Philippines Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel and Region, 2025-2033

Philippines Vegan Cosmetics Market Overview:

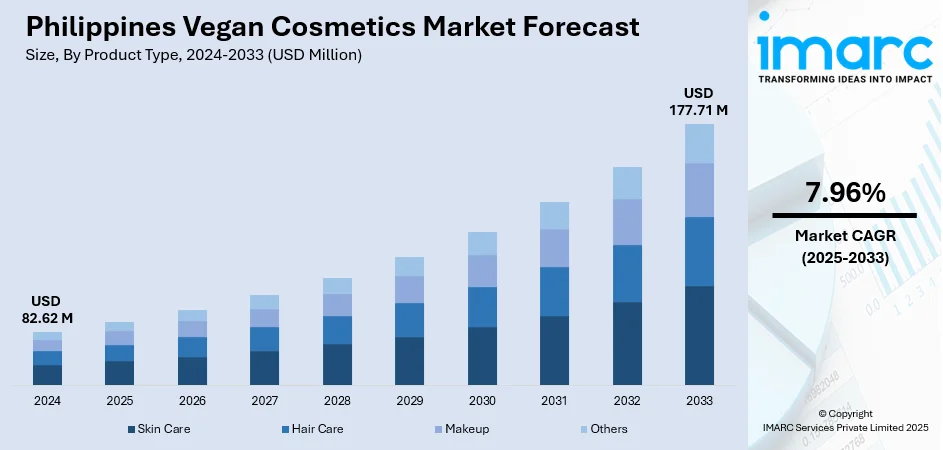

The Philippines vegan cosmetics market size reached USD 82.62 Million in 2024. Looking forward, the market is expected to reach USD 177.71 Million by 2033, exhibiting a growth rate (CAGR) of 7.96% during 2025-2033. The market is fueled by increasing concern for health and environmental gains, leading consumers to look for cruelty‑free, plant‑based options. Social media and celebrity endorsements create heightened visibility for local and foreign vegan brands. Young Filipino urban consumers are attracted to sustainable packaging and open ingredient sourcing. Homegrown brands with refillable, eco‑friendly variants gain popularity in major metropolitans such as Manila and Cebu, further complementing the Philippines vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 82.62 Million |

| Market Forecast in 2033 | USD 177.71 Million |

| Market Growth Rate 2025-2033 | 7.96% |

Philippines Vegan Cosmetics Market Trends:

Emergence of Local Botanical Ingredients and Indigenous Beauty Routines

In the Philippines, the market for vegan cosmetics is increasingly tapping into rich local botanical traditions and indigenous beauty routines. Filipino companies are innovating by using indigenous plant extracts like calamansi, coconut, aloe vera, and turmeric to create vegan products that are true to ancient skincare knowledge. These ingredients strike a chord with consumers because they are perceived as local and culturally attuned. Brands are putting these botanical remedies into clean, cruelty-free containers, like plant-based moisturizers, lightweight serums, and herbal-infused toners, that resonate with Filipino consumers who want ethical beauty without compromising familiarity. The application of coconut oil, a widely accepted staple in Filipino households, as a vegan base for lip balms and hair masks has become particularly trendy. This combination of local ingredients and contemporary vegan standards places vegan cosmetics at once sustainable and locally rooted, inviting pride and confidence in Filipino consumers who seek to have cosmetics that are ethically produced and deeply Filipino. For example, Rosalina Tan, a trailblazer in the organic farming sector of the Philippines, is the proud founder and owner of the beauty and wellness label "Pili Ani." For Rosalina, “Pili Ani” represents much more than a mere brand; through her enterprise, she effectively advocates for the sustainable growth and harvesting of the Pili Tree, aiding in the preservation of a crucial element of the Philippines’ floral legacy.

To get more information on this market, Request Sample

Influence of Social Media and Youth-Led Clean Beauty Adoptions

Young and digitally active Filipino consumers are leading the charge in vegan beauty trends via social media, reviews from influencers, and word of mouth. Platforms such as Instagram, TikTok, and Facebook are hubs for local beauty vloggers and micro-influencers to stage vegan skincare routines and makeup tutorials with plant-based Philippine-made brands. These visuals highlight ingredient transparency, cruelty-free logos, and sustainable packaging in creating aspirational but accessible narratives. Young urban professionals in Metro Manila and Cebu, for instance, are embracing priorities on minimalism, ethical sourcing, and value-driven consumption. They are attracted to vegan formulations with the promise of gentle, nourishing benefits from non-harsh chemicals, particularly in humid climatic conditions. Social media chatter creates a clean beauty community where people exchange information on vegan substitutes and promote local vegan cosmetics to wider audiences as part of eco-friendly lifestyle. This online drive is propelling vegan products from niche to mainstream, with peer-to-peer trust serving as a powerful Philippines vegan cosmetics market growth catalyst.

Niche Positioning and Retail Evolution in Natural Beauty Channels

Consumer trends in the Philippines are increasingly tilting toward clean, vegan makeup online and offline, especially in niche wellness and beauty stores. City hubs are experiencing the growth of edited stores and spa-beauty shops that highlight plant-based, cruelty-free, and chemical-free makeup. These shops sell products bearing halal and vegan tags next to each other, appealing to both ethical and religious consumers. Online shopping sites are also catching up with special vegan beauty collections of Philippine brands that focus on sustainable sourcing and recyclable packaging. Pop‑up happenings and beauty fairs in Manila and Davao now regularly feature vegan beauty areas with local entrepreneurs who emphasize traceability and environmentally friendly practices. The market for special-purpose vegan products, such as deodorants, foundation cushions, and hydrating mists appropriate for tropical climates, has created niche product segments relevant to the Philippine climate. This developing retail landscape, marrying online convenience with offline experiential marketing, is making vegan cosmetics a differentiated and expanding niche in the larger beauty space.

Philippines Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

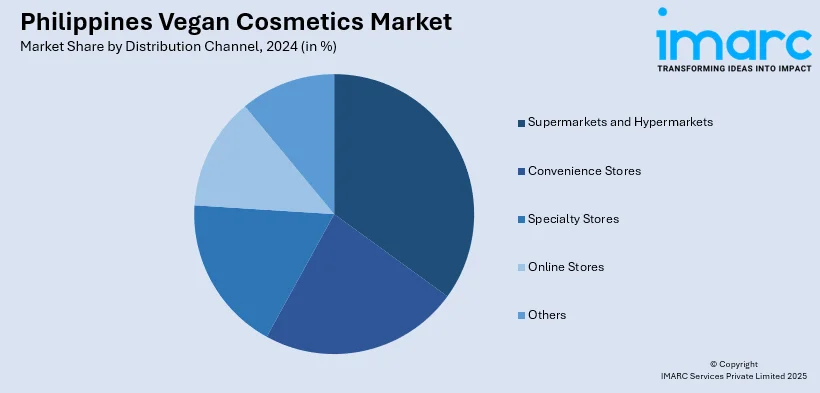

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines vegan cosmetics market on the basis of product type?

- What is the breakup of the Philippines vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Philippines vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Philippines vegan cosmetics market?

- What are the key driving factors and challenges in the Philippines vegan cosmetics market?

- What is the structure of the Philippines vegan cosmetics market and who are the key players?

- What is the degree of competition in the Philippines vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)