Philippines Vaccine Market Size, Share, Trends and Forecast by Technology, Patient Type, Indication, Route Of Administration, Product Type, Treatment Type, End User, Distribution Channel, and Region, 2025-2033

Philippines Vaccine Market Overview:

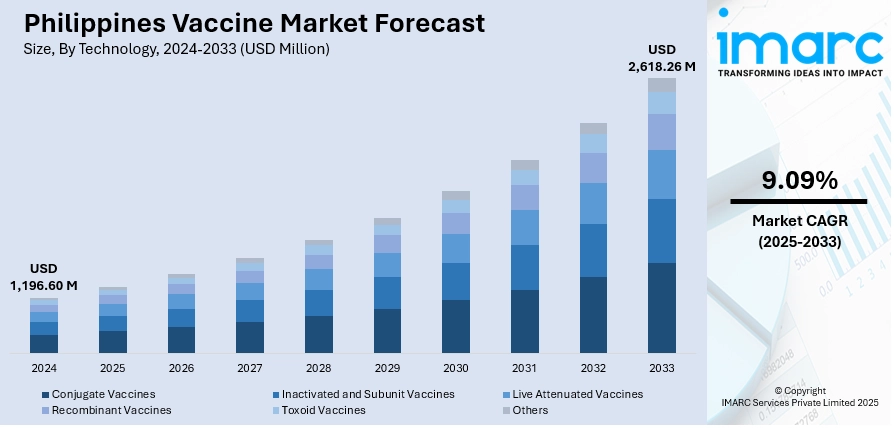

The Philippines vaccine market size reached USD 1,196.60 Million in 2024. Looking forward, the market is projected to reach USD 2,618.26 Million by 2033, exhibiting a growth rate (CAGR) of 9.09% during 2025-2033. The market is witnessing steady growth, driven by rising government immunization programs, increasing awareness about preventive healthcare, and expanding private healthcare initiatives. Demand is further supported by population growth, urbanization, and efforts to address both infectious and lifestyle-related diseases. Technological advancements, along with collaborations between public and private sectors, are also enhancing vaccine accessibility and distribution, thereby supporting the growing Philippines vaccine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,196.60 Million |

| Market Forecast in 2033 | USD 2,618.26 Million |

| Market Growth Rate 2025-2033 | 9.09% |

Philippines Vaccine Market Trends:

Growing Government Immunization Programs

Government-led immunization efforts are vital for enhancing vaccine access and improving public health in the Philippines. These programs aim to deliver essential vaccines to children, adolescents, and adults thereby lowering the incidence of preventable diseases. The Department of Health’s ongoing initiatives, such as nationwide vaccination drives and school-based immunization programs, are boosting coverage in both urban and rural regions. For instance, in October 2024, the Department of Education and the Department of Health launched the Bakuna Eskwela program to revive school-based immunizations for preventable diseases. Kicking off in Manila, the initiative aims to vaccinate 3.8 million students against measles, rubella, and HPV following a four-year hiatus due to the pandemic. By emphasizing vaccines for diseases such as measles, polio, and influenza, the government ensures that at-risk populations are safeguarded. Furthermore, targeted campaigns to address outbreaks through swift vaccination efforts demonstrate a commitment to sustaining high immunity levels within the community. This organized methodology, bolstered by awareness campaigns and better distribution systems, is laying a strong groundwork for broader vaccine acceptance. As a result, government initiatives are significantly accelerating Philippines vaccine market growth by promoting long-term demand and accessibility.

To get more information on this market, Request Sample

Preventive Healthcare Focus Driving Routine Vaccination Uptake

The Philippines is increasingly focusing on preventive healthcare, which is contributing to the rise in routine vaccination uptake. As awareness about the significance of disease prevention grows, families and individuals are opting for timely immunizations as a proactive strategy, rather than depending solely on treatment after falling ill. For instance, in November 2024, the Department of Health launched the “Bakuna BayaniJuan: Big Catch-up Immunization” campaign in the National Capital Region, aiming to vaccinate over 107,000 children aged 0 to 23 months against vaccine-preventable diseases The initiative addresses missed vaccinations and promotes accurate information about vaccine safety and efficacy. Health education campaigns, community outreach initiatives, and advocacy efforts from both government and private healthcare entities are emphasizing the long-term advantages of vaccination, including lower medical expenses and enhanced quality of life. This shift towards prevention is strengthening herd immunity and alleviating pressure on hospitals and clinics by decreasing instances of preventable diseases. As consumers become more conscious of their health, there is a steady increase in demand for vaccines targeting childhood illnesses, seasonal infections, and health risks related to lifestyle, reinforcing vaccination as a key component of the nation’s preventive healthcare approach.

Philippines Vaccine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, patient type, indication, route of administration, product type, treatment type, end user, and distribution channel.

Technology Insights:

- Conjugate Vaccines

- Inactivated and Subunit Vaccines

- Live Attenuated Vaccines

- Recombinant Vaccines

- Toxoid Vaccines

- Others

The report has provided a detailed breakup and analysis of the market based on technology. This includes conjugate vaccines, inactivated and subunit vaccines, live attenuated vaccines, recombinant vaccines, toxoid vaccines, and others.

Patient Type Insights:

- Paediatric

- Adult

A detailed breakup and analysis of the market based on the patient type have also been provided in the report. This includes paediatric and adult.

Indication Insights:

- Bacterial Diseases

- Meningococcal Disease

- Pneumococcal Disease

- Diphtheria/Tetanus/Pertussis (DPT)

- Tuberculosis

- Haemophilus Influenzae (Hib)

- Typhoid

- Others

- Viral Diseases

- Hepatitis

- Influenza

- Human Papillomavirus (HPV)

- Measles/Mumps/Rubella (MMR)

- Rotavirus

- Herpes Zoster

- Varicella

- Japanese Encephalitis

- Rubella

- Polio

- Rabies

- Dengue

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes bacterial diseases (meningococcal disease, pneumococcal disease, diphtheria/tetanus/pertussis (DPT), tuberculosis, haemophilus influenzae (Hib), typhoid, and others) and viral diseases (hepatitis, influenza, human papillomavirus (HPV), measles/mumps/rubella (MMR), rotavirus, herpes zoster, varicella, Japanese encephalitis, rubella, polio, rabies, dengue, and others).

Route of Administration Insights:

- Intramuscular and Subcutaneous Administration

- Oral Administration

- Others

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes intramuscular and subcutaneous administration, oral administration, and others.

Product Type Insights:

- Multivalent Vaccine

- Monovalent Vaccine

The report has provided a detailed breakup and analysis of the market based on the product type. This includes multivalent vaccine and monovalent vaccine.

Treatment Type Insights:

- Preventive Vaccine

- Therapeutic Vaccine

A detailed breakup and analysis of the market based on the treatment type have also been provided in the report. This includes preventive vaccine and therapeutic vaccine.

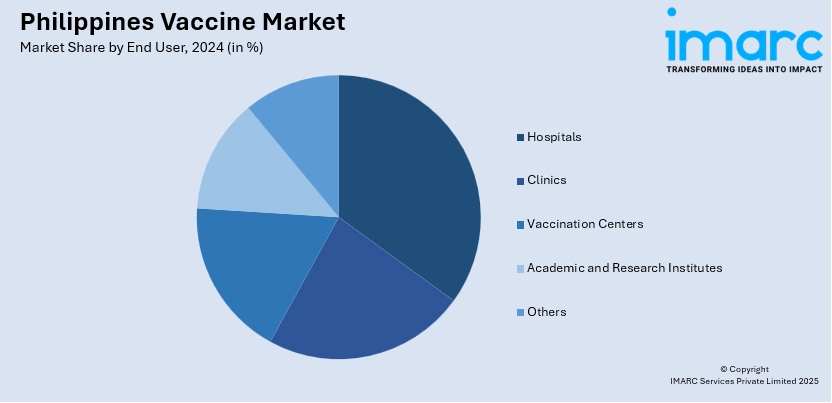

End User Insights:

- Hospitals

- Clinics

- Vaccination Centers

- Academic and Research Institutes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, clinics, vaccination centers, academic and research institutes, and others.

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Institutional Sales

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacies, retail pharmacies, institutional sales, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Vaccine Market News:

- In June 2025, the Philippines pledged USD 20,000 to the International Vaccine Institute (IVI). Ambassador Theresa Dizon-De Vega emphasized ongoing support for global vaccine development and health equity. Discussions included the Philippines' leadership in global health and engagement with IVI on future initiatives.

Philippines Vaccine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Conjugate Vaccines, Inactivated and Subunit Vaccines, Live Attenuated Vaccines, Recombinant Vaccines, Toxoid Vaccines, Others |

| Patient Types Covered | Paediatric, Adult |

| Indications Covered |

|

| Route of Administrations Covered | Intramuscular and Subcutaneous Administration, Oral Administration, Others |

| Product Types Covered | Multivalent Vaccine, Monovalent Vaccine |

| Treatment Types Covered | Preventive Vaccine, Therapeutic Vaccine |

| End Users Covered | Hospitals, Clinics, Vaccination Centers, Academic and Research Institutes, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Institutional Sales, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines vaccine market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines vaccine market on the basis of technology?

- What is the breakup of the Philippines vaccine market on the basis of patient type?

- What is the breakup of the Philippines vaccine market on the basis of indication?

- What is the breakup of the Philippines vaccine market on the basis of route of administration?

- What is the breakup of the Philippines vaccine market on the basis of product type?

- What is the breakup of the Philippines vaccine market on the basis of treatment type?

- What is the breakup of the Philippines vaccine market on the basis of end user?

- What is the breakup of the Philippines vaccine market on the basis of distribution channel?

- What is the breakup of the Philippines vaccine market on the basis of region?

- What are the various stages in the value chain of the Philippines vaccine market?

- What are the key driving factors and challenges in the Philippines vaccine market?

- What is the structure of the Philippines vaccine market and who are the key players?

- What is the degree of competition in the Philippines vaccine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines vaccine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines vaccine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines vaccine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)