Philippines Textile Recycling Market Size, Share, Trends and Forecast by Product Type, Textile Waste, Distribution Channel, End Use, and Region, 2026-2034

Philippines Textile Recycling Market Summary:

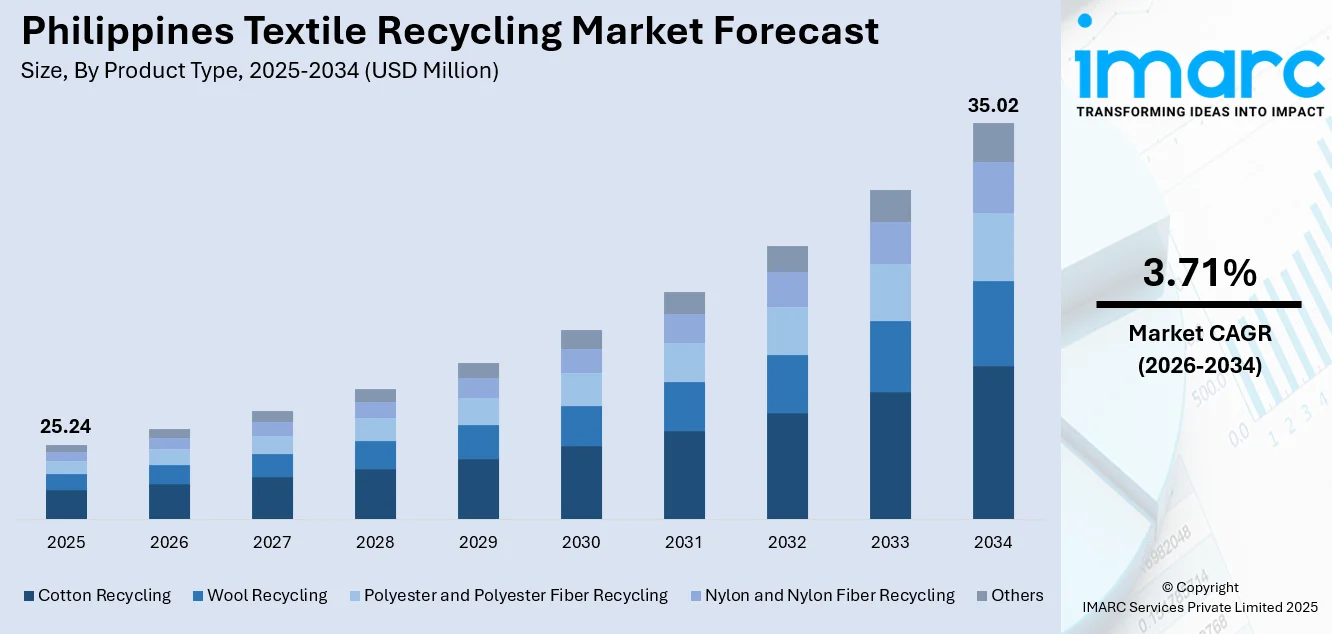

The Philippines textile recycling market size was valued at USD 25.24 Million in 2025 and is projected to reach USD 35.02 Million by 2034, growing at a compound annual growth rate of 3.71% from 2026-2034.

The Philippines textile recycling market is experiencing growth driven by mounting environmental concerns, evolving individual preferences toward sustainable fashion, and increasing textile waste generated by the fast fashion industry. Local entrepreneurs, non-governmental organizations, and community-based initiatives are actively developing innovative textile reuse and recycling solutions, supported by environmentally conscious individuals seeking responsible disposal alternatives. Rapid urbanization and the concentration of garment manufacturing hubs in key economic zones contribute to higher textile waste volumes, underscoring the critical need for efficient recycling infrastructure. Government research institutions are collaborating with private sector partners to advance circular economy practices, positioning the country for sustainable textile waste management.

Key Takeaways and Insights:

- By Product Type: Polyester and polyester fiber recycling dominate the market with a share of 36% in 2025, driven by the widespread availability of synthetic textile waste from garment manufacturing facilities, cost-effective mechanical recycling processes, and the growing demand for recycled polyester in activewear and sustainable fashion applications.

- By Textile Waste: Post-consumer textile leads the market with a share of 60% in 2025, owing to the thriving secondhand clothing culture, increasing user awareness about textile disposal, and the growing community-based collection initiatives that divert discarded garments from landfills.

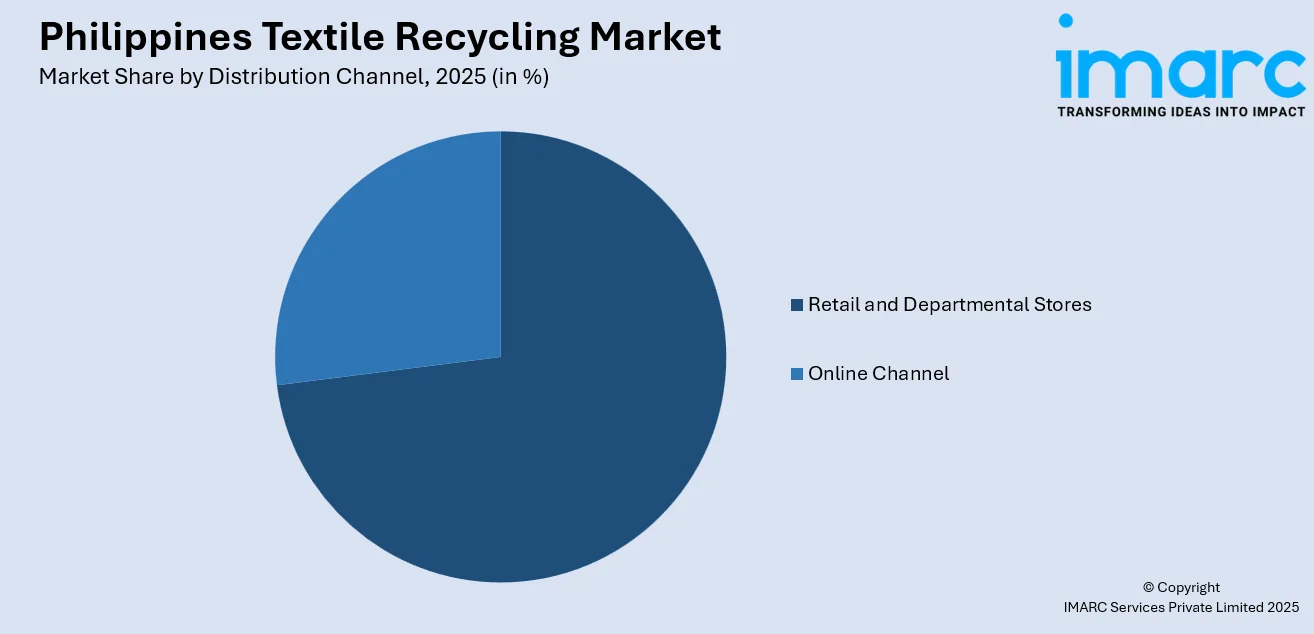

- By Distribution Channel: Retail and departmental stores represent the largest segment with a market share of 73% in 2025, reflecting the dominance of established retail networks in facilitating recycled textile product sales and the integration of sustainability initiatives by major retail chains across the country.

- By End Use: Apparel dominates the market with a share of 45% in 2025, due to rising user preference for sustainable fashion, increasing adoption of recycled fibers by local clothing brands, and the growing awareness about the environmental impact of textile production.

- By Region: Luzon leads the market with a share of 49% in 2025, supported by its economic significance and concentration of textile production and usage. As the country’s largest island, Luzon houses major metropolitan areas, such as Metro Manila, where a high volume of textile waste is generated from both residential and industrial sources.

- Key Players: The Philippines textile recycling market features moderate competitive intensity, with local recycling enterprises, community-based organizations, and emerging sustainable fashion brands operating alongside international sustainability initiatives to advance circular economy practices.

To get more information on this market Request Sample

The Philippines textile recycling market is driven by several key factors, including the growing environmental awareness, government support, and shifting user behavior. As concerns about the environmental impact of textile waste intensify, both individuals and businesses are prioritizing sustainability. Government initiatives that promote recycling and circular economy principles are fostering a favorable policy environment, encouraging investment in textile recycling infrastructure. Additionally, individual purchasing habits are increasingly aligned with sustainability, with a marked preference for secondhand, upcycled, and recycled-material products. This shift in behavior is compounded by the expanding population of the Philippines, which, according to the Philippine Statistics Authority (PSA), reached 112,729,484 as of July 1, 2024. This growing user base creates significant opportunities for sustainable fashion, further driving the demand for eco-friendly alternatives. As a result, brands are incorporating recycled textiles into their collections, while advancements in recycling technologies are contributing to the growth of the market.

Philippines Textile Recycling Market Trends:

Investment in Infrastructure and Recycling Facilities

The growth of the textile recycling market in the Philippines is driven by the increasing investment in recycling infrastructure and facilities. Upgrading waste management systems, establishing modern textile recycling plants, and improving the logistics of textile waste collection are key priorities for both the public and private sectors. In 2025, Quezon City launched the QC-ANTHILL Circularity Hub at the Payatas Controlled Disposal Facility to advance sustainability and circular economy efforts. This collaboration with ANTHILL Fabric Gallery supported community-based upcycling and job creation for local artisans. The hub promoted waste reduction and sustainable livelihoods through textile recycling and creative design. Such development of specialized recycling infrastructure is essential for meeting the rising demand for recycled textiles and ensuring the long-term sustainability of the market.

Rising Demand for Sustainable Fashion Brands

Fashion brands that prioritize sustainability and ethical practices are increasingly resonating with environmentally conscious individuals. This shift is evident in the growing demand for eco-friendly fashion, which is driving innovation in textile recycling technologies. For instance, in 2025, Danish fashion brand GANNI opened its first pop-up store in the Philippines at Power Plant Mall in Makati, showcasing its Pre-Fall 2025 collection. The store highlighted sustainability by featuring accessories and footwear made from recycled materials, while its design incorporated bespoke interiors crafted from recycled fabrics and plastic waste. This trend underscores the rising influence of sustainable fashion, benefiting industries like textile recycling in the Philippines.

Shift in Purchasing Behavior

Changing user purchasing behavior is a significant factor influencing the textile recycling market, as more people prioritize sustainability in their buying decisions. This is particularly evident among younger demographics, who are increasingly drawn to secondhand or upcycled clothing, as well as products made from recycled materials. In the Philippines, where 30 million individuals aged 10-24 make up 28% of the population, this trend is particularly pronounced. According to projections by the Philippines Statistics Authority, this youthful population will remain a substantial portion of the country’s total population through 2055. As individual preferences shift, brands are responding by offering recycled textile collections, further driving the demand for textile recycling in the region.

Market Outlook 2026-2034:

The Philippines textile recycling market shows growth potential throughout the forecast period, driven by rising environmental awareness and shifting user attitudes towards sustainable fashion. The market generated a revenue of USD 25.24 Million in 2025 and is projected to reach a revenue of USD 35.02 Million by 2034, growing at a compound annual growth rate of 3.71% from 2026-2034. The increasing demand for eco-friendly practices and recycled materials in the fashion industry is further bolstering the market growth, as individuals and brands embrace more sustainable and circular solutions in textile production and disposal.

Philippines Textile Recycling Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Polyester and Polyester Fiber Recycling | 36% |

| Textile Waste | Post-consumer Textile | 60% |

| Distribution Channel | Retail and Departmental Stores | 73% |

| End Use | Apparel | 45% |

| Region | Luzon | 49% |

Product Type Insights:

- Cotton Recycling

- Wool Recycling

- Polyester and Polyester Fiber Recycling

- Nylon and Nylon Fiber Recycling

- Others

Polyester and polyester fiber recycling dominate with a market share of 36% of the total Philippines textile recycling market in 2025.

Polyester and polyester fiber recycling hold the biggest market share, due to the widespread use of polyester in the apparel industry. As one of the most common materials in fast fashion, the high volume of discarded polyester textiles is creating a significant demand for recycling solutions. Recycling polyester helps reduce waste, lowers production costs, and supports sustainability efforts, making it a preferred option for brands and consumers seeking eco-friendly alternatives.

Furthermore, advancements in recycling technologies, such as chemical recycling, is making polyester fiber recycling more efficient and cost-effective. These innovations allow for the recovery of high-quality fibers, which can be reused in new textile products, thereby closing the loop in textile production. As environmental concerns grow and people increasingly demand sustainable fashion, the recycling of polyester and polyester fibers is expected to continue dominating the Philippine market, contributing to a circular economy and reducing the overall environmental impact of textile waste.

Textile Waste Insights:

- Pre-Consumer Textile

- Post-Consumer Textile

Post-consumer textile leads with a market share of 60% of the total Philippines textile recycling market in 2025.

Post-consumer textile leads the market owing to the high volume of discarded clothing and fabric from individuals. Fast fashion, along with the growing trend of seasonal wardrobe changes, leads to significant textile waste, much of which is unsuitable for donation or reuse. Recycling post-consumer textiles helps mitigate landfill waste and reduces the environmental impact of textile disposal, making it an essential part of the nation’s sustainable fashion movement.

Additionally, advancements in textile sorting and recycling technologies are making it more feasible to recycle post-consumer materials. With the rising demand for sustainable fashion and eco-friendly products, textile recycling companies are increasingly focused on collecting, processing, and transforming used garments into new fibers and fabrics. This trend is expected to expand, as both government policies and individual attitudes shift towards a more circular economy and a reduction in the environmental footprint of the fashion industry.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Channel

- Retail and Departmental Stores

Retail and departmental stores exhibit a clear dominance with a 73% share of the Philippines textile recycling market in 2025.

Retail and departmental stores dominate the market because of their widespread reach and user accessibility. These stores play a key role in collecting used textiles from individuals through recycling programs or donation bins. Many large retail chains and department stores have integrated recycling initiatives into their operations, allowing people to drop off unwanted garments in exchange for discounts or incentives, making it easy to participate in textile recycling.

Furthermore, retail and departmental stores serve as essential points for educating people about the benefits of textile recycling. By promoting sustainability and offering in-store collection services, these stores foster greater individual engagement with eco-friendly practices. As a result, they contribute significantly to the growth of the textile recycling market in the Philippines, facilitating the circular economy by diverting textiles from landfills and encouraging the reuse and recycling of fabric for new products.

End Use Insights:

- Apparel

- Industrial

- Home Furnishings

- Non-woven

- Others

Apparel dominates with a market share of 45% of the total Philippines textile recycling market in 2025.

Apparel accounts for the majority of the market share attributed to the high volume of discarded clothing generated by people. With fast fashion driving frequent purchases and rapid turnover of styles, a significant portion of textile waste comes from old or out-of-fashion garments. Recycling apparel allows for the repurposing of fabrics into new products, reducing landfill waste and contributing to sustainability. This trend is increasingly supported by both brands and individuals seeking eco-friendly alternatives.

Additionally, the demand for recycled apparel is growing as environmental concerns rise, with people opting for sustainable and recycled clothing. Apparel recycling not only helps minimize waste but also reduces the need for virgin materials, such as cotton and polyester, which have a high environmental impact. This shift in user behavior, combined with advancements in textile recycling technology, positions apparel as the dominant segment in the Philippine textile recycling market, encouraging a more circular economy.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon leads with a market share of 49% of the total Philippines textile recycling market in 2025.

Luzon represents the largest segment, driven by its economic significance and concentration of textile production and usage. According to the data published by the International Trade Administration in 2024, Central Luzon, as an emerging growth center, contributes roughly 9% to the national GDP. As the country’s largest island, Luzon houses major metropolitan areas, such as Metro Manila, where a high volume of textile waste is generated from both residential and industrial sources. In addition, many of the country's leading retail, manufacturing, and distribution centers are located here, creating a central hub for textile recycling initiatives.

Furthermore, Luzon benefits from better infrastructure, more access to recycling technologies, and higher individual awareness about sustainability practices compared to other regions. The presence of large retail chains and governmental support for green initiatives has encouraged textile recycling activities in the region. With more recycling facilities and collection programs available, Luzon plays a critical role in impelling the growth of the Philippine textile recycling market, shaping the country's transition to a more circular economy.

Market Dynamics:

Growth Drivers:

Why is the Philippines Textile Recycling Market Growing?

Rising Urbanization and Textile Utilization

As urbanization accelerates in the Philippines, textile utilization is growing, particularly in urban centers, which is leading to a corresponding increase in textile waste. This rise in demand for clothing, often driven by fast fashion trends, directly impacts the volume of waste generated. According to the IAMRC Group, the Philippines textile market is projected to reach USD 75.9 Million by 2034, highlighting the scale of this growth. This increase in textile waste is creating a strong impetus for establishing more efficient recycling programs and waste management systems. To address this challenge, investment in recycling technologies, facilities, and collection systems is crucial to managing the growing waste in urban areas.

Technological Innovations in Sorting and Separation

Continuous advancements in sorting and separation technologies play a pivotal role in enhancing the efficiency and scalability of textile recycling in the Philippines. Innovations in automated sorting systems, fiber identification, and material separation techniques are making it easier to process mixed textiles, such as polyester-cotton blends, that were previously challenging to recycle. These technological improvements reduce the labor intensity of recycling processes, increase material recovery rates, and lower processing costs. As technology continues to evolve, the textile recycling market becomes more efficient, cost-effective, and attractive to both businesses and individuals.

Circular Economy Framework

The rising adoption of a circular economy framework, which emphasizes the continuous use and repurposing of resources, is a critical factor impelling the Philippine textile recycling market growth. This framework seeks to minimize waste and make the most of textile products throughout their lifecycle. The shift from a linear “take-make-dispose” model to a circular approach is leading to increased investments in recycling technologies, material recovery systems, and sustainable production methods. By adopting circular economy principles, the Philippines aims to create a more sustainable textile industry, reducing reliance on virgin resources and minimizing environmental impact.

Market Restraints:

What Challenges the Philippines Textile Recycling Market is Facing?

Limited Recycling Infrastructure and Processing Capacity

The Philippines lacks the necessary infrastructure to manage mass textile recycling and disposal, leading to the majority of textile waste being sent to landfills. Without large-scale collection systems and processing facilities, there is no formal mechanism for systematic reuse or recycling. The limited investment in advanced recycling technologies and equipment further hinders efficient processing of various textile types, preventing the country from fully addressing its growing textile waste issue and promoting sustainability.

Absence of Formal Textile Circularity Policy Framework

The Philippines currently lacks specific textile circularity policies, such as mandatory collection, recycling, or extended producer responsibility for textile products. Without regulatory frameworks to enforce industry compliance, textile recycling remains voluntary and fragmented. Many local government units also lack dedicated systems for sorting and processing textile waste, hindering coordinated efforts in waste management. As a result, the country faces challenges in effectively managing and reducing textile waste across the nation.

Informal Sector Dominance in Textile Waste Collection

In the Philippines, the informal sector controls much of the textile waste collection, leading to challenges in maintaining standardized quality control and tracking material flows. This fragmented collection system results in inconsistent material quality and availability, complicating recycling efforts. Additionally, the absence of formal collection networks limits the scalability of recycling enterprises, preventing them from operating economically and hindering the country's ability to develop an efficient and sustainable textile recycling industry.

Competitive Landscape:

The Philippines textile recycling market exhibits emerging competitive dynamics characterized by the presence of local recycling enterprises, community-based organizations, and social enterprises operating alongside international sustainability initiatives. Market participants range from grassroots upcycling ventures and secondhand clothing retailers to corporate retail sustainability programs and government-backed research institutions. Competition is increasingly shaped by innovation capabilities, collection network reach, and partnerships that enable scale and market access. Strategic collaborations between fashion brands and waste management entities are creating pilot initiatives for take-back schemes and circular production models. The competitive landscape is evolving as sustainability becomes a key differentiator, with market participants seeking to develop efficient recycling technologies, establish reliable collection infrastructure, and build consumer trust through transparent circular economy practices.

Recent Developments:

- November 2025: Pilipinas Shell Foundation, Inc. launched the first Textile Circularity Hub in Manila, a key part of the ReShell: Weaving Waste Project. This initiative aimed to convert textile waste into reusable materials like uniforms, while training local women in Payatas for sustainable livelihoods.

- February 2025: Department of Science and Technology–Philippine Textile Research Institute (DOST-PTRI) launched the Textile Revitalized (TexRev) Project in collaboration with Bayo Manila to tackle textile waste. The initiative converts post-industrial fabric scraps into sustainable yarns, promoting a circular textile economy. TexRev aims to reduce landfill waste and minimize environmental impact while offering sustainable alternatives to traditional textile production.

Philippines Textile Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cotton Recycling, Wool Recycling, Polyester and Polyester Fiber Recycling, Nylon and Nylon Fiber Recycling, Others |

| Textile Wastes Covered | Pre-consumer Textile, Post-consumer Textile |

| Distribution Channels Covered | Online Channel, Retail and Departmental Stores |

| End Uses Covered | Apparel, Industrial, Home Furnishings, Non-woven, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines textile recycling market size was valued at USD 25.24 Million in 2025.

The Philippines textile recycling market is expected to grow at a compound annual growth rate of 3.71% from 2026-2034 to reach USD 35.02 Million by 2034.

Polyester and polyester fiber recycling hold the largest market share of 36% in 2025, driven by widespread synthetic textile waste availability from garment manufacturing facilities, cost-effective mechanical recycling processes, and growing demand for recycled polyester in sustainable fashion applications.

Key factors driving the Philippines textile recycling market include the investments in recycling infrastructure. For instance, in 2025, Quezon City launched the QC-ANTHILL Circularity Hub to promote sustainability, upcycling, and job creation, advancing textile recycling and supporting local artisans through creative design and waste reduction efforts.

Major challenges include limited recycling infrastructure and processing capacity, absence of formal textile circularity policy frameworks, informal sector dominance in waste collection preventing standardized quality control, and lack of large-scale collection systems creating access barriers for systematic textile recycling.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)