Philippines Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2026-2034

Philippines Used Car Market Size and Share:

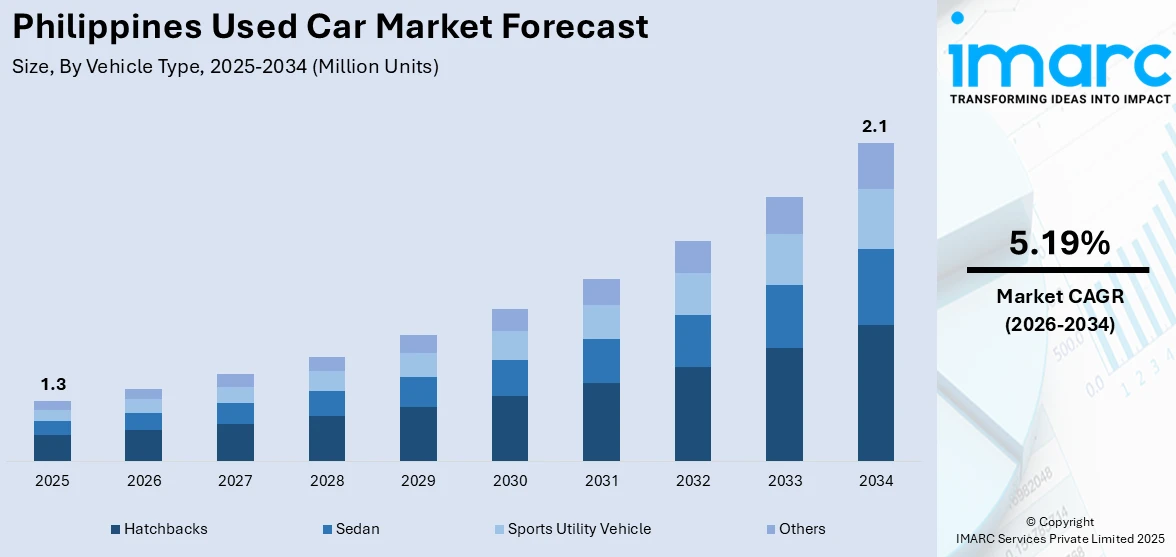

The Philippines used car market size reached 1.3 Million Units in 2025. Looking forward, the market is expected to reach 2.1 Million Units by 2034, exhibiting a growth rate (CAGR) of 5.19% during 2026-2034. The Philippines used car market share is expanding, driven by the increasing implementation of government policies that facilitate vehicle import and encourage domestic production of vehicles, leading to a consistent influx of used cars, along with the expansion of digital marketplaces that offer car condition reports and easy financing options, making the entire process smoother and more transparent.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 1.3 Million Units |

| Market Forecast in 2034 | 2.1 Million Units |

| Market Growth Rate (2026-2034) | 5.19% |

Key Trends of Philippines Used Car Market:

Increasing government support for automotive industry

The government’s support for the automotive industry is offering a favorable Philippines used car market outlook. In February 2025, the Department of Trade and Industry (DTI) unveiled a new incentive initiative, the Automotive Industry for Competitiveness Enhancement (RACE) program, aimed at enticing automotive firms to establish their manufacturing processes in the Philippines. The 2025 General Appropriations Act indicated that PHP250 Million was preliminarily allocated for the RACE program. Policies that ease the importation of vehicles and promote local manufacturing have resulted in a steady flow of cars into the market. This means that more cars, both new and used, are available for resale, giving users more options to choose from. The government agencies also have programs that encourage trade-ins, making it easier for people to upgrade to newer vehicles and make used cars more accessible to others. According to the Philippines used car market analysis, some initiatives aim to improve infrastructure, which in turn helps to drive the demand for cars, including used ones. As new cars become more affordable through government incentives or lowered taxes, it also leads to more cars circulating, which eventually results in a larger supply of quality used cars. With these measures, the government agencies not only make cars more accessible to a wider range of individuals but also ensure the continuous flow of used vehicles into the market, keeping it active and competitive.

To get more information of this market Request Sample

Expansion of online platforms

The expansion of online channels is impelling the Philippines used car market growth. More people are turning to the internet to buy and sell used cars because it offers convenience and a varied selection. E-commerce platforms have made it easier for buyers to browse through a variety of cars, compare prices, and find deals from both private sellers and dealers. This online shift reduces the hassle of physically visiting car lots and allows buyers to make informed decisions from the comfort of their homes. Moreover, digital marketplaces provide tools, such as car condition reports, financing options, and delivery services, which make the entire process smoother and more transparent. For sellers, these platforms provide greater exposure, allowing them to reach a wider audience across the country, which is boosting the Philippines used car market demand. With the broadening of e-commerce portals, people have become more confident in purchasing used cars online because they can easily check reviews, ratings, and certifications. As per industry reports, the e-commerce market in the Philippines is anticipated to expand consistently throughout the forecast period, achieving a CAGR of 11.38% from 2024 to 2028. The Gross Merchandise Value of e-commerce in the nation is expected to rise from USD 14.2 Billion in 2023 to USD 24.8 Billion by 2028.

Growth Drivers of Philippines Used Car Market:

Growing Middle-Class Population and Urbanization

The Philippines is recording a steady economic growth, and an increasing number of the middle-class population is demanding cheaper and more practical mobility solutions. Second-hand vehicles also offer an affordable option for new cars, particularly in cities where the demand for transportation is increasing. With increasing numbers of people migrating to urban centers to work or study, personal mobility will become crucial to the demand further. Also, younger consumers who are joining the workforce are first-time buyers interested in second-hand cars because of their financial limitations. Used cars are becoming more popular due to their affordable prices and better financing conditions. This demographic and economic shift continues to fuel consistent demand across cities and emerging metro areas, contributing to the expansion of the country’s used car ecosystem.

Rising Vehicle Ownership Aspirations and Accessibility

Car ownership in the Philippines is increasingly seen as a symbol of independence, convenience, and status—especially among younger consumers and growing families. While new cars may be out of reach for many, used cars offer an accessible entry point. With a wide range of models, brands, and price points available, buyers have more flexibility to find vehicles that suit their preferences and needs. The growing availability of affordable financing, low down-payment schemes, and flexible repayment options have further boosted the purchasing power of budget-conscious consumers. As aspirations rise and options become more attainable, used car sales are seeing steady growth, particularly in Tier 2 and Tier 3 cities, where public transportation may be limited or unreliable.

Enhanced Trust through Vehicle Inspection and Certification

Trust and transparency in the used car market have improved significantly with the rise of professional inspection and certification services. Many dealers and platforms now offer certified pre-owned vehicles that have passed rigorous quality checks, giving buyers greater confidence in the condition and value of their purchase. Detailed vehicle history reports, warranties, and after-sales support also reduce perceived risks associated with second-hand car purchases. These advancements help shift consumer perception of used cars from being uncertain purchases to trusted, value-for-money investments. As trust builds in the secondary market, more consumers are willing to make long-term commitments to pre-owned vehicles, driving market growth and encouraging repeat purchases within a more organized ecosystem.

Philippines Used Car Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on vehicle type, vendor type, fuel type, and sales channel.

Vehicle Type Insights:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle types. This includes hatchbacks, sedan, sports utility vehicle, and others.

Vendor Type Insights:

- Organized

- Unorganized

A detailed breakup and analysis of the market based on the vendor types have also been provided in the report. This includes organized and unorganized.

Fuel Type Insights:

- Gasoline

- Diesel

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel types. This includes gasoline, diesel, and others.

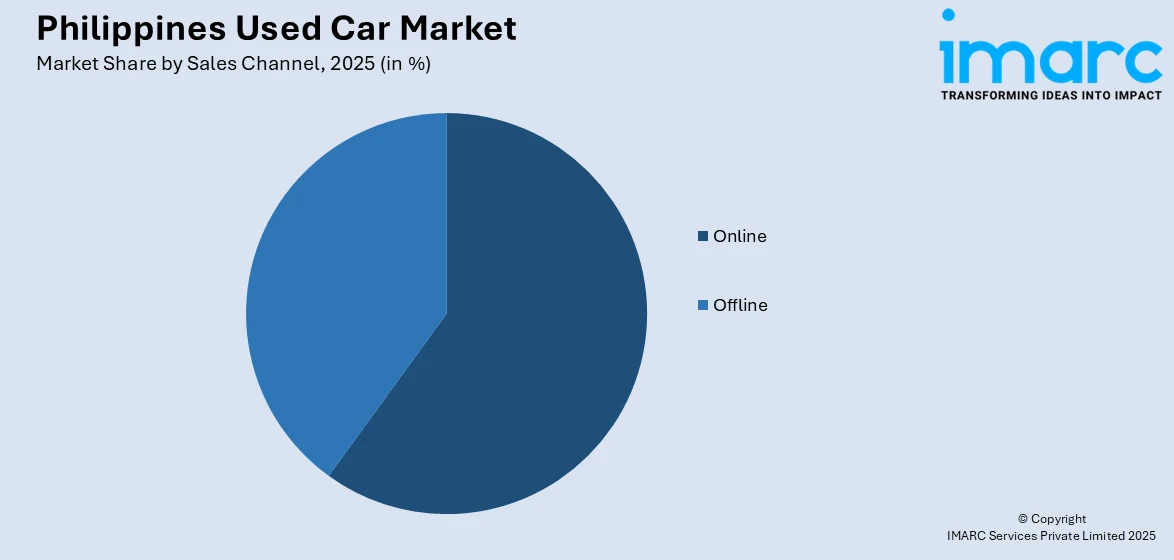

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the sales channels have also been provided in the report. This includes online and offline.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Automart.Ph

- Car Empire

- Carmax

- Carmudi

- Carousell

- LausGroup of Companies

- Philkotse.com

- Sirqo Group Inc.

- Toyota Motor Philippines Corporation

- Tsikot.com

- Zigwheels

Philippines Used Car Market News:

- In March 2025, Honda Cars Philippines Inc. (HCPI) officially launched the Honda Certified Plus Program. According to HCPI, the program applies to Honda vehicles that are up to 10 years old or have not exceeded 100,000 kilometers in mileage. Currently, this certification initiative is offered at six dealerships, including Honda Cars Makati, Honda Cars Alabang, and Honda Cars Quezon City.

- In December 2024, CarDekho SEA, an auto financing service platform based in Singapore, secured USD 60 Million in equity, giving the company a valuation exceeding USD 300 Million, from Dragon Fund and Navis Capital Partners. The Southeast Asia division of India’s CarDekho Group aimed to utilize the funding to enhance its growth in Southeast Asia, concentrating on the financing of used cars and bikes in Indonesia and the used vehicle financing market in the Philippines.

- In December 2024, WowCar, a high-quality services provider in economy cars, revealed its launch in the Philippines. WowCar sought to provide a smooth, clear, and trustworthy platform for every participant in the used car industry. WowCar aimed to introduce its distinct combination of cutting-edge features, inventive tools, and a focus on user experience, establishing a fresh benchmark in the nation’s used car market.

- In October 2024, Philippine-based fintech startup OneLot raised $4 million in a pre-seed funding round aimed at revolutionizing used car financing in the country. The round was spearheaded by 468 Capital, with additional backing from Kaya Founders, Crestone Venture Capital, 21yield, Founders Launchpad, and several angel investors.

Philippines Used Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Luzon, Visayas, Mindanao |

| Companies Covered | Automart.Ph, Car Empire, Carmax, Carmudi, Carousell, LausGroup of Companies, Philkotse.com, Sirqo Group Inc., Toyota Motor Philippines Corporation, Tsikot.com, Zigwheels, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines used car market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines used car market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The used car market in the Philippines size reached 1.3 Million Units in 2025.

The Philippines used car market is projected to exhibit a CAGR of 5.19% during 2026-2034.

The Philippines used car market is projected to reach a volume of 2.1 Million Units by 2034.

The Philippines used car market is seeing rising adoption of online auto marketplaces, growing demand for certified pre-owned and fuel-efficient vehicles, increased availability from shorter ownership cycles, and a shift toward hybrid and electric used models amid sustainability and affordability concerns.

The rising middle-class affordability, preference for budget-friendly mobility solutions, improved access to auto financing, favorable government trade-in and import policies, and increasing digital transparency and trust in vehicle history reports are accelerating the growth of the Philippines used car market nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)