Philippines Silica Sand Market Size, Share, Trends and Forecast by End Use, and Region, 2026-2034

Philippines Silica Sand Market Summary:

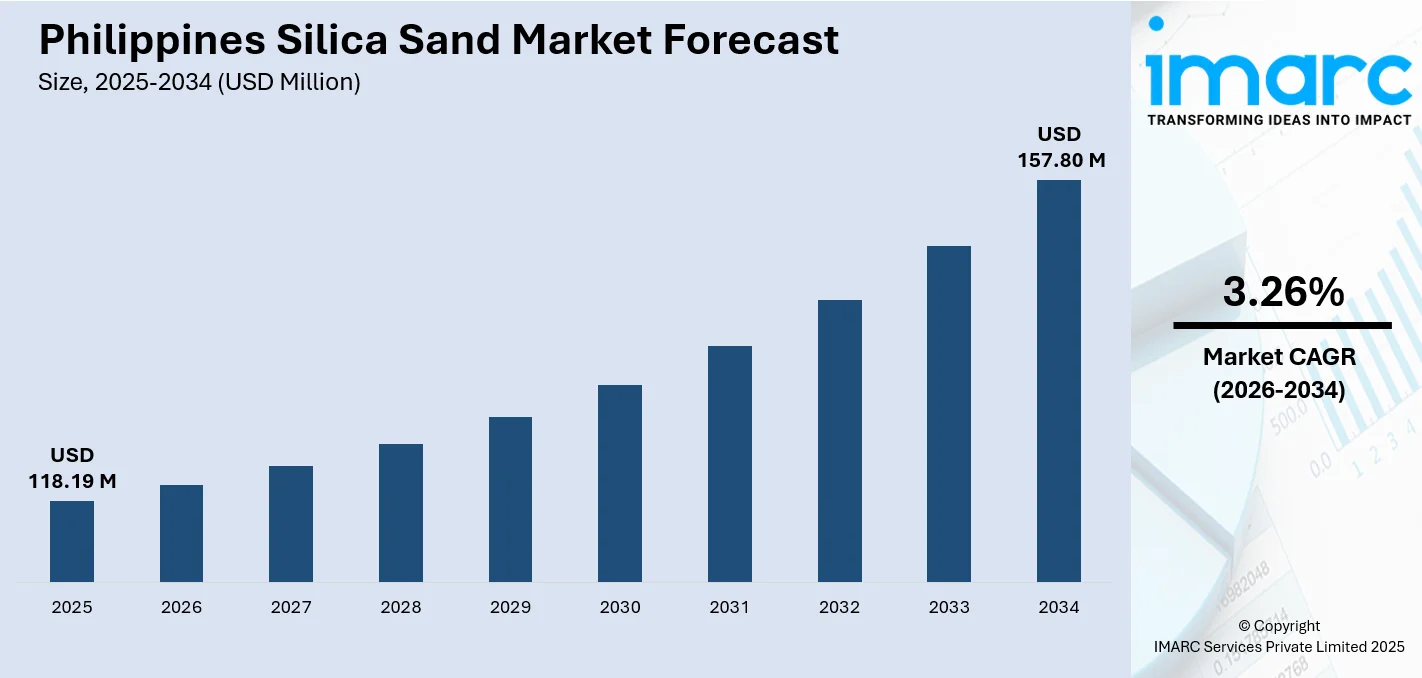

The Philippines silica sand market size was valued at USD 118.19 Million in 2025 and is projected to reach USD 157.80 Million by 2034, growing at a compound annual growth rate of 3.26% from 2026-2034.

The market is experiencing sustained and robust growth momentum driven by the rapidly expanding construction sector, rising glass manufacturing output across multiple product categories, and accelerating infrastructure development initiatives. Strong and consistent demand from concrete production facilities, specialty building material manufacturers, ready-mix concrete plants, and diverse industrial applications continues propelling consumption levels to unprecedented heights across all major regions. Government investments in comprehensive transportation networks including roads, bridges, airports, and seaports, large-scale housing projects are significantly expanding the Philippines silica sand market share.

Key Takeaways and Insights:

-

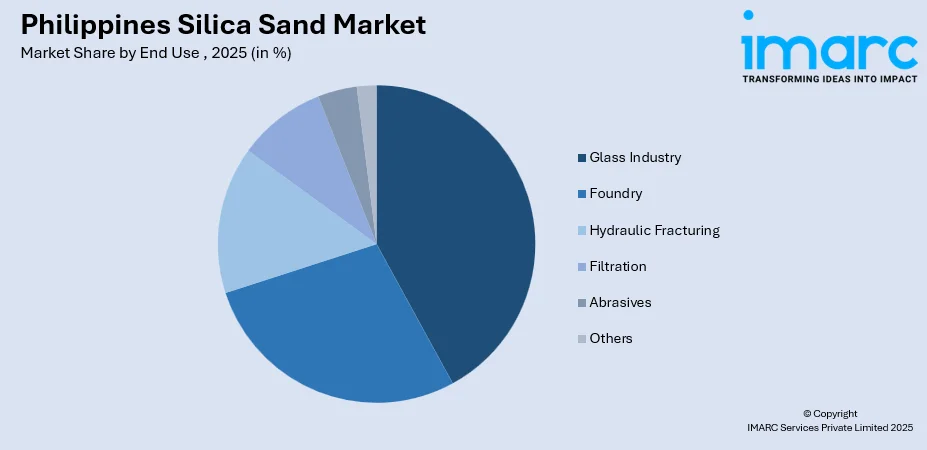

By End Use: Glass industry dominates the market with a substantial share of 42.06% in 2025, driven by robust container glass production for food and beverage packaging serving both domestic consumption and export markets.

-

By Region: Luzon leads the market with a share of 47% in 2025, supported by highly concentrated industrial activities, extensive construction projects, strategic proximity to major glass manufacturing facilities and processing plants, and well-established supply chain networks.

-

Key Players: The Philippines silica sand market exhibits moderate competitive intensity, characterized by established domestic producers including and regional suppliers serving diverse local industrial requirements across construction, glass manufacturing, and filtration applications, alongside imported supplies, and sophisticated industrial applications requiring stringent quality specifications, consistent material properties, and reliable supply capabilities throughout the year.

To get more information on this market Request Sample

The Philippines silica sand market is advancing steadily as construction activities accelerate nationwide across residential, commercial, industrial, and infrastructure segments, glass manufacturing capacity expands significantly with new investments and facility modernization programs, and infrastructure investments increase substantially across the entire archipelago under the government's ambitious development agenda. Growing urbanization trends with urban population reported at 1.5005 % in 2024, rising housing demand driven by population growth, household formation patterns, and expanding commercial developments including shopping centers, office buildings, hotels, and mixed-use projects are collectively driving consumption of high-quality silica sand for concrete production, mortar preparation, specialty building materials, and decorative applications. The glass packaging industry continues experiencing robust growth, strongly supported by food and beverage sector expansion with new manufacturing facilities, increasing consumer preference for sustainable and recyclable packaging solutions over single-use plastic alternatives, and growing pharmaceutical industry requirements for chemically inert packaging materials protecting product integrity.

Philippines Silica Sand Market Trends:

Growing Preference for High-Purity Silica Sand in Construction Applications

The Philippine construction sector is increasingly and systematically shifting from traditional river sand extraction to processed silica sand due to demonstrably superior performance characteristics and mounting environmental considerations affecting sourcing decisions across residential, commercial, and infrastructure projects. Silica sand offers significantly higher compressive strength essential for structural applications, better consistency in grain size distribution ensuring uniform concrete quality, enhanced durability for demanding construction applications requiring long service life, and superior chemical stability compared to conventional alternatives that may contain impurities affecting concrete performance. Government restrictions on river sand extraction activities are substantially accelerating this important transition across the construction industry. In 2025, The governor of Lanao del Sur announced the shutting down of illegal mines and sand and gravel quarries in the province effective from September 1, 2025, via an executive order.

Significant Expansion of Glass Manufacturing Capacity Across Multiple Product Categories

The Philippines glass manufacturing sector is experiencing significant and sustained capacity expansion, driven by growing demand for container glass packaging solutions serving food, beverage, pharmaceutical, and cosmetic industries, alongside expanding architectural glass applications in the construction industry including windows, facades, and interior partitions. This remarkable growth trajectory is creating sustained and growing demand for high-purity silica sand as the fundamental raw material essential for all glass production processes, requiring consistent supplies meeting stringent specifications for silica content, iron oxide limits, and grain size distribution. In 2025, the 47th ASEAN conference was held in Cebu, the Philippines where glass manufacturers within the ASEAN members strategically collaborated to strengthen the glass sector in the region.

Infrastructure-Led Demand Surge from Comprehensive Government Investment Programs Nationwide

Major government infrastructure development programs are generating substantial and sustained demand for silica sand across all regions of the Philippines archipelago, from Northern Luzon through the Visayas to Mindanao. The 2025 national budget allocated a significant PHP 861.2 billion (approximately USD 14.9 billion) specifically for comprehensive transport infrastructure development projects including national roads, expressways, bridges, airports, seaports, and rail systems, alongside PHP 257.1 billion (USD 4.5 billion) dedicated to water infrastructure improvements including irrigation systems, flood control projects, and water supply facilities. These comprehensive and sustained investments in road networks connecting major economic centers, bridge construction spanning rivers and waterways, airport modernization serving domestic and international passengers, seaport expansion facilitating trade, and public facility development improving government services are driving robust consumption of high-quality silica sand for concrete production in structural applications.

Market Outlook 2026-2034:

The Philippines silica sand market outlook remains decidedly positive and optimistic as construction activities expand significantly across all regions and market segments, glass manufacturing capacity increases substantially with new investments and facility upgrades, and infrastructure investments accelerate under comprehensive government development programs spanning the entire archipelago. The market generated a revenue of USD 118.19 Million in 2025 and is projected to reach a revenue of USD 157.80 Million by 2034, growing at a compound annual growth rate of 3.26% from 2026-2034. Industrial applications including municipal and industrial water filtration systems treating millions of liters daily, foundry operations producing castings for automotive, machinery, and equipment manufacturers, and abrasive manufacturing serving surface treatment and preparation needs further diversify demand sources and strengthen overall market resilience against sector-specific fluctuations.

Philippines Silica Sand Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| End Use | Glass Industry | 42.06% |

| Region | Luzon | 47% |

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Glass Industry

- Foundry

- Hydraulic Fracturing

- Filtration

- Abrasives

- Others

Glass industry dominates with a market share of 42.06% of the total Philippines silica sand market in 2025.

The glass industry maintains its commanding and undisputed dominant position in the Philippines silica sand market due to the essential and irreplaceable role of high-purity silica as the primary raw material for all glass manufacturing processes across multiple product categories. Container glass production for food and beverage packaging applications serving domestic consumption and export markets, flat glass manufacturing for construction and architectural applications in residential buildings, commercial properties, and industrial facilities, and specialty glass production for pharmaceutical packaging, cosmetic containers, laboratory equipment, and various industrial uses collectively drive substantial silica sand consumption volumes annually throughout the country.

Major glass manufacturers operating in the Philippines operate extensive and sophisticated production facilities requiring consistent and reliable supplies of quality-controlled silica sand meeting stringent international specifications for chemical purity with silica content typically exceeding 99%, precise grain size distribution ensuring optimal melting behavior, low iron oxide content preventing unwanted coloration, and consistent physical properties essential for producing high-quality glass products meeting customer requirements. The segment also benefits significantly and increasingly from growing consumer preference for glass packaging driven by sustainability considerations, heightened environmental awareness regarding plastic pollution, and premium product positioning opportunities that glass containers uniquely provide compared to alternative packaging materials

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon leads with a share of 47% of the total Philippines silica sand market in 2025.

Luzon maintains undisputed and commanding market leadership driven by highly concentrated industrial activities spanning multiple sectors, extensive infrastructure development initiatives under national and regional programs, and strategic proximity to major end-use industries requiring consistent and reliable silica sand supplies for diverse applications. Metro Manila, the National Capital Region, and surrounding provinces in Central Luzon including Bulacan, Pampanga, Tarlac, and Nueva Ecija, along with the Calabarzon region comprising Cavite, Laguna, Batangas, Rizal, and Quezon provinces, host the vast majority of glass manufacturing facilities, construction material producers, ready-mix concrete plants, and industrial consumers requiring high-quality silica sand for demanding applications.

The region benefits substantially from well-established supply chain networks developed over several decades of industrial development, modern port infrastructure at Manila, Batangas, and Subic facilitating efficient handling of imported supplies when domestic production cannot meet specialized requirements, and access to skilled labor forces supporting value-added processing operations. Central Luzon is projected to experience the highest regional growth rate through 2030, driven by industrial zone expansions in Clark Special Economic Zone and Subic Bay Freeport, infrastructure corridor developments connecting major economic centers, and new manufacturing investments attracted by competitive operating conditions.

Market Dynamics:

Growth Drivers:

Why is the Philippines Silica Sand Market Growing?

Rapid Urbanization and Population Growth Driving Sustained Housing Demand

The Philippines is experiencing rapid urbanization and sustained population growth that are fundamentally transforming demand patterns for construction materials including silica sand across residential, commercial, and mixed-use development projects. According to the 2024 census data, the Philippines' population has grown by over three million in the past four years, with the urban population expanding even faster as rural-to-urban migration accelerates in search of employment opportunities, better education access, and improved living standards. The World Bank's collection of development indicators reported the urban population in the Philippines at 56,316,242 in 2024, creating unprecedented demand for new housing units, apartment buildings, condominium towers, and supporting commercial infrastructure throughout metropolitan regions. These developments are further driving the need for high quality silica sand.

Expanding Water Treatment Infrastructure and Growing Filtration Applications

The Philippines is making substantial investments in water treatment infrastructure and filtration systems that are creating growing demand for specialized silica sand grades across municipal, industrial, and commercial applications throughout the archipelago. In 2025, Hitachi Asia Ltd. together with its partners, Meralco Energy, Inc. (MSERV) and Toshiba Plant System & Services Corporation, Philippines (TPSC), announced plans to improve wastewater management practices at the Cupang Water Reclamation Facility (WRF) in Muntinlupa City for Maynilad Water Services, Inc. This initiative bolstered wastewater treatment capabilities and guarantee adherence to the most recent standards established by the Department of Environment and Natural Resources (DENR) Administrative Order No. 2021-19 (DAO2021-19)opens in a new tab. Provincial water districts across Luzon, Visayas, and Mindanao are similarly upgrading their treatment facilities to meet drinking water quality standards mandated by the Philippine National Standards for Drinking Water, driving demand for filtration-grade silica sand with specific particle size distributions and purity levels essential for effective water treatment processes.

Growth of Foundry and Metalcasting Industry

The Philippine foundry and metalcasting industry is experiencing sustained growth as the country's manufacturing sector expands, creating consistent demand for foundry-grade silica sand essential for producing metal castings used in automotive components, machinery parts, industrial equipment, and infrastructure applications. The Philippine Metalcasting Association Inc. (PMAI) represents approximately 55 member foundries operating throughout the country, producing a diverse range of cast iron, cast steel, aluminum, and non-ferrous castings serving domestic industries and export markets in Asia and beyond. These foundries consume substantial quantities of silica sand for creating molds and cores used in sand casting processes, the predominant casting method employed for producing automotive engine blocks, transmission housings, pump casings, valve bodies, manhole covers, and countless other industrial components essential for Philippine economic activities.

Market Restraints:

What Challenges the Philippines Silica Sand Market is Facing?

Stringent Environmental Regulations and Complex Mining Permit Requirements Creating Operational Barriers

Environmental compliance requirements present significant and often challenging operational hurdles for silica sand extraction, processing, and distribution activities throughout the Philippines, potentially constraining supply expansion and increasing operational costs for market participants. Mining operators must navigate complex and time-consuming permitting processes involving multiple government agencies at both national and local levels with varying requirements and timelines, secure free, prior, and informed consent from indigenous peoples and cultural communities where operations affect ancestral domains, and obtain local government endorsements. The regulatory environment, while essential for environmental protection and sustainable resource management, presents notable challenges for market participants seeking to expand production capacity to meet growing demand.

Significant Regional Price Variations and Supply Chain Constraints Affecting Market Efficiency

Significant and persistent price variations across Philippine regions create notable market inefficiencies and substantially complicate procurement planning for industrial consumers seeking predictable input costs for their operations. Silica sand prices range widely from PHP 300 to PHP 800 per cubic meter depending on geographic location relative to production sources, specific quality specifications and purity requirements, transportation distances from supply sources to consumption points, and local supply availability influenced by seasonal and logistical factors. Remote areas and island provinces face particularly elevated costs due to freight premiums that can increase delivered prices above source location prices, limited local supply sources, challenging logistics conditions during monsoon seasons affecting shipping schedules, and higher inventory carrying costs due to supply uncertainty.

Import Dependency for Specialized High-Purity Grades Creating Supply Chain Vulnerabilities

The Philippines remains notably and persistently dependent on imports for specialized high-purity silica sand grades required by certain demanding industrial applications, particularly in advanced glass manufacturing requiring exceptionally high silica content and precision filtration systems requiring consistent particle size distribution and purity levels. This ongoing import dependency creates notable supply chain vulnerabilities to international commodity price fluctuations affecting procurement budgets, currency exchange rate movements between the Philippine peso and major trading currencies impacting landed costs, shipping disruptions during adverse weather conditions.

Competitive Landscape:

The Philippines silica sand market exhibits moderate competitive intensity, characterized by established domestic producers serving diverse local industrial requirements across construction, glass manufacturing, filtration, foundry, and specialty applications alongside imported supplies meeting specialized demand for high-purity grades that domestic sources cannot consistently provide at required quality levels. Market participants focus strategically on ensuring consistent quality through rigorous testing protocols and quality management systems, developing efficient extraction and processing capabilities using modern technologies to improve yields and reduce costs, and establishing reliable distribution networks reaching customers across the geographically dispersed archipelago. Leading domestic suppliers including Ody Silica, Richson's Trading, and regional producers have established strong market positions through demonstrated quality consistency, reliable supply capabilities meeting customer scheduling requirements, competitive pricing for standard grades, and responsive customer service addressing technical and logistical needs.

Philippines Silica Sand Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Glass Industry, Foundry, Hydraulic Fracturing, Filtration, Abrasives, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines silica sand market size was valued at USD 118.19 Million in 2025.

The Philippines silica sand market is expected to grow at a compound annual growth rate of 3.26% from 2026-2034 to reach USD 157.80 Million by 2034.

The Glass Industry segment holds the largest revenue share at 42.06% in 2025, maintaining its dominant position driven by robust container glass production for food and beverage packaging serving domestic consumption and export markets, expanding flat glass manufacturing for construction and architectural applications in buildings and commercial properties, and growing specialty glass requirements across pharmaceutical packaging.

Key factors driving the Philippines silica sand market include robust construction industry expansion across residential, commercial, industrial, and infrastructure segments with the sector, sustained glass manufacturing sector growth with strategic capacity investments and facility modernization programs, comprehensive government infrastructure investment programs for transport infrastructure, accelerating urbanization trends, rising housing demand from population growth, expanding water filtration applications across municipal and industrial segments treating millions of liters daily, and growing foundry operations supporting automotive and machinery manufacturing industries.

Major challenges confronting the Philippines silica sand market include stringent environmental and mining regulations requiring Environmental Compliance Certificates, Environmental Protection and Enhancement Programs, and rehabilitation fund deposits that can delay project timelines and increase operational costs, significant regional price variations depending on location, quality, and transportation distances, and persistent import dependency for high-purity grades with prices creating supply chain vulnerabilities to international price fluctuations and currency movements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)