Philippines Vision Care Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Philippines Vision Care Market Overview:

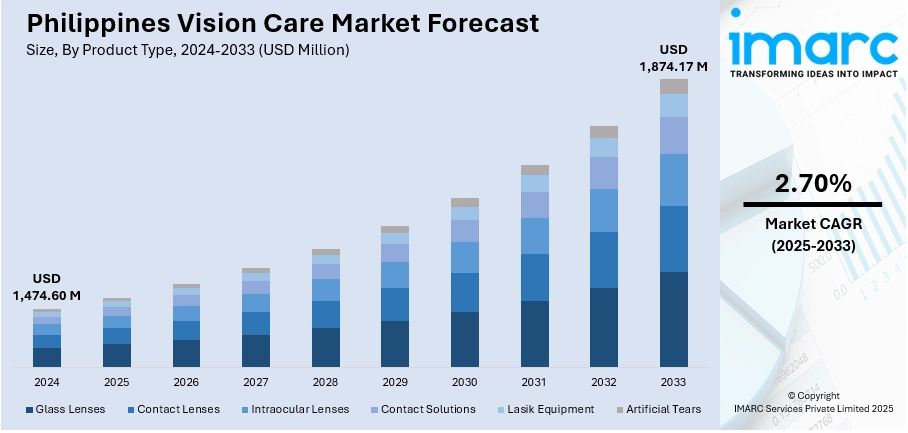

The Philippines vision care market size reached USD 1,474.60 Million in 2024. Looking forward, the market is projected to reach USD 1,874.17 Million by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. The market is witnessing steady growth, supported by rising cases of eye disorders, lifestyle changes, and greater awareness about preventive eye health. Increasing access to optometry services and the availability of advanced eyewear products are also boosting adoption. Rising digital screen exposure and an aging population are further strengthening the Philippines vision care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,474.60 Million |

| Market Forecast in 2033 | USD 1,874.17 Million |

| Market Growth Rate 2025-2033 | 2.70% |

Philippines Vision Care Market Trends:

Rising Demand for Corrective Eyewear

Corrective eyewear, which includes glasses and contact lenses, is experiencing robust demand in the Philippines due to the increasing incidence of vision impairments like myopia, hyperopia, and presbyopia. Factors such as urbanization, heightened academic pressures, and changing lifestyles are leading to a rise in visual problems among younger people, while age-related eye conditions are driving demand among older individuals. While glasses remain the most commonly used option, contact lenses are becoming increasingly popular among the younger and fashion-conscious demographic. Furthermore, eyewear is increasingly viewed as a fashion statement, opening new avenues for premium and designer offerings. Initiatives by healthcare organizations and retailers to raise awareness about eye health are encouraging regular eye examinations, promoting early detection of vision issues. All these elements are contributing to the ongoing growth of the vision care market in the Philippines, positioning corrective eyewear as a significant growth catalyst.

To get more information on this market, Request Sample

Growing Adoption of Digital Eye Strain Solutions

In the Philippines, there is a notable rise in eye health issues associated with the increased use of devices like smartphones, tablets, computers, and televisions. Digital eye strain, a condition linked to extended screen time, has emerged as a leading cause of eye discomfort among students, professionals, and children alike. To combat this, consumers are increasingly seeking specialized solutions, including blue-light blocking glasses, contact lenses with protective features, and moisturizing eye drops. Retailers and healthcare providers are actively promoting these products to enhance awareness about the prevention and mitigation of digital eye strain. The rise of remote work and online education has also intensified the demand for protective eyewear. This lifestyle shift plays a crucial role in driving the Philippines vision care market growth, as consumers prioritize their eye health in response to challenges posed by technology.

Expanding Access Through Retail and Online Channels

Access to vision care products in the Philippines has significantly improved with the growth of both conventional retail outlets and digital commerce platforms. Optical shops, pharmacy chains, and major retail stores now provide a diverse range of eyewear and eye care products catering to various price points. Concurrently, online shopping is becoming more widespread, allowing consumers to easily browse, compare, and purchase items with home delivery. Numerous brands are utilizing digital channels to offer virtual try-on features and tailored recommendations, making the eyewear buying experience more engaging and attractive. Cost-effective options for prescription glasses and contact lenses are also aimed at middle- and lower-income consumers, expanding the potential market. By addressing urban-rural accessibility challenges and offering more competitive alternatives, these evolving distribution networks are transforming the market, ensuring sustained growth opportunities for the vision care sector.

Philippines Vision Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Glass Lenses

- Contact Lenses

- Intraocular Lenses

- Contact Solutions

- Lasik Equipment

- Artificial Tears

The report has provided a detailed breakup and analysis of the market based on the product type. This includes glass lenses, contact lenses, intraocular lenses, contact solutions, Lasik equipment, and artificial tears.

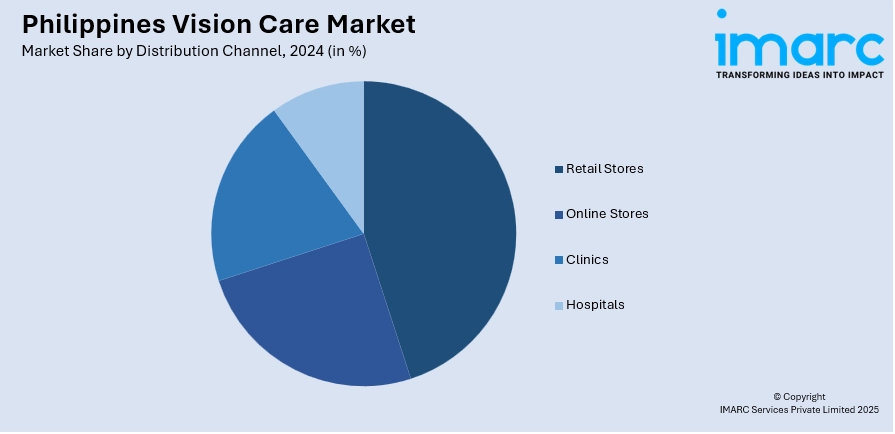

Distribution Channel Insights:

- Retail Stores

- Online Stores

- Clinics

- Hospitals

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail stores, online stores, clinics, and hospitals.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Vision Care Market News:

- In May 2024, Vision Express Philippines celebrated the grand opening of its Ayala Center Cebu branch. The store specializes in designer eyewear and advanced prescription lenses, showcasing local craftsmanship.

- In April 2023, Johnson & Johnson Vision announced the launch of ACUVUE® MOIST and ACUVUE DEFINE contact lenses in the Philippines. These lenses feature LACREON® Technology for enhanced comfort and UV protection. The initiative aims to improve eye health awareness among Filipinos, addressing myths about contact lens usage among younger generations.

Philippines Vision Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Glass Lenses, Contact Lenses, Intraocular Lenses, Contact Solutions, LASIK Equipment, Artificial Tears |

| Distribution Channels Covered | Retail stores, Online stores, Clinics, Hospitals |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines vision care market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines vision care market on the basis of product type?

- What is the breakup of the Philippines vision care market on the basis of distribution channel?

- What is the breakup of the Philippines vision care market on the basis of region?

- What are the various stages in the value chain of the Philippines vision care market?

- What are the key driving factors and challenges in the Philippines vision care market?

- What is the structure of the Philippines vision care market and who are the key players?

- What is the degree of competition in the Philippines vision care market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines vision care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines vision care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines vision care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)