Philippines Salmon Market Size, Share, Trends and Forecast by Type, Species, End Product Type, Distribution Channel, and Region, 2025-2033

Philippines Salmon Market Overview:

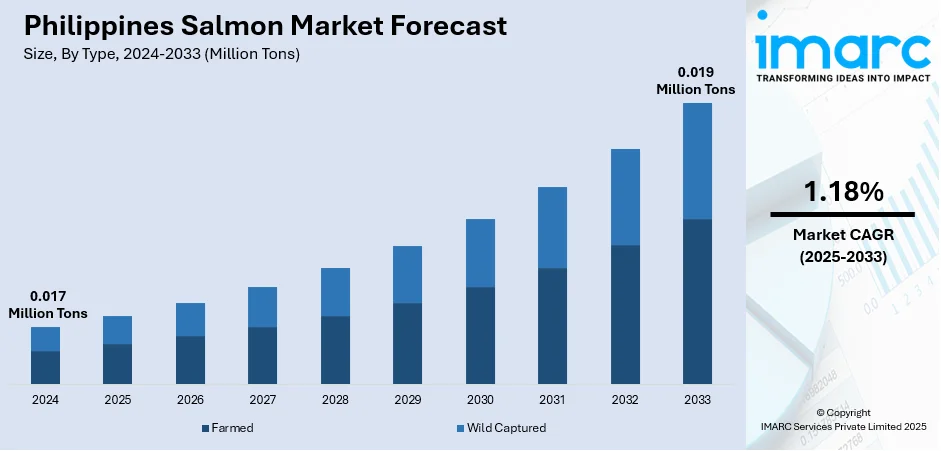

The Philippines salmon market size reached 0.017 Million Tons in 2024. Looking forward, the market is expected to reach 0.019 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.18% during 2025-2033. The market is experiencing steady growth, supported by rising consumer demand for nutritious seafood, expanding distribution channels, and the increasing popularity of salmon in foodservice and retail sectors. Growing awareness about health benefits and preference for premium protein sources further strengthen the industry, enhancing the overall Philippines salmon market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 0.017 Million Tons |

| Market Forecast in 2033 | 0.019 Million Tons |

| Market Growth Rate 2025-2033 | 1.18% |

Philippines Salmon Market Trends:

Rising Consumer Preference for Healthy and Nutritious Food

Increased interest in health and wellness among Filipino consumers is a key driver of salmon demand. Salmon is also generally known as a high-protein, omega-3 fatty acid, and nutrient-dense food, which explains why it is a top choice for people who want to eat a balanced and heart-healthy diet. As knowledge about lifestyle-related diseases increases, more families are adding salmon to their everyday meals as a high-end but healthy food choice. Besides, urban professionals and younger generations are fueling consumption because of their demand for healthier eating options. Not only does this health-focused shift increase salmon demand in homes, but it also stabilizes demand in restaurants and hotels, aligning salmon as a prioritized protein option in the changing food culture in the Philippines.

To get more information on this market, Request Sample

Expansion of Foodservice and Retail Channels

The rapid growth of foodservice establishments and modern retail outlets in the Philippines significantly contributes to the Philippines salmon market growth. Restaurants, hotels, and quick-service chains are increasingly featuring salmon dishes to meet consumer demand for premium and international cuisines. Meanwhile, supermarkets, hypermarkets, and online grocery platforms are improving salmon availability by offering frozen, chilled, and ready-to-cook options. This expansion enhances accessibility for both urban and semi-urban consumers, creating new consumption opportunities. Promotional activities, product innovations, and improved cold chain logistics are also making salmon more affordable and appealing. As foodservice diversification continues and retail channels strengthen, salmon is becoming a regular feature in both premium dining and everyday household purchases, driving sustained market growth.

Influence of Globalization and Changing Food Habits

Globalization and exposure to international cuisines are reshaping consumer eating habits in the Philippines, fueling demand for salmon. Overseas travel, media influence, and the rising popularity of Japanese, Western, and fusion cuisines have made salmon a widely recognized and desirable food. Sushi, sashimi, grilled salmon, and other salmon-based dishes have gained mainstream acceptance across urban markets. Younger demographics, in particular, are driving this trend, showing strong interest in global food experiences and experimenting with premium seafood. The presence of international restaurant chains and the increasing influence of global dining culture are also reinforcing salmon’s position as a staple in modern menus. This shift in food habits is creating long-term growth prospects for salmon consumption across both retail and foodservice sectors.

Philippines Salmon Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, species, end product type, and distribution channel.

Type Insights:

- Farmed

- Wild Captured

The report has provided a detailed breakup and analysis of the market based on the type. This includes farmed and wild captured.

Species Insights:

- Atlantic

- Pink

- Chum/Dog

- Coho

- Sockeye

- Others

A detailed breakup and analysis of the market based on the species have also been provided in the report. This includes Atlantic, pink, chum/dog, coho, sockeye, and others.

End Product Type Insights:

- Frozen

- Fresh

- Canned

- Others

A detailed breakup and analysis of the market based on the end product type have also been provided in the report. This includes frozen, fresh, canned, and others.

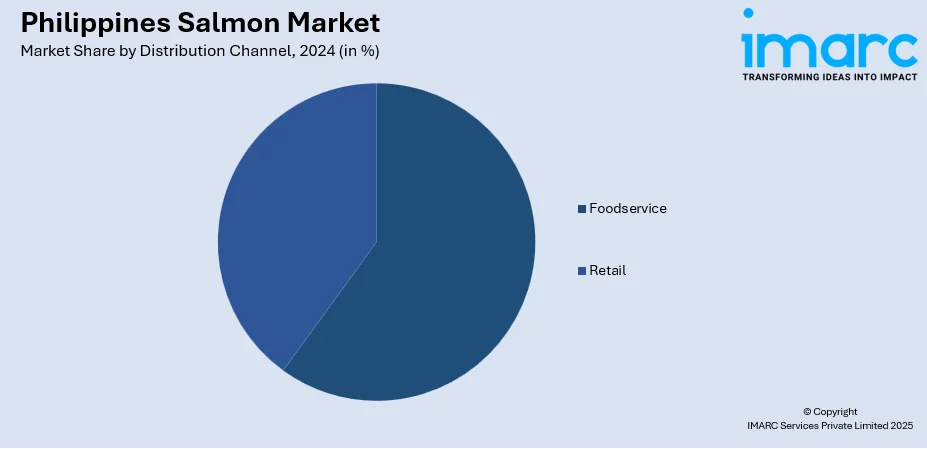

Distribution Channel Insights:

- Foodservice

- Retail

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes foodservice and retail.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Salmon Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Farmed, Wild Captured |

| Species Covered | Atlantic, Pink, Chum/Dog, Coho, Sockeye, Others |

| End Product Types Covered | Frozen, Fresh, Canned, Others |

| Distribution Channels Covered | Foodservice, Retail |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines salmon market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines salmon market on the basis of type?

- What is the breakup of the Philippines salmon market on the basis of species?

- What is the breakup of the Philippines salmon market on the basis of end product type?

- What is the breakup of the Philippines salmon market on the basis of distribution channel?

- What is the breakup of the Philippines salmon market on the basis of region?

- What are the various stages in the value chain of the Philippines salmon market?

- What are the key driving factors and challenges in the Philippines salmon market?

- What is the structure of the Philippines salmon market and who are the key players?

- What is the degree of competition in the Philippines salmon market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines salmon market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines salmon market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines salmon industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)