Philippines Takaful Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033

Philippines Takaful Market Overview:

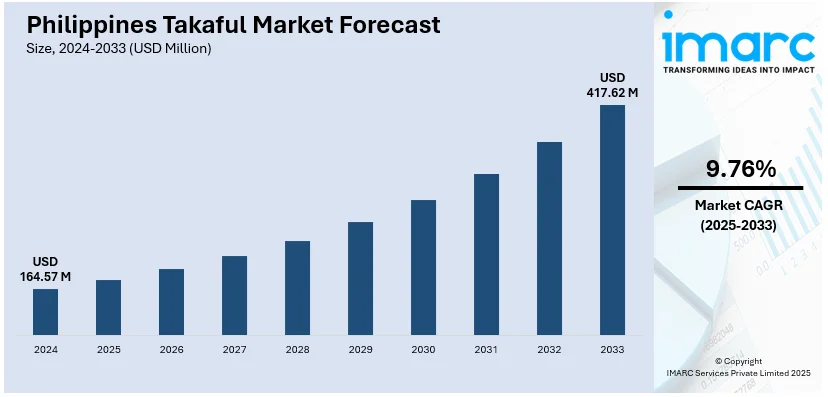

The Philippines Takaful market size reached USD 164.57 Million in 2024. The market is projected to reach USD 417.62 Million by 2033, exhibiting a growth rate (CAGR) of 9.76% during 2025-2033. The market is witnessing steady growth, supported by increasing awareness of Shariah-compliant financial products and rising demand for inclusive insurance solutions. Regulatory support and expanding financial literacy are encouraging broader participation in ethical insurance models. As more stakeholders recognize the value of cooperative risk-sharing and community-based financial protection, the market is gradually gaining traction. This positive shift is contributing to financial inclusion and shaping the future of the Philippines takaful market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 164.57 Million |

| Market Forecast in 2033 | USD 417.62 Million |

| Market Growth Rate 2025-2033 | 9.76% |

Philippines Takaful Market Trends:

First Takaful License Ushers in Islamic Insurance

The Philippines has taken a major step forward in expanding financial inclusion with the issuance of its first official takaful license. This move marks a significant milestone in providing Shariah-compliant insurance solutions tailored for the country’s underserved Muslim population. In November 2024, the Insurance Commission formally granted this license, establishing a legal and regulatory foundation for takaful operations to begin in the Philippines. The structure of takaful built on shared responsibility, ethical investment, and mutual benefit offers an alternative to conventional insurance models that may not align with the values or needs of some communities. With this license in place, new offerings are expected to emerge that cater to both religious preferences and increase interest in socially responsible financial products. The move also reflects broader government efforts to promote inclusive finance, offering equitable access to risk protection across all regions. By laying this groundwork, the country is opening new pathways for ethical finance. It’s a meaningful and timely development that underscores the positive direction of the Philippines takaful market growth.

To get more information on this market, Request Sample

Micro-Takaful Meets Everyday Needs

Micro-takaful products are emerging as practical solutions to everyday financial risks, offering accessible protection to individuals who have traditionally been left out of formal insurance systems. These plans are structured to cover specific needs such as minor accidents, hospital stays, or public transportation incidents through simple, affordable policies. In February 2025, a group personal accident micro-takaful plan was introduced in the Philippines, providing flexible, low-cost coverage with multiple enrollment options throughout the year. This format allows people to hold several certificates simultaneously, depending on their needs, making it easier to integrate coverage into their daily lives. Such offerings are gaining attention for their user-friendly design and affordability, which are especially important in regions with lower insurance penetration and financial literacy. By focusing on relevance and accessibility, micro-takaful is helping reshape the way communities engage with insurance shifting the focus from large, long-term plans to smaller, more immediate protection. This trend highlights how Philippines takaful market trends are evolving to meet real-life needs while promoting inclusion and financial resilience in underserved populations.

Regulatory Momentum Enshrines Financial Inclusion

The government of the Philippines' consistent regulatory backing is instrumental in driving the growth of the takaful business as well as increasing access to Islamic insurance products. The Insurance Commission celebrated its 76th year in March 2025 by emphasizing takaful's official acknowledgement as part of its overall role in encouraging financial inclusion, particularly in Muslim-populated regions. This awareness is more than a milestone it is a signal of a firm policy orientation toward building fair financial systems based on ethical values. In bringing takaful into the national insurance system, regulators are promoting the development of cooperation and shared-risk-based products, values that appeal to a sizeable group of the populace. This growth also heralds growing acceptance of takaful not only as a niche offering but as a credible, mainstream choice for safeguarding individuals and families. As awareness grows and availability increases, takaful has the potential to underpin both financial stability and socio-economic strength. This policy momentum is a key driver of the Philippines takaful industry, highlighting the good that comes from policy that prioritizes inclusiveness and ethical finance.

Philippines Takaful Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type.

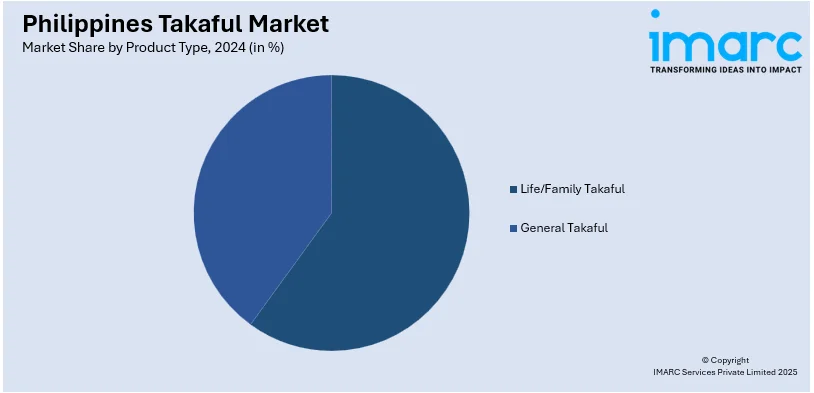

Product Type Insights:

- Life/Family Takaful

- General Takaful

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life/family takaful and general takaful.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Takaful Market News:

- August 2025: Etiqa Philippines has introduced a new Takaful Personal Accident (PA) plan, aiming to provide affordable, values-based protection to Filipino families. The launch underscores the company's commitment to financial inclusion and ethical insurance solutions. By offering Shariah-compliant products, Etiqa seeks to cater to the diverse needs of the Filipino population, promoting mutual cooperation and shared responsibility. This initiative marks a significant step in expanding accessible insurance options across the country.

- June 2025: Pru Life UK has launched PRUTerm Lindungi, the Philippines' first Shari’ah-compliant life protection plan. This initiative addresses the long-standing gap for ethical insurance solutions, particularly benefiting the country's Muslim population. The plan operates on principles of mutual aid, fairness, and shared responsibility, offering affordable coverage options. It is designed to be inclusive, catering to all Filipinos regardless of faith, and aims to enhance financial inclusion across diverse communities.

Philippines Takaful Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life/Family Takaful, General Takaful |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines Takaful market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines Takaful market on the basis of product type?

- What is the breakup of the Philippines Takaful market on the basis of region?

- What are the various stages in the value chain of the Philippines Takaful market?

- What are the key driving factors and challenges in the Philippines Takaful market?

- What is the structure of the Philippines Takaful market and who are the key players?

- What is the degree of competition in the Philippines Takaful market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines Takaful market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines Takaful market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines Takaful industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)