Philippines Vinyl Record Market Size, Share, Trends and Forecast by Product, Feature, Gender, Age Group, Application, Distribution Channel, and Region, 2026-2034

Philippines Vinyl Record Market Summary:

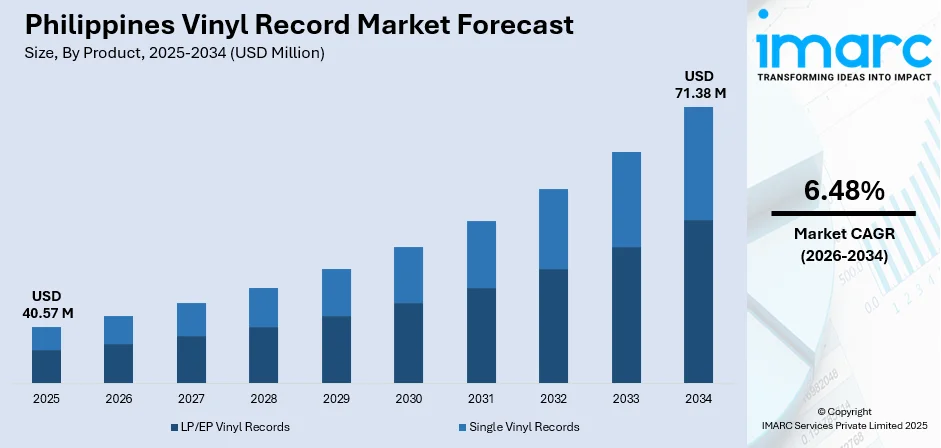

The Philippines vinyl record market size was valued at USD 40.57 Million in 2025 and is projected to reach USD 71.38 Million by 2034, growing at a compound annual growth rate of 6.48% from 2026-2034.

The Philippine vinyl record industry is seeing a remarkable revival in recent years due to the increasing interest of consumers in the analog format for playing music. The increasing intergenerational appeal of the vinyl record format, where the older generation searches for nostalgia and the younger generation is exposed to the distinctive traits of vinyl records, is a factor contributing to the growth of the Philippine vinyl record industry.

Key Takeaways and Insights:

- By Product: LP/EP vinyl records dominate the market with a share of 69% in 2025, driven by their comprehensive album art, superior sound quality, and collectible value that resonates with audiophiles and music enthusiasts.

- By Feature: Colored leads the market with a share of 41% in 2025, owing to their aesthetic appeal and limited-edition exclusivity that attracts collectors seeking visually distinctive additions to their collections.

- By Gender: Men dominate the market with a share of 59% in 2025, reflecting traditional collecting patterns and strong engagement in audiophile communities and record fair participation.

- By Age Group: The 26-35 leads the market with a share of 30% in 2025, representing young professionals with disposable income who appreciate tangible music formats and vintage aesthetics.

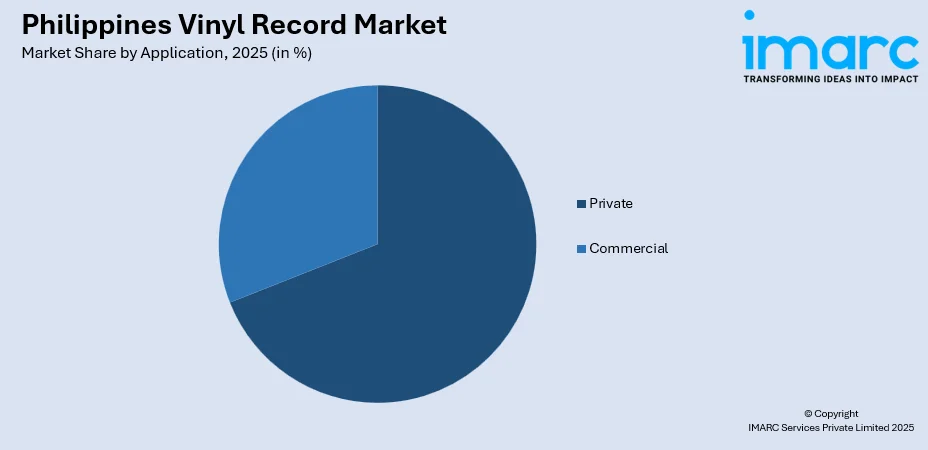

- By Application: Private dominate the market with a share of 78% in 2025, driven by personal music collections and home listening experiences that offer intimate engagement with analog sound quality.

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 30% in 2025, benefiting from widespread accessibility and convenience for mainstream consumers exploring vinyl purchases.

- By Region: Luzon dominate the market with a share of 51% in 2025, owing to the concentration of specialty record stores, major record fairs, and the largest urban consumer base.

- Key Players: The Philippines vinyl record market is highly fragmented, with independent retailers, specialty stores, OPM-focused labels, and international distributors competing to serve increasing demand from collectors and music enthusiasts across the country, driven by nostalgia and the resurgence of analog music formats.

To get more information on this market Request Sample

The Philippines vinyl record market is experiencing a notable resurgence, fueled by growing consumer preference for analog sound and tangible music ownership. Independent Filipino punk labels like Still ill Records and Mutilated Noise are actively championing vinyl releases for local artists, reinforcing the format’s cultural relevance and showing physical media isn’t just a novelty but a committed part of the music scene in 2025. Vinyl’s warm, rich audio attracts both audiophiles and casual listeners. The market thrives through community engagement at record fairs, listening sessions, and pop-up events, fostering cultural appreciation for physical music. Original Pilipino Music on vinyl has gained popularity, with labels releasing classic and contemporary albums for local collectors. Expanding specialty stores and online platforms enhance accessibility, while cross-generational interest ensures sustained demand among nostalgic and new enthusiasts alike.

Philippines Vinyl Record Market Trends:

Growing Generation Z Adoption of Vinyl Culture

A growing number of young Filipino listeners, especially Generation Z, are embracing vinyl records despite the dominance of music streaming. In June 2025, alternative rock artist Kitchie Nadal announced that her third studio album Malaya would be released on vinyl, highlighting how local artists and indie labels use physical formats to strengthen fan engagement. This generation is drawn to vinyl’s vintage charm, aesthetic appeal, and unique analog sound. Social media also fuels the trend, with fans sharing collections and joining record fair communities, supporting sustained market growth.

Expansion of Original Pilipino Music Vinyl Releases

The Philippines vinyl record market is seeing a surge in Original Pilipino Music (OPM) releases, as local artists and labels embrace the format’s cultural importance. In July 2025, Polyeast Records announced a vinyl compilation featuring popular singer‑songwriter TJ Monterde, bringing hits like “Dating Tayo” and “Ikaw at Ako” to collectors nationwide. Classic albums from legendary Filipino artists are being remastered for vinyl, while contemporary musicians increasingly release new work in analog form. This trend reflects growing demand for local music that celebrates heritage, authenticity, and the preservation of the nation’s musical history for future generations.

Rise of Community-Driven Record Fairs and Events

Community engagement through record fairs has become a hallmark of the Philippines vinyl record market. The quarterly One Stop Record Fair: Vinyl in Motion at Ayala Malls TriNoma attracts numerous vendors and music enthusiasts, from seasoned collectors to curious newcomers, offering rare first presses, limited editions, and new releases in a vibrant, social setting that connects generations. Partnerships with major malls like TriNoma have increased accessibility, exposing vinyl to wider audiences and fostering shared music discovery experiences that strengthen and expand the local vinyl community.

Market Outlook 2026-2034:

The Philippines vinyl record market outlook remains highly positive, supported by growing appreciation for analog sound quality and the enduring appeal of tangible music ownership. Specialty retailers and online platforms continue expanding accessibility, while community events and record fairs strengthen consumer engagement and loyalty. The cross-generational appeal of vinyl, combined with rising OPM releases and premium limited editions, positions the market for sustained growth. The market generated a revenue of USD 40.57 Million in 2025 and is projected to reach a revenue of USD 71.38 Million by 2034, growing at a compound annual growth rate of 6.48% from 2026-2034.

Philippines Vinyl Record Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | LP/EP Vinyl Records | 69% |

| Feature | Colored | 41% |

| Gender | Men | 59% |

| Age Group | 26-35 | 30% |

| Application | Private | 78% |

| Distribution Channel | Supermarkets and Hypermarkets | 30% |

| Region | Luzon | 51% |

Product Insights:

- LP/EP Vinyl Records

- Single Vinyl Records

The LP/EP vinyl records dominate with a market share of 69% of the total Philippines vinyl record market in 2025.

LPs and EPs are still the preferred formats for music fans looking for a full music album experience. They offer the artist’s intended experience, from well-placed song sequencing to engaging music covers that are complemented by additional insight from liner notes, which are a key factor in engaging fans more effectively. Fans cherish these formats due to their capacity to deliver intended artistic expression, which cannot be achieved by any other music formats for that matter.

The appeal of the LP/EP vinyl record is further reinforced through its incredible sound quality and its potential for collecting,” Peterson writes. Based on its ability to deliver a high level of audio detail with playtime long enough to include multiple songs, audiophiles are drawn to the offerings of the type of record, while the larger size of the discs also allows for impressive artwork designs.

Feature Insights:

- Colored

- Gatefold

- Picture

The colored leads with a share of 41% of the total Philippines vinyl record market in 2025.

Colored vinyl records are gaining strong market attention for their striking visual appeal and collectible exclusivity. In April 2025, P‑pop group BINI’s vinyl reissues featured unique pressings, such as solid ‘hot pink’ and translucent light blue, which sold out rapidly and boosted collector demand for visually distinctive editions. These variants turn music ownership into an aesthetic experience, often reflecting album themes, artist branding, or limited-edition concepts. Filipino collectors increasingly seek colored vinyl to enhance the visual diversity of their collections, driving growth in premium format offerings.

The popularity of colored vinyl goes beyond aesthetics, as these releases often represent exclusive or limited production runs that increase in collector value with time. Record labels and artists utilize colored variants for special anniversary editions, exclusive retail partnerships, and commemorative releases that generate urgency for collectors. This has been especially successful in the Philippines market, where enthusiasts actively seek out unique pressings.

Gender Insights:

- Men

- Women

The men dominate with a market share of 59% of the total Philippines vinyl record market in 2025.

Male consumers comprise the biggest segment of the vinyl record market in the Philippines. This is attributed to the massive interest they have in audio equipment and music. This demographic not only participates in record fairs, audiophile groups, and trading sites on the Internet but has played a major role in increasing the number of sales in the vinyl record market. This group not only boosts the sales of vinyl records but also the social involvement aspect.

The male-dominated segment shows particular interest in rock, jazz, and classic album pressings; they invest in premium turntable equipment and sound systems to maximize their vinyl listening experience. This demographic often acts as entry points for household vinyl adoption, exposing family members and friends to the format, while socially influencing and increasing the overall consumer base through shared listening experiences.

Age Group Insights:

- 13-17

- 18-25

- 26-35

- 36-50

- Above 50

The 26-35 leads with a share of 30% of the total Philippines vinyl record market in 2025.

The age range with the highest activity in the vinyl record industry in the Philippines is 26-35 years old. This is where they have spending power along with a great appreciation for physical copies of music. Some young professionals in this age range were introduced to music by online streaming services and not long after turned to vinyl because of a desire to connect with artists on a more personal level with physical copies of music that they possess.

This age segment has demonstrated a level of sophisticated collection activity that not only involves investment in good quality playback devices but also in assembling a collection that cuts across various genres of music. It is a segment that has shown a level of appreciation for past recordings in addition to support for current artists releasing on vinyl in the Philippines.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Commercial

The private dominates with a market share of 78% of the total Philippines vinyl record market in 2025.

Private consumption dominates vinyl record use in the Philippines, emphasizing the format’s role in personal music collections and home listening. In December 2025, according to reports, collectors continued to embrace physical media such as vinyl, CDs, and cassettes despite the prevalence of streaming. Many enthusiasts intentionally build personal collections and dedicated listening spaces, valuing the tactile, immersive experience. Vinyl allows listeners to engage deeply with albums, making music ownership a lifestyle that combines sound quality, ritual, and personal enjoyment.

In the private application segment, there is a rise in interest in home entertainment and intentional listening. Listeners are increasingly regarding vinyl as an antidote to passive digital streaming; instead, they actively engage with their music collections through the ritual of selection, handling, and playing of physical records. This mindful approach to music consumption keeps strengthening demand in the category of private use.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Independent Retailers

- Online Stores

- Others

The supermarkets and hypermarkets lead with a share of 30% of the total Philippines vinyl record market in 2025.

Supermarkets and hypermarkets have become key distribution channels, providing casual consumers with easy access to mainstream vinyl releases. By capitalizing on high foot traffic and strategic product placement, these retailers expose a wider audience to vinyl, including those who might not visit specialty music stores. This approach helps broaden the format’s appeal, extending its reach beyond devoted collectors and enthusiasts, and introduces new listeners to the tactile, immersive experience of vinyl in everyday shopping environments.

Supermarkets and hypermarkets promote sales of vinyl records by encouraging impulse buys and gifting, particularly with popular releases from well-known artists. Supermarkets and hypermarkets are known to sell records at competitive prices and with the added convenience of a one-stop shop for all purposes, making it easier for new customers to try the product. The convenience of these supermarkets plays a significant role in bringing new customers to the world of vinyl records.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits a clear dominance with a 51% share of the total Philippines vinyl record market in 2025.

Luzon dominates the Philippines vinyl record market, driven by its concentration of specialty record stores, major shopping centers, and Metro Manila’s large urban consumer base. The region also hosts prominent record fairs and vinyl events that draw collectors from across the country, reinforcing its status as the heart of the nation’s vinyl culture. With a vibrant community and strong retail infrastructure, Luzon remains the central hub where enthusiasts and casual listeners alike engage with the growing vinyl movement.

Luzon’s dominance goes beyond retail, encompassing the headquarters of major music labels, distribution networks, and vinyl-focused businesses that influence the national market. Urban areas with higher disposable incomes drive purchases of premium vinyl and audiophile equipment, while cultural institutions, live music venues, and entertainment hubs offer additional avenues for discovering and appreciating vinyl. This combination of economic capacity and cultural infrastructure reinforces Luzon’s role as the primary driver of the Philippines’ vinyl record market.

Market Dynamics:

Growth Drivers:

Why is the Philippines Vinyl Record Market Growing?

Growing Consumer Appreciation for Analog Sound Quality

The Philippines vinyl record market is expanding rapidly as consumers increasingly appreciate the superior sound quality of analog formats. In May 2025, Backspacer Records reopened pre-orders for the second pressing of P‑pop group BINI’s vinyl discography, featuring collectible foil-stamped jackets and exclusive colored pressings. The releases quickly generated strong demand from Filipino collectors, showcasing how local specialty shops are fueling interest in high-quality physical records. Vinyl’s warmer, richer audio and the tactile experience of handling records enhance listening to enjoyment, attracting both audiophiles and casual listeners and driving sustained market growth.

Cross-Generational Appeal and Community Engagement

The Philippines vinyl record market has strong cross-generational appeal, sustaining wide consumer interest. In September 2025, the government supported the Philippine Creative Industries Month, a national initiative promoting Filipino creatives across music and arts, highlighting cultural sectors that include physical formats like vinyl. Older listeners are drawn to vinyl for nostalgia, while younger audiences explore its distinctive sound through social media, streaming recommendations, and community events. Record fairs, pop-ups, and listening sessions encourage shared discovery and strengthen cultural appreciation across generations.

Expansion of Original Pilipino Music Vinyl Offerings

The rise of Original Pilipino Music (OPM) vinyl releases is a major growth driver in the Philippines market. Local artists and labels increasingly use vinyl to preserve and celebrate Filipino musical heritage. In August 2025, veteran OPM singer Martin Nievera released Take 2, a curated vinyl collection of his most iconic songs spanning four decades, reconnecting longtime fans with classic hits and introducing younger audiences to OPM’s legacy. Remastered classics and new releases appeal to collectors and audiophiles, making vinyl an essential medium for engaging with Philippine music history and supporting local talent.

Market Restraints:

What Challenges the Philippines Vinyl Record Market is Facing?

Limited Local Manufacturing Infrastructure

The Philippines vinyl record market faces constraints from limited domestic manufacturing facilities for vinyl production. Most vinyl records sold in the country are pressed overseas, requiring international shipping and extended lead times that increase costs and reduce availability. This dependency on foreign manufacturing creates supply chain vulnerabilities and limits the ability of local artists and labels to produce vinyl releases efficiently.

Competition from Digital Music Streaming Platforms

The widespread availability and convenience of digital music streaming services presents ongoing competitive pressure for the vinyl record market. Streaming platforms offer unlimited music access at relatively low subscription costs, while vinyl purchases require significant per-album investments and dedicated playback equipment. Convincing mainstream consumers to invest in physical formats despite streaming convenience remains a persistent challenge.

Higher Price Points Limiting Mass Market Accessibility

Vinyl record pricing presents accessibility barriers for price-sensitive Filipino consumers. New vinyl releases typically command premium prices compared to digital albums, while the additional requirement for turntable equipment and accessories increases the total investment needed to enjoy the format. These cost considerations may deter potential enthusiasts from entering the vinyl market despite growing interest in analog music experiences.

Competitive Landscape:

The Philippines vinyl record market exhibits a fragmented competitive landscape characterized by independent specialty retailers, online platforms, and OPM-focused labels competing alongside international distributors. Independent record stores play a crucial role in curating diverse collections and fostering community engagement through events and personalized customer experiences. Online platforms have expanded market accessibility, enabling consumers across the archipelago to purchase vinyl records from both local and international sources. The competitive environment is further shaped by record fair vendors, thrift stores offering vintage finds, and major retail chains stocking mainstream releases. This diverse competitive structure supports consumer choice while ensuring that various market segments from budget-conscious beginners to premium audiophile collectors can find appropriate purchasing channels.

Recent Developments:

- In December 2025, IV OF SPADES released their critically acclaimed album Andalucia on vinyl, coinciding with their two-day sold-out concert at SM Mall of Asia Arena. The 12-track album, featuring singles like “Aura” and “Konsensya,” marks the band’s first vinyl release. Fans enjoyed live performances of the full album alongside classics from their debut.

Philippines Vinyl Record Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | LP/EP Vinyl Records, Single Vinyl Records |

| Features Covered | Colored, Gatefold, Picture |

| Genders Covered | Men, Women |

| Age Groups Covered | 13-17, 18-25, 26-35, 36-50, Above 50 |

| Applications Covered | Private, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Independent Retailers, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines vinyl record market size was valued at USD 40.57 Million in 2025.

The Philippines vinyl record market is expected to grow at a compound annual growth rate of 6.48% from 2026-2034 to reach USD 71.38 Million by 2034.

LP/EP vinyl records dominated the market with a share of 69%, driven by their comprehensive album experiences, superior sound quality characteristics, and collectible value that resonates with audiophiles and music enthusiasts seeking tangible music ownership.

Key factors driving the Philippines vinyl record market include growing consumer appreciation for analog sound quality offering warmer and richer audio experiences, cross-generational appeal with older collectors seeking nostalgia and younger listeners discovering vinyl characteristics, expansion of OPM vinyl releases, and community engagement through record fairs and listening sessions.

Major challenges include limited local manufacturing infrastructure requiring international pressing and extended lead times, competition from convenient digital music streaming platforms, higher price points limiting mass market accessibility, and the additional investment required for turntable equipment and vinyl care accessories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)