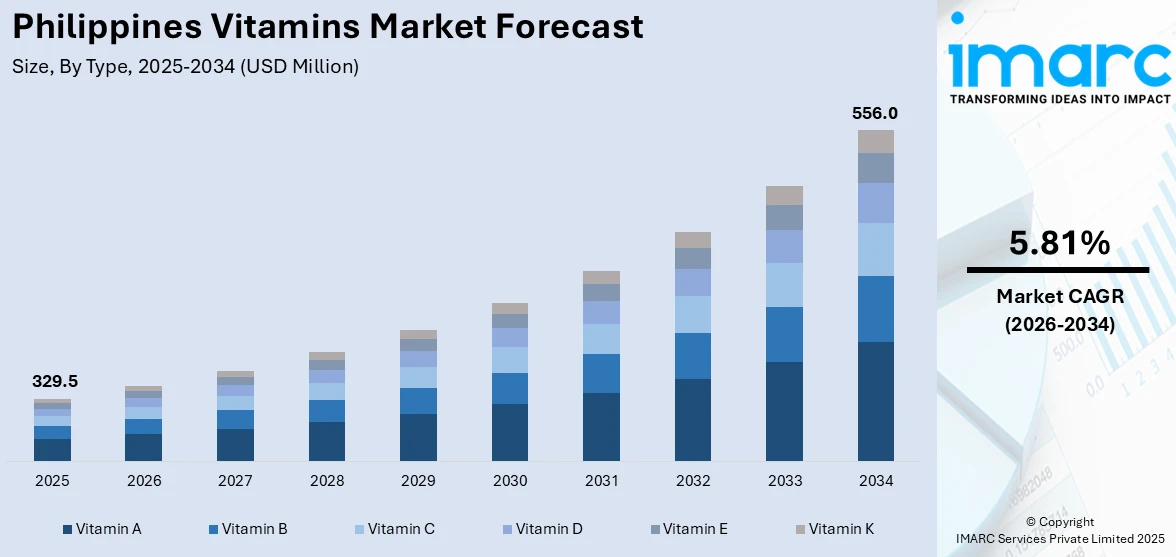

Philippines Vitamins Market Report by Type (Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, Vitamin K), Source (Natural, Synthetic), Application (Personal Care Products, Food and Beverages, Healthcare Products, and Others), and Region 2026-2034

Philippines Vitamins Market Size and Share:

The Philippines vitamins market size reached USD 329.5 Million in 2025. Looking forward, the market is expected to reach USD 556.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.81% during 2026-2034. The vitamins market is primarily driven by increasing health consciousness among consumers, the growing geriatric population, and the rising demand for supplements promoting immunity, energy, and overall wellness due to proactive health measures across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 329.5 Million |

| Market Forecast in 2034 | USD 556.0 Million |

| Market Growth Rate (2026-2034) | 5.81% |

Key Trends of Philippines Vitamins Market:

The growing geriatric population

The rising geriatric population is substantially increasing in the Philippines, resulting in an extensive need for vitamins. Additionally, the growing geriatric population needs more nutritional assistance as they become older, to maintain good health and prevent age-related problems. Moreover, vitamin is especially important for older individuals since it supports immune system function, ocular health, and general well-being. For instance, senior citizens are defined as those sixty years of age or older. According to the Philippine Statistics Authority, in 2020, they made up 9.3% (166,678 persons) of the household population, an increase from the 7.4% (132,893 persons) recorded in 2015. Among senior citizens in 2020, there were more females (54.4%) than men (45.6%). Furthermore, the growing prevalence of age-related health issues including immune system weakness and visual degradation is increasing the demand for vitamin-containing supplements. Hence, there is an increasing need for vitamin-containing medicines to treat age-related health concerns such as macular degeneration and compromised immunological function among the geriatric population across the Philippines.

To get more information on this market Request Sample

Increasing Health Awareness

The Philippines is witnessing a notable surge in health consciousness, fueling a burgeoning demand for vitamins and supplements. Additionally, the growing emphasis on wellness and preventative healthcare highlights a fundamental change in the direction of proactive health management, which is fueling the Philippines vitamins market share. Moreover, the growing tendency is influenced by the availability of reliable health information, increased disposable incomes, and changing lifestyle habits. The need for vitamins is growing as people become more aware of their health demands, creating a situation where prevention is prioritized above treating illness as a whole. According to the World Health Organization (WHO) in low- and middle-income countries, vitamin A deficiency (VAD) affects over 190 million children under the age of five and is associated with several harmful health effects, including death. Based on current research and a previous version of this assessment, the World Health Organization recommends vitamin A supplementation (VAS) for children between the ages of 6 and 59 months. Moreover, in the Philippine National Demographic and Health Survey (NDHS) in 2022, 79% of children aged 6-59 months were given vitamin A supplements. As individuals become more concerned about their health needs, the demand for vitamins is contributing to the market growth.

Growth Drivers of Philippines Vitamins Market:

Expansion of E-Commerce and Digital Health Platforms

The rise of e-commerce and health-focused digital platforms has transformed how consumers access and purchase vitamins. Online channels offer convenience, broader product choices, and easier price comparisons, encouraging both urban and rural consumers to explore supplementation options. With the growing influence of digital marketing and health influencers, consumers are now more aware of product benefits and usage. Online pharmacies and wellness apps also offer subscription-based models, bundling, and tailored recommendations that improve customer retention, which is driving the Philippines vitamins market demand. Additionally, the digital space allows local and international brands to enter the Philippine market with minimal overhead costs. As internet penetration increases and digital payment systems become more reliable, e-commerce will continue to drive vitamin sales across diverse demographics.

Rise in Preventive and Personalized Healthcare Trends

Filipinos are increasingly shifting toward preventive and personalized healthcare, creating strong demand for targeted vitamin supplements. Consumers are now seeking vitamins formulated for specific health goals, such as immunity, energy, skin health, or stress relief, based on their individual lifestyle and dietary needs. According to the Philippines vitamins market analysis, this shift is largely influenced by growing access to health information through social media, fitness communities, and wellness blogs. Personalized health assessments and in-store consultations are also guiding purchase decisions, encouraging consumers to choose supplements suited to their exact requirements. Brands that offer customized product lines or bundle solutions tailored for specific age groups, activity levels, or deficiencies are gaining traction. This rising preference for tailored wellness is reshaping product development and marketing strategies in the Philippine vitamins market.

Government and Corporate Wellness Initiatives

Various government-led health programs and corporate wellness campaigns are encouraging the regular intake of vitamins, particularly among working professionals and low-income families, thus boosting the Philippines vitamins market growth. Public health agencies often include vitamin supplementation in nutrition campaigns aimed at addressing nutrient deficiencies and improving productivity. At the same time, employers are incorporating vitamins and wellness kits into employee benefits, especially in industries with demanding schedules. These initiatives not only promote better health outcomes but also increase consumer exposure to branded supplements. Collaborations between health agencies, NGOs, and private firms further amplify market visibility and access. As institutional support continues to grow, the vitamins market benefits from consistent demand across public and private sectors, helping to establish long-term consumption habits.

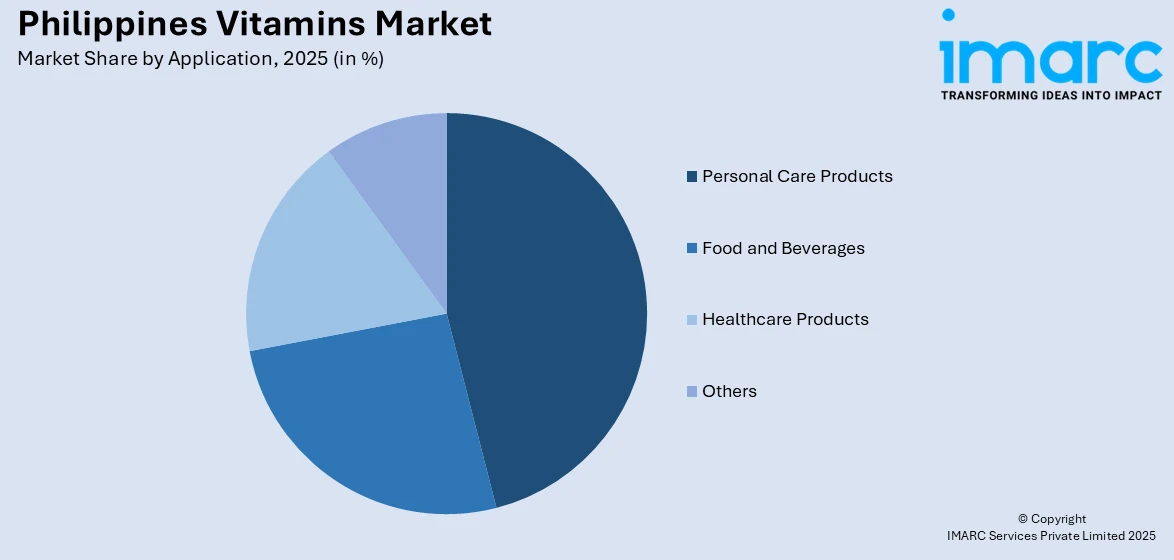

Philippines Vitamins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, source, and application.

Type Insights:

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Vitamin E

- Vitamin K

The report has provided a detailed breakup and analysis of the market based on the type. This includes vitamin A, vitamin B, vitamin C, vitamin D, vitamin E, and vitamin K.

Source Insights:

- Natural

- Synthetic

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes natural and synthetic.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Personal Care Products

- Food and Beverages

- Healthcare Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes personal care products, food and beverages, healthcare products, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Vitamins Market News:

- April 2025: Nestlé introduced a new “milk plus soy” powdered beverage in the Philippines, specifically designed for school-aged children. The company claims the product offers a more affordable option to support children's nutritional needs across the country. Before this launch, the BEAR BRAND product line already catered to school-aged kids with fortified milk powders enriched with essential nutrients such as vitamin D, calcium, protein, iron, zinc, and vitamin C.

- April 2024: Vitamin Angels collaborated with the Department of Health (DOH) in the Philippines to incorporate MMS into the National Drug Formulary, thereby enhancing its availability for pregnant women nationwide. Additionally, through a memorandum of understanding with the DOH, Vitamin Angels has partnered with a consortium of established implementation organizations, such as UNICEF Philippines, to strategize the procurement and distribution of multiple micronutrient supplements (MMS) sustainably.

- March 2023: A Thanksgiving event was organized in Antique province to express gratitude to the farmer-partners and local officials who played key roles in the initial rollout of Malusog Rice. It presents a hopeful solution to Vitamin A deficiency in the Philippines and other developing nations. Additionally, enhanced cooperation among scientists, policymakers, and communities is essential to its successful adoption, potentially revolutionizing efforts to prevent Vitamin A deficiency and making significant contributions to global health and nutrition initiatives. At the gathering, the provincial board of antiques publicly declared its endorsement of Malusog Rice cultivation and consumption. According to the Department of Agriculture's Philippine Rice Research Institute (DA-PhilRice), market testing conducted earlier in Central Luzon previous year demonstrated that Malusog Rice is viable for the market, with its pricing comparable to the prevailing rates of regular milled rice in the region.

Philippines Vitamins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, Vitamin K |

| Sources Covered | Natural, Synthetic |

| Applications Covered | Personal Care Products, Food and Beverages, Healthcare Products, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines vitamins market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines vitamins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines vitamins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vitamins market in the Philippines was valued at USD 329.5 Million in 2025.

The Philippines vitamins market is projected to exhibit a CAGR of 5.81% during 2026-2034.

The Philippines vitamins market is projected to reach a value of USD 556.0 Million by 2034.

The key trend of the Philippines vitamins market is increased consumer demand for natural, clean-label supplements, a growing emphasis on personalized nutrition, rising health and preventive-care awareness, and strong reliance on traditional retail, pharmacies, and health stores remain the main distribution channels.

The market expansion is propelled by the aging population’s need for health supplementation, heightened wellness consciousness post-pandemic, rising disposable incomes among middle-class consumers, and online channel growth that enhances accessibility and variety of vitamin supplements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)