Philippines Third Party Logistics (3PL) Market Size, Share, Trends and Forecast by Transport, Service Type, End Use, and Region, 2025-2033

Philippines Third Party Logistics (3PL) Market Overview:

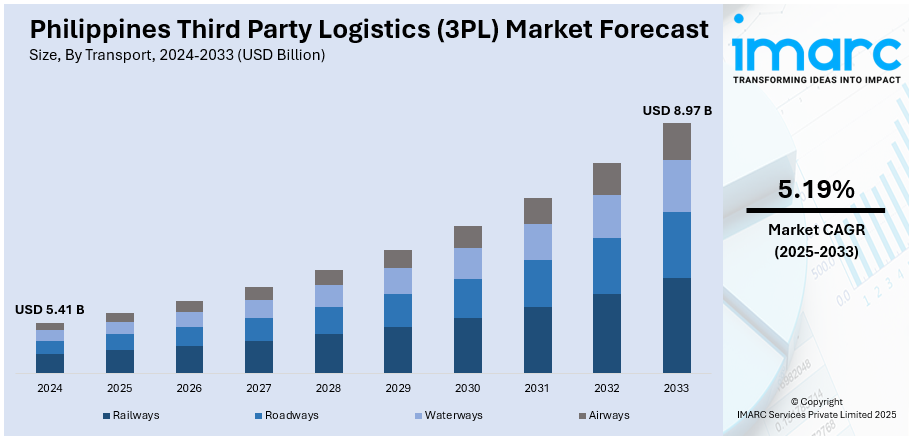

The Philippines third party logistics market size reached USD 5.41 Billion in 2024. Looking forward, the market is projected to reach USD 8.97 Billion by 2033, exhibiting a growth rate (CAGR) of 5.19% during 2025-2033. The market is expanding due to rising e-commerce activities, increased cross-border trade, and the need for efficient supply chain management. Growing adoption of technology-driven solutions, such as automation and real-time tracking, is further enhancing operational efficiency. Demand for cost-effective, flexible logistics services supports industry growth, strengthening Philippines third party logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.41 Billion |

| Market Forecast in 2033 | USD 8.97 Billion |

| Market Growth Rate 2025-2033 | 5.19% |

Philippines Third Party Logistics (3PL) Market Trends:

Technology Integration

Technology integration is transforming the logistics landscape in the Philippines with third-party logistics (3PL) providers increasingly utilizing digital platforms, automation, and real-time tracking systems. These advancements improve supply chain visibility, eliminate operational inefficiencies, and enable businesses to monitor shipments with enhanced precision. For instance, in March 2025, Yusen Logistics Philippines Inc. inaugurated its new Supply Chain Solutions Office highlighting its commitment to innovation in logistics. The facility features advanced resources for order management, 4PL/LLP solutions, IT-enabled services, and centralized control tower operations, enhancing efficiency and scalability in supply chain management for clients. Automation in warehouses enhances inventory management accelerates order processing and reduces errors while real-time tracking guarantees prompt deliveries and improved customer satisfaction. Furthermore, the adoption of data analytics and AI-driven tools facilitates predictive planning, route optimization, and cost control thereby boosting logistics performance. As businesses transition toward digital-first operations 3PL providers investing in cutting-edge technologies are securing a competitive advantage. This technological shift plays a significant role in Philippines third party logistics market growth fostering scalability, reliability, and sustainability in an ever-expanding logistics sector.

To get more information on this market, Request Sample

Cold Chain Expansion

The growth of cold chain logistics is emerging as a key trend in the Philippines fueled by the increasing demand for temperature-sensitive products in the pharmaceuticals, food, and agriculture sectors. In June 2025, Agriculture Secretary Francisco P. Tiu Laurel Jr. urged the Cold Chain Association of the Philippines to aid in developing cold storage infrastructure vital for food security. An investment of P3 billion will fund 99 facilities to reduce post-harvest losses and enhance market access benefiting farmers and consumers alike. As the consumption of fresh and frozen foods rises along with the critical need for the safe transport of vaccines and biologics there is a significant demand for dependable cold chain solutions. Third-party logistics providers are enhancing their offerings by investing in advanced refrigeration systems, insulated vehicles, and temperature-monitoring technologies to preserve product quality throughout the supply chain. This approach ensures adherence to safety standards while minimizing spoilage and losses. Moreover, the agricultural export sector is heavily dependent on robust cold chain infrastructure to maintain freshness and prolong shelf life. As industries place greater emphasis on quality and safety the expansion of cold chain capabilities is establishing logistics providers as vital partners in the country's evolving supply chain ecosystem.

Philippines Third Party Logistics (3PL) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on transport, service type, and end use.

Transport Insights:

- Railways

- Roadways

- Waterways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transport. This includes railways, roadways, waterways, and airways.

Service Type Insights:

- Dedicated Contract Carriage

- Domestic Transportation Management

- International Transportation Management

- Warehousing and Distribution

- Value Added Logistics Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes dedicated contract carriage, domestic transportation management, international transportation management, warehousing and distribution, and value added logistics services.

End Use Insights:

-market.webp)

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, retail, healthcare, automotive, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Third Party Logistics (3PL) Market News:

- In April 2025, FAST Logistics and Evodine Company Builder launched the Revv-Evodine Venture Studio, the Philippines' first startup incubator focused on logistics innovation, on April 3. This initiative aims to tackle supply chain challenges through AI-driven solutions, providing mentorship and resources to nurture scalable ventures from both internal teams and young entrepreneurs.

- In September 2024, Royal Cargo partnered with European MedTech Services (EMTS) to enhance healthcare solutions in the Philippines. EMTS will offer medical equipment maintenance and repair services via Royal Cargo's logistics network, establishing a workshop in Laguna to improve efficiency and reliability in patient care.

Philippines Third Party Logistics (3PL) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transports Covered | Railways, Roadways, Waterways, Airways |

| Service Types Covered | Dedicated Contract Carriage, Domestic Transportation Management, International Transportation Management, Warehousing and Distribution, Value Added Logistics Services |

| End Uses Covered | Manufacturing, Retail, Healthcare, Automotive, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines third party logistics (3PL) market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines third party logistics (3PL) market on the basis of transport?

- What is the breakup of the Philippines third party logistics (3PL) market on the basis of service type?

- What is the breakup of the Philippines third party logistics (3PL) market on the basis of end use?

- What is the breakup of the Philippines third party logistics (3PL) market on the basis of region?

- What are the various stages in the value chain of the Philippines third party logistics (3PL) market?

- What are the key driving factors and challenges in the Philippines third party logistics (3PL) market?

- What is the structure of the Philippines third party logistics (3PL) market and who are the key players?

- What is the degree of competition in the Philippines third party logistics (3PL) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines third party logistics (3PL) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines third party logistics (3PL) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines third party logistics (3PL) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)