle and share customer interest, retailers can create increased experiential value while minimizing risk, creating opportunities for incubation of brands and hyper-local retail innovation.

Sustainable & Digital-First Retail Experiences

The convergence of sustainability awareness and online connectivity presents a clean break opportunity for the Philippines' retail landscape to differentiate and expand. Consumers, particularly young and environmentally conscious segments, are being pulled toward retailers adopting green-friendly practices, like zero-waste packaging, refill stations, or biodegradable materials that reflect indigenous craft. Envision refill bars for locally crafted bath soaps, or eco-fashion bazaars wrapped in abaca, bamboo, or recycled cloth. Together with technology—such as app-based rewards schemes, virtual try-ons, QR-product storytelling, or even localized supply chains—the shopping experience is both seamless and responsible. For example, consumers can pre-order products through mobile app and collect from local green kiosks, eliminating delivery waste and congestion. The stores can gain further advantages by collaborating with locally grown eco-friendly producers with bamboo wood furniture manufacturers, coconut body care makers, and recycled material designers, to create special "Ethical Filipino Brands" sections in stores. By sharing honest stories, responsible design, and green infrastructure, retail enterprises can attract socially responsible consumers and become promoters of both ethical values and local pride.

Challenges of Philippines Retail Market:

Geographical Fragmentation and Fragmented Supply Chains

One of the most formidable barriers to retail growth in the Philippines is the archipelagic nature of the country. With thousands of islands spread across vast maritime routes, managing logistics becomes complex and costly. Retailers must coordinate shipments via inter-island ferries or cargo ships, often compounded by limited infrastructure in smaller ports and regional terminals. This logistical fragmentation challenges timely product delivery and inventory replenishment, especially for perishable or seasonal goods. Furthermore, inland roads in provincial areas frequently lack capacity, making last-mile transport to rural towns slow and unreliable. Urban stores may face sporadic stockouts or delays in restocking popular items, hurting consumer trust and loyalty. Balancing costs and expectations, retailers must often choose between expanding reach, at the risk of operational inefficiencies, or concentrating in urban cores where infrastructure is more reliable. These geographic constraints demand strategic supply chain planning, multimodal transport coordination, and adaptive store network design to mitigate both cost pressures and service gaps.

Regulatory Complexity and Operational Overheads

Philippine retail operators frequently face a patchwork of regulatory demands that vary across local jurisdictions. Each city or province may enforce different requirements, ranging from business permits and zoning rules to environmental regulations and signage policies, making compliance a bureaucratic labyrinth. These variances can delay store openings, add administrative burdens, and inflate start-up costs for retail chains seeking nationwide rollout. In addition, small-format urban or mall-based outlets often face strict guidelines around operating hours, space utilization, and waste disposal, increasing compliance obligations. In tourist zones or economic zones, special licensing or security clearances may further complicate set-up. Beyond licensing, retailers must navigate tax structures that differ per locality, as well as labor regulations such as mandated holiday closures or rest-day pay, which are variables that affect staffing costs and store schedules. Particularly for SMEs and emerging brands, these operational overheads can consume resources better devoted to marketing, innovation, or expansion. Overcoming such regulatory complexity requires astute local partnerships, deep familiarity with municipal frameworks, and agile adaptation that can strain organizational capacity.

Informal Retail Competition and Price Sensitivity

Despite expanding modern retail formats and malls, conventional street-side vendors, sari‑sari stores, and mobile kiosks remain cornerstones of Philippine commerce, especially in rural areas and residential neighborhoods. These informal retailers often provide convenience, low prices, and flexible payment arrangements, forming a trusted and easy-access retail network. Competing against these deeply entrenched alternatives creates a challenge for formal retailers striving for scale and sustainable margins. Many Filipino shoppers, especially in lower-income or provincial markets, prioritize affordability over curated selection or premium ambiance, making them sensitive to price and wary of fixed pricing models. This price-conscious behavior forces formal retailers to walk a fine line between maintaining product variety, quality, and enticing store experiences while keeping prices competitive. Additionally, informal retailers often benefit from lower overheads and informal supply networks that formal operators cannot replicate easily. Mitigating this competitive pressure requires formal retailers to innovate with localized product assortments, create loyalty programs aligned with value perception, and explore micro-format stores strategically embedded within communities to build trust and relevance.

Philippines Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Food and Beverages

- Personal and Household Care

- Apparel, Footwear and Accessories

- Furniture, Toys and Hobby

- Electronic and Household Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes food and beverages, personal and household care, apparel, footwear and accessories, furniture, toys and hobby, electronic and household appliances, and others.

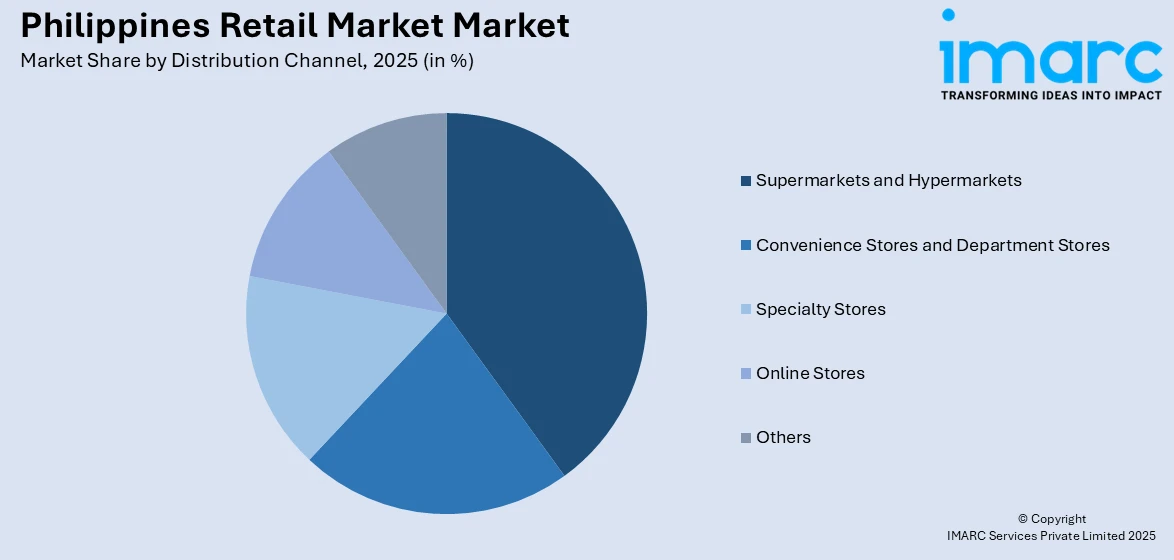

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores and Department Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores and department stores, specialty stores, online stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Retail Market News:

- On February 5, 2024, SMX Convention Center Manila solidified its position as a leading venue in Southeast Asia by earning the prestigious ASEAN MICE Venue Award in the Exhibition Venue category. This recognition highlights SMX Manila's distinction in services, facilities, and overall contribution to the tourism industry as a hub for business and tourism.

- On December 6, 2023, The Department of Trade and Industry (DTI) has revalidated the Gold Bagwis Seals for three Metro Retail stores, Metro Supermarket Carmen, Super Metro Carcar, and Super Metro Bogo, and awarded the Silver Bagwis Seal to Metro Supermarket Hilongos for its commitment to upholding consumer rights and responsible business practices.

Philippines Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores and Department Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines retail market was valued at USD 74.8 Billion in 2025.

The Philippines retail market is projected to exhibit a CAGR of 7.39% during 2026-2034.

The Philippines retail market is expected to reach a value of USD 144.8 Billion by 2034.

The Philippines retail market trends include the rise of omnichannel shopping, growth in e-commerce and social commerce, and increasing demand for locally made and sustainable products. Experiential retail, mobile wallet adoption, and pop-up stores are gaining traction, while consumers seek personalized, convenient, and value-driven shopping experiences across both urban and provincial areas.

The Philippines retail market is driven by rising urbanization, a growing middle class, increased consumer spending, and widespread digital connectivity. Expansion of malls, e-commerce platforms, and mobile payment systems also support growth. Cultural affinity for shopping as a social activity further fuels demand for both online and in-store retail experiences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)