Philippines Travel Insurance Market Size, Share, Trends and Forecast by Insurance Type, Coverage, Distribution Channel, End User, and Region, 2025-2033

Philippines Travel Insurance Market Overview:

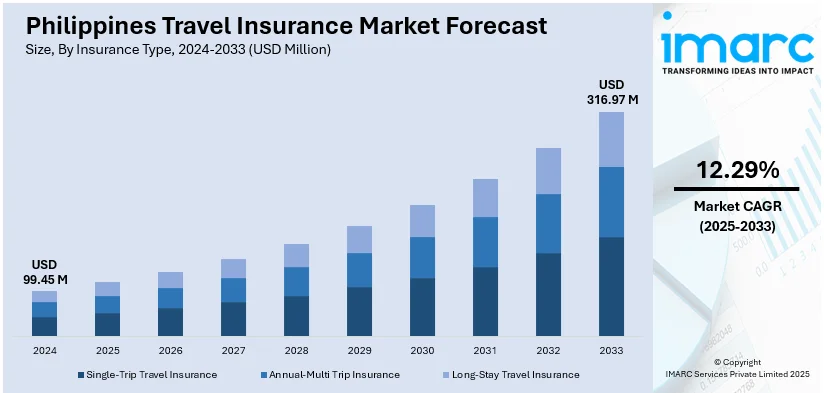

The Philippines travel insurance market size reached USD 99.45 Million in 2024. The market is projected to reach USD 316.97 Million by 2033, exhibiting a growth rate (CAGR) of 12.29% during 2025-2033. The market is fueled by the country's booming tourism sector, with the support of government efforts to bring in international tourists and boost local travel infrastructure. Furthermore, increasing knowledge among tourists regarding the need to protect themselves against medical crises financially, lost luggage, and cancellations of trips is substantially driving the demand for travel insurance. In addition, the increasing number of overseas Filipino workers and outbound leisure travelers, along with visa-based insurance mandates, is fueling the Philippines travel insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 99.45 Million |

| Market Forecast in 2033 | USD 316.97 Million |

| Market Growth Rate 2025-2033 | 12.29% |

Philippines Travel Insurance Market Trends:

Digital Transformation and Embedded Insurance

The market in the Philippines is undergoing a significant digital transformation, reshaping how policies are offered and purchased. Insurtech advancements have played a key role in enabling insurers to provide tech-driven solutions such as on-demand and personalized travel insurance. These solutions leverage artificial intelligence (AI) to assess customer needs based on individual data, allowing for more tailored coverage options. Moreover, online platforms, including mobile apps and websites, make it easier for consumers to purchase travel insurance, track claims, and receive real-time updates. For instance, in May 2025, Surely.Digital, PhilInsure, and Malayan Insurance jointly launched TravelSmart Marketplace, a digital platform designed to simplify access to reliable and visa-compliant travel insurance for Filipino travelers, including overseas Filipino workers and families. The initiative integrates Surely’s insurtech expertise, PhilInsure’s distribution capabilities, and Malayan Insurance’s underwriting strength to deliver a comprehensive solution. Another notable trend is the integration of insurance offerings directly into booking platforms, such as travel agencies and airline websites. This trend, known as embedded insurance, simplifies the process for customers by providing immediate access to coverage at the point of purchase, increasing overall policy uptake. These digital shifts have resulted in a more convenient and seamless experience for travelers, while also lowering operational costs for insurers.

To get more information on this market, Request Sample

Rise in Health and Medical Coverage

Since the onset of the COVID-19 pandemic, the demand for travel insurance with health and medical coverage in the Philippines has risen significantly. Travelers are increasingly seeking comprehensive policies that protect them from unexpected medical emergencies during their trips. This includes coverage for hospitalization, medical evacuations, and repatriation in the event of serious illness or injury. Policies are also being designed to address pandemic-related issues such as COVID-19 testing and quarantine costs. This heightened demand is largely driven by the concerns of Filipino expatriates, overseas workers, and tourists, who prioritize health security while traveling abroad. As a result, insurance providers are expanding their offerings to cover a broader range of medical risks, ensuring that travelers are adequately protected against potential health-related disruptions. This shift reflects the evolving needs of travelers who value peace of mind and comprehensive protection when planning their trips.

Expansion of Niche and Specialized Products

As the Philippines travel insurance market growth continues, insurers are increasingly offering specialized policies tailored to the unique needs of specific customer segments. This trend towards niche products is driven by the desire to offer more relevant and personalized coverage to a diverse range of travelers. For instance, policies are now available for adventure travelers who engage in high-risk activities such as hiking, scuba diving, or extreme sports, with coverage specifically designed to address the risks associated with these activities. Similarly, business travelers can now find policies that cover issues like trip cancellations, business interruption, and lost or delayed equipment. In addition, the growing medical tourism sector has led to the development of policies that cover pre-existing medical conditions and elective surgeries. By diversifying their product offerings, insurers are able to cater to the needs of various market segments, thereby attracting a wider customer base and enhancing the overall customer experience.

Philippines Travel Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on insurance type, coverage, distribution channel, and end user.

Insurance Type Insights:

- Single-Trip Travel Insurance

- Annual-Multi Trip Insurance

- Long-Stay Travel Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes single-trip travel insurance, annual-multi trip insurance, and long-stay travel insurance.

Coverage Insights:

- Medical Expenses

- Trip Cancellation

- Trip Delay

- Property Damage

- Others

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes medical expenses, trip cancellation, trip delay, property damage, and others.

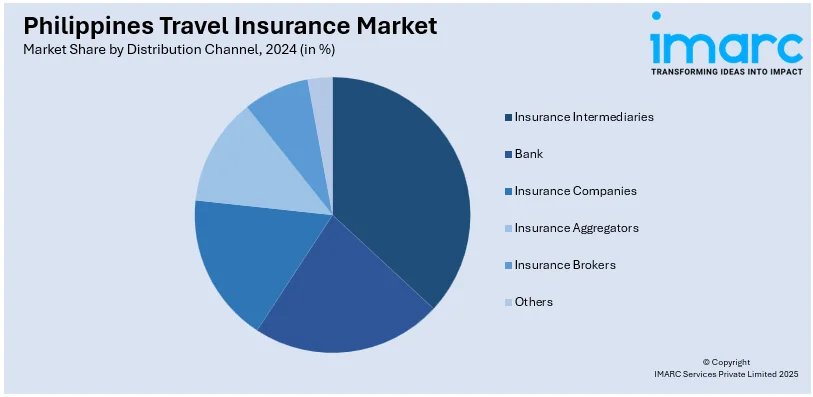

Distribution Channel Insights:

- Insurance Intermediaries

- Bank

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes insurance intermediaries, bank, insurance companies, insurance aggregators, insurance brokers, and others.

End User Insights:

- Senior Citizens

- Educational Travelers

- Business Travelers

- Family Travelers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes senior citizens, educational travelers, business travelers, family travelers, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Travel Insurance Market News:

- September 2024: Lockton Philippines launched “Safe To Go,” a travel insurance platform tailored for Filipino travelers to South Korea, aiming to simplify choice and enhance accessibility. The platform allows users to compare curated insurance options by price, trip duration, and age, purchase online with instant policy delivery, and includes emergency contact details. Lockton plans to expand provider partnerships and broaden coverage beyond Korea to other Asian countries, ensuring travelers can access suitable protection for diverse destinations.

Philippines Travel Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Single-Trip Travel Insurance, Annual-Multi Trip Insurance, Long-Stay Travel Insurance |

| Coverages Covered | Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Others |

| Distribution Channels Covered | Insurance Intermediaries, Bank, Insurance Companies, Insurance Aggregators, Insurance Brokers, Others |

| End Users Covered | Senior Citizens, Educational Travelers, Business Travelers, Family Travelers, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines travel insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines travel insurance market on the basis of insurance type?

- What is the breakup of the Philippines travel insurance market on the basis of coverage?

- What is the breakup of the Philippines travel insurance market on the basis of distribution channel?

- What is the breakup of the Philippines travel insurance market on the basis of end user?

- What is the breakup of the Philippines travel insurance market on the basis of region?

- What are the various stages in the value chain of the Philippines travel insurance market?

- What are the key driving factors and challenges in the Philippines travel insurance market?

- What is the structure of the Philippines travel insurance market and who are the key players?

- What is the degree of competition in the Philippines travel insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines travel insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines travel insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines travel insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)