Philippines Soup Market Size, Share, Trends and Forecast by Type, Category, Packaging, Distribution Channel, and Region, 2025-2033

Philippines Soup Market Overview:

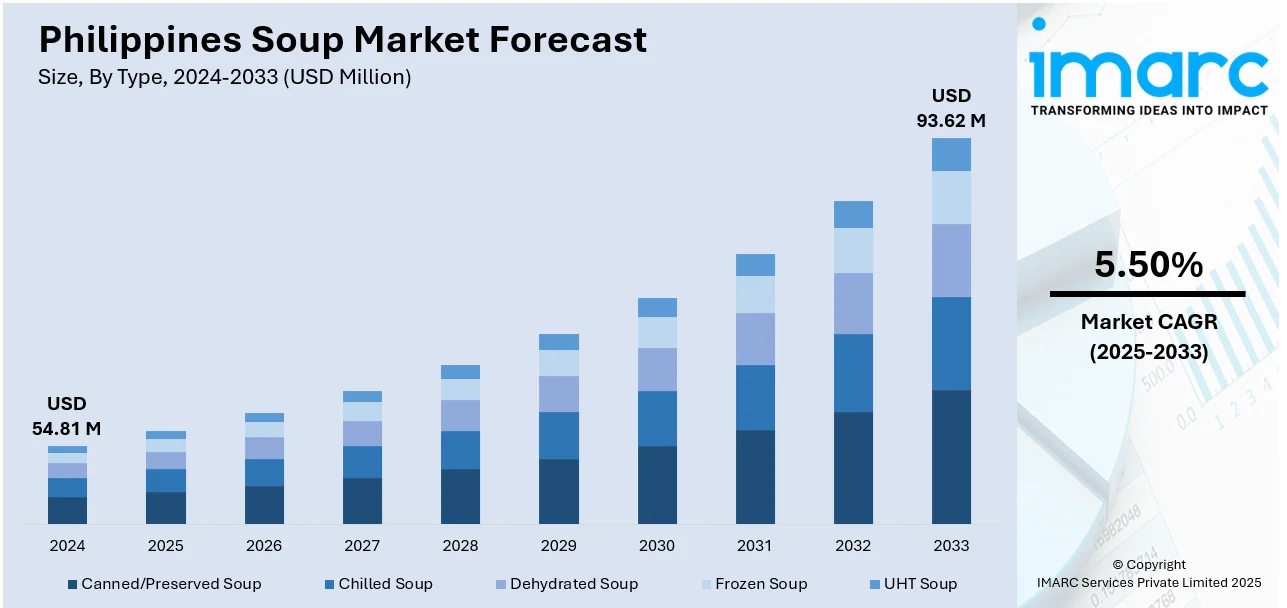

The Philippines soup market size reached USD 54.81 Million in 2024. Looking forward, the market is projected to reach USD 93.62 Million by 2033, exhibiting a growth rate (CAGR) of 5.50% during 2025-2033. The market is witnessing steady growth driven by changing dietary habits, rising demand for convenient meals, and the increasing popularity of packaged and instant soup products. Growing urbanization and busy lifestyles are encouraging consumers to opt for quick, ready-to-eat options. The shift toward healthier formulations, including low-sodium and nutrient-rich soups, is shaping product innovation, thereby influencing the Philippines soup market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.81 Million |

| Market Forecast in 2033 | USD 93.62 Million |

| Market Growth Rate 2025-2033 | 5.50% |

Philippines Soup Market Trends:

Rising Demand for Convenience Foods

The increasing preference for convenience foods has emerged as a significant factor driving the growth of the soup market in the Philippines. Due to rapid urbanization, busy lifestyles, and changing consumer habits, numerous individuals are seeking quick meal options that require minimal preparation. Instant and ready-to-eat soups align perfectly with this trend, providing convenience and comfort for busy families, professionals, and students. For instance, in July 2024, Ajinomoto Philippines launched its first instant soup offering, Soup & Go, featuring three flavors: Corn, Potato, and Pumpkin. Made with premium Japanese ingredients, each box contains three single-serve sachets priced at PHP 85. Initially available exclusively at 7-11 for three months, it will be expanded nationwide afterward. These products are typically designed to be portable, affordable, and available in a diverse range of flavors, making them a suitable choice for everyday consumption. The rising demand is further bolstered by the growth of modern retail outlets, convenience stores, and e-commerce platforms, enhancing accessibility. As more Filipinos adopt on-the-go eating patterns, soup products focused on convenience are anticipated to maintain their popularity, solidifying their role as a key contributor to overall Philippines soup market growth.

To get more information on this market, Request Sample

Health and Wellness Focus

The increasing awareness about health and nutrition among Filipino consumers is profoundly influencing the soup market. Shoppers are now actively seeking products that fit healthier lifestyles, resulting in a rising demand for low-sodium, organic, and nutrient-packed soup options. Consumers are emphasizing choices that aid weight management, heart health, and overall wellness while retaining convenience and flavor. This trend is particularly pronounced among young professionals and health-oriented households, who appreciate functional ingredients such as vegetables, herbs, and fortified nutrients in their meals. Manufacturers are responding by reformulating existing products and introducing new lines that accommodate various dietary preferences, including gluten-free and plant-based options. This growing trend toward health consciousness is anticipated to continue driving the Philippines soup market.

Premiumization of Products

Premiumization is emerging as a significant trend in the Philippines soup market as consumers increasingly seek options beyond basic, budget-friendly products. Growing disposable incomes and greater exposure to international food trends are encouraging shoppers to explore gourmet, flavored, and value-added soup offerings. This includes soups enhanced with exotic ingredients, distinctive spices, and authentic global recipes that provide a more indulgent and restaurant-like experience at home. The trend also demonstrates consumers’ readiness to invest more for quality, taste, and innovation. Packaged soups featuring premium packaging, enhanced nutritional profiles, and distinctive flavor combinations are becoming more popular in urban households and modern retail environments. This appetite for elevated culinary experiences is transforming product strategies and aiding the expansion of the premium segment in the Philippines soup market.

Philippines Soup Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, category, packaging, and distribution channel.

Type Insights:

- Canned/Preserved Soup

- Chilled Soup

- Dehydrated Soup

- Frozen Soup

- UHT Soup

The report has provided a detailed breakup and analysis of the market based on the type. This includes canned/preserved soup, chilled soup, dehydrated soup, frozen soup, and UHT soup.

Category Insights:

- Vegetarian Soup

- Non-Vegetarian Soup

A detailed breakup and analysis of the market based on the category has also been provided in the report. This includes vegetarian soup and non-vegetarian soup.

Packaging Insights:

- Canned

- Pouched

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes canned, pouched, and others.

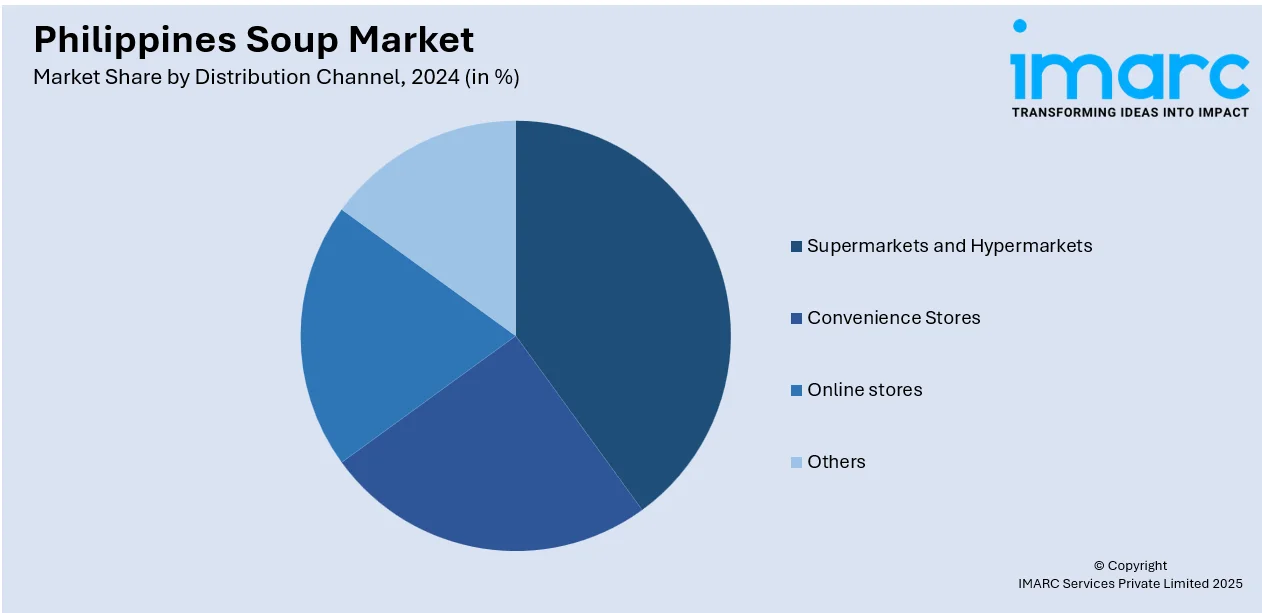

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Soup Market News:

- In July 2025, the DOST-ITDI launched innovative food products, including the "Pack of Duty," featuring ready-to-eat meals for soldiers and police, like Chicken Corn Soup. They also introduced goat meat snacks and tropical fruit wine-making kits, promoting nutrition, environmental sustainability, and addressing food needs in remote areas.

Philippines Soup Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Canned/Preserved Soup, Chilled Soup, Dehydrated Soup, Frozen Soup, UHT Soup |

| Categories Covered | Vegetarian Soup, Non-Vegetarian Soup |

| Packagings Covered | Canned, Pouched, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines soup market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines soup market on the basis of type?

- What is the breakup of the Philippines soup market on the basis of category?

- What is the breakup of the Philippines soup market on the basis of packaging?

- What is the breakup of the Philippines soup market on the basis of distribution channel?

- What is the breakup of the Philippines soup market on the basis of region?

- What are the various stages in the value chain of the Philippines soup market?

- What are the key driving factors and challenges in the Philippines soup market?

- What is the structure of the Philippines soup market and who are the key players?

- What is the degree of competition in the Philippines soup market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines soup market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines soup market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines soup industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)