Philippines Socks Market Size, Share, Trends and Forecast by Product, Material, Application, Distribution Channel, and Region, 2026-2034

Philippines Socks Market Summary:

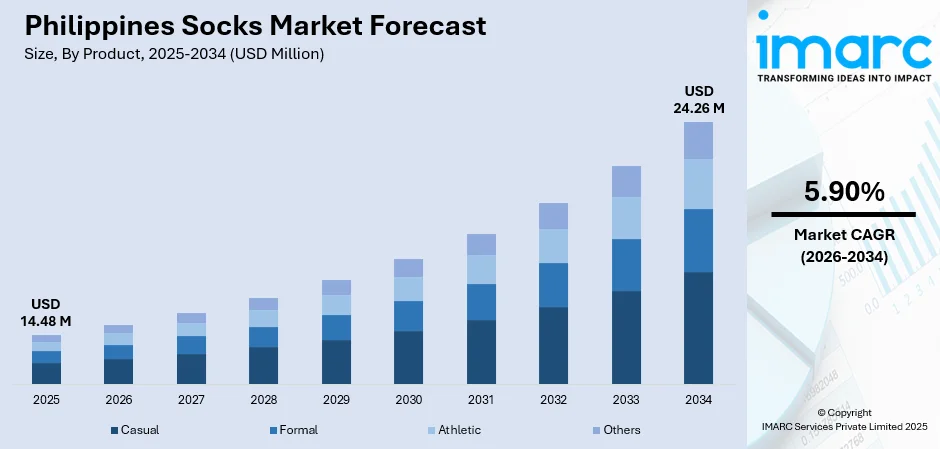

The Philippines socks market size was valued at USD 14.48 Million in 2025 and is projected to reach USD 24.26 Million by 2034, growing at a compound annual growth rate of 5.90% from 2026-2034.

The Philippines socks market is experiencing substantial growth driven by changing consumer tastes, growing awareness about fitness and health, and the rapid expansion of modern retail infrastructure across the archipelago. Rising disposable incomes among the growing middle-class population are enabling consumers to allocate more spending toward quality apparel and accessories. The proliferation of e-commerce platforms and digital payment solutions has significantly enhanced product accessibility, allowing consumers in both urban and provincial areas to explore diverse sock styles from local and international brands. Additionally, the athleisure trend continues to gain momentum as younger demographics seek comfortable yet fashionable everyday wear. These converging factors are collectively strengthening the Philippines socks market share.

Key Takeaways and Insights:

-

By Product: Casual socks dominate the market with a share of 56.71% in 2025, driven by widespread consumer preference for versatile everyday wear suitable for various occasions from home to office settings.

-

By Material: Cotton leads the market with a share of 52% in 2025, owing to its natural breathability, moisture absorption capabilities, and comfort properties preferred in tropical climates.

-

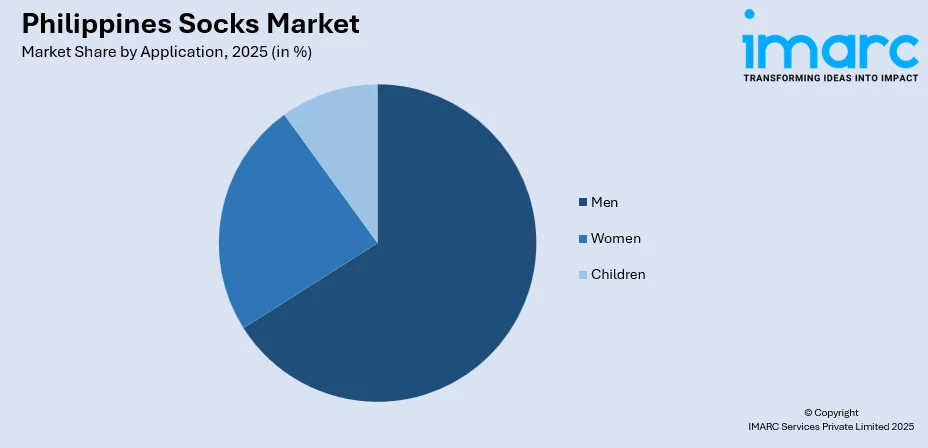

By Application: Men represent the largest segment with a market share of 65.83% in 2025, attributed to higher participation rates in sports and fitness activities requiring specialized performance socks.

-

By Distribution Channel: Supermarkets and Hypermarkets account for the largest share of 57.65% in 2025, leveraging extensive retail networks, bundled promotions, and consumer trust in established shopping destinations.

-

By Region: Luzon dominates the market with a share of 65% in 2025, supported by Metro Manila's concentrated population, higher purchasing power, and dense retail infrastructure.

-

Key Players: The Philippines socks market exhibits a competitive landscape characterized by a dynamic mix of international sportswear brands and domestic manufacturers. Leading global players compete alongside local producers across various price segments, with market participants focusing on product innovation, digital retail expansion, and strategic partnerships with retail chains to strengthen their market positioning.

To get more information on this market Request Sample

The Philippines socks market demonstrates robust fundamentals underpinned by demographic advantages and lifestyle transformations across the archipelago. The country's young population, with a median age below thirty years, exhibits strong affinity for fashion-forward products and athletic footwear accessories that complement active lifestyles. Urbanization trends continue accelerating as provincial residents migrate to metropolitan areas seeking employment opportunities, creating concentrated consumer bases with evolving wardrobe requirements. The fitness culture has gained significant traction, with the Philippine sportswear market reflecting heightened demand for performance-oriented apparel including specialized athletic socks. Government health campaigns and increased access to fitness applications are motivating consumers toward physically active lifestyles, thereby driving demand for functional sock products featuring moisture-wicking materials and ergonomic designs. Social media platforms and influencer marketing play instrumental roles in shaping purchasing decisions, particularly among Gen Z and millennial consumers who view socks as expressive fashion accessories rather than mere functional necessities.

Philippines Socks Market Trends:

Rising Athleisure Culture and Performance-Oriented Demand

The athleisure movement is reshaping sock consumption patterns as Filipinos increasingly blend athletic wear with casual fashion for everyday use. Young consumers, particularly Gen Z and millennials, are driving this trend by favoring apparel that offers both comfort and trendiness. Performance features such as moisture-wicking capabilities, cushioning, and arch support are becoming standard expectations rather than premium additions. In April 2023, the Philippine Olympic Committee extended its collaboration with Asics, the renowned sportswear brand, ensuring national athletes continue wearing Asics apparel during training and competitive events, thereby influencing consumer brand perceptions.

Digital Commerce Transformation and Omnichannel Retail

E-commerce penetration is fundamentally transforming how Filipino consumers discover and purchase socks, with digital platforms offering unprecedented product variety and competitive pricing. Mobile shopping applications, live-stream selling events, and integrated payment options have democratized access to diverse sock styles from both local and international brands. The Philippines e-commerce market is projected to reach USD 86.2 Billion by 2034, exhibiting a growth rate (CAGR) of 13.32% during 2026-2034, with fashion accessories including socks ranking among top-performing categories. GCash, the leading mobile wallet, amassed approximately 94 million users by early 2025, facilitating seamless digital transactions that accelerate online sock purchases.

Sustainable and Eco-Conscious Material Preferences

Sustainability consciousness is emerging as a significant factor influencing sock purchasing decisions among environmentally aware Filipino consumers. Growing interest in eco-friendly materials including organic cotton, bamboo fibers, and recycled polyester reflects broader shifts toward responsible consumption patterns. In June 2025, the Bamboo Textile Fiber Innovation Hub launched in Lingayen, Pangasinan, aiming to boost sustainable fashion using eco-friendly bamboo through advanced machinery that produces bamboo fiber for textiles while promoting local weaving traditions and providing hands-on training for students. This government-supported initiative underscores the country's commitment to sustainable textile development.

Market Outlook 2026-2034:

The Philippines socks market outlook remains optimistic, supported by favorable demographic dynamics, rising consumer spending power, and continued retail infrastructure expansion across provincial areas. Economic growth projections indicate average per-capita income could nearly double, significantly enlarging the consumer base for quality apparel products. The convergence of physical and digital retail channels will create enhanced shopping experiences as brands adopt omnichannel strategies integrating online convenience with in-store engagement. The market generated a revenue of USD 14.48 Million in 2025 and is projected to reach a revenue of USD 24.26 Million by 2034, growing at a compound annual growth rate of 5.90% from 2026-2034.

Philippines Socks Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Casual | 56.71% |

| Material | Cotton | 52% |

| Application | Men | 65.83% |

| Distribution Channel | Supermarkets and Hypermarkets | 57.65% |

| Region | Luzon | 65% |

Product Insights:

- Casual

- Formal

- Athletic

- Others

The casual socks dominate with a market share of 56.71% of the total Philippines socks market in 2025.

The casual socks segment maintains commanding market leadership driven by widespread consumer demand for versatile everyday wear products. Filipino consumers across all age demographics prefer casual socks for their adaptability across multiple occasions, from home relaxation to office environments and social gatherings. The segment benefits from extensive product variety encompassing diverse colors, patterns, and designs that enable personal expression. Manufacturers continuously expand their casual sock portfolios with contemporary styles responding to evolving fashion preferences, with the Philippine clothing market to reach USD 15.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.9% during 2025-2033, reflecting strong apparel consumption.

Consumer preference for comfort-oriented casual socks has intensified as work-from-home and hybrid work arrangements persist across the Philippine workforce. Price accessibility positions casual socks as affordable fashion accessories allowing frequent purchases and wardrobe updates without significant financial consideration. Retail channels from traditional markets to modern supermarkets maintain robust casual sock inventories ensuring widespread product availability. Brand competition within this segment focuses on quality differentiation, innovative designs, and value propositions that resonate with budget-conscious yet style-aware consumers seeking reliable everyday wear solutions.

Material Insights:

- Nylon

- Cotton

- Polyester

- Waterproof Breathable Membrane

- Others

The cotton leads with a share of 52% of the total Philippines socks market in 2025.

Cotton socks maintain market leadership owing to superior natural properties ideally suited to the Philippines' tropical climate conditions. The material's inherent breathability allows effective air circulation preventing excessive foot perspiration during humid weather conditions prevalent throughout the archipelago. Moisture absorption capabilities ensure comfortable wear throughout extended periods, making cotton the preferred choice for daily use applications. The Philippines textile sector increasingly emphasizes sustainable cotton sourcing, with the Department of Science and Technology highlighting innovations at the Philippine Textile Congress in November 2024 showcasing commitment to sustainable and innovative textile development.

Consumer perception associates cotton socks with quality, durability, and skin-friendly characteristics that minimize irritation and allergic reactions. Local and international manufacturers prioritize cotton-based sock production responding to consistent market demand and consumer preference patterns. Cotton's versatility enables diverse product applications from basic everyday socks to premium performance variants incorporating cotton blends with synthetic materials. The material's widespread cultivation globally ensures stable supply chains and competitive pricing that supports market accessibility across various consumer income segments.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Men

- Women

- Children

The men hold the largest share with 65.83% of the total Philippines socks market in 2025.

The men's segment commands market leadership attributed to higher participation rates in sports, fitness activities, and formal employment requiring diverse sock wardrobes. Filipino men demonstrate strong consumption patterns across casual, athletic, and formal sock categories, driven by varied lifestyle requirements from professional settings to recreational pursuits. The Philippines sports apparel and athleisure market reflects substantial male consumer engagement with performance-oriented products. Corporate dress codes and professional environments necessitate formal sock purchases, while growing fitness consciousness drives athletic sock demand.

Brand awareness among male consumers influences purchasing decisions, with international sportswear labels commanding significant market presence alongside value-oriented local alternatives. Marketing strategies targeting male demographics emphasize functionality, durability, and performance attributes resonating with practical consumption motivations. The segment benefits from synthetic material innovations offering moisture-wicking, odor control, and compression features particularly appealing to fitness enthusiasts. Distribution across sports specialty retailers, department stores, and e-commerce platforms ensures comprehensive market coverage addressing diverse male consumer preferences.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The supermarkets and hypermarkets exhibit clear dominance with 57.65% share of the total Philippines socks market in 2025.

Supermarkets and hypermarkets maintain distribution channel leadership leveraging extensive retail networks, consumer trust, and convenient one-stop shopping experiences across the Philippines. Major retail chains including SM Hypermarket, Robinsons Supermarket, and Savemore operate dense outlet matrices enabling widespread product accessibility. Supermarkets and hypermarkets combined delivered a substantial share of the Philippines retail market, with their bundled promotions and loyalty programs nurturing repeat consumer traffic. The channel benefits from established consumer shopping behaviors where apparel purchases often accompany routine grocery shopping trips.

Strategic merchandise placement within these retail environments maximizes sock product visibility and impulse purchase opportunities. Retailer private-label sock offerings provide affordable alternatives competing alongside branded products, expanding consumer choice across price points. The channel continues modernizing through digital integration, with click-and-collect services and mobile application ordering enhancing convenience. Investment in store renovations and enhanced shopping experiences addresses evolving consumer expectations while maintaining the channel's competitive positioning against rapidly growing online alternatives.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates the market with 65% share of the total Philippines socks market in 2025.

Luzon commands overwhelming regional market share driven by Metro Manila's concentrated population, higher purchasing power, and dense retail infrastructure supporting diverse consumer preferences. The region reflects significant economic dominance and consumer market concentration across the archipelago. Metro Manila serves as the primary hub for both traditional retail operations and e-commerce fulfillment, with major shopping malls, department stores, and distribution centers concentrated within the National Capital Region. The presence of established retail chains ensures comprehensive product accessibility for urban consumers.

Provincial areas within Luzon benefit from improving logistics networks enabling faster product delivery and retail expansion beyond metropolitan boundaries. Rising disposable incomes across Luzon's urban and suburban populations support sustained demand growth for quality sock products. The region's well-developed transportation infrastructure facilitates efficient supply chain operations, ensuring consistent product availability across both established urban centers and emerging suburban retail destinations throughout the island. Continued infrastructure investments further strengthen distribution capabilities connecting provincial markets to major commercial hubs.

Market Dynamics:

Growth Drivers:

Why is the Philippines Socks Market Growing?

Expanding Middle-Class Population and Rising Disposable Incomes

The Philippines economic trajectory demonstrates consistent middle-class expansion, creating enlarged consumer bases with increasing discretionary spending capacity for apparel products including socks. Rising household incomes enable consumers to prioritize quality, branded products over basic functional alternatives, driving premiumization trends across sock categories. Average per-capita GDP is projected to nearly double from approximately USD 3,541 in 2023 to USD 6,500 by 2030, significantly expanding the purchasing power of Filipino consumers. This income growth translates into broader wardrobe investments as consumers allocate higher portions of budgets toward fashion and personal care products. Urbanization accelerates this trend as rural-to-urban migrants adopt metropolitan consumption patterns emphasizing diverse sock wardrobes for professional and social occasions.

Digital Retail Revolution and E-Commerce Expansion

Digital transformation is fundamentally reshaping the Philippine retail landscape, with e-commerce platforms dramatically expanding sock product accessibility beyond traditional brick-and-mortar limitations. The Philippines e-commerce sector is projected to grow, with fashion accessories including socks ranking among top-performing online categories. Mobile-first shopping behaviors, supported by widespread smartphone penetration and reliable digital payment infrastructure, enable convenient sock purchases from diverse brand portfolios. Social commerce through platforms integrating shopping with entertainment content creates engaging purchasing experiences particularly resonating with younger demographics. Live-stream selling events and influencer collaborations drive impulse purchases while building brand awareness across previously unreachable provincial consumer markets.

Health Consciousness and Fitness Culture Adoption

Growing health awareness among Filipino consumers is generating sustained demand for performance-oriented athletic socks supporting active lifestyle pursuits. Increased participation in fitness activities including running, basketball, gym workouts, and outdoor recreation creates requirements for specialized sock products featuring cushioning, arch support, and moisture management capabilities. Outdoor sports participation has reportedly increased in recent periods, with activities like hiking, cycling, and running gaining significant traction. Government health campaigns and proliferating fitness applications are motivating broader population segments toward physically active lifestyles. The rising gym membership culture, particularly among urban professionals and younger demographics, establishes consistent demand channels for athletic sock products from both international performance brands and value-oriented alternatives.

Market Restraints:

What Challenges the Philippines Socks Market is Facing?

Price Sensitivity and Competition from Low-Cost Alternatives

Filipino consumers exhibit significant price sensitivity, particularly in lower and middle-income segments, creating challenges for premium sock brands seeking market penetration. Abundant availability of low-cost imported products and unbranded alternatives from informal retail channels intensifies price competition across the market. Counterfeit products mimicking established brands further complicate competitive dynamics while eroding consumer trust and legitimate brand revenues.

Fragmented Distribution and Geographic Accessibility Barriers

The Philippines' archipelagic geography presents inherent distribution challenges, with logistics costs and infrastructure limitations constraining product accessibility in remote provincial and island communities. Transportation inefficiencies between major urban centers and rural areas create supply chain complexities that elevate product prices in underserved markets. Limited modern retail presence outside metropolitan areas restricts consumer exposure to diverse sock product offerings and brands.

Limited Domestic Manufacturing Capacity

The Philippines maintains limited domestic sock manufacturing capabilities, resulting in heavy dependence on imported products that expose the market to currency fluctuations and international supply chain disruptions. Higher production costs compared to regional manufacturing centers like Vietnam and China constrain local producer competitiveness. Insufficient investment in textile manufacturing infrastructure limits value-added domestic production despite available raw material resources.

Competitive Landscape:

The Philippines socks market demonstrates a competitive structure characterized by the presence of established international sportswear brands competing alongside domestic manufacturers across diverse price segments. Leading global players leverage brand recognition, product innovation, and extensive marketing resources to maintain premium market positioning, while local producers compete through value propositions, distribution relationships, and regional market understanding. Competition intensifies across retail channels as brands pursue omnichannel strategies integrating physical store presence with e-commerce platforms and social commerce initiatives. Product differentiation strategies emphasize performance features, material innovations, and design aesthetics to capture consumer attention in an increasingly crowded marketplace. Strategic partnerships between brands and major retail chains create exclusive distribution arrangements while private-label offerings from supermarket chains introduce additional competitive pressure.

Philippines Socks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Casual, Formal, Athletic, Others |

| Materials Covered | Nylon, Cotton, Polyester, Wool, Waterproof Breathable Membrane, Others |

| Applications Covered | Men, Women, Children |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines socks market size was valued at USD 14.48 Million in 2025.

The Philippines socks market is expected to grow at a compound annual growth rate of 5.90% from 2026-2034 to reach USD 24.26 Million by 2034.

The casual socks hold the largest market share, driven by widespread consumer preference for versatile everyday wear that accommodates diverse occasions from home relaxation to office environments.

Key factors driving the Philippines socks market include expanding middle-class population with rising disposable incomes, digital retail revolution through e-commerce expansion, and growing health consciousness driving athleisure and performance sock demand.

Major challenges include price sensitivity and competition from low-cost alternatives, fragmented distribution across the archipelagic geography, and limited domestic manufacturing capacity resulting in import dependence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)