Philippines Virtual Data Room Market Size, Share, Trends and Forecast by Component, Deployment Type, Enterprise Size, Business Function, Vertical, and Region, 2026-2034

Philippines Virtual Data Room Market Summary:

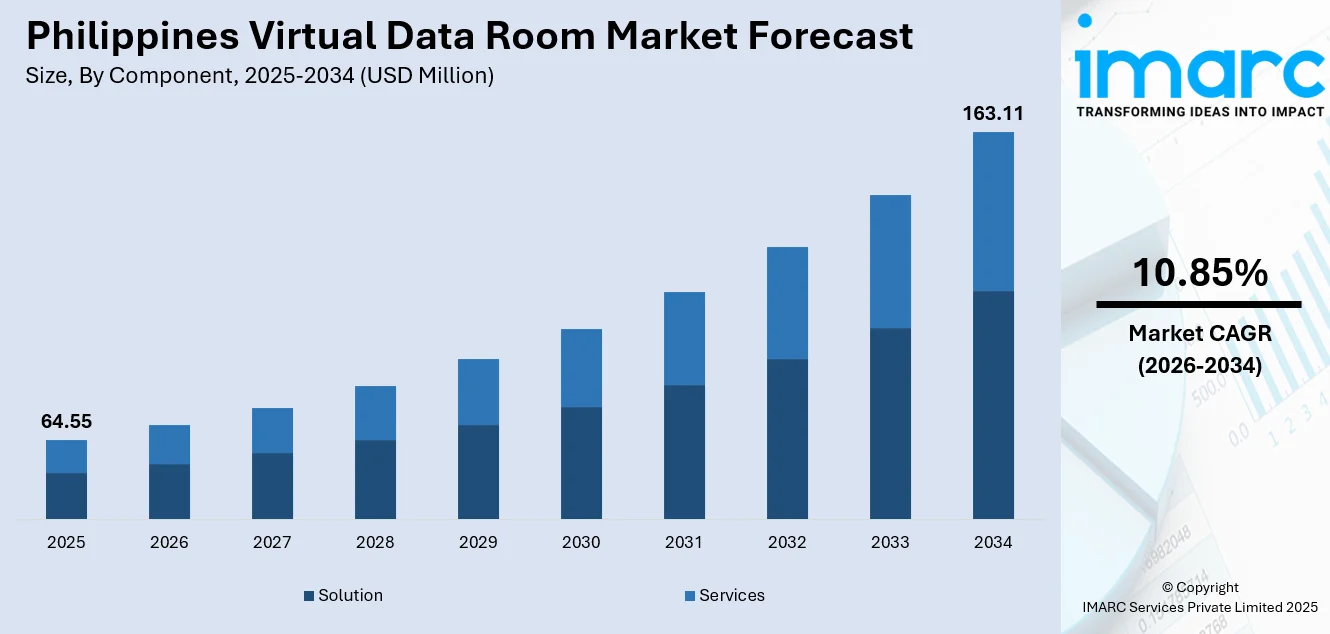

The Philippines virtual data room market size was valued at USD 64.55 Million in 2025 and is projected to reach USD 163.11 Million by 2034, growing at a compound annual growth rate of 10.85% from 2026-2034.

The market is experiencing robust expansion as enterprises prioritize secure document management, regulatory compliance, and seamless collaboration across geographically dispersed teams. Apart from this, digital transformation initiatives across banking, real estate, and legal sectors are accelerating adoption, while foreign investment inflows necessitate sophisticated due diligence platforms that ensure data sovereignty and audit trail capabilities for cross-border transactions, thereby expanding the Philippines virtual data room market share.

Key Takeaways and Insights:

- By Component: Solution dominates the market with a share of 61% in 2025, driven by enterprises seeking comprehensive platforms offering document repositories, permission controls, activity tracking, and integration capabilities rather than standalone consulting services.

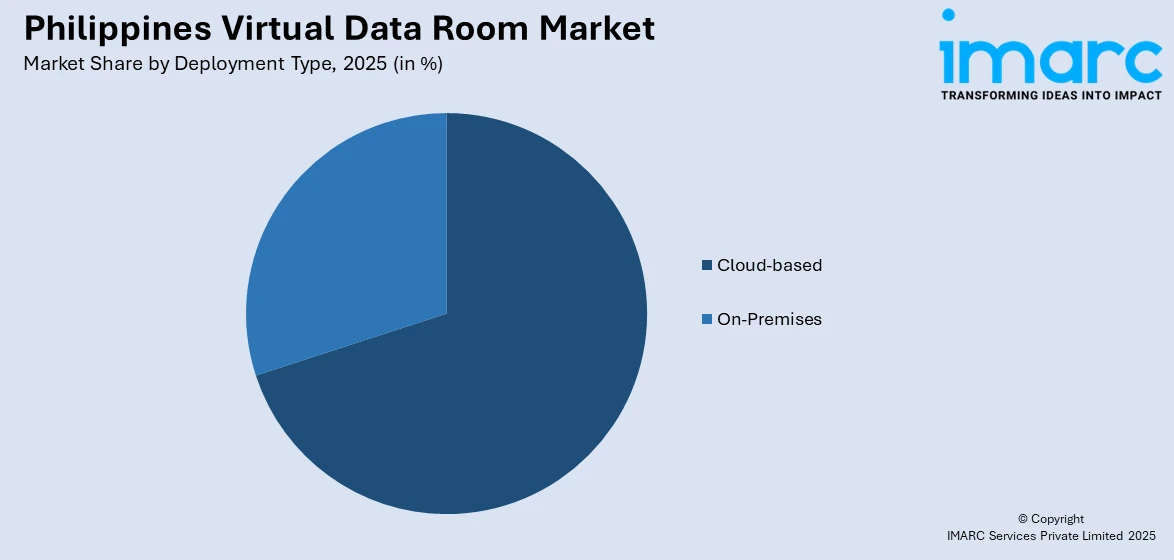

- By Deployment Type: Cloud-based deployment leads the market with a share of 70% in 2025, reflecting organizational preferences for scalable infrastructure, reduced capital expenditure, rapid deployment timelines, and automatic security updates without dedicated IT resource requirements.

- By Enterprise Size: Large enterprises represent the largest segment with a market share of 54% in 2025, owing to complex multi-stakeholder transactions, stringent regulatory compliance obligations, extensive document volumes, and substantial budgets allocated for enterprise-grade security and customization requirements.

- By Business Function: Finance leads the market with a share of 25% in 2025, driven by capital raising activities, mergers and acquisitions due diligence, loan syndication processes, and regulatory reporting that demand secure financial document exchange and granular access controls.

- By Vertical: BFSI represented the largest segment with 28% share in 2025, reflecting the industry's regulatory scrutiny, high-value transaction volumes, sensitive customer data protection requirements, and frequent corporate restructuring activities necessitating secure collaboration platforms.

- By Region: Luzon exhibited clear dominance with a share of 49% in 2025, concentrated around Metro Manila's financial district, multinational corporate headquarters, legal firms, and real estate developers executing high-stakes transactions requiring sophisticated virtual data room infrastructure.

- Key Players: The Philippines virtual data room market demonstrates moderate competitive intensity with global SaaS providers, specialized data room vendors, and emerging regional players competing across enterprise and mid-market segments through differentiated security features and localized support capabilities.

To get more information on this market Request Sample

The Philippines market is being propelled by the Bangko Sentral ng Pilipinas' financial sector digitalization roadmap, which mandates enhanced data protection standards for banking institutions. The Securities and Exchange Commission's streamlined corporate registration processes have accelerated mergers and acquisitions activity, with transactions increasingly requiring virtual data rooms for confidential information exchange. Business process outsourcing companies are deploying secure collaboration platforms to facilitate client communications while maintaining ISO certifications and data privacy compliance. Real estate developers are utilizing virtual data rooms for property sale transactions, enabling international investors to conduct remote due diligence on commercial and residential projects. Legal firms are transitioning from physical document repositories to cloud-based platforms that provide litigation support, contract management, and secure client portals with comprehensive audit trails. In 2025, in a pioneering effort to propel the Philippines' digital and AI evolution, DCI (DBP Data Center, Inc.), entirely owned by the Development Bank of the Philippines (DBP), partnered with CloudSigma to affirm the dedication to create, establish, and introduce the nation’s inaugural Government GPU-as-a-Service (GPUaaS) framework for AI. This strategic action bolsters the Philippine government's digitalization initiatives while maintaining sovereign authority over essential national information.

Philippines Virtual Data Room Market Trends:

Accelerating Cloud-First Adoption Across Philippine Enterprises

Cloud-based virtual data rooms are gaining substantial traction as Philippine organizations execute digital transformation strategies aligned with government initiatives. A major percentage of Philippine enterprises plan to complete full-scale cloud migration by 2025, reflecting strong confidence in cloud infrastructure for secure data management. This momentum is supported by the government's Cloud First Policy under the Philippine Development Plan 2023-2028, which prioritizes cloud solutions for public sector IT needs. The Department of Information and Communications Technology has committed USD 960 million toward the National Fibre Backbone and Accelerated Fibre Build projects, enhancing the digital infrastructure foundation necessary for reliable VDR deployment. Data center capacity in the Philippines is projected to increase five-fold to reach 300 megawatts by 2025, with the domestic data center market expanding from USD 633 million in 2024 to an estimated USD 1.97 billion by 2030, providing the physical infrastructure backbone that enables scalable, low-latency VDR access for enterprises nationwide. In 2025, the Department of Information and Communications Technology (DICT) has made another significant advancement in enhancing the nation’s digital framework with the official. Through the integration of fibre optic cables and wireless technologies, the NBP aims to bridge the digital gap, enhance the living standards of Filipinos, and promote inclusive engagement in the digital economy. The initiative additionally fosters public service innovation and the creation of smart cities, aiding in sustainable economic advancement.

Integration of AI-Powered Security and Analytics Features

Virtual data room providers are incorporating artificial intelligence and machine learning capabilities to enhance document management, security protocols, and user analytics. These technological advancements address growing cybersecurity concerns in the Philippines, where organizations face increasing digital threats amid rapid digitalization. The National Cybersecurity Plan 2024-2028, approved in February 2024, outlines comprehensive strategies for protecting critical infrastructure and upskilling the cybersecurity labor force, creating an environment where AI-enhanced VDR security features become essential for maintaining data integrity and regulatory compliance during sensitive corporate transactions.

Growing Demand from BFSI Sector Digital Transformation

The banking, financial services, and insurance sector in the Philippines is undergoing profound digital transformation, driving significant VDR adoption for secure document exchange and regulatory compliance. Additionally, major law firms in Manila reported increased deployment of cloud-based virtual data rooms for cross-border merger and acquisitions (M&A) transactions, demonstrating heightened confidence in secure digital collaboration environments. The financial services sector recorded 17 M&A deals in 2024, including the landmark merger of Robinsons Bank with Bank of the Philippine Islands effective January 1, 2024, requiring extensive secure data sharing during integration processes. The Philippine central bank’s reduction of reserve requirement ratios by 200 basis points effective March 2025 is freeing up additional liquidity for Philippine banks, potentially fueling further M&A activity and corresponding VDR demand.

Market Outlook 2026-2034:

The Philippines virtual data room market is positioned for sustained growth as regulatory frameworks strengthen data localization requirements, compelling multinational corporations to deploy secure collaboration platforms with local data residency capabilities. Infrastructure development projects under the Build Better More program are generating substantial transaction volumes requiring sophisticated due diligence platforms for public-private partnership evaluations and contractor selection processes. The market generated a revenue of USD 64.55 Million in 2025 and is projected to reach a revenue of USD 163.11 Million by 2034, growing at a compound annual growth rate of 10.85% from 2026-2034. The expanding business process outsourcing sector is creating demand for virtual data rooms that facilitate client communications while maintaining international security certifications and compliance for global client portfolios.

Philippines Virtual Data Room Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Solution |

61% |

|

Deployment Type |

Cloud-based |

70% |

|

Enterprise Size |

Large Enterprises |

54% |

|

Business Function |

Finance |

25% |

|

Vertical |

BFSI |

28% |

|

Region |

Luzon |

49% |

Component Insights:

- Solution

- Services

Solution dominates with a market share of 61% of the total Philippines virtual data room market in 2025.

The solution segment's leadership reflects enterprise preferences for comprehensive platforms that combine document storage, collaboration tools, security features, and analytics capabilities within integrated offerings rather than fragmented point solutions requiring complex integration efforts. Organizations value turnkey platforms that provide immediate deployment capabilities without extensive customization or professional services engagements that extend implementation timelines and increase total cost of ownership. Vendors offering robust solution packages address the complete transaction lifecycle from initial setup through document upload, stakeholder invitation, permission management, Q&A workflows, and final reporting, eliminating the need for multiple disparate tools that create workflow discontinuities and security vulnerabilities across the due diligence process.

The solution-centric approach enables rapid scaling during high-volume transaction periods when legal and financial teams must simultaneously manage multiple concurrent deals with overlapping stakeholders and compressed timelines. Pre-built integrations with enterprise content management systems, customer relationship management platforms, and electronic signature services create seamless workflows that reduce manual data transfers and associated error risks. Subscription-based pricing models for comprehensive solutions provide predictable budgeting and automatic feature enhancements without additional procurement cycles, particularly attractive for organizations executing periodic rather than continuous transactions where maintaining dedicated infrastructure would be economically inefficient compared to on-demand access to enterprise-grade platforms.

Deployment Type Insights:

Access the comprehensive market breakdown Request Sample

- Cloud-based

- On-Premises

Cloud-based leads with a share of 70% of the total Philippines virtual data room market in 2025.

Cloud-based virtual data rooms have become the preferred deployment model due to their elimination of capital expenditure requirements for server infrastructure, networking equipment, and dedicated IT personnel for ongoing maintenance and security updates. Organizations appreciate the rapid provisioning capabilities that enable transaction teams to establish secure collaboration environments within hours rather than the weeks typically required for on-premises implementations involving hardware procurement, software installation, and security configuration. The scalability inherent in cloud architectures accommodates fluctuating storage and user requirements across transaction lifecycles without advance capacity planning or infrastructure overprovisioning that characterizes traditional on-premises deployments with fixed resource allocations.

The cloud model's automatic software updates ensure continuous access to latest security patches, compliance certifications, and feature enhancements without disruptive upgrade projects that require scheduled downtime and compatibility testing across enterprise systems. Disaster recovery capabilities are significantly enhanced through geographically distributed data centers with automated failover mechanisms that maintain business continuity during infrastructure failures or natural disasters. The vendor-managed security model leverages economies of scale for advanced threat detection, intrusion prevention, and security operations center monitoring that would be prohibitively expensive for individual organizations to implement independently, particularly for small and medium enterprises conducting occasional transactions requiring institutional-grade security without dedicated cybersecurity teams.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises exhibit a clear dominance with a 54% share of the total Philippines virtual data room market in 2025.

Large enterprises dominate virtual data room adoption due to their frequent participation in complex, high-value transactions including mergers and acquisitions, corporate restructurings, capital market activities, and international expansion initiatives that generate substantial document volumes requiring secure management and controlled dissemination. These organizations face stringent regulatory obligations across multiple jurisdictions that mandate comprehensive audit trails, granular access controls, and data residency compliance impossible to achieve through standard file-sharing platforms or email-based document distribution. The sophistication of large enterprise transactions typically involves numerous stakeholders including investment bankers, legal counsel, accounting firms, regulatory authorities, and potential investors whose simultaneous access requires robust permission management and activity monitoring capabilities.

Budget availability within large enterprises enables investment in premium virtual data room features including advanced analytics, custom branding, dedicated support, and extensive customization to align with corporate standards and integration requirements with existing enterprise systems. The reputational risks associated with data breaches or confidentiality violations justify substantial expenditure on enterprise-grade security features including multi-factor authentication, dynamic watermarking, remote wipe capabilities, and forensic activity tracking. Large organizations benefit from vendor relationship management programs offering volume discounts, priority support, and dedicated account teams that provide strategic guidance on optimizing virtual data room utilization across diverse business units and transaction types.

Business Function Insights:

- Marketing and Sales

- Legal

- Finance

- Workforce Management

Finance leads with a share of 25% of the total Philippines virtual data room market in 2025.

Finance departments drive virtual data room adoption through their central role in capital raising activities, mergers and acquisitions transactions, loan syndications, and investor relations that require secure exchange of sensitive financial information with external parties under confidentiality agreements and regulatory frameworks. The due diligence processes inherent in these activities demand organized presentation of financial statements, tax records, debt agreements, asset valuations, and cash flow projections to potential investors, lenders, or acquirers whose thorough examination determines transaction success and pricing. Virtual data rooms provide the controlled environment necessary for finance teams to selectively disclose information based on transaction stage, stakeholder role, and negotiation status while maintaining comprehensive audit trails documenting who accessed which documents and when.

Regulatory reporting obligations including securities filings, banking supervision requirements, and tax authority audits generate substantial document management needs that virtual data rooms address through version control, automated retention policies, and secure archiving capabilities. The finance function's responsibility for corporate governance and compliance necessitates platforms offering granular permission structures that enforce segregation of duties principles and prevent unauthorized access to restricted financial information. The analytical capabilities embedded in modern virtual data rooms enable finance teams to track stakeholder engagement patterns, identify areas requiring additional disclosure or clarification, and measure transaction progress through document review completion metrics that inform negotiation strategies and timeline management.

Vertical Insights:

- BFSI

- Retail and E-Commerce

- Government

- Healthcare and Life Sciences

- IT and Telecommunications

- Others

BFSI exhibits a clear dominance with a 28% share of the total Philippines virtual data room market in 2025.

The banking, financial services, and insurance sector's dominance stems from its transaction-intensive nature characterized by continuous mergers and acquisitions, initial public offerings, loan syndications, asset sales, and regulatory examinations that generate perpetual demand for secure document sharing infrastructure. Financial institutions operate under stringent regulatory frameworks including Bangko Sentral ng Pilipinas guidelines, anti-money laundering requirements, and Securities and Exchange Commission disclosure obligations that mandate meticulous documentation, audit trail maintenance, and controlled information dissemination impossible to achieve through conventional collaboration tools. The sector's handling of highly sensitive customer financial data, proprietary trading strategies, and confidential merger discussions creates elevated security requirements that justify investment in premium virtual data room capabilities including advanced encryption, geographic access restrictions, and behavioral analytics detecting unusual access patterns.

Investment banking divisions utilize virtual data rooms for virtually every capital markets transaction, private equity deal, and corporate advisory engagement, creating consistent recurring demand regardless of broader economic conditions. Insurance companies deploy these platforms for portfolio acquisitions, claims litigation management, regulatory compliance documentation, and catastrophic event response coordination requiring secure multi-party collaboration. The reputational consequences and regulatory penalties associated with data breaches in financial services drive conservative technology selection favoring established vendors with proven security track records, compliance certifications, and financial stability ensuring long-term platform availability throughout extended transaction lifecycles and post-closing integration periods.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon leads with a share of 49% of the total Philippines virtual data room market in 2025.

Luzon's market leadership derives from Metro Manila's concentration of multinational corporation headquarters, investment banking offices, major law firms, and real estate developers executing the majority of high-value transactions requiring virtual data room infrastructure. The Makati and Bonifacio Global City business districts host the country's largest banks, private equity firms, and corporate advisory practices whose transaction volumes and deal complexity drive sophisticated virtual data room requirements beyond capabilities of smaller regional competitors. The presence of the Philippine Stock Exchange, Securities and Exchange Commission, and Bangko Sentral ng Pilipinas creates a regulatory ecosystem where compliance-driven documentation requirements are most stringently enforced and monitored, compelling organizations to adopt institutional-grade secure collaboration platforms.

The region's advanced telecommunications infrastructure including widespread fiber optic connectivity and reliable internet service provider networks enables seamless cloud-based virtual data room access without the connectivity challenges that can impede adoption in less developed regions. The concentration of professional services firms including Big Four accounting firms, international law practices, and management consultancies creates an ecosystem where virtual data room utilization is standard practice and client expectations demand these capabilities for major engagements. Educational institutions in Metro Manila produce the largest pools of finance, legal, and technology professionals familiar with virtual data room platforms from prior employment, reducing training requirements and accelerating organizational adoption when these professionals join new enterprises.

Market Dynamics:

Growth Drivers:

Why is the Philippines Virtual Data Room Market Growing?

Accelerating Mergers and Acquisitions Activity Driven by Foreign Direct Investment Inflows

The Philippines continues attracting substantial foreign direct investment across sectors including business process outsourcing, manufacturing, real estate, and infrastructure, with international corporations seeking local acquisitions to establish market presence and operational capabilities. These cross-border transactions require sophisticated virtual data rooms enabling geographically dispersed teams to conduct simultaneous due diligence without travel constraints or time zone limitations that would otherwise extend transaction timelines and increase costs. Foreign acquirers demand institutional-grade security, comprehensive audit trails, and compliance with international data protection standards that local file-sharing solutions cannot provide, compelling target companies to adopt enterprise virtual data room platforms. The government's liberalization of foreign ownership restrictions in previously protected sectors is expanding the universe of potential transactions requiring secure collaboration infrastructure for confidential information exchange between domestic sellers and international buyers navigating unfamiliar regulatory environments. Multiple industries have been opened up to permit as much as 100 percent foreign ownership. These encompass manufacturing aimed at exports, IT and business process outsourcing (BPO), tourism and hospitality businesses, and wholesale commerce that satisfies minimum capital thresholds. Investment promotion agencies like the Board of Investments (BOI) and the Philippine Economic Zone Authority (PEZA) support these industries by facilitating business establishment and sector entry.

Expansion of Business Process Outsourcing Industry Requiring Secure Client Collaboration Platforms

The Philippines business process outsourcing sector continues rapid growth as multinational corporations outsource customer service, technical support, finance, and accounting functions to leverage cost advantages and English language proficiency. These engagements generate substantial secure document exchange requirements as outsourcing providers must access client proprietary information, operational procedures, customer databases, and financial records while maintaining strict confidentiality and compliance with client security policies and industry regulations. Virtual data rooms provide the controlled environment necessary for providers to receive, process, and return client documents with granular access controls ensuring only authorized personnel access specific information categories. IMARC Group predicts that the Philippines virtual data room market is projected to attain USD 152.01 Million by 2033.

Strengthening Regulatory Requirements for Data Protection and Corporate Governance

The implementation of the Data Privacy Act and subsequent regulations by the National Privacy Commission has elevated organizational obligations for protecting personal information, maintaining consent records, and demonstrating appropriate technical and organizational measures securing sensitive data. Virtual data rooms enable compliance through features including automated data classification, encryption at rest and in transit, geographic access restrictions, and comprehensive audit trails documenting who accessed what information and when. Corporate governance reforms requiring enhanced board oversight, audit committee scrutiny, and stakeholder transparency are driving adoption of platforms that facilitate secure board document distribution, committee collaboration, and controlled investor communications. Securities and Exchange Commission requirements for public company disclosures, beneficial ownership reporting, and related party transaction documentation create ongoing needs for secure repositories with version control and stakeholder access management capabilities that virtual data rooms provide through purpose-built workflows and permission structures. In 2025, Japan, Canada, Australia, the United States, and the European Union (EU) have shown support for the Philippines in enhancing its artificial intelligence (AI) and cybersecurity skills. At the Stratbase ADR Institute 2025 Pilipinas Conference, Japanese Ambassador Endo Kazuya highlighted the swift rise of cyberattacks worldwide and the urgent necessity for global collaboration.

Market Restraints:

What Challenges the Philippines Virtual Data Room Market is Facing?

High Platform Costs Creating Adoption Barriers for Small and Medium Enterprises

Virtual data room subscription fees and transaction-based pricing models represent significant expenditure for small and medium enterprises conducting infrequent transactions, particularly when compared to seemingly free file-sharing alternatives that lack equivalent security and compliance capabilities. The perception that virtual data rooms are necessary only for large, complex transactions limits adoption among smaller organizations that could benefit from enhanced security and professional presentation even for modest transactions. Budget constraints force many small enterprises to rely on email attachments and consumer file-sharing services despite their security vulnerabilities and lack of audit trail capabilities.

Limited Awareness of Virtual Data Room Capabilities Beyond Due Diligence Applications

Many organizations perceive virtual data rooms exclusively as tools for mergers and acquisitions due diligence rather than recognizing their broader applicability for ongoing document management, board communications, regulatory compliance, litigation support, and intellectual property protection. This narrow perception limits market expansion beyond investment banking and legal sectors to other functions and industries that could benefit from secure collaboration infrastructure. The lack of vendor education and marketing targeted at non-traditional use cases perpetuates misconceptions about platform applicability and value proposition for routine business operations.

Concerns About Data Sovereignty and Cloud Service Provider Reliability

Organizations handling sensitive government information, defense-related contracts, or regulated personal data express hesitation about entrusting critical documents to cloud-based platforms operated by international vendors without local data center presence. Questions about data residency, foreign government access to information stored on overseas servers, and vendor compliance with Philippine regulatory requirements create adoption barriers particularly among government agencies and highly regulated industries. The dependence on internet connectivity for cloud-based virtual data room access creates concerns about availability during network disruptions or cybersecurity incidents affecting service providers.

Competitive Landscape:

The Philippines virtual data room market exhibits moderate competitive intensity with established global software-as-a-service providers offering comprehensive platforms alongside specialized vendors focusing exclusively on secure document collaboration and transaction management capabilities. International technology companies leverage their existing customer relationships, broad product portfolios, and global support networks to cross-sell virtual data room solutions to enterprise clients already utilizing their productivity suites and cloud infrastructure services. Regional players differentiate through localized support, Philippine peso pricing, integration with domestic accounting and legal software, and customization addressing specific local regulatory requirements and business practices. The ecosystem includes value-added resellers and system integrators who bundle virtual data room subscriptions with implementation services, user training, and ongoing technical support particularly valuable for organizations lacking dedicated IT resources. Competition centers on security certifications, user interface intuitiveness, customer support responsiveness, pricing transparency, and demonstrated transaction success across diverse industries and deal complexures rather than purely on feature breadth.

Philippines Virtual Data Room Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Types Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Business Functions Covered | Marketing and Sales, Legal, Finance, Workforce Management |

| Verticals Covered | BFSI, Retail and E-Commerce, Government, Healthcare and Life Sciences, IT and Telecommunications, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines virtual data room market size was valued at USD 64.55 Million in 2025.

The Philippines virtual data room market is expected to grow at a compound annual growth rate of 10.85% from 2026-2034 to reach USD 163.11 Million by 2034.

Solution dominated the market with a 61% share in 2025, driven by enterprise preferences for comprehensive integrated platforms offering document management, collaboration tools, security features, and analytics capabilities within turnkey packages requiring minimal customization or professional services engagement, enabling rapid deployment and predictable subscription-based pricing models.

Key growth factors influencing the Philippines virtual data room market include accelerating M&A activity, stringent data privacy compliance requirements under the Data Privacy Act with 72-hour breach notification mandates, government digital infrastructure investments exceeding USD 960 million, and widespread cloud adoption with a major percentage of enterprises planning full cloud migration by 2025.

Major challenges include high platform subscription costs creating adoption barriers for small and medium enterprises conducting infrequent transactions, limited awareness of virtual data room capabilities beyond traditional mergers and acquisitions due diligence restricting market expansion into adjacent use cases, concerns about data sovereignty and cloud service provider reliability particularly among government agencies and highly regulated industries requiring local data residency, integration complexity with legacy enterprise systems, and perceived setup difficulty deterring organizations preferring familiar file-sharing alternatives despite their security limitations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)