Philippines Tin Market Size, Share, Trends and Forecast by Product Type, Application, End-Use Industry, and Region, 2026-2034

Philippines Tin Market Summary:

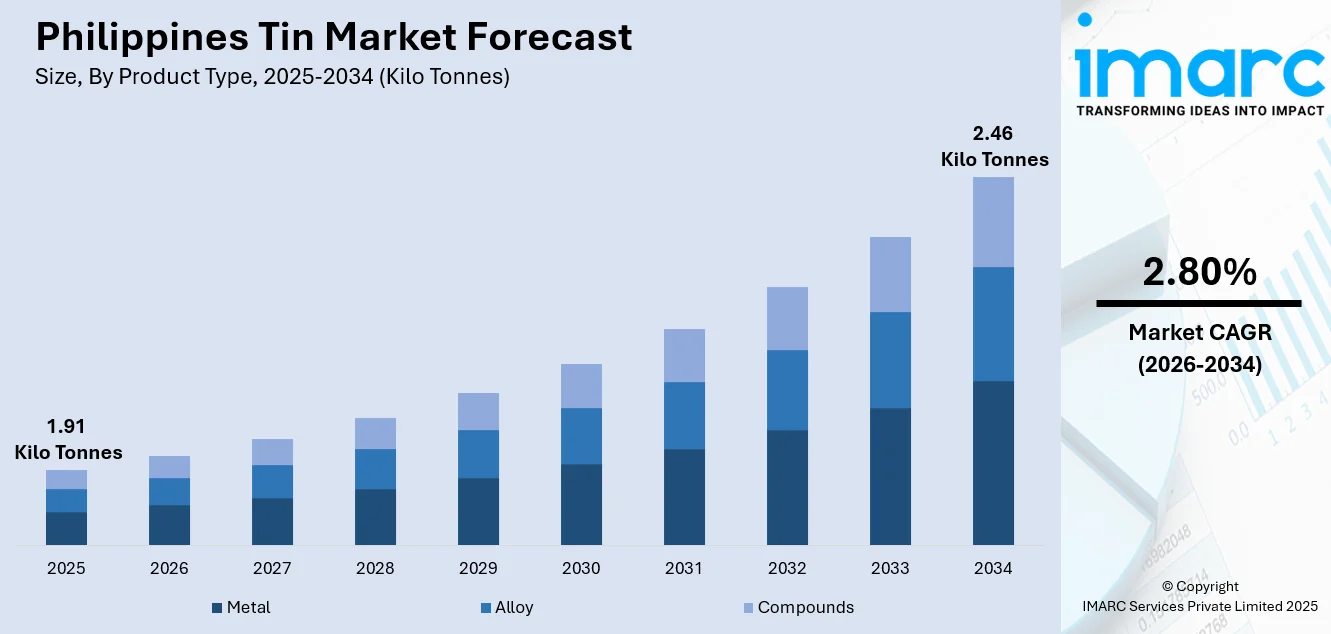

The Philippines tin market size reached 1.91 Kilo Tonnes in 2025 and is projected to reach 2.46 Kilo Tonnes by 2034, growing at a compound annual growth rate of 2.80% from 2026-2034.

The market is driven by expanding electronics manufacturing activities, increasing adoption of tin-based soldering materials in consumer electronics and automotive applications, and growing demand from the food packaging sector. Rising industrial development and infrastructure investments, coupled with technological advancements in tin processing and alloy production, continue to strengthen domestic consumption patterns. Additionally, supportive government policies promoting manufacturing growth and export competitiveness further reinforce market expansion, contributing to the Philippines tin market share.

Key Takeaways and Insights:

- By Product Type: Metal dominates the market with a share of 46% in 2025, driven by extensive utilization in soldering applications for electronic assembly and industrial coating processes requiring superior corrosion resistance.

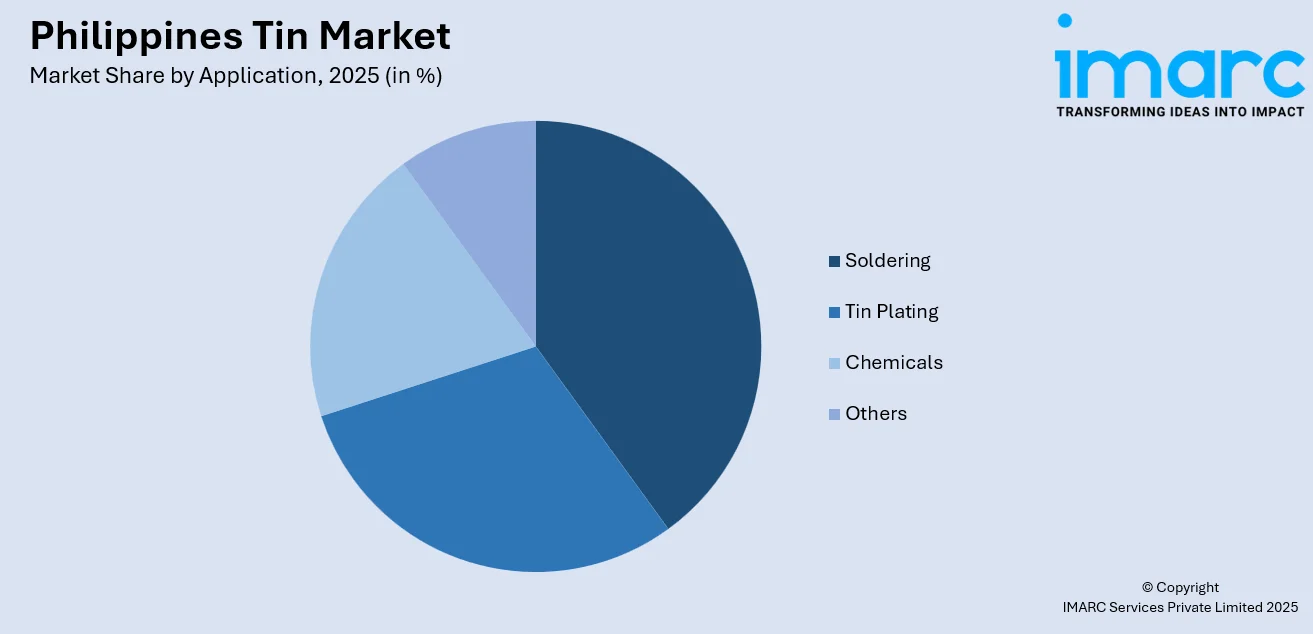

- By Application: Soldering leads the market with a share of 40% in 2025, owing to its critical role in electronics manufacturing for circuit board assembly and lead-free solder formulations.

- By End-Use Industry: Electronics represents the largest segment with a market share of 35% in 2025, driven by the Philippines as a major manufacturing hub for electronics that produce consumer devices.

- By Region: Luzon leads the market with a share of 48% in 2025, owing to concentration of manufacturing facilities in Metro Manila and nearby industrial zones with superior infrastructure connectivity.

- Key Players: The Philippines tin market exhibits moderate competitive fragmentation, with established regional processors competing alongside international trading entities across various industrial segments and application categories. Market participants differentiate through product quality specifications, supply chain reliability, technical expertise, and strategic distribution networks serving diverse end-use industries.

To get more information on this market Request Sample

The Philippines tin market is experiencing sustained growth driven by robust demand from the electronics manufacturing sector, which represents one of the country's largest export industries. The proliferation of consumer electronic devices, including smartphones, tablets, and computing equipment, necessitates substantial quantities of tin for soldering applications in circuit board assembly. According to reports, in 2025, the Philippine government established a Semiconductor and Electronics Industry Advisory Council to accelerate electronics manufacturing and strengthen global competitiveness, directly supporting downstream demand for tin-based solder materials. Additionally, the automotive sector's expansion, particularly in vehicle electronics and advanced driver-assistance systems, creates incremental demand for high-quality tin-based solder materials. The food and beverage packaging industry further bolsters consumption through requirements for tin-plated steel containers offering superior corrosion resistance and food safety properties. Industrial development initiatives and foreign investment in manufacturing facilities continue strengthening domestic tin consumption patterns across diverse application segments.

Philippines Tin Market Trends:

Transition Toward Lead-Free Soldering Solutions

The Philippine electronics manufacturing sector is progressively adopting lead-free tin-based soldering solutions in response to stringent international environmental regulations and export market requirements. As per sources, in January 2025, Philippine companies secured new leads from the U.S. semiconductor and electronics supply chain at the Consumer Electronics Show (CES), highlighting stronger global integration and increasing demand for compliant electronic components. Moreover, manufacturers are reformulating solder compositions to meet compliance standards established by major importing regions, driving demand for high-purity refined tin and specialized alloy formulations. This transition encompasses enhanced quality control processes and investment in advanced soldering equipment.

Integration of Advanced Tin Alloy Technologies

Industrial manufacturers across the Philippines are increasingly incorporating advanced tin alloy formulations designed for specialized applications in electronics, automotive, and aerospace sectors. As per sources, in September 2025, the Department of Science and Technology opened its 7th Advanced Manufacturing Center in Laguna to support additive manufacturing, materials development, and advanced industrial components, strengthening innovation capacity for high-technology manufacturing. Furthermore, these sophisticated material compositions offer enhanced thermal performance, improved mechanical strength, and superior conductivity characteristics compared to conventional alternatives. Research institutions and manufacturing facilities are collaborating to develop proprietary alloy blends addressing specific industrial requirements.

Expansion of Domestic Tin Processing Capabilities

The Philippines tin market is witnessing strategic investments in expanding domestic processing and refining capabilities to enhance value-added production. As per sources in November 2025, the government temporarily reduced import duty on key tin‑mill blackplate materials to stabilize supply chains and support local tin plate manufacturing for the food packaging industry, encouraging investment in downstream processing operations. Additionally, industry participants are upgrading facilities to produce refined tin products meeting international quality specifications while reducing dependence on imported processed materials. This vertical integration approach enables greater supply chain control and improved margins through downstream value capture.

Market Outlook 2026-2034:

The Philippines tin market is projected to demonstrate steady revenue growth throughout the forecast period, supported by expanding electronics manufacturing activities and increasing industrial applications. Rising demand from automotive electronics, renewable energy installations, and food packaging sectors will sustain consumption growth. The market is expected to witness revenue expansion driven by technological advancements in tin alloy production, growing export competitiveness of Philippine electronics, and continued foreign investment in manufacturing facilities. The market size was estimated at 1.91 Kilo Tonnes in 2025 and is expected to reach 2.46 Kilo Tonnes by 2034, reflecting a compound annual growth rate of 2.80% over the forecast period 2026-2034.

Philippines Tin Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Metal | 46% |

| Application | Soldering | 40% |

| End-Use Industry | Electronics | 35% |

| Region | Luzon | 48% |

Product Type Insights:

- Metal

- Alloy

- Compounds

Metal dominates with a market share of 46% of the total Philippines tin market in 2025.

The metal commands the largest share of the Philippines tin market, primarily driven by its fundamental role in soldering applications across the electronics manufacturing sector. Refined tin metal serves as the primary input material for producing solder alloys essential in circuit board assembly, semiconductor packaging, and electronic component interconnections. According to reports, in October 2025, Philippine electronics exports grew 38.19% year-on-year to US$4.50 Billion, led by semiconductor components and medical/industrial instrumentation, highlighting strong industrial demand for refined tin solder materials.

Philippine electronics manufacturers, producing goods for both domestic consumption and international export markets, generate substantial demand for high-purity refined tin metal meeting stringent quality specifications. The metal category additionally serves tin plating applications protecting steel components against corrosion in packaging and industrial applications. Growing manufacturing activities, technology upgrades, and increasing export competitiveness continue reinforcing metal tin's dominant position. Foreign investment inflows and expanding industrial zones further support sustained demand growth within the Philippine market throughout the forecast period.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Soldering

- Tin Plating

- Chemicals

- Others

Soldering leads with a share of 40% of the total Philippines tin market in 2025.

The soldering leads the Philippines tin market, reflecting the country's significant electronics manufacturing base and export-oriented production activities. Tin-based solder materials are essential components in assembling electronic devices, connecting components to circuit boards, and establishing reliable electrical pathways within sophisticated electronic systems. The transition toward lead-free solder formulations has intensified demand for high-quality tin suitable for environmentally compliant manufacturing processes meeting international regulatory standards.

Consumer electronics production which includes smartphones, computers, tablets, and home appliances, drives substantial solder consumption throughout Philippine manufacturing facilities. Additionally, automotive electronics applications requiring durable solder connections under demanding operating conditions contribute meaningfully to the category demand. Growing semiconductor packaging activities and increasing complexity of electronic assemblies continue expanding soldering applications. The proliferation of advanced driver-assistance systems and vehicle electrification trends further accelerate demand growth across diverse manufacturing operations nationwide.

End-Use Industry Insights:

- Automotive

- Electronics

- Packaging (Food and Beverages)

- Glass

- Others

Electronics exhibits a clear dominance with a 35% share of the total Philippines tin market in 2025.

The electronics represents the largest end-use within the Philippines tin market, underpinned by the country's established position as a major electronics manufacturing and export hub. Philippine facilities produce substantial volumes of electronic components, consumer devices, and industrial electronics destined for international markets, generating consistent demand for tin-based materials throughout production processes. As per sources, in 2025, Philippine merchandise exports rose 19.4% year‑on‑year to US$7.39 Billion, with electronics leading shipments, highlighting stronger global demand for locally manufactured electronic products and downstream tin consumption.

The proliferation of connected devices, advancement of computing technologies, and expansion of consumer electronics ownership globally sustain growth momentum within this category. Philippine manufacturers serving international brands benefit from competitive production capabilities and established supply chain relationships with global technology leaders. Ongoing investment in manufacturing capacity expansion and technology upgrades ensures continued electronics dominance within domestic tin consumption patterns throughout the forecast period. Rising demand for smartphones, wearable devices, tablets, and computing equipment further reinforces this category's leading position within the Philippine market.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates with a market share of 48% of the total Philippines tin market in 2025.

Luzon dominates the Philippines tin market, benefiting from concentrated industrial activity, superior infrastructure development, and proximity to major commercial centers. Metro Manila and surrounding industrial zones host numerous electronics manufacturing facilities, automotive component producers, and packaging operations representing primary tin consumption centers. Established transportation networks, reliable utilities infrastructure, and access to skilled workforce populations support manufacturing competitiveness. The region's strategic geographic positioning and regulatory environment continue attracting sustained foreign investment inflows from multinational corporations seeking regional production capabilities.

Special economic zones within Luzon attract foreign investment in electronics and industrial manufacturing, generating sustained demand for tin materials across diverse applications. The region's established supply chain networks enable efficient material sourcing and distribution supporting manufacturing operations throughout the area. Strategic location advantages, regulatory support for industrial development, and concentration of technical expertise reinforce Luzon's dominant position within national tin consumption patterns. Continued infrastructure modernization and industrial expansion initiatives further strengthen regional market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Philippines Tin Market Growing?

Expanding Electronics Manufacturing and Export Activities

The Philippines maintains a robust electronics manufacturing sector representing a significant contributor to national export revenues and industrial employment. Major international electronics brands utilize Philippine manufacturing facilities for producing consumer devices, computing equipment, and electronic components destined for global markets. As per sources, in November 2025, Samsung Electro‑Mechanics Philippines announced a PhP50.7 Billion investment to expand its high‑technology manufacturing facility in Laguna, reflecting stronger electronics production and downstream demand for tin-based solder materials. Moreover, this manufacturing concentration generates substantial demand for tin-based soldering materials essential in circuit board assembly processes.

Growing Automotive Sector and Vehicle Electronics Integration

The Philippine automotive industry demonstrates steady expansion, driven by increasing domestic vehicle ownership and manufacturing investment. Modern automobiles incorporate extensive electronic components requiring tin-based solder connections for engine management systems, infotainment units, and safety systems. The proliferation of advanced driver-assistance features and connected vehicle technologies amplifies tin consumption per vehicle unit. Domestic automotive assembly operations generate incremental demand for high-quality tin materials meeting automotive-grade specifications. As per sources, in December 2024, Toyota Motor Philippines invested ₱5.5 Billion to revive Tamaraw production, strengthening local automotive parts manufacturing and enhancing the national automotive value chain.

Rising Demand from Food and Beverage Packaging Applications

The Philippine food and beverage industry demonstrates sustained growth, driven by expanding population and rising disposable incomes. Tin-plated steel containers offer superior corrosion resistance, food safety properties, and extended shelf-life characteristics valued by manufacturers and consumers alike. Growing urbanization and changing lifestyle patterns drive demand for tinplate packaging materials across retail and commercial channels. Export-oriented food processing operations require packaging solutions meeting international quality standards. The category benefits from established distribution infrastructure and continued investment in food processing capacity expansion.

Market Restraints:

What Challenges the Philippines Tin Market is Facing?

Supply Chain Vulnerabilities and Import Dependencies

The Philippines relies significantly on imported tin materials to meet domestic industrial requirements, creating exposure to international supply disruptions, price volatility, and logistics challenges. Limited domestic tin mining and refining capacity necessitates dependence on external suppliers, potentially affecting manufacturing continuity during supply chain disruptions. Currency fluctuations impact import costs while transportation infrastructure limitations may constrain material availability in certain regions across the country.

Competition from Alternative Materials and Technologies

Tin faces competitive pressure from alternative materials in certain applications, including aluminum packaging, polymer-based solutions, and emerging interconnection technologies. Cost considerations and performance requirements in specific applications may favor substitute materials over traditional tin-based solutions. Ongoing research into conductive adhesives and alternative soldering approaches presents potential long-term substitution risks that could impact market demand across key application categories.

Environmental and Regulatory Compliance Requirements

Increasingly stringent environmental regulations governing mining, processing, and manufacturing activities impose compliance costs and operational constraints throughout the tin value chain. International standards regarding material traceability, responsible sourcing, and environmental impact create administrative burdens for market participants. Adapting to evolving regulatory frameworks requires investment in compliance systems, process modifications, and documentation procedures to maintain market access.

Competitive Landscape:

The Philippines tin market features a moderately fragmented competitive structure characterized by the participation of established regional processors, international trading entities, and specialized industrial suppliers serving diverse end-use segments. Market participants differentiate through product quality specifications, supply reliability, technical support capabilities, and pricing competitiveness across various application categories. Distribution networks and customer relationships developed over extended operating periods provide competitive advantages for established market participants. The competitive environment encourages continuous improvement in processing efficiency, quality control systems, and customer service responsiveness. Strategic partnerships between domestic processors and international suppliers enhance material availability and market reach.

Philippines Tin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Kilo Tonnes |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Metal, Alloy, Compounds |

| Applications Covered | Soldering, Tin Plating, Chemicals, Others |

| End-Use Industries Covered | Automotive, Electronics, Packaging (Food and Beverages), Glass, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines tin market reached a volume of 1.91 Kilo Tonnes in 2025.

The Philippines tin market is expected to grow at a compound annual growth rate of 2.80% from 2026-2034 to reach 2.46 Kilo Tonnes by 2034.

Metal held the largest Philippines tin market share, driven by its fundamental role in soldering applications across electronics manufacturing, superior conductivity characteristics, and extensive utilization in tin plating applications protecting steel components against corrosion.

Key factors driving the Philippines tin market include expanding electronics manufacturing and export activities, growing automotive sector integration with advanced vehicle electronics, rising food and beverage packaging demand, industrial development initiatives, and increasing foreign investment in manufacturing facilities.

Major challenges include supply chain vulnerabilities from import dependencies, competition from alternative materials and emerging technologies, environmental compliance requirements, price volatility in international markets, infrastructure constraints affecting distribution efficiency, and limited domestic mining and refining capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)