Philippines Vape Market Size, Share, Trends and Forecast by Product Type, Component, Flavors, Distribution Channel, End User, and Region, 2026-2034

Philippines Vape Market Size and Share:

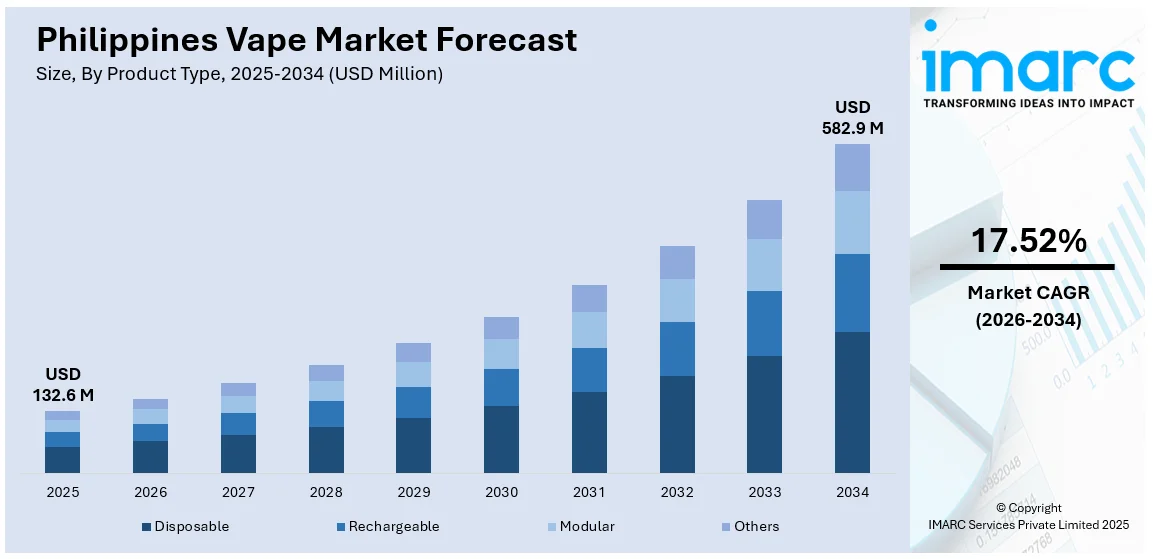

The Philippines vape market size reached USD 132.6 Million in 2025. Looking forward, the market is expected to reach USD 582.9 Million by 2034, exhibiting a growth rate (CAGR) of 17.52% during 2026-2034. The increasing acceptance of vaping as a smoking alternative, ongoing technological advancements, rising health awareness, continuous innovation in flavor variety, aggressive marketing strategies, regulatory changes, e-commerce expansion, and growing social trends among young adults are some of the key factors strengthening the Philippines vape market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 132.6 Million |

| Market Forecast in 2034 | USD 582.9 Million |

| Market Growth Rate 2026-2034 | 17.52% |

Key Trends of Philippines Vape Market:

Rise of nicotine salt formulations

Nicotine salts, derived from the natural state of nicotine found in tobacco leaves, allow for a smoother and more efficient delivery of nicotine compared to traditional freebase nicotine. This formulation enables higher nicotine concentrations without the harsh throat hit, making it appealing to smokers seeking a similar sensation to combustible cigarettes. The development and popularity of nicotine salt e-liquids have attracted many smokers looking to transition to vaping, as these products provide a more satisfying nicotine intake and mimic the experience of smoking more closely. This trend, supported by manufacturers continuously innovating and expanding their range of nicotine salt e-liquids, thereby catering to various flavor preferences and nicotine strengths, is fueling the Philippines vape market demand.

To get more information on this market Request Sample

The increasing popularity of pod systems

Pod systems are compact, user-friendly devices that utilize pre-filled or refillable pods containing e-liquid. Their ease of use, portability, and discrete design make them attractive to both new vapers and experienced users looking for a convenient alternative to traditional vape devices. Pod systems often employ nicotine salts, enhancing their appeal by providing a satisfying and efficient nicotine delivery. The rise of pod systems has also been driven by their sleek, modern aesthetics and the ability to offer a wide range of flavors in easily interchangeable pods. For instance, in July 2022, ZOVOO introduced the '1st Disposable Pod Mod' - DRAGBAR R6000. The global broadcast of ZOVOO's 2022 product launch unveiled revolutionary advancements in electronic atomization, captivating audiences worldwide and thereby creating a positive Philippines vape market outlook.

Growing emphasis on harm reduction and smoking cessation

According to the Philippines vape market analysis, public health organizations and governments in many regions recognize vaping as a less harmful alternative to smoking, thus driving its acceptance and adoption. This is reflected in the actions taken by the Philippines, where the Department of Health (DOH) acknowledges the severe impact of tobacco-related diseases, which claim 87,600 Filipino lives annually and incur significant healthcare costs. Moreover, according to the Harm Reduction Alliance of the Philippines (HARAP), e-cigarettes are less harmful than traditional cigarettes, producing fewer toxic substances like lead and cadmium. This aligns with global trends where vaping products are marketed as tools for smoking cessation, supported by research indicating fewer health risks compared to smoking. Moreover, strict regulations ensuring minors cannot access these products, and the prohibition on high-nicotine vape sales are further supporting the transition from smoking to vaping, thus impelling market growth.

Growth Drivers of Philippines Vape Market:

Shift in Perception Toward Harm Reduction and Alternatives to Smoking

One of the major impellers that have driven the expansion of the Philippine vape market is the growing perception that vaping is a healthier, less harmful alternative to cigarette smoking. Filipino cigarette smokers have, in large numbers, resorted to e-cigarettes as a perceived step-down solution for decreasing or ending tobacco use altogether. This change is particularly evident in major cities such as Manila, Cebu, and Davao, where exposure to health campaign messages and internet forums has popularized harm reduction as a concept. Moreover, vaping is perceived by most as cleaner and more respectable than smoking, particularly in communal areas. The lesser odor, flavored versions, and adjustable level of nicotine are disrupting younger adult users to switch over. As more individuals value wellness while looking for alternatives to bad habits, vaping is becoming the middle ground between full abstinence and persistent smoking, driving market growth across various demographics and geographies in the nation.

Technological Innovation and Product Variety

Technological innovation in vape products and product variety has played an important role in the growing vape market in the Philippines. From high-tech mods that contain intelligent features to slim, pocket-sized pod systems, the market has responded rapidly to evolving consumer demands. Filipino consumers have been especially interested in miniaturized, user-friendly devices that provide potent nicotine output without the discomfiting harshness of conventional smoke. Concurrently, the domestic market has nurtured a dynamic flavor community for e-liquids, with numerous Philippine domestic brands providing exotic tropical and dessert flavors that suit local preferences. Such innovation in taste has enabled vaping to gain a strong lifestyle following, as opposed to merely being a smoking substitute. Increased interest in hobby vaping and social groups has also encouraged custom builds and performance vaping, which further broadened consumer appeal. As technology advances and diversity widens, the popularity of vaping keeps on rising, extending to wider groups across geographies and income segments.

Regulatory Environment and E‑Commerce Expansion

The Philippines' regulatory environment has been a significant factor in facilitating the expansion of the vape industry. New legislation has clarified the legal status of vape products, establishing a more organized framework for sales and promotion. This regulatory change, intended to ensure product quality and safety, made vaping more convenient for adult consumers as well. At the same time, the emergence of e-commerce has revolutionized the way vape products are delivered nationwide. Online stores now function as a key source of buying devices and e-liquids, especially where local vape stores are scarce. The convenience of home delivery, coupled with extensive product choices and online discounts, has also made online purchases the most popular method among many Filipino vapers. This digital openness, combined with a legal system that facilitates legal distribution, has enabled the industry to grow into new markets and consumer segments across the Philippines.

Philippines Vape Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, component, flavors, distribution channel, and end user.

Product Type Insights:

- Disposable

- Rechargeable

- Modular

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes disposable, rechargeable, modular, and others.

Component Insights:

- Atomizer

- Vape Mod

- Cartomizer

- E-Liquid

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes atomizer, vape mod, cartomizer, e-liquid, and others.

Flavors Insights:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

A detailed breakup and analysis of the market based on the flavors have also been provided in the report. This includes tobacco, botanical, fruit, sweet, beverage, and others.

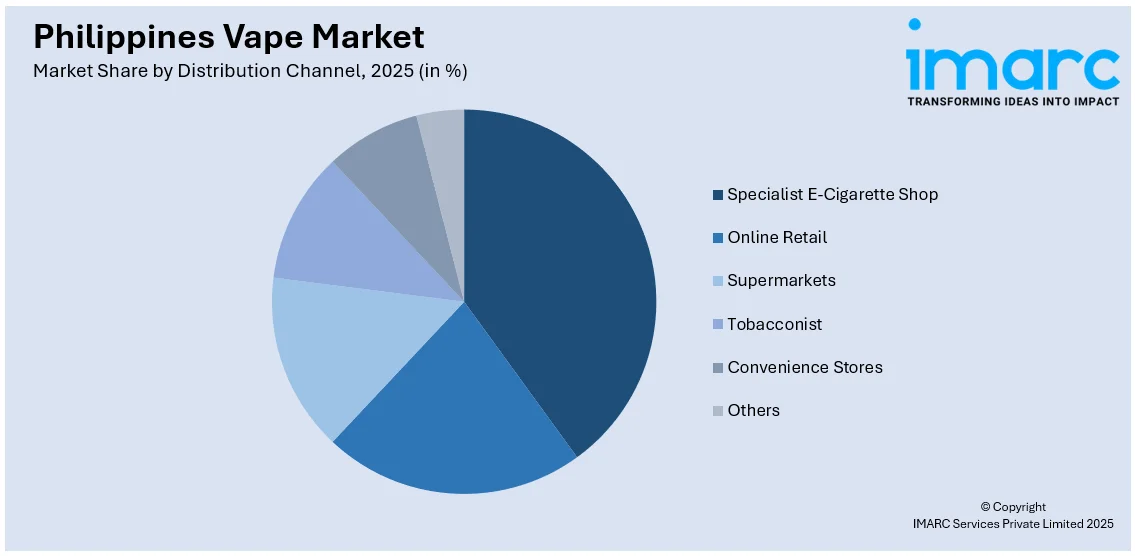

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialist E-Cigarette Shop

- Online Retail

- Supermarkets

- Tobacconist

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialist e-cigarette shop, online retail, supermarkets, tobacconist, convenience stores, and others.

End User Insights:

- Men

- Women

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Vape Market News:

- In November 2023, Voopoo launched the DRAG S2 and DRAG X2 devices, both equipped with the innovative PnP X platform. VOOPOO's PnP X atomization technology makes its debut with these POD MOD devices, guaranteeing great performance in a compact size. With this technology, users can enjoy up to 100 mL of e-liquid without compromising on flavor or risking coil burnout, promising a consistently satisfying vaping experience.

- In October 2023, Voopoo introduced the ARGUS P1s, a groundbreaking vaping device set to redefine the industry. The ARGUS P1s redefines the standard for consumers seeking improved performance and convenience with its unique combination of features, which includes quick charging and an unmatched flavor experience owing to iCOSM CODE technology.

Philippines Vape Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Disposable, Rechargeable, Modular, Others |

| Components Covered | Atomizer, Vape Mod, Cartomizer, E-Liquid, Others |

| Flavors Covered | Tobacco, Botanical, Fruit, Sweet, Beverage, Others |

| Distribution Channels Covered | Specialist E-Cigarette Shop, Online Retail, Supermarkets, Tobacconist, Convenience Stores, Others |

| End Users Covered | Men, Women, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines vape market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines vape market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines vape industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines vape market was valued at USD 132.6 Million in 2025.

The Philippines vape market is projected to exhibit a CAGR of 17.52% during 2026-2034.

The Philippines vape market is expected to reach a value of USD 582.9 Million by 2034.

Growing demand for nicotine replacement, changing consumer tastes in favor of flavored e-liquids, and increasing vape retailing networks propel the market in the Philippines. Awareness about harm reduction, competitive promotion of local and global brands, rising urban populace, and peer pressure further fuel consumption.

The Philippines vape market is evolving rapidly due to shifting consumer preferences, increasing acceptance of harm-reduction products, and technological innovations like pod systems. Growth is fueled by flavored e-liquid popularity, expanding retail networks, aggressive brand marketing, and peer influence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)