Philippines Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Philippines Steel Tubes Market Overview:

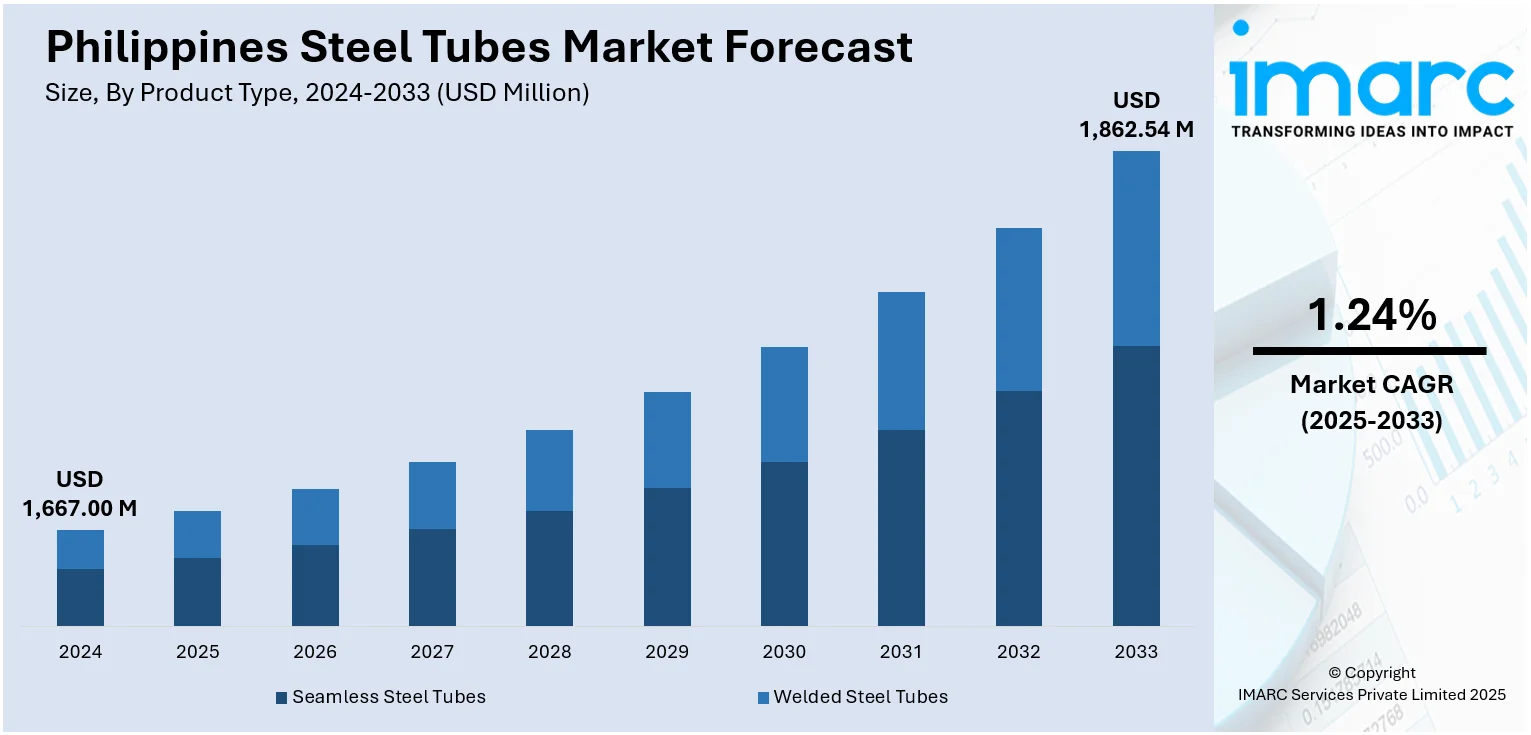

The Philippines steel tubes market size reached USD 1,667.00 Million in 2024. The market is projected to reach USD 1,862.54 Million by 2033, exhibiting a growth rate (CAGR) of 1.24% during 2025-2033. The market is poised for steady growth supported by infrastructure development, industrial growth, and growing demand across industries including construction, automotive, and energy. The application of advanced manufacturing technology and sustainability improves the product's quality as well as efficiency. Other than this, the government emphasis on local production and import dependency reduction are favorable to enhance market growth. The above factors are enhancing the changing dynamics of the Philippines steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,667.00 Million |

| Market Forecast in 2033 | USD 1,862.54 Million |

| Market Growth Rate 2025-2033 | 1.24% |

Philippines Steel Tubes Market Trends:

Infrastructure Investments Fuel Steel Tube Market Momentum

In May 2025, the Philippine government confirmed additional financing for major infrastructure projects including highways, bridges, and transport systems. These developments are significantly increasing the demand for structural steel tubes, which are widely used in elevated expressways, marine bridges, and rail foundations. For example, the Bataan–Cavite Interlink Bridge spans over 32 kilometers, requiring large volumes of tubular steel in its design and construction phases. Industry professionals report that such megaprojects are accelerating the procurement of steel tubes even before full-scale construction begins. Meanwhile, other ongoing developments like the MRT-7 rail line are contributing to a steady stream of demand for structural steel. With multiple large-scale works happening simultaneously, steel tubes have become essential for meeting structural performance standards and fast-paced delivery timelines. These investments are strengthening the sector’s pipeline for materials across Luzon and Metro Manila. In this context, the Philippines steel tubes market growth is increasingly tied to infrastructure rollouts, positioning steel tubes as foundational elements in the country’s ongoing development strategy.

To get more information on this market, Request Sample

Manufacturing Growth Spurs Steel Tube Demand

In December 2024, the Philippines manufacturing sector showed strong expansion with its Purchasing Managers’ Index (PMI) reaching 54.3, the highest since many years, as reported by sources. This increase was driven by rising new orders and output, supported by diversified products and growing demand from both local and international customers. Manufacturers boosted their purchasing activities to keep up with production needs while inflationary pressures softened, helping control costs. The positive performance in manufacturing is expected to increase demand for steel tubes, which are critical in various construction and industrial projects across the country. Confidence remains high that output will continue to grow throughout the year, encouraging producers to improve capacity and supply chain efficiency to meet the rising need for steel tubes. These developments underscore an important factor influencing the Philippines steel tubes market trends, highlighting how manufacturing growth directly supports demand for steel products and contributes to the sector’s ongoing strength and resilience.

Sustainability Initiatives Shape Steel Tube Manufacturing

In June 2025, the Philippines government issued new environmental regulations intended to cut back carbon emissions from manufacturing, including steelmaking. The policy promotes local steel tube producers to use cleaner technology like electric arc furnaces and increasing the use of recycled steel. These moves are in line with international trends towards sustainability and the nation's obligations under global climate agreements. Producers are now making investments in cleaner production techniques to achieve tighter environmental controls, as well as to ensure product quality and longevity. Not only is this environmentally sound, but it is also increasingly demanded by the construction and infrastructure ventures that need environmental-friendly products. With these green projects gaining traction, they are also likely to redefine production operations and supply chains in the steel tube business. This emphasis on sustainability goes well with the continued infrastructure development and manufacturing growth, opening up new opportunities for innovation. All these elements go a long way in propelling the favorable sentiment for Philippines steel tubes market.

Philippines Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

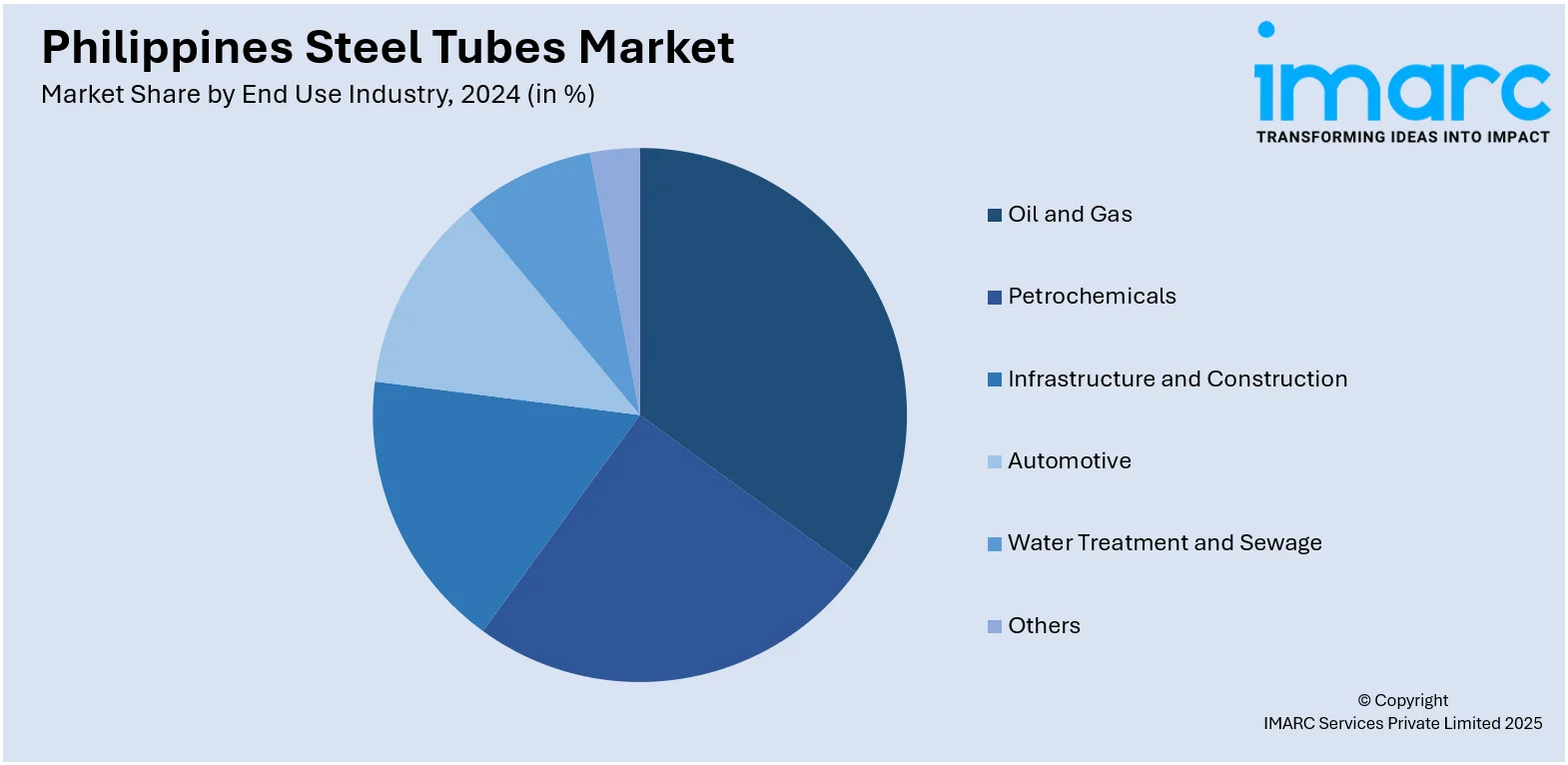

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include the Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines steel tubes market on the basis of product type?

- What is the breakup of the Philippines steel tubes market on the basis of material type?

- What is the breakup of the Philippines steel tubes market on the basis of end use industry?

- What is the breakup of the Philippines steel tubes market on the basis of region?

- What are the various stages in the value chain of the Philippines steel tubes market?

- What are the key driving factors and challenges in the Philippines steel tubes market?

- What is the structure of the Philippines steel tubes market and who are the key players?

- What is the degree of competition in the Philippines steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)