Philippines Thermal Paper Market Size, Share, Trends and Forecast by Application, Width, Technology, and Region, 2026-2034

Philippines Thermal Paper Market Summary:

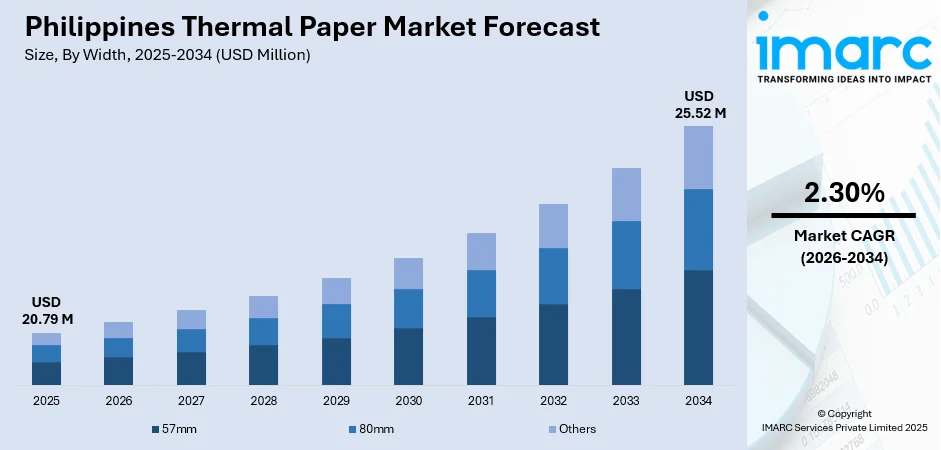

The Philippines thermal paper market size was valued USD 20.79 Million in 2025 and is projected to reach USD 25.52 Million by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034.

The market is witnessing steady expansion fueled by the rapid modernization of retail infrastructure, proliferation of point-of-sale systems across supermarkets and convenience stores, and the growing adoption of automated billing machines in financial institutions. The healthcare sector's increasing demand for diagnostic printouts and the logistics industry's reliance on thermal labels for shipping and tracking are further bolstering consumption. Additionally, the government's digital transformation initiatives and rising e-commerce activities are creating substantial opportunities, strengthening the competitive landscape of the Philippines thermal paper market share.

Key Takeaways and Insights:

-

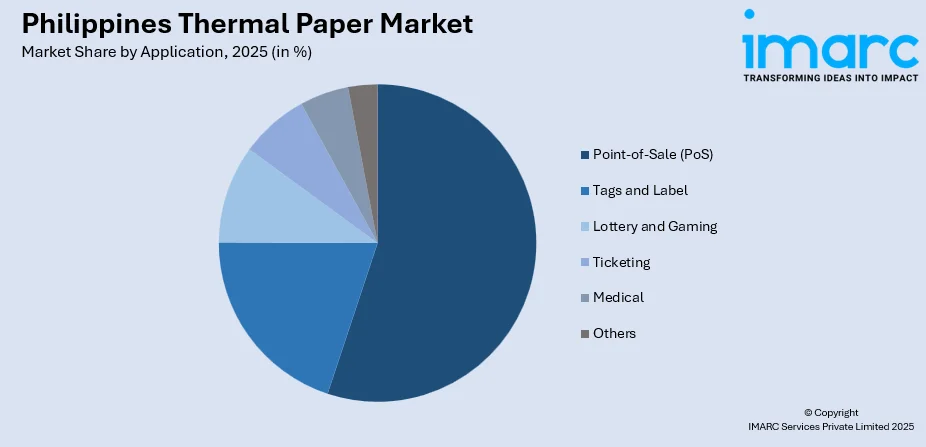

By Application: Point-of-Sale (PoS) dominates the market with a share of 55.22% in 2025, driven by the widespread adoption of electronic cash registers and automated billing systems across organized retail outlets, shopping malls, and quick-service restaurants.

-

By Technology: Direct thermal leads the market with a share of 70.05% in 2025, owing to its cost-effectiveness, operational simplicity, and widespread compatibility with receipt printers and labeling machines across retail and banking sectors.

-

By Region: Luzon represents the largest segment with a market share of 42% in 2025, attributed to the concentration of commercial establishments, banking institutions, and logistics hubs in Metro Manila and surrounding provinces.

-

Key Players: The Philippines thermal paper market exhibits moderate competitive intensity, with both domestic distributors and international manufacturers competing across price segments. Companies are differentiating through product quality, format compatibility, and supply chain reliability to capture market share.

To get more information on this market Request Sample

The Philippines thermal paper market plays a crucial role in supporting transaction printing across various industries. The retail sector remains the key driver, with the expansion of organized retail formats in urban areas boosting point-of-sale activities and receipt generation. The banking industry continues to rely on ATMs and self-service kiosks, while efforts to increase financial inclusion are expanding access to banking services in underserved regions. The Philippines banking market size reached USD 10.4 Billion in 2025. Looking forward, the market is expected to reach USD 62.6 Billion by 2034, exhibiting a growth rate (CAGR) of 22.07% during 2026-2034. At the same time, the growth of e-commerce is transforming logistics operations, increasing the need for thermal labels and shipping documentation. Collectively, these factors create a steady demand for thermal paper, supporting consistent market growth across retail, banking, and logistics applications throughout the forecast period.

Philippines Thermal Paper Market Trends:

Digital Payment Ecosystem Integration Driving Receipt Volumes

The integration of thermal printing with digital payment infrastructure is reshaping market dynamics. As the Philippines exceeds its digital payment transformation targets, retailers are upgrading POS systems to handle increased transaction frequencies. The Bangko Sentral ng Pilipinas surpassed its aim for 50% digital payment under its Digital Payments Transformation Roadmap 2018-2023, driving investments in modern terminals that rely on thermal paper for customer receipts. ANSI Information Systems launched its WinVQP POS Kiosk suite in April 2024, specifically designed to optimize retail operations and enhance customer experience for Filipino consumers, demonstrating the ongoing modernization trend.

Expansion of Self-Service Kiosks and Automated Terminals

Self-service technologies are proliferating across banking, retail, and transportation sectors, creating new demand channels for thermal paper. Financial institutions are deploying cash deposit machines and automated teller machines in geographically isolated and disadvantaged areas as part of financial inclusion initiatives. RCBC announced nationwide expansion of its ATM Go network in March 2024, focusing on underserved and unbanked areas. These deployments require consistent thermal paper supplies for transaction slips, positioning the market for sustained institutional demand.

Growing Emphasis on Sustainability and BPA-Free Solutions

Environmental consciousness is influencing product development and procurement decisions in the thermal paper industry. Manufacturers are developing BPA-free and phenol-free thermal papers to address regulatory concerns and meet sustainability expectations. For instance, in May 2024, Appvion introduced its EarthChem range, a portfolio of sustainable thermal solutions developed to address the rising demand for environmentally friendly custom labeling products. Philippine businesses are increasingly evaluating thermal paper suppliers based on environmental credentials, anticipating future regulatory requirements aligned with global sustainability standards.

Market Outlook 2026-2034:

The outlook for the Philippines thermal paper market remains positive, driven by growth across retail, banking, healthcare, and logistics sectors. Expanding commercial development and improved logistics connectivity are expected to indirectly boost demand for thermal paper. In retail, increased point-of-sale transactions continue to support consistent receipt consumption. Similarly, investments in healthcare infrastructure and the broader implementation of healthcare services are likely to drive higher usage of medical diagnostic and billing equipment, further sustaining the demand for thermal paper across multiple applications. The market generated a revenue of USD 20.79 Million in 2025 and is projected to reach a revenue of USD 25.52 Million by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034.

Philippines Thermal Paper Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Point-of-Sale (PoS) | 55.22% |

| Technology | Direct Thermal | 70.05% |

| Region | Luzon | 42% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Point-of-Sale (PoS)

- Tags and Label

- Lottery and Gaming

- Ticketing

- Medical

- Others

The point-of-sale (PoS) dominates with a market share of 55.22% of the total Philippines thermal paper market in 2025.

The dominance of the POS application segment reflects the fundamental role of receipt printing in retail and service transactions throughout the Philippines. Supermarkets, convenience stores, and shopping malls have experienced rapid expansion, with point-of-sale system usage growing dramatically across Metro Manila, Cebu, and Davao. The Philippines retail market size reached USD 69.42 Billion in 2024. Looking forward, the market is expected to reach USD 143.46 Billion by 2033, exhibiting a growth rate (CAGR) of 7.70% during 2025-2033, continues to modernize with automated billing systems that rely exclusively on thermal paper for receipt generation.

Small and medium-sized retail outlets are increasingly incorporating electronic cash registers as part of operational modernization efforts. The Philippine Retailers Association forecasted a 10-15% increase in retail sales for 2025, indicating sustained transaction volumes. Quick-service restaurants, food kiosks, and convenience store chains like 7-Eleven and Ministop continue expanding their footprints, each outlet requiring thermal paper supplies for daily operations. This widespread retail infrastructure ensures long-term stability for POS thermal paper demand.

Width Insights:

- 57mm

- 80mm

- Others

The 57mm thermal paper size is widely used in compact point-of-sale (POS) systems, portable printers, and small-format retail terminals across the Philippines. Its compact dimensions make it ideal for businesses with limited counter space or mobile operations, such as food carts and small retail outlets. The ease of handling, lower paper consumption, and compatibility with a broad range of printers contribute to its strong market presence.

The 80mm thermal paper size dominates larger POS systems, supermarkets, and high-volume retail outlets due to its ability to accommodate detailed receipts and transaction information. Its wider format allows for clearer printing of logos, barcodes, and multiple itemized entries, enhancing customer experience. The extensive compatibility with standard POS printers and preference among larger enterprises drive its leading position in the Philippines thermal paper market.

Technology Insights:

- Direct Thermal

- Thermal Transfer

The direct thermal leads the market with a share of 70.05% of the total Philippines thermal paper market in 2025.

Direct thermal technology dominates the Philippines thermal paper market primarily due to its cost-effectiveness and operational simplicity. Unlike traditional thermal transfer systems, direct thermal printers do not require ribbons or inks, reducing maintenance costs and downtime. This convenience makes them ideal for high-volume applications such as retail receipts, banking, and logistics. Additionally, the technology offers faster printing speeds and consistent print quality, making it a preferred choice for businesses seeking efficient and reliable point-of-sale and ticketing solutions.

Another factor driving the adoption of direct thermal paper is its compatibility with compact, portable printing devices. Small-format printers, widely used in convenience stores, restaurants, and mobile service operations, rely on direct thermal paper for easy handling and minimal operational complexity. Furthermore, the growing demand for eco-friendly and recyclable paper solutions has encouraged suppliers to offer coated thermal papers that reduce environmental impact, reinforcing direct thermal technology’s leadership in the Philippines market.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits clear dominance with a 42% share of the total Philippines thermal paper market in 2025.

The Philippines thermal paper market in Luzon is being driven by the rapid growth of the retail and e-commerce sectors. Increasing consumer spending and the expansion of supermarkets, convenience stores, and retail chains are boosting demand for POS systems, which rely heavily on thermal paper. Additionally, the rise of cashless payments and digital transaction receipts has further accelerated the adoption of thermal paper, as businesses seek efficient, low-maintenance printing solutions for high-volume transactions.

Another key factor fueling the thermal paper market in Luzon is the widespread use of portable and compact printing devices in food service, logistics, and transportation industries. Small-format printers for mobile ticketing, delivery receipts, and billing statements rely on direct thermal paper for operational efficiency. Moreover, the demand for fast, reliable, and cost-effective printing solutions, combined with the availability of different paper widths such as 57mm and 80mm, supports sustained market growth in the region.

Market Dynamics:

Growth Drivers:

Why is the Philippines Thermal Paper Market Growing?

Expansion of Organized Retail and Modern Trade Formats

The transformation of the Philippine retail landscape from traditional trade to modern organized formats represents a primary growth catalyst for the thermal paper market. Supermarkets, hypermarkets, convenience stores, and shopping malls are expanding rapidly across urban and semi-urban areas, each establishment requiring POS systems that consume thermal paper for receipt printing. According to Packworks, more than 175,000 stores engaged in transactions using its Sari.PH Pro app in 2024, marking a significant rise from approximately 133,000 stores the previous year, reflecting strong growth in adoption and active usage of the platform. This systematic upgrade of retail infrastructure guarantees consistent thermal paper demand growth throughout the forecast period.

Banking Sector Modernization and Financial Inclusion Initiatives

The Philippine banking sector's commitment to financial inclusion is driving the deployment of ATMs, cash deposit machines, and self-service kiosks across previously underserved areas. Account ownership in the Philippines has grown significantly, reaching a majority of households, reflecting successful financial inclusion initiatives and the expansion of banking infrastructure across the country. This increase indicates broader access to financial services and improved opportunities for households to participate in formal banking systems. Six digital banks currently operate in the country, collectively serving 8.7 million depositors, with the BSP planning to issue up to four additional licenses in 2025. Banks prefer thermal paper for transaction slips due to excellent print quality, durability, and capacity for high-volume operations without requiring ink cartridges. This combination of convenience and efficiency makes thermal paper indispensable in financial services, ensuring sustained institutional demand.

E-Commerce Growth Accelerating Logistics Label Demand

The Philippines e-commerce market size reached USD 28.0 Billion in 2025. Looking forward, the market is expected to reach USD 86.2 Billion by 2034, exhibiting a growth rate (CAGR) of 13.32% during 2026-2034. This is creating substantial demand for thermal paper in logistics applications. The rapid growth of online selling has significantly increased the demand for shipping labels and tracking documentation. Thermal paper, with its smudge-proof and moisture-resistant properties, is well-suited for labeling packages in transportation and handling operations. As e-commerce expands and consumer expectations for fast and reliable delivery rise, the need for thermal labels in logistics applications continues to grow, supporting efficient barcode scanning and accurate package tracking throughout the supply chain.

Market Restraints:

What Challenges the Philippines Thermal Paper Market is Facing?

Growing Adoption of Digital Receipts and Paperless Transactions

The accelerating shift toward digital receipts and electronic documentation poses a structural challenge to thermal paper consumption. Major retailers and e-commerce platforms are increasingly offering digital receipt options through email and mobile applications, reducing physical receipt generation. Environmental consciousness and operational cost considerations are driving businesses to evaluate paperless alternatives.

Regulatory Concerns Over Chemical Coatings

Health and environmental regulations concerning bisphenol A (BPA) and bisphenol S (BPS) coatings in thermal paper are influencing procurement decisions. The EU has restricted BPA concentration to 0.02% by weight, establishing global precedents that may influence Philippine regulatory frameworks. Compliance with evolving chemical safety standards requires manufacturers to invest in alternative coating technologies.

Import Dependency and Supply Chain Vulnerabilities

The Philippines lacks significant domestic thermal paper manufacturing capacity, creating reliance on imports primarily from China, Japan, and regional suppliers. This dependency exposes the market to exchange rate fluctuations, international shipping cost variations, and supply chain disruptions. Geopolitical tensions and logistics constraints can impact product availability and pricing stability.

Competitive Landscape:

The Philippines thermal paper market exhibits moderate competitive intensity characterized by the presence of international manufacturers and domestic distributors serving various end-user segments. Competition centers on product quality, format compatibility with local POS equipment, pricing strategies, and supply chain reliability. Companies differentiate through offering complete product ranges covering different widths, roll lengths, and coating specifications to meet diverse customer requirements. Distribution networks and after-sales support capabilities influence competitive positioning, particularly for serving geographically dispersed retail and banking clients. The market observes ongoing consolidation as larger players acquire regional distributors to expand coverage and capture market share across different Philippine regions.

Philippines Thermal Paper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Point-Of-Sale (POS), Tags and Label, Lottery and Gaming, Ticketing, Medical, Others |

| Widths Covered | 57mm, 80mm, Others |

| Technologies Covered | Direct Thermal, Thermal Transfer |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines thermal paper market size was valued at USD 20.79 Million in 2025.

The Philippines thermal paper market is expected to grow at a compound annual growth rate of 2.30% from 2026-2034 to reach USD 25.52 Million by 2034.

The Point-of-sale (PoS) dominated the market with a share of 55.22% in 2025, driven by the extensive adoption of electronic cash registers and automated billing systems across organized retail establishments, shopping malls, and quick-service restaurants.

Key factors driving the Philippines thermal paper market include expansion of organized retail formats and modern trade establishments, banking sector modernization with increased ATM and kiosk deployments, rapid e-commerce growth creating demand for logistics labels, and healthcare sector investments in diagnostic equipment.

Major challenges include growing adoption of digital receipts and paperless transactions, regulatory concerns over BPA and BPS chemical coatings requiring alternative formulations, import dependency creating supply chain vulnerabilities, and price competition from regional thermal paper suppliers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)