Philippines Wallpaper Market Size, Share, Trends and Forecast by Wallpaper Type, Distribution Channel, End User, and Region, 2026-2034

Philippines Wallpaper Market Summary:

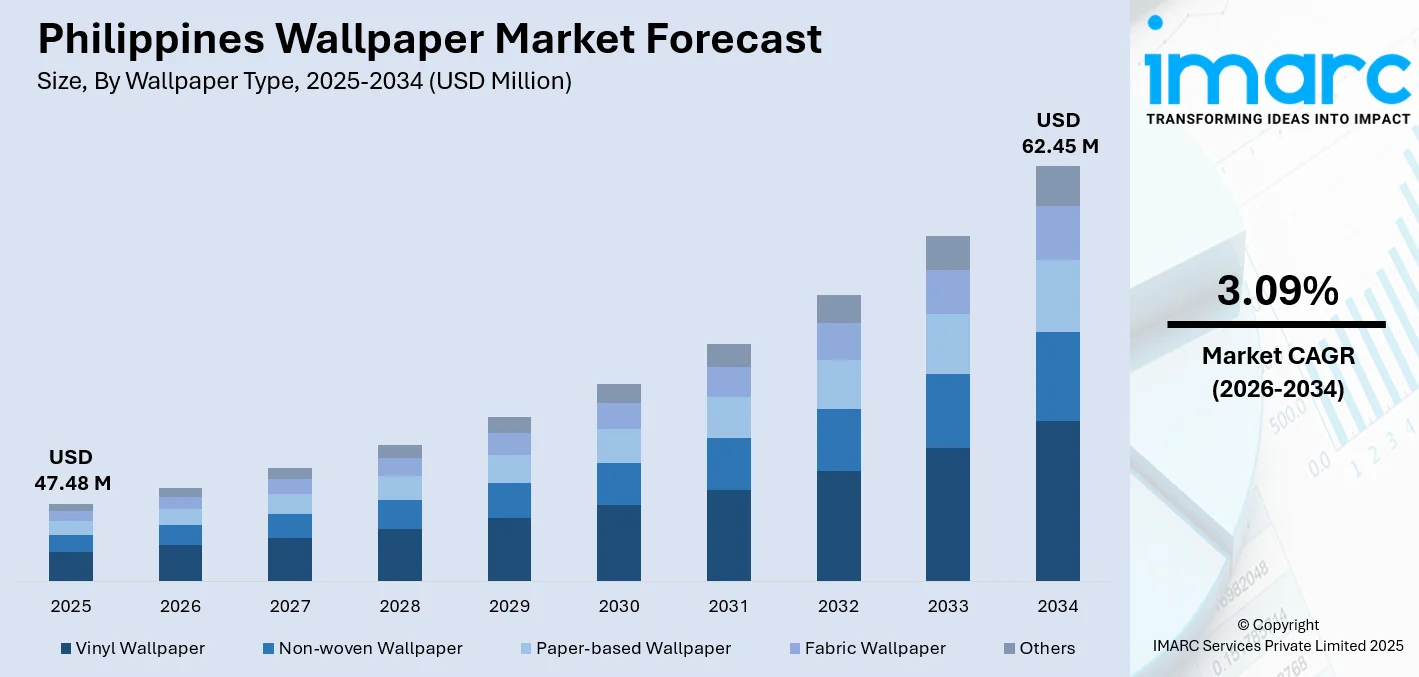

The Philippines wallpaper market size was valued at USD 47.48 Million in 2025 and is projected to reach USD 62.45 Million by 2034, growing at a compound annual growth rate of 3.09% from 2026-2034.

The Philippines wallpaper market is experiencing steady expansion driven by rising urbanization, growing consumer interest in interior aesthetics, and the flourishing hospitality and commercial sectors. Wallpaper has evolved from a niche decorative product into a mainstream interior design element across residential and commercial applications. Increasing investments in real estate development and renovation activities continue to fuel demand for innovative wall covering solutions throughout the archipelago.

Key Takeaways and Insights:

- By Wallpaper Type: Vinyl wallpaper dominates the market with a share of 36.92% in 2025, owing to its exceptional moisture resistance, durability, and ease of maintenance that make it ideal for the tropical Philippine climate. Rising demand from commercial establishments and residential renovations continues to drive segment growth.

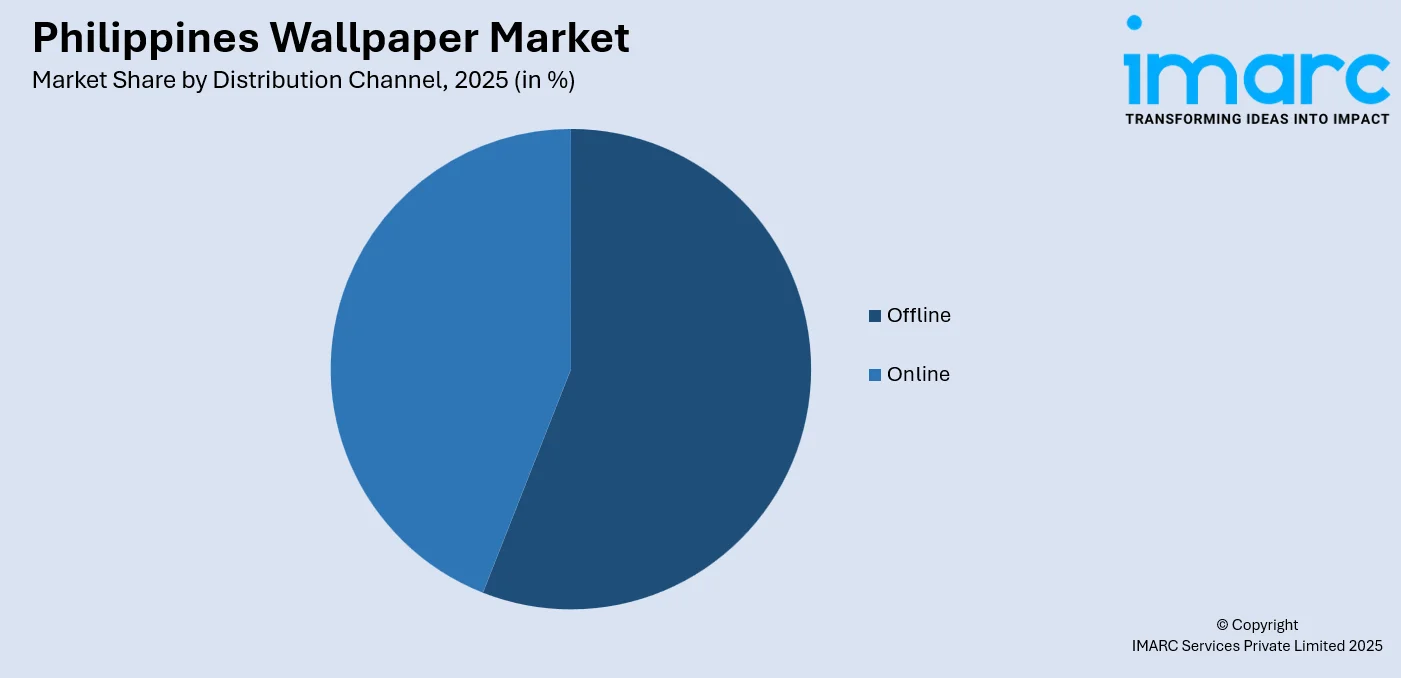

- By Distribution Channel: Offline leads the market with a share of 55.94% in 2025. This dominance is driven by consumer preference for tactile product evaluation, personalized expert consultation, and immediate product availability through dedicated home improvement retailers and specialty wallpaper showrooms across the country.

- By End User: Commercial represents the biggest segment with a market share of 54.09% in 2025, reflecting growing investment in visually engaging interior environments across hotels, restaurants, retail establishments, and office spaces that utilize wallpaper to create distinctive branded atmospheres.

- By Region: Luzon is the largest region with 47% share in 2025, driven by the concentration of economic activities in Metro Manila, Clark, and CALABARZON, coupled with extensive infrastructure development and commercial real estate expansion throughout the region.

- Key Players: Key players drive the Philippines wallpaper market by expanding product portfolios, introducing moisture-resistant technologies, and strengthening distribution networks. Their investments in marketing, design innovation, and partnerships with interior designers boost awareness and accelerate adoption across diverse consumer segments.

To get more information on this market Request Sample

The Philippines wallpaper market is positioned for sustained growth as urbanization accelerates across Metro Manila, Cebu, Davao, and emerging regional cities. Rising consumer awareness of interior design trends, coupled with the proliferation of home improvement content on social media platforms, has transformed wallpaper from a specialized product into a mainstream decorative solution. The commercial segment demonstrates particular strength as hospitality and retail establishments increasingly utilize wallpaper to create distinctive visual identities and enhance customer experiences. In December 2024, Wilcon Depot, the country's leading home improvement retailer, celebrated the opening of its 100th store in Lubao, Pampanga, reflecting the robust expansion of physical retail infrastructure supporting home décor products nationwide. This milestone underscores the sustained consumer preference for in-store shopping experiences where customers can evaluate textures, patterns, and colors before purchase. The convergence of traditional retail strength with growing digital awareness creates favorable conditions for continued market expansion throughout the forecast period.

Philippines Wallpaper Market Trends:

Rising Demand for Digital Customization and Personalized Designs

The Philippines wallpaper market is presently witnessing growing consumer preference for digitally printed and customized wallpaper designs that enable unique interior expressions. Interior design firms across Metro Manila report an increase in the demand for bespoke wallpapers in condominium renovation projects and co-living spaces. This trend aligns with broader shifts toward personalization in home décor, where consumers seek distinctive patterns reflecting individual tastes and lifestyle preferences rather than standard mass-produced options.

Growing Emphasis on Sustainable and Eco-Friendly Materials

Environmental consciousness is reshaping product development in the Philippines wallpaper market as manufacturers introduce eco-friendly wallcovering solutions aligned with global sustainability trends. Non-woven wallpapers made from natural and synthetic fiber blends are gaining popularity due to their breathability, dimensional stability, and reduced environmental impact compared to traditional vinyl alternatives. Consumers increasingly prioritize products featuring low-VOC formulations and recyclable substrates, particularly in residential applications where indoor air quality and health considerations significantly influence purchasing decisions among environmentally aware Filipino homeowners seeking safer interior environments.

Integration of Textured and Three-Dimensional Wall Covering Solutions

Textured wallpapers featuring three-dimensional effects and tactile surfaces are emerging as preferred choices among Filipino consumers and interior designers seeking distinctive aesthetic statements. These innovative products convincingly replicate natural materials including stone, wood, brick, and fabric while offering practical advantages over actual material installations in terms of weight, cost, and installation complexity. The trend reflects broader design preferences toward creating visual depth and engaging sensory experiences in living and working environments without the expense and technical challenges associated with traditional architectural finishes.

Market Outlook 2026-2034:

The Philippines wallpaper market outlook remains positive as favorable macroeconomic conditions and evolving consumer preferences create sustained demand for decorative wall covering solutions. Continued urbanization across major metropolitan areas, combined with government infrastructure initiatives and private sector investments, provides a strong foundation for market expansion. The market generated a revenue of USD 47.48 Million in 2025 and is projected to reach a revenue of USD 62.45 Million by 2034, growing at a compound annual growth rate of 3.09% from 2026-2034. Key growth drivers include expanding commercial real estate development, rising renovation activities in residential properties, and increasing adoption of innovative wallpaper technologies suited for tropical climates. The hospitality sector recovery and tourism industry growth further strengthen demand for premium wall covering solutions across hotels, restaurants, and retail establishments nationwide.

Philippines Wallpaper Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Wallpaper Type |

Vinyl Wallpaper |

36.92% |

|

Distribution Channel |

Offline |

55.94% |

|

End User |

Commercial |

54.09% |

|

Region |

Luzon |

47% |

Wallpaper Type Insights:

- Vinyl Wallpaper

- Non-woven Wallpaper

- Paper-based Wallpaper

- Fabric Wallpaper

- Others

Vinyl wallpaper dominates with a market share of 36.92% of the total Philippines wallpaper market in 2025.

Vinyl wallpaper maintains its leading position in the Philippines market due to its exceptional functional properties that address the unique challenges of tropical environments. The polyvinyl chloride surface layer creates a protective barrier against moisture penetration, making these wallpapers particularly suitable for high-humidity conditions prevalent throughout the archipelago. Commercial establishments including hotels, restaurants, and retail spaces increasingly prefer vinyl options due to their durability, ease of maintenance, and flame-retardant characteristics that meet building safety requirements.

The material's resistance to staining and ability to withstand regular cleaning make it ideal for high-traffic areas where wall surfaces experience frequent contact and potential soiling. The segment continues to benefit from ongoing product innovations that expand design possibilities while maintaining practical performance advantages. Home décor retailers across the Philippines have expanded their wallpaper collections with moisture-resistant vinyl and textured designs specifically tailored for tropical climates, addressing durability concerns in high-humidity environments. Modern vinyl wallpapers offer diverse aesthetic options including patterns mimicking natural materials, three-dimensional textures, and custom digital prints, enabling consumers to achieve sophisticated interior designs without compromising on functionality or long-term performance.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 55.94% of the total Philippines wallpaper market in 2025.

The offline distribution channel maintains dominance in the Philippines wallpaper market as consumers continue to value physical product evaluation before purchasing decorative wall coverings. Physical retail stores enable customers to assess texture, color accuracy, and pattern scale, providing confidence in purchasing decisions for products that significantly impact interior aesthetics. Home improvement retailers and specialty wallpaper showrooms offer expert consultation services that guide consumers through product selection based on specific application requirements and design preferences. Sales associates provide valuable guidance on installation techniques, material suitability for different environments, and complementary design elements that enhance overall interior schemes.

The robust expansion of physical retail infrastructure supports continued channel strength throughout the country. Leading home improvement retailers have accelerated store network expansion across major urban centers and emerging provincial markets, ensuring convenient access to comprehensive product selections for both homeowners and industry professionals. This strategic retail development brings quality wall covering solutions closer to consumers nationwide while maintaining the personalized service experience that drives customer loyalty and repeat purchases in the decorative materials segment.

End User Insights:

- Residential

- Commercial

Commercial exhibits a clear dominance with 54.09% share of the total Philippines wallpaper market in 2025.

The commercial segment leads the Philippines wallpaper market driven by expanding hospitality, retail, and office sectors that increasingly utilize decorative wall coverings to create distinctive brand identities and enhance customer experiences. Hotels, resorts, restaurants, and retail establishments deploy wallpaper strategically to establish thematic environments that differentiate their spaces and reinforce brand positioning. Commercial-grade wallpapers featuring durability, moisture resistance, and easy maintenance properties address operational requirements of high-traffic business environments where walls experience frequent contact and require regular cleaning without compromising visual appeal. The growing emphasis on creating Instagram-worthy interiors further drives commercial adoption as businesses recognize the marketing value of distinctive wall treatments.

The Philippines welcomed nearly 5.65 Million international tourists by December 17, 2024, driving continued investment in hospitality infrastructure and interior renovations that support wallpaper demand. Hotels and resorts across popular destinations including Boracay, Palawan, and Cebu are investing in interior upgrades that incorporate premium wall covering solutions to enhance guest experiences. Office spaces in major business districts are also adopting wallpaper as a cost-effective alternative to traditional finishes for creating professional and visually appealing work environments.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon represents the leading segment with 47% share of the total Philippines wallpaper market in 2025.

Luzon maintains market leadership driven by the concentration of economic activities, population density, and commercial development across Metro Manila and surrounding provinces. The region encompasses key urban and industrial zones including the National Capital Region, CALABARZON, and Central Luzon, which collectively account for a significant portion of the country's GDP and construction activity. Major real estate developers continue expanding residential and commercial projects throughout Luzon, creating sustained demand for interior finishing materials including wallpaper. The presence of numerous condominium developments, commercial complexes, and hospitality establishments generates consistent requirements for quality wall covering solutions across diverse applications.

Government infrastructure initiatives further strengthen Luzon's market position through enhanced regional connectivity and economic development. In April 2024, the Philippines, United States, and Japan launched the Luzon Economic Corridor, a flagship infrastructure initiative designed to link Subic Bay, Clark, Manila, and Batangas to accelerate economic growth. The National Economic and Development Authority proposed 21 projects with an initial cost estimate of PHP 2.1 Trillion for corridor development, supporting real estate expansion and commercial construction activities that drive wallpaper demand.

Market Dynamics:

Growth Drivers:

Why is the Philippines Wallpaper Market Growing?

Rapid Urbanization and Real Estate Development Expansion

The Philippines wallpaper market benefits significantly from accelerating urbanization and sustained real estate development across major metropolitan areas. Rapid population growth in urban centers drives demand for residential housing, condominium developments, and commercial spaces that require interior finishing solutions including decorative wallcoverings. Metro Manila continues to experience substantial construction activity as developers respond to housing demand from a growing middle class and increasing numbers of overseas Filipino workers investing in domestic property. The total condominium stock in Metro Manila's central business districts has expanded steadily in recent years, with new completions adding significant inventory to the residential property landscape. This expansion creates consistent demand for wallpaper products used in unit interiors, common areas, and amenity spaces where developers seek to differentiate their offerings through distinctive interior finishes. Additionally, emerging regional cities including Cebu, Davao, and Iloilo are experiencing similar urbanization trends that extend market opportunities beyond traditional demand centers, as provincial economies grow and attract increased residential and commercial investment.

Expanding Hospitality and Tourism Sector Investment

The Philippines hospitality sector represents a significant growth driver for the wallpaper market as hotels, resorts, restaurants, and entertainment venues invest in interior design to enhance customer experiences and competitive positioning. Tourism recovery following pandemic-related restrictions has stimulated renovation activities and new property development across popular destinations. Hotels and resorts utilize wallpaper extensively to create distinctive themed environments that reflect brand identities and appeal to diverse guest preferences. Commercial-grade wallpapers featuring durability, moisture resistance, and easy maintenance address operational requirements while enabling creative design expressions. The growing trend toward boutique hotels emphasizing Filipino craftsmanship and design authenticity further supports demand for unique wallcovering solutions. Restaurant and retail establishments similarly deploy wallpaper as a cost-effective approach to creating visually engaging spaces that differentiate their offerings.

Government Infrastructure Initiatives and Economic Development Programs

Government investment in infrastructure and economic development programs creates favorable conditions for wallpaper market growth by stimulating broader construction and renovation activities. The Build Better More program focuses on major transportation projects, industrial facilities, and public infrastructure that support commercial real estate development. Enhanced regional connectivity through railway systems, expressways, and port facilities improves accessibility of developing areas, attracting residential and commercial investment. The Luzon Economic Corridor initiative represents a strategic framework for coordinated infrastructure development connecting key economic zones. These investments generate multiplier effects throughout the construction value chain, including demand for interior finishing materials. Government spending on institutional facilities including educational buildings and healthcare facilities further contributes to wallpaper consumption as these structures require durable and aesthetically appropriate wall treatments.

Market Restraints:

What Challenges the Philippines Wallpaper Market is Facing?

Tropical Climate and High Humidity Concerns

The tropical Philippine climate with high humidity levels presents challenges for wallpaper applications as moisture can affect adhesion and long-term durability. Improper installation or inadequate wall preparation in humid environments may result in peeling, bubbling, or mold growth that diminishes product performance. These concerns require careful material selection and professional installation practices that increase overall costs and complexity for consumers.

Competition from Traditional Paint and Alternative Finishes

Paint remains the dominant wall covering choice in the Philippines due to lower cost, ease of application, and widespread familiarity among consumers and contractors. Traditional paint finishes require less specialized installation expertise and offer straightforward maintenance through repainting. Alternative decorative options including textured paints, wall decals, and natural materials compete for consumer attention and budget allocation in interior design decisions.

Consumer Price Sensitivity and Affordability Constraints

Price sensitivity among Philippine consumers limits adoption of premium wallpaper products, particularly in residential applications where budget constraints influence material choices. The relatively higher initial cost of quality wallpaper compared to paint creates barriers for price-conscious homeowners. Installation expenses add to total project costs, further affecting purchasing decisions among consumers unfamiliar with long-term value propositions of durable wallcovering solutions.

Competitive Landscape:

The Philippines wallpaper market features a diverse competitive environment comprising international manufacturers, regional distributors, and local retailers that collectively address varied consumer preferences and price points. Market participants compete through product differentiation, design innovation, distribution network expansion, and customer service excellence. International brands leverage established reputations for quality and design sophistication, while local distributors offer competitive pricing and market-specific product selections. Successful competitors focus on developing moisture-resistant formulations suited for tropical conditions, expanding showroom networks for enhanced customer access, and building partnerships with interior designers, architects, and contractors. Investment in digital marketing and e-commerce capabilities enables market participants to reach broader audiences while maintaining physical retail presence for product evaluation experiences.

Philippines Wallpaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Wallpaper Types Covered | Vinyl Wallpaper, Non-woven Wallpaper, Paper-based Wallpaper, Fabric Wallpaper, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines wallpaper market size was valued at USD 47.48 Million in 2025.

The Philippines wallpaper market is expected to grow at a compound annual growth rate of 3.09% from 2026-2034 to reach USD 62.45 Million by 2034.

Vinyl wallpaper dominated the market with a share of 36.92%, owing to its exceptional moisture resistance, durability, and suitability for tropical climate conditions across residential and commercial applications.

Key factors driving the Philippines wallpaper market include rapid urbanization and real estate development, expanding hospitality and commercial sectors, and government infrastructure initiatives supporting construction activities nationwide.

Major challenges include high humidity and tropical climate concerns affecting wallpaper performance, competition from traditional paint finishes and alternative decorative materials, consumer price sensitivity, and limited awareness of wallpaper benefits among residential consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)