Philippines Vending Machine Market Size, Share, Trends and Forecast by Type, Technology, Payment Mode, Application, and Region, 2026-2034

Philippines Vending Machine Market Summary:

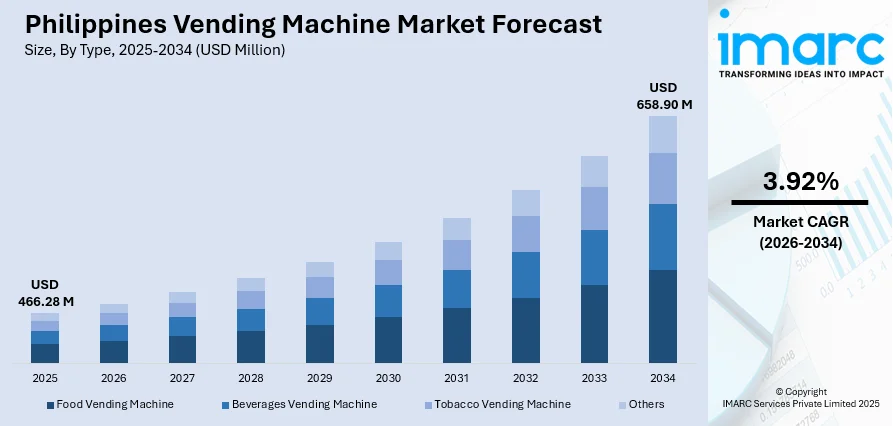

The Philippines vending machine market size was valued at USD 466.28 Million in 2025 and is projected to reach USD 658.90 Million by 2034, growing at a compound annual growth rate of 3.92% from 2026-2034.

The market is driven by rapid urbanization, growing consumer preference for convenience-oriented retail solutions, and the expanding adoption of cashless payment technologies across the archipelago. Rising disposable incomes among the urban middle class and the proliferation of digital wallet platforms continue to fuel demand for automated retail solutions. Strategic placement of vending machines in high-traffic commercial centers and transportation hubs supports sustainable growth, strengthening the Philippines vending machine market share.

Key Takeaways and Insights:

-

By Type: Food vending machine dominates the market with a share of 39.4% in 2025, driven by strong Filipino snacking habits, busy urban lifestyles, and strategic placement in offices, schools, and other high-traffic areas.

-

By Technology: Automatic machine leads the market with a share of 50% in 2025, owing to operational efficiency, minimal labor needs, and round-the-clock service, fulfilling the growing demand for instant access to products without human intervention.

-

By Payment Mode: Cashless represents the largest segment with a market share of 53% in 2025, driven by the popularity of digital wallets like GCash and Maya, government cashless initiatives, and adoption among tech-savvy, young Filipino consumers.

-

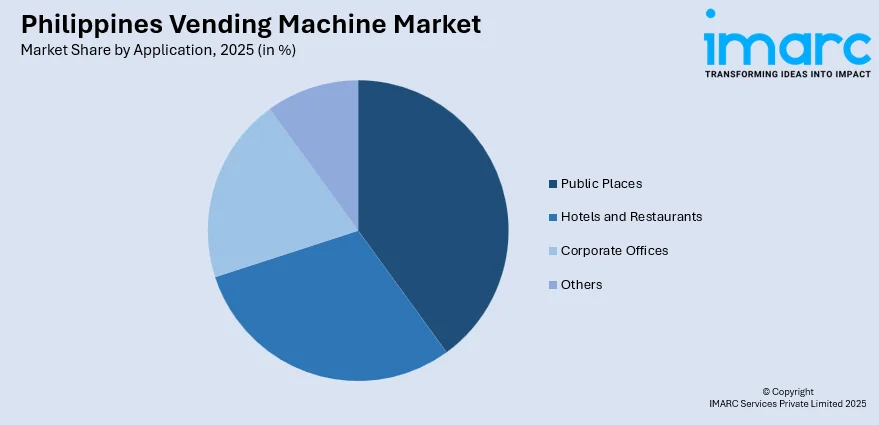

By Application: Public places dominate the market with a share of 34% in 2025, owing to high foot traffic at transportation hubs, malls, and recreational areas, ensuring maximum product visibility and consumer accessibility.

-

By Region: Luzon leads the market with a share of 49% in 2025, driven by major metropolitan centers like Metro Manila, advanced infrastructure, high urbanization, and concentration of commercial establishments and transport hubs.

-

Key Players: The Philippines vending machine market exhibits moderate to highly competitive dynamics, with international automated retail corporations competing alongside regional distributors and local operators across diverse product and technology segments. Strategic partnerships and technology investments define the competitive positioning.

To get more information on this market Request Sample

The Philippines vending machine market is driven by a combination of socioeconomic trends, technological advancements, and evolving consumer behaviour reshaping retail across the archipelago. Rapid urbanization continues to influence lifestyle patterns, as metropolitan populations increasingly seek convenient and accessible retail options that align with fast-paced daily routines. The widespread adoption of digital payment systems, fueled by fintech innovations and government initiatives promoting cashless transactions, has lowered barriers to vending machine utilization. Moreover, the young, tech-savvy population exhibits a strong preference for automated, contactless retail experiences, reinforcing demand for these solutions. As per sources, in 2025, Bandai Namco Philippines Inc. accounted for over 80 to 90% of global Gashapon Station capsule vending machine production, supporting Manila’s rapid expansion of Japanese capsule vending installations. Moreover, businesses are also recognizing the operational efficiencies, reduced labor requirements, and cost-effectiveness offered by vending technologies, prompting increased commercial investment and strategic deployment in high-traffic locations such as offices, educational institutions, transportation hubs, and shopping centers.

Philippines Vending Machine Market Trends:

Integration of Smart Technology and Artificial Intelligence

The Philippines vending machine market is witnessing significant transformation through the integration of intelligent (AI) technologies that enhance operational efficiency and consumer experience. Modern vending units increasingly incorporate touchscreen interfaces, real-time inventory monitoring systems, and predictive analytics capabilities that optimize stock management and reduce product waste. These technological advancements enable operators to analyze purchasing patterns, customize product offerings based on location-specific demand, and implement dynamic pricing strategies. The adoption of remote monitoring capabilities allows centralized management of distributed vending networks, reducing maintenance costs and ensuring consistent product availability. According to sources, eTap Solutions operated 4,000+ self-service kiosks nationwide, serving over 12 Million users, and announced cash-out machine launches and new regional hubs in 2026.

Expansion of Healthier and Premium Product Offerings

Consumer preferences in the Philippines are shifting toward healthier alternatives and premium product options, prompting vending machine operators to diversify their merchandise portfolios. Health-conscious Filipino consumers increasingly seek nutritious snacks, organic beverages, and fresh food options from automated retail channels. This trend has encouraged operators to incorporate refrigerated units capable of dispensing salads, yogurt, fresh juices, and protein-rich snacks alongside traditional confectionery items. Premium coffee vending machines offering specialty beverages are gaining popularity in corporate environments and commercial centers, catering to sophisticated consumer tastes and willingness to pay for quality convenience.

Emergence of Multi-Purpose Vending Solutions

The Philippine market is experiencing growing interest in multi-functional vending kiosks that transcend traditional product dispensing to offer diverse services. These innovative installations combine conventional vending capabilities with supplementary functions including mobile phone credit loading, transportation card recharging, bill payment processing, and even parcel pickup services for e-commerce purchases. As per sources, in 2024, ECPay deployed over 70 self-service kiosks across Pampanga, providing cashless payments, bill processing, and mobile top-ups, demonstrating the rise of multifunctional vending solutions in the Philippines. Further, this convergence transforms vending machines into versatile micro-retail hubs that address multiple consumer needs within single transactions. Operators are strategically positioning these multipurpose units in transit stations, residential complexes, and commercial districts to maximize consumer engagement and revenue generation per installation.

Market Outlook 2026-2034:

The Philippines vending machine market revenue is projected to experience sustained growth throughout the forecast period, driven by continuous urbanization, digital payment ecosystem expansion, and evolving consumer lifestyle patterns. Revenue generation will be supported by strategic infrastructure investments in commercial developments, transportation networks, and mixed-use facilities that create optimal placement opportunities. The increasing penetration of smart vending technologies and diversification of product offerings beyond traditional categories will unlock additional revenue streams. The market generated a revenue of USD 466.28 Million in 2025 and is projected to reach a revenue of USD 658.90 Million by 2034, growing at a compound annual growth rate of 3.92% from 2026-2034.

Philippines Vending Machine Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Food Vending Machine |

39.4% |

|

Technology |

Automatic Machine |

50% |

|

Payment Mode |

Cashless |

53% |

|

Application |

Public Places |

34% |

|

Region |

Luzon |

49% |

Type Insights:

- Food Vending Machine

- Beverages Vending Machine

- Tobacco Vending Machine

- Others

Food vending machine dominates with a market share of 39.4% of the total Philippines vending machine market in 2025.

The food vending machine maintains its leading position within the Philippine market, reflecting strong cultural affinity for snacking and demand for quick meal solutions among urban consumers. Furthermore, these machines are strategically positioned in locations with high concentrations of professionals and students, including office buildings, educational institutions, and transportation terminals where time constraints drive preference for immediate food access. The segment benefits significantly from Filipino dining culture that embraces frequent small meals throughout the day.

Operators continue expanding the food vending offerings to include locally preferred items alongside international snack brands, ensuring product resonance with regional taste preferences across the archipelago. The integration of temperature-controlled compartments enables dispensing of both ambient and chilled food products, broadening consumer appeal considerably. Ongoing investment in food safety technologies and freshness monitoring systems reinforces consumer confidence in vended food items, supporting sustained segment growth across diverse geographic markets nationwide.

Technology Insights:

- Automatic Machine

- Semi-Automatic Machine

- Smart Machine

Automatic machine leads with a share of 50% of the total Philippines vending machine market in 2025.

Automatic machines dominate the technology segment, offering reliable unattended operation that meets continuous service demands of modern retail environments across the Philippines. These systems deliver consistent product dispensing through mechanical precision, requiring minimal human intervention while maintaining operational uptime across extended periods. The technology appeals strongly to operators seeking cost-effective solutions that balance functionality with manageable capital investment requirements for sustainable business operations throughout diverse commercial locations.

The prevalence of the automatic machines reflects their proven track record in diverse installation environments, from climate-controlled indoor spaces to semi-outdoor locations requiring robust construction standards. As per sources, in August 2025, Coca-Cola Europacific Aboitiz Philippines launched new Refresh Stations at five LRT-1 stations, providing automated beverage vending and supporting local micro-retailers in high-traffic commuter hubs. Moreover, the manufacturers continue enhancing automatic machine capabilities through improved vending mechanisms, energy-efficient components, and modular designs accommodating various product categories effectively. The segment maintains strong growth momentum as operators expand installation networks across emerging commercial developments and expanding transportation infrastructure throughout Philippine urban centers.

Payment Mode Insights:

- Cash

- Cashless

Cashless exhibits a clear dominance with a 53% share of the total Philippines vending machine market in 2025.

Cashless has emerged as the dominant transaction method within the Philippine vending machine ecosystem, driven by widespread digital wallet adoption and government initiatives promoting electronic payments nationwide. The proliferation of platforms like GCash and Maya has created payment infrastructure perfectly suited for vending machine transactions, particularly among younger demographics comfortable with smartphone-based purchasing experiences. This significant shift reduces cash handling complexities for operators while substantially enhancing overall transaction security measures.

The cashless benefits from the continuous expansion of contactless payment acceptance points across commercial establishments, normalizing digital transactions in everyday consumer behavior patterns. According to sources, in 2025, up to 180 local government units nationwide adopted the PalengQR Ph cashless payment program, expanding QRbased digital transactions in markets, transport, and small businesses. Further, the QR code payment capabilities enable rapid integration with existing vending infrastructure, lowering technological barriers for operators transitioning from traditional cash-only systems effectively. The segment growth trajectory aligns with national financial inclusion objectives and broader economic shift toward digital transaction processing throughout Philippine commerce and retail sectors.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Hotels and Restaurants

- Corporate Offices

- Public Places

- Others

Public places lead with a market share of 34% of the total Philippines vending machine market in 2025.

Public places represent as the leading application segment, capitalizing on high pedestrian traffic in transportation hubs, shopping centers, parks, and recreational facilities throughout the Philippines. As per sources, LRMC partnered with Snacks To-Go by Rebisco to install vending machines at LRT1 Carriedo and Yamaha Monumento stations, offering commuters to-go snacks via cash or GCash. Moreover, these strategic locations provide the maximum consumer visibility and accessibility, generating consistent transaction volumes from diverse demographic groups across various age categories. The segment benefits considerably from extended operating hours in public venues where traditional retail options may have limited the availability during off-peak periods.

The strategic positioning within public spaces enables operators to serve impulse purchase occasions while providing essential convenience to commuters and visitors throughout daily activities. Infrastructure development projects expanding transportation networks and commercial complexes continuously create new placement opportunities within this growing segment. Municipal authorities increasingly recognize vending machines as complementary amenities that enhance public space functionality without requiring dedicated retail infrastructure investment or significant ongoing maintenance commitments from government bodies.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates with a market share of 49% of the total Philippines vending machine market in 2025.

Luzon maintains leading regional market position, anchored by Metro Manila's status as the national economic center with its substantial concentration of commercial, educational, and transportation infrastructure assets throughout the metropolitan area. The region's advanced urbanization, superior connectivity networks, and higher average income levels create favorable conditions for vending machine deployment and sustained utilization rates. Major commercial districts, business process outsourcing hubs, and prominent educational institutions provide diverse and highly profitable installation opportunities for vending operators.

Beyond Metro Manila, emerging urban centers throughout Luzon present significant expansion opportunities as economic development disperses progressively toward secondary cities and provincial capitals across the island. The region's extensive transportation infrastructure, including major airports, seaports, and intercity bus terminals, generates consistent demand for convenient automated retail solutions among commuters and travelers daily. Continued investment in commercial real estate projects and mixed-use developments ensures sustained growth in viable installation locations throughout the broader Luzon market region.

Market Dynamics:

Growth Drivers:

Why is the Philippines Vending Machine Market Growing?

Accelerating Urbanization and Changing Consumer Lifestyles

The Philippines is experiencing significant urbanization trends, with growing populations concentrating in metropolitan areas where fast-paced lifestyles create strong demand for convenient retail solutions. Urban consumers increasingly prioritize time efficiency, seeking immediate access to products without queuing at traditional retail outlets. The proliferation of commercial developments, including office towers, shopping complexes, and residential condominiums, generates abundant high-traffic locations suitable for vending machine installations. This urban transformation fundamentally reshapes consumer purchasing behavior, favoring automated retail channels that accommodate busy schedules and provide reliable product availability throughout extended operating hours.

Digital Payment Ecosystem Expansion and Financial Inclusion

The rapid expansion of digital payment infrastructure throughout the Philippines has eliminated traditional cash-handling barriers that historically constrained vending machine adoption. Government initiatives promoting cashless transactions, combined with widespread mobile wallet penetration, have created seamless payment ecosystems perfectly suited for automated retail environments. According to sources, digital transactions accounted for 57.4 percent of total monthly retail payment volume in the Philippines, reflecting growing adoption of e-wallets, QR payments, and electronic fund transfers nationwide. Furthermore, the high smartphone ownership rates among Filipino consumers enable effortless integration between personal devices and vending payment systems. This digital transformation extends financial accessibility to previously underserved populations while providing operators with enhanced transaction security, real-time sales monitoring, and reduced operational complexities associated with physical currency management.

Transportation Infrastructure Development and Strategic Location Availability

Ongoing investment in Philippine transportation infrastructure, including expanded rail networks, modernized bus terminals, and enhanced airport facilities, creates exceptional opportunities for vending machine deployment in high-traffic transit environments. These transportation hubs generate consistent consumer flows comprising commuters, travelers, and visitors requiring convenient product access during journeys. The development of integrated transportation centers and intermodal facilities provides premium installation locations where vending machines serve essential convenience functions. Additionally, the growth of commercial real estate developments emphasizing mixed-use concepts ensures continued availability of strategic placement opportunities that maximize consumer accessibility and transaction volumes.

Market Restraints:

What Challenges the Philippines Vending Machine Market is Facing?

High Initial Capital Investment Requirements

The substantial upfront costs associated with acquiring, installing, and commissioning modern vending machines present significant entry barriers for potential market participants. Advanced units incorporating smart technology features, cashless payment systems, and refrigeration capabilities require considerable capital outlays that may exceed the financial capacity of small-scale entrepreneurs. These investment requirements limit market participation to established operators with sufficient resources, potentially constraining overall market expansion rates.

Limited Penetration in Rural and Regional Areas

The concentration of vending machine installations in metropolitan areas leaves significant portions of the Philippine population without access to automated retail services. Rural regions face infrastructure constraints including unreliable electrical supply, limited digital payment connectivity, and lower population densities that challenge operational viability. The geographic fragmentation of the archipelago creates logistical complexities for product distribution and equipment maintenance in distant locations, further discouraging expansion beyond established urban markets.

Operational Maintenance and Technical Support Challenges

Vending machine operations require consistent technical maintenance to ensure reliable functionality and optimal consumer experience. The availability of qualified technicians capable of servicing sophisticated electronic and mechanical systems remains limited across many Philippine regions. Equipment malfunctions, payment system errors, and product dispensing failures can negatively impact consumer confidence and operator revenues. Additionally, the tropical climate conditions present specific challenges for equipment durability, requiring specialized maintenance protocols.

Competitive Landscape:

The Philippines vending machine market exhibits a dynamic competitive environment characterized by the participation of international equipment manufacturers, regional distributors, and local operating companies across diverse market segments. Competition intensifies around strategic location acquisition, with operators seeking prime placements in high-traffic commercial and transportation venues. Technology adoption serves as a key differentiator, with market participants investing in smart vending capabilities, enhanced payment integration, and improved user interfaces to attract consumer engagement. The market demonstrates consolidation tendencies as established operators leverage scale advantages in equipment procurement, product sourcing, and maintenance logistics. Strategic partnerships between technology providers, payment platforms, and operating companies shape competitive positioning and market access strategies.

Recent Developments:

-

In December 2025, foodpanda Philippines launched pink “We Gotchu Stop” vending machines at key commuter hubs, including One Ayala Terminal, providing free essentials like water, tissues, and sanitizer. The initiative supports holiday travelers, offering convenience and comfort while showcasing the brand’s use of automated vending technology in high-traffic urban locations.

Philippines Vending Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food Vending Machine, Beverages Vending Machine, Tobacco Vending Machine, Others |

| Technologies Covered | Automatic Machine, Semi-Automatic Machine, Smart Machine |

| Payment Modes Covered | Cash, Cashless |

| Applications Covered | Hotels and Restaurants, Corporate Offices, Public Places, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines vending machine market size was valued at USD 466.28 Million in 2025.

The Philippines vending machine market is expected to grow at a compound annual growth rate of 3.92% from 2026-2034 to reach USD 658.90 Million by 2034.

Food vending machine held the largest market share driven by the strong Filipino snacking culture, strategic placements in commercial and educational institutions, and growing demand for convenient meal solutions among urban consumers.

Key factors driving the Philippines vending machine market include accelerating urbanization, widespread digital wallet adoption, expanding transportation infrastructure, rising disposable incomes among middle-class consumers, and growing preference for convenient automated retail solutions among the young, tech-savvy population.

Major challenges include high initial capital investment requirements, limited penetration in rural and regional areas, operational maintenance complexities, inconsistent electrical infrastructure in remote locations, and competition from traditional convenience retail formats including sari-sari stores.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)