Philippines Urea Market Size, Share, Trends and Forecast by Grade, Application, End-Use Industry, and Region, 2025-2033

Philippines Urea Market Overview:

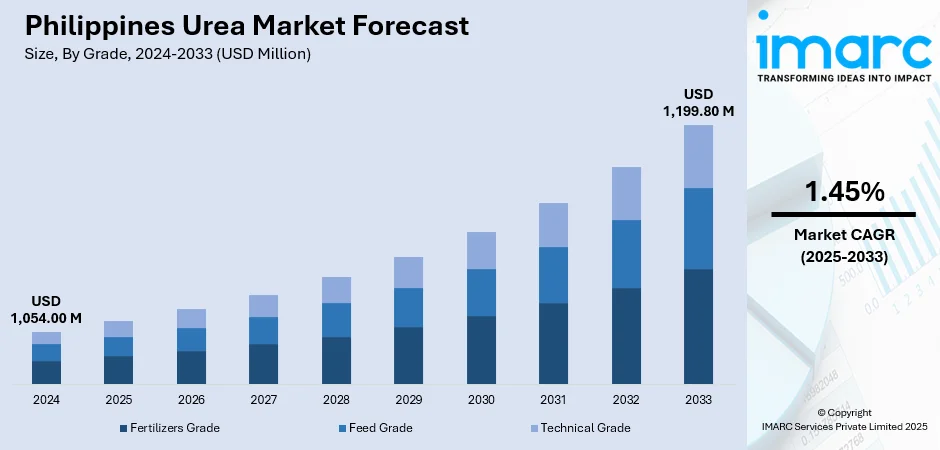

The Philippines urea market size reached USD 1,054.00 Million in 2024. Looking forward, the market is expected to reach USD 1,199.80 Million by 2033, exhibiting a growth rate (CAGR) of 1.45% during 2025-2033. The market is experiencing steady growth, driven by rising demand in agriculture as farmers seek efficient nitrogen-based fertilizers to improve crop productivity. Increasing applications in industrial sectors, coupled with government support for sustainable farming practices, further contributing to market expansion. Strong import dependency and evolving trade dynamics also influence supply patterns, shaping the competitive landscape of the Philippines urea market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,054.00 Million |

| Market Forecast in 2033 | USD 1,199.80 Million |

| Market Growth Rate 2025-2033 | 1.45% |

Philippines Urea Market Trends:

Agricultural Dependency and Food Security Needs

Agriculture is an important sector in the Philippines, where much of the country's population depends on agriculture for livelihood and food supply. Urea, as a major nitrogenous fertilizer, contributes to crop development and yield improvement of staple crops such as rice, corn, and sugarcane. Increased demand for food because of population increases is forcing farmers to use more efficient fertilizing systems to address consumption demands. In addition, government programs for enhancing agricultural production and farmer welfare schemes are nudging the application of urea to sustain soil fertility and develop an organic food supply. This increasing dependence on fertilizers positively influences the demand for urea throughout the country's agrarian economy.

To get more information on this market, Request Sample

Industrial Applications and Growing Diversification

Beyond agriculture, urea is increasingly being utilized in industrial applications, which is expanding its demand base in the Philippines. The adhesives, plastics, resins, and chemicals industries use urea as a raw material for production purposes. Its use in environmental products, such as diesel exhaust fluid (DEF) to curb vehicle emissions, is opening new growth prospects. With industrial growth and increasing environmental legislation, urea's function is being redirected away from the use of fertilizers into other diversified industrial applications. Such diversification not only adds stability to the market but also decreases dependence on agriculture. Domestic manufacturing growth, in addition to increased demand for cleaner industrial processes, is a strong motivator for the market.

Import Dependency and Trade Dynamics

The Philippines relies heavily on imports to meet its domestic urea demand, making global trade dynamics a crucial factor driving the Philippines urea market growth. Fluctuations in international prices, shipping costs, and supply chain efficiency directly affect local availability and pricing. Growing demand in agriculture and industries has intensified the need for consistent imports, encouraging both private and public players to strengthen trade partnerships with major exporting countries. Additionally, government policies aimed at ensuring affordable and reliable fertilizer access are influencing import strategies. While import dependency poses risks from global price volatility, it also drives market growth by integrating the Philippines into the international fertilizer trade network, ensuring that supply keeps pace with rising domestic consumption.

Philippines Urea Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on grade, application, and end-use industry.

Grade Insights:

- Fertilizers Grade

- Feed Grade

- Technical Grade

The report has provided a detailed breakup and analysis of the market based on the grade. This includes fertilizers grade, feed grade, and technical grade.

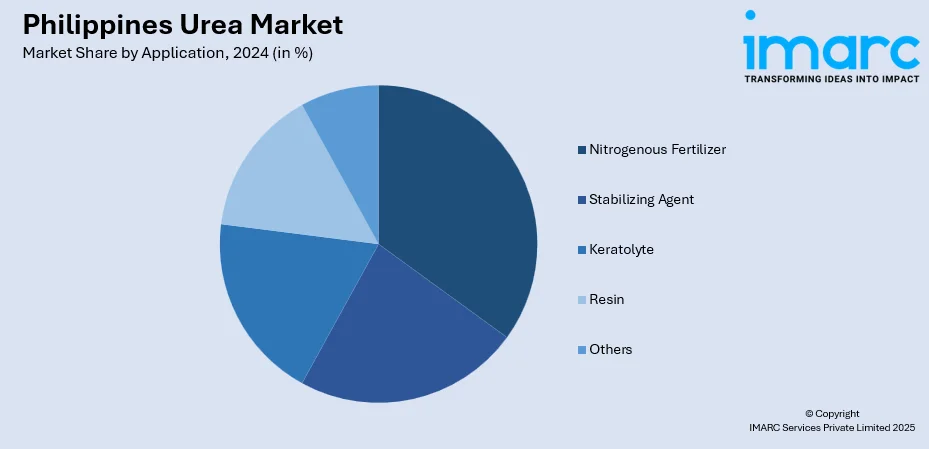

Application Insights:

- Nitrogenous Fertilizer

- Stabilizing Agent

- Keratolyte

- Resin

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes nitrogenous fertilizer, stabilizing agent, keratolyte, resin, and others.

End-Use Industry Insights:

- Agriculture

- Chemical

- Automotive

- Medical

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes agriculture, chemical, automotive, medical, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Urea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Fertilizers Grade, Feed Grade, Technical Grade |

| Applications Covered | Nitrogenous Fertilizer, Stabilizing Agent, Keratolyte, Resin, Others |

| End Use Industries Covered | Agriculture, Chemical, Automotive, Medical, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines urea market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines urea market on the basis of grade?

- What is the breakup of the Philippines urea market on the basis of application?

- What is the breakup of the Philippines urea market on the basis of end-use industry?

- What is the breakup of the Philippines urea market on the basis of region?

- What are the various stages in the value chain of the Philippines urea market?

- What are the key driving factors and challenges in the Philippines urea market?

- What is the structure of the Philippines urea market and who are the key players?

- What is the degree of competition in the Philippines urea market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines urea market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines urea market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines urea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)