Philippines Trade Finance Market Size, Share, Trends and Forecast by Finance Type, Offering, Service Provider, End User, and Region, 2026-2034

Philippines Trade Finance Market Summary:

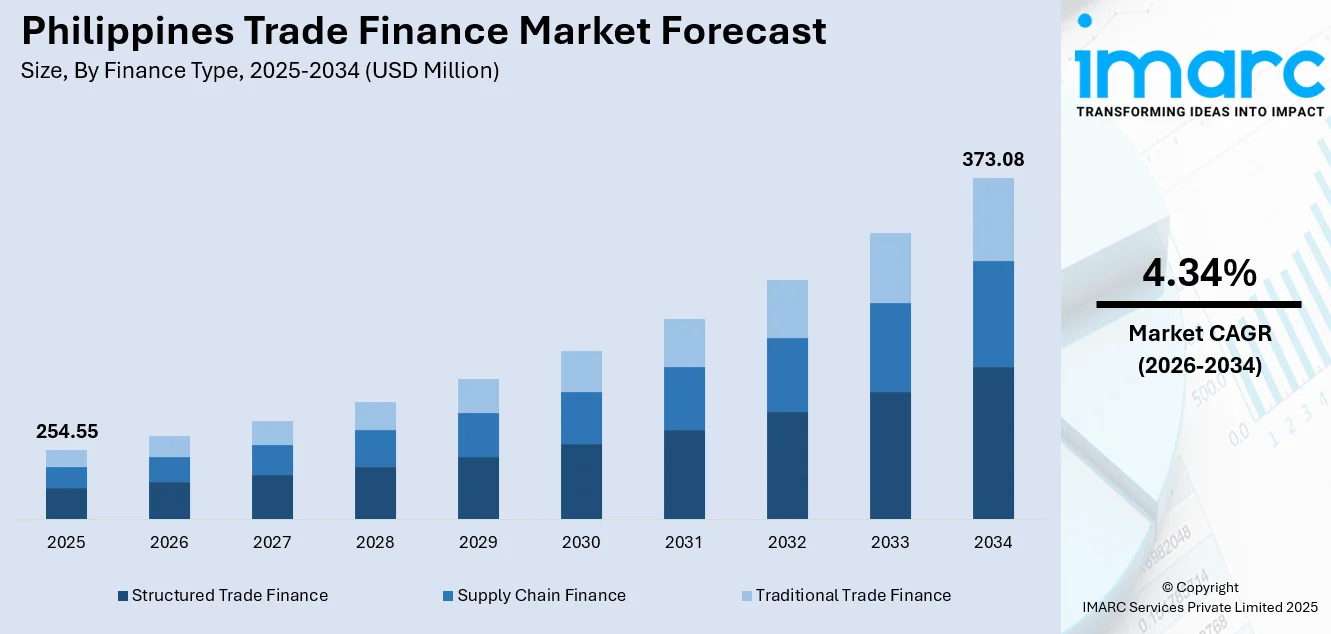

The Philippines trade finance market size was valued at USD 254.55 Million in 2025 and is projected to reach USD 373.08 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

The Philippines market is experiencing steady growth driven by expanding international trade activities, increasing participation of small and medium enterprises in global commerce, and government initiatives promoting export competitiveness. Digital transformation in banking services and the adoption of blockchain-based trade finance platforms are modernizing transaction processes, while regulatory reforms aimed at streamlining documentary requirements are reducing friction in cross-border trade operations, thereby expanding Philippines trade finance market share.

Key Takeaways and Insights:

- By Finance Type: Structured trade finance dominates the market with a share of 42% in 2025, driven by complex commodity trading requirements in agricultural exports, large-scale manufacturing imports requiring sophisticated financing structures, and corporate demand for customized trade solutions.

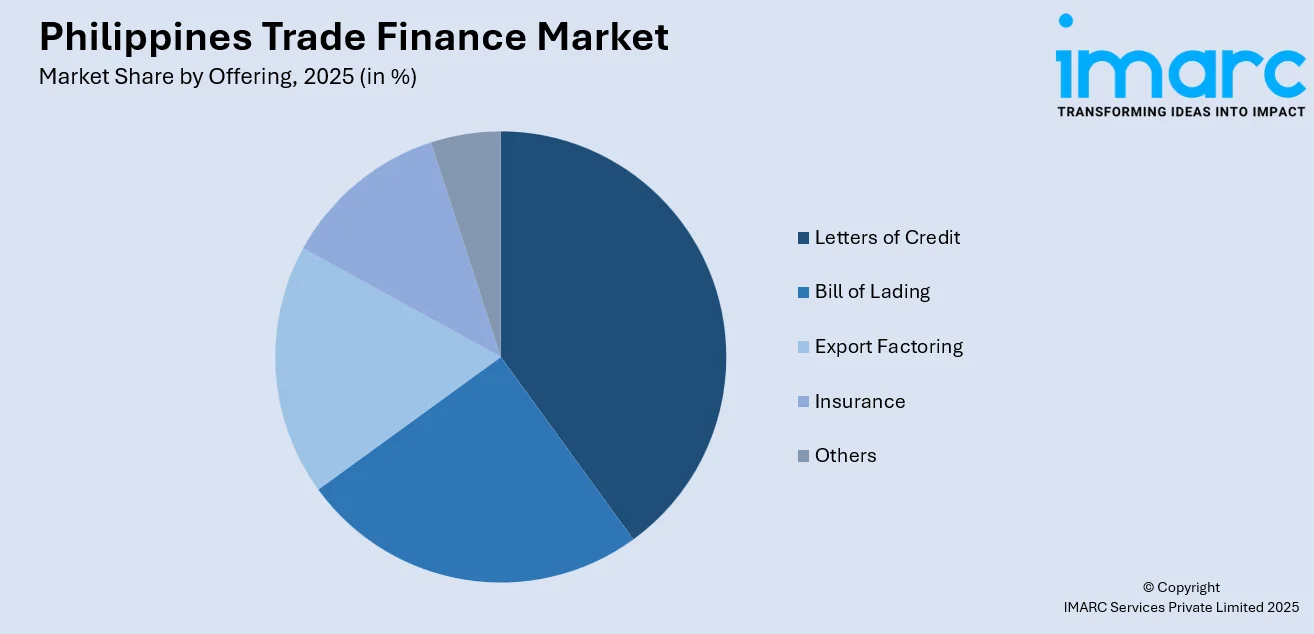

- By Offering: Letters of credit lead the market with a 30% share in 2025, owing to their established role in mitigating payment risks in international transactions, widespread acceptance among global trading partners, and regulatory familiarity among Philippine banks.

- By Service Provider: Banks account for the largest share of 68% in 2025, reflecting their dominant position in traditional trade finance infrastructure, established correspondent banking networks, regulatory compliance capabilities, and trusted relationships with corporate importers and exporters.

- By End User: Small and medium sized enterprises (SMEs) represent the leading segment with a market share of 60% in 2025, driven by government export promotion programs targeting SME participation, increasing digital platform accessibility reducing traditional banking barriers, and growing entrepreneurial engagement in international commerce.

- By Region: Luzon exhibits a clear dominance with a market share of 49% in 2025, concentrated around Metro Manila's position as the financial and commercial capital, proximity to major seaports and airports facilitating trade logistics, and headquarters concentration of multinational corporations and trading companies.

- Key Players: The Philippines trade finance market demonstrates moderate competitive intensity with universal banks competing alongside specialized trade finance houses and emerging fintech platforms across corporate and SME segments, alongside international financial institutions supporting cross-border trade corridors.

To get more information on this market Request Sample

The market benefits from expanding merchandise trade in electronics, agricultural products, and processed foods that requires secure payment mechanisms. Moreover, the growing integration into regional value chains creates consistent demand for instruments that bridge funding gaps between shipment and payment receipt. Apart from this, small and medium enterprises increasingly utilize guarantees, invoice discounting, and receivables financing to participate in international commerce without bearing excessive working capital pressure. Digital platforms are streamlining documentation processes, reducing transaction times, and improving accessibility for businesses operating across the archipelago. Government and private initiatives supporting financial inclusion further strengthen the foundation for sustained market development. In 2024, the Asian Development Bank (ADB) sanctioned a $300 million policy-based loan to aid the Philippine government in establishing a more robust institutional and policy framework aimed at enhancing access to financial services for Filipinos, especially for the vulnerable population, and fostering economic growth. ADB’s Inclusive Finance Development Program, Subprogram 3, is aiding reforms aimed at enhancing financial inclusion in the nation by upgrading the financial infrastructure, which includes broadening the digital financing ecosystem. It also bolsters initiatives to enhance the capabilities of financial service providers, such as rural banks and nonbank financial entities, to deliver quality products and services accessible through diverse delivery channels.

Philippines Trade Finance Market Trends:

Digital Transformation of Trade Finance Operations

In 2025, several major Philippine banks announced the rollout of enhanced digital trade finance portals that enable exporters to upload documents online, track transaction status in real time, and receive faster approvals. For instance, in 2025, GCash, the top finance super app in the Philippines, collaborated with global payment solutions provider BPC to introduce 'GCash PocketPay', a fresh card-present acceptance solution aimed at making digital payments accessible to millions of merchants. These platforms are streamlining processes that traditionally required manual handling, reducing transaction times and improving operational efficiency across banking institutions. The shift toward digital-first trade operations marks a fundamental transformation in how Philippine exporters and importers interact with financial institutions, eliminating geographical barriers and enabling businesses in provincial areas to access sophisticated financing instruments previously available primarily through metropolitan branch networks.

Government-led Initiatives for SME Trade Finance Access

The Philippines govt is partnering with financial institutions to conduct workshops on export financing and risk management for SMEs, underscoring the government's commitment to expanding trade finance inclusivity. These workshops are designed to help smaller enterprises understand available financing instruments and navigate documentation requirements, enabling more businesses to participate in international trade activities. The coordinated approach between government agencies and financial institutions reflects recognition that SME export capacity depends critically on adequate financing access, with educational initiatives addressing knowledge gaps that have historically prevented smaller firms from utilizing available trade finance solutions effectively. In 2024, the Fintech Philippines Association (FPH) held the second edition of its Open Finance Revolution conference on July 3, 2024, at Shangri-La, The Fort in Manila. Growing from a half-day event in 2023, the 2024 conference will feature a full-day agenda centered on the latest trends and advancements in open finance. Attendees were allowed to anticipate contract sessions on open banking, embedded lending, fraud prevention, and international money transfers.

Expansion of Supply Chain Finance Programs

Industry reports highlighted increased adoption of supply chain finance programs across the electronics, agricultural, and consumer goods sectors, with participating firms reporting tangible improvements in cash flow stability and supplier relationships. This growing acceptance of structured financing solutions is helping companies optimize working capital while strengthening their supply chain resilience. The trend reflects recognition among larger buyers that supporting supplier financing creates mutual benefits through more reliable delivery schedules, reduced supply disruptions, and enhanced bargaining power in international markets where consistent product flow provides competitive advantage. In 2025, HSBC Philippines and Unilever Philippines introduced a sustainable supply chain finance initiative that provides enhanced financing conditions to Unilever’s suppliers according to their sustainability evaluations. The program seeks to motivate suppliers to enhance their environmental, social, and governance (ESG) performance, directly connecting reduced financing costs to their sustainability accomplishments.

Market Outlook 2026-2034:

The Philippines trade finance market is positioned for sustained growth as ASEAN economic integration deepens regional trade flows requiring efficient financing mechanisms, while bilateral trade agreements with major partners create expanded export opportunities across agricultural, manufacturing, and services sectors. The government's push for export diversification beyond traditional markets and products is generating demand for specialized trade finance solutions supporting new trading corridors and non-traditional exporters. The market generated a revenue of USD 254.55 Million in 2025 and is projected to reach a revenue of USD 373.08 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034. Infrastructure investments in port modernization and logistics connectivity are reducing transaction costs and transit times, making Philippine exports more competitive while increasing trade volumes requiring financing support.

Philippines Trade Finance Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Finance Type |

Structured Trade Finance |

42% |

|

Offering |

Letters of Credit |

30% |

|

Service Provider |

Banks |

68% |

|

End User |

Small and Medium Sized Enterprises (SMEs) |

60% |

|

Region |

Luzon |

49% |

Finance Type Insights:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Structured trade finance dominates with a market share of 42% of the total Philippines trade finance market in 2025.

Structured trade finance is the largest segment, reflecting the complexity of commodity trading transactions that characterize significant portions of Philippine international commerce. Agricultural exports including coconut products, tropical fruits, and seafood require sophisticated financing arrangements that bridge extended production cycles, seasonal harvest patterns, and variable international commodity prices, making standardized trade finance products insufficient for these sectors' needs. Mining and mineral exports similarly demand customized financing structures that account for extraction timelines, quality verification processes, and price volatility in global metals markets.

Manufacturing importers, particularly those in electronics assembly and automotive parts production, utilize structured trade finance to manage large-scale component purchases requiring inventory financing, quality inspection protocols, and just-in-time delivery coordination with overseas suppliers. The ability to tailor repayment schedules to production cycles and synchronize financing with buyer purchase orders provides critical working capital optimization for manufacturers operating on thin margins in competitive global supply chains, making structured solutions indispensable for maintaining operational efficiency.

Offering Insights:

Access the comprehensive market breakdown Request Sample

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

Letters of credit leads with a share of 30% of the total Philippines trade finance market in 2025.

Letters of credit exhibit a clear dominance, representing the foundational instrument for mitigating counterparty payment risks in international transactions where trading partners lack established trust relationships. Philippine importers rely on letters of credit to provide payment assurance to overseas suppliers, particularly when sourcing from new vendors or conducting large-value transactions where supplier reluctance to extend open account terms would otherwise constrain procurement flexibility. The instrument's regulatory framework, standardized documentation requirements under Uniform Customs and Practice guidelines, and widespread acceptance among international banks create a reliable mechanism for facilitating cross-border commerce.

Exporters utilize letters of credit to guarantee payment from foreign buyers, enabling them to fulfill large orders with confidence while using confirmed letters of credit as collateral for pre-shipment financing from local banks. The examination of documents against strict compliance standards provides sellers with payment certainty conditional only on proper documentation, reducing the commercial and political risks inherent in international trade. Despite the emergence of open account terms and documentary collections in established trading relationships, letters of credit remain essential for transactions involving higher-risk destinations, new trading partnerships, or substantial transaction values where payment security justifies the instrument's cost and documentary complexity.

Service Provider Insights:

- Banks

- Trade Finance Houses

Banks exhibits a clear dominance with a 68% share of the total Philippines trade finance market in 2025.

Banks dominate themarket leveraging their comprehensive correspondent banking networks, regulatory compliance infrastructure, and established customer relationships with importers and exporters across sectors. Universal banks and commercial banks provide integrated trade finance services encompassing letters of credit issuance, bills for collection, import financing, export financing, and foreign exchange hedging, offering convenience through single-relationship transaction execution. Their access to international settlement systems, relationships with overseas correspondent banks, and credit assessment capabilities enable them to intermediate complex cross-border transactions while managing counterparty risks.

The regulatory framework governing trade finance activities, including documentary verification requirements, anti-money laundering compliance, and foreign exchange regulations, creates significant barriers to entry that favor established banking institutions with dedicated compliance departments and experienced trade finance specialists. Banks' ability to cross-sell complementary services including cash management, foreign currency accounts, and supply chain finance solutions strengthens customer relationships and creates switching costs that sustain their market position despite emerging competition from specialized trade finance houses and digital platforms seeking to disintermediate traditional banking channels.

End User Insights:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

Small and medium sized enterprises lead with a share of 60% of the total Philippines trade finance market in 2025.

Small and medium sized enterprises is the leading segment, driven by government initiatives specifically targeting SME export competitiveness through streamlined documentary requirements, simplified application processes, and concessional financing programs designed to reduce barriers traditionally limiting smaller enterprise participation in international trade. The Department of Trade and Industry's export promotion programs provide technical assistance, market intelligence, and financing facilitation that enable SMEs to identify export opportunities and navigate complex trade procedures, significantly expanding the addressable market for trade finance providers.

Digital platforms and fintech innovations have democratized access to trade finance by reducing minimum transaction thresholds, automating credit assessment through alternative data sources beyond traditional collateral requirements, and providing user-friendly interfaces that eliminate the need for specialized trade finance expertise. SMEs engaged in agricultural exports, handicrafts, processed foods, and light manufacturing increasingly participate in global value chains through e-commerce platforms and international marketplaces that require efficient payment collection and receivables financing mechanisms, creating demand for accessible trade finance solutions tailored to smaller transaction sizes and faster processing timelines that traditional banking products often failed to accommodate effectively.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits a clear dominance with a 49% share of the total Philippines trade finance market in 2025.

Luzon represents the largest region, concentrated in Metro Manila's position as the nation's financial, commercial, and logistics hub where major banks, trading companies, multinational corporations, and government agencies maintain headquarters operations. The National Capital Region hosts the country's primary international airport and major seaport facilities in Manila and nearby Cavite, creating natural concentration of import and export activities requiring proximate trade finance services. Corporate importers sourcing raw materials, components, and finished goods for domestic distribution maintain purchasing departments in Manila, while exporters coordinating shipments to international markets similarly concentrate operations near port facilities and freight forwarding services.

The presence of special economic zones in Cavite, Laguna, and Bataan supporting electronics manufacturing, automotive assembly, and other export-oriented industries generates substantial demand for trade finance services facilitating both component imports and finished goods exports. Regional banks and trade finance houses establish primary operations in Metro Manila to serve this concentrated customer base while maintaining branch networks extending to provincial manufacturing centers and agricultural export hubs, creating a hub-and-spoke service delivery model that reinforces Luzon's market dominance while serving nationwide trade finance requirements through centralized processing and credit approval infrastructure.

Market Dynamics:

Growth Drivers:

Why is the Philippines Trade Finance Market Growing?

Expanding Regional Integration Through ASEAN Economic Community Creating Cross-Border Trade Opportunities

The deepening integration of ASEAN member economies through tariff reductions, harmonized customs procedures, and mutual recognition agreements is facilitating increased intra-regional trade flows that require efficient financing mechanisms. Philippine manufacturers are increasingly participating in regional supply chains where components cross multiple borders during production processes, creating demand for supply chain finance solutions that optimize working capital across geographically dispersed production networks. Services exports including business process outsourcing, tourism, and professional services generate foreign currency receivables requiring efficient collection mechanisms and foreign exchange management, expanding the scope of trade finance beyond traditional goods transactions. The ASEAN Single Window initiative streamlining customs documentation and the Regional Comprehensive Economic Partnership agreement expanding preferential trade access are reducing non-tariff barriers while increasing transaction volumes requiring financial intermediation. In 2026, President Ferdinand R. Marcos Jr. observed the significant signing of a free trade agreement (FTA) between the Philippines and the United Arab Emirates (UAE) during his two-day official trip to Abu Dhabi. The accord seeks to lower tariffs, improve market entry for goods and services, boost investment streams, and generate new prospects for Filipino professionals and service providers in the UAE. It additionally includes key areas like digital commerce, MSMEs, sustainable growth, intellectual property, competition and consumer safeguarding, public procurement, and technical collaboration.

Government Export Promotion Initiatives Targeting SME International Market Participation

The Philippine government has implemented comprehensive programs specifically designed to increase small and medium enterprise participation in international trade through export financing guarantees, trade mission support, market intelligence provision, and capacity building initiatives that reduce traditional barriers limiting smaller firm export engagement. The Philippine Export-Import Credit Agency provides credit guarantees and insurance products that enable banks to extend trade finance to exporters lacking conventional collateral, effectively expanding the addressable market for trade finance providers while reducing risk exposure. Simplified documentary requirements for smaller-value transactions, fast-track approval processes, and dedicated SME trade finance desks at major banks are lowering the operational complexity that previously discouraged smaller enterprises from pursuing export opportunities, creating market expansion opportunities for financial institutions developing specialized SME trade finance products. On 31 January 2025, a new collaborative initiative backed by the United Nations was introduced to offer digital resources and training to a minimum of 15,000 small enterprises in underprivileged areas of the Philippines. Representatives from the government, development and diplomatic sectors, as well as the private industry, participated in the launch. The new UN joint initiative ultimately seeks to enhance the competitiveness of micro, small, and medium enterprises (MSMEs) by promoting better connectivity.

Digital Transformation of Banking Services Improving Trade Finance Accessibility and Efficiency

Philippine banks are deploying digital platforms that enable electronic document submission, automated compliance checking, and real-time transaction tracking, significantly reducing processing timelines that traditionally extended from days to hours while lowering operational costs through workflow automation. Blockchain-based trade finance platforms are emerging that provide immutable transaction records, automated smart contract execution for conditional payments, and distributed ledger transparency that reduces documentation disputes and fraud risks while accelerating settlement processes. Mobile banking applications are extending trade finance access to geographically remote exporters and importers who previously faced challenges accessing bank branches, while application programming interfaces are enabling integration between enterprise resource planning systems and bank platforms that automate purchase order financing, invoice discounting, and receivables management without manual intervention. In 2025, GoTyme Bank, the rapidly expanding bank in the Philippines and a collaboration between the Gokongwei Group and Tyme Group, revealed the introduction of its cryptocurrency investment option. This launch was enabled through collaboration with Alpaca, a worldwide frontrunner in brokerage infrastructure APIs that offer access to cryptocurrencies, stocks, ETFs, options, and fixed income.

Market Restraints:

What Challenges the Philippines Trade Finance Market is Facing?

Complex Documentary Requirements and Regulatory Compliance Creating Operational Friction

The intricate documentation standards required for international trade transactions including commercial invoices, packing lists, certificates of origin, phytosanitary certificates, and transport documents create administrative burdens particularly challenging for smaller enterprises lacking dedicated trade compliance personnel. Discrepancies between documents and letter of credit terms frequently delay payments and increase transaction costs, with strict compliance requirements under international banking standards creating rejection risks that discourage some businesses from utilizing formal trade finance instruments. Regulatory requirements including anti-money laundering verification, export control screening, and foreign exchange documentation add layers of procedural complexity that extend transaction timelines and increase the cost of trade finance relative to domestic financing alternatives.

Limited Financial Literacy Among SMEs Regarding Trade Finance Instruments and Risk Management

Many small and medium enterprises lack understanding of available trade finance products, their appropriate applications, and the risk mitigation benefits they provide, resulting in underutilization of instruments that could improve working capital efficiency and enable larger transaction execution. The technical terminology, complex documentation requirements, and procedural unfamiliarity associated with letters of credit, documentary collections, and structured trade finance create psychological barriers that lead businesses to rely on cash-in-advance or open account terms that either constrain sales opportunities or increase payment risk exposure. Insufficient awareness of export credit insurance, pre-shipment financing, and supply chain finance solutions limits SMEs' ability to compete effectively against larger corporations with sophisticated treasury management capabilities and established banking relationships providing competitive financing terms.

Currency Volatility and Foreign Exchange Risk Exposure Affecting Transaction Profitability

Philippine peso fluctuations against major trading currencies including the US dollar, euro, and Japanese yen create exchange rate risks for both importers and exporters that can significantly impact transaction margins and profitability. Importers face increased peso costs when the domestic currency depreciates between order placement and payment execution, while exporters experience reduced peso revenues when foreign currencies weaken between contract agreement and payment receipt. Limited availability of affordable hedging instruments for smaller transaction sizes and shorter maturities constrains risk management options for SMEs, while the cost of forward contracts and currency options can erode profit margins sufficiently to discourage international trade participation among price-sensitive businesses operating in competitive markets.

Competitive Landscape:

The Philippines trade finance market exhibits moderate competitive intensity with universal banks leveraging comprehensive service capabilities and established correspondent networks competing alongside specialized trade finance houses offering focused expertise in specific sectors or transaction types. International banks with global trade finance platforms provide cross-border facilitation advantages particularly valuable for multinational corporations and large exporters requiring seamless transaction execution across multiple jurisdictions. Emerging fintech platforms are targeting underserved small and medium enterprise segments with digital-first solutions that reduce minimum transaction thresholds and streamline application processes through alternative credit assessment methodologies. The ecosystem includes government-backed export credit agencies providing guarantee programs that enable commercial banks to expand lending to higher-risk exporters while managing portfolio exposure. Competition is increasingly differentiated on digital capabilities, processing speed, pricing transparency, and specialized industry expertise rather than traditional relationship banking alone, creating opportunities for nimble competitors to capture market share through superior customer experience and operational efficiency.

Philippines Trade Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Finance Types Covered | Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance |

| Offerings Covered | Letters of Credit, Bill of Lading, Export Factoring, Insurance, Others |

| Service Providers Covered | Banks, Trade Finance Houses |

| End Users Covered | Small and Medium Sized Enterprises (SMEs), Large Enterprises |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines trade finance market size was valued at USD 254.55 Million in 2025.

The Philippines trade finance market is expected to grow at a compound annual growth rate of 4.34% from 2026-2034 to reach USD 373.08 Million by 2034.

Structured trade finance dominates the Philippines trade finance market with a 42% share in 2025, driven by the complexity of commodity trading in agricultural exports, large-scale manufacturing component imports requiring customized financing arrangements, mining sector transactions demanding price volatility management, and the need for tailored repayment schedules aligned with production cycles and buyer purchase orders in export-oriented manufacturing.

Key factors driving the Philippines Trade Finance market include expanding international trade networks with major Asian, North American, and European partners, increasing SME participation in export activities supported by government initiatives and specialized financing products, and infrastructure development through projects like the Luzon Economic Corridor that enhance logistics efficiency and reduce trade transaction costs.

Major challenges include complex documentary requirements and strict compliance standards creating administrative burdens particularly for smaller enterprises, limited financial literacy among SMEs regarding available trade finance instruments and their appropriate applications, currency volatility exposing importers and exporters to foreign exchange risks that impact transaction profitability, insufficient availability of affordable hedging instruments for smaller transaction sizes, and the cost of trade finance products relative to domestic financing alternatives potentially discouraging international trade participation among price-sensitive businesses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)