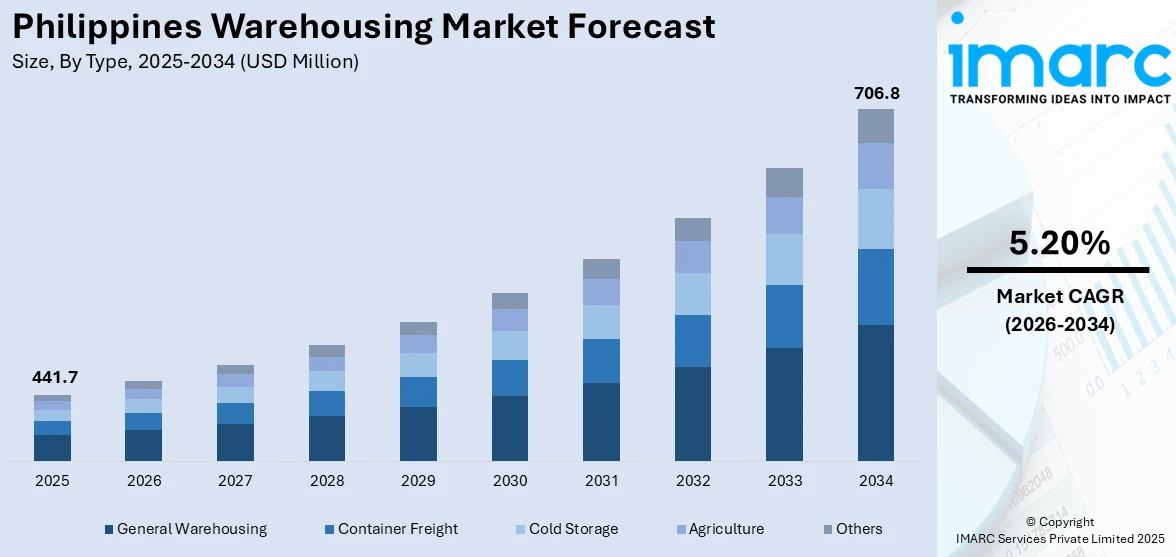

Philippines Warehousing Market Report by Type (General Warehousing, Container Freight, Cold Storage, Agriculture, and Others), End User (Food and Beverages, Chemicals and Materials, Electronics, Pharmaceutical, Consumer Durables, and Others), and Region 2026-2034

Philippines Warehousing Market Overview:

The Philippines warehousing market size reached USD 441.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 706.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.20% during 2026-2034. There are various factors that are driving the market, which include numerous collaborations between key players, the thriving e-commerce industry, rising focus on supply chain optimization, and favorable government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 441.7 Million |

|

Market Forecast in 2034

|

USD 706.8 Million |

| Market Growth Rate 2026-2034 | 5.20% |

Philippines Warehousing Market Trends:

Collaborations between Key Players

Warehousing developers are collaborating with logistics companies to design and construct custom-built facilities that meet the specific needs of the logistics providers to ensure efficient operations and maximize space utilization. In addition, real estate developers are partnering with financial institutions or institutional investors in joint ventures in order to finance massive warehouse projects. This collaboration allows developers to access capital while investors gain exposure to the growing warehousing market. Furthermore, major firms in the industry are participating in mergers and acquisitions (M&As) as to increase their geographic reach, diversify their service offerings, or consolidate market share. These strategic collaborations allow companies to leverage each other's strengths and achieve synergies in operations and increasing consumer base. For instance, on 22 March 2024, global logistics leader UPS announced that it would begin the construction of a new logistics hub at Clark International Airport in the Philippines as part of its continued investment in Asia Pacific operations.

To get more information of this market Request Sample

Thriving E-Commerce Sector

There is an increase in the need for warehousing facilities due to the thriving e-commerce sector. With the rise of online shopping, e-commerce companies require extensive warehousing facilities to store inventory. This need for storage space is leading to the development of large-scale fulfillment centers and distribution hubs across the country. Furthermore, e-commerce companies are investing in last-mile delivery centers located closer to urban areas to expedite order fulfillment and meet user expectations for fast shipping times. They rely on efficient inventory management systems to track stock levels, monitor sales trends, and forecast demand accurately. Additionally, warehousing providers equipped with advanced inventory management technologies can offer value-added services to e-commerce clients such as real time inventory visibility and automated replenishment. According to the International Trade Administration (ITA), Philippines’ e-commerce market sales are estimated to reach US$ 24 Billion by 2025.

Philippines Warehousing Market News:

- 10 April 2024: Cemex Philippines launched a new 1500m2 warehouse in Barangay Pangao West, Batangas, to enhance its supply chain capabilities and meet the growing need for building supplies in the area. In addition, this opening coincides with the Philippine national government's allocation of US$ 17.7 Billion for infrastructure development in 2024. Furthermore, the facility will supply cement to neighboring provinces.

- 31 December 2023: Brenntag unveiled its new warehouse facility in Mamplasan, Laguna, Philippines. It is located approximately 16 km away from the Brenntag office in Alabang and aims to improve the accessibility for Brenntag's clients. The warehouse, which occupies 4,000 square meters, has the ability to store 4,000 pallet positions, 500 of which are in its temperature-controlled room, 500 of which are in its dangerous goods (DG) section, and 3,000 of which are in its ambient warehouse.

Philippines Warehousing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- General Warehousing

- Container Freight

- Cold Storage

- Agriculture

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes general warehousing, container freight, cold storage, agriculture, others.

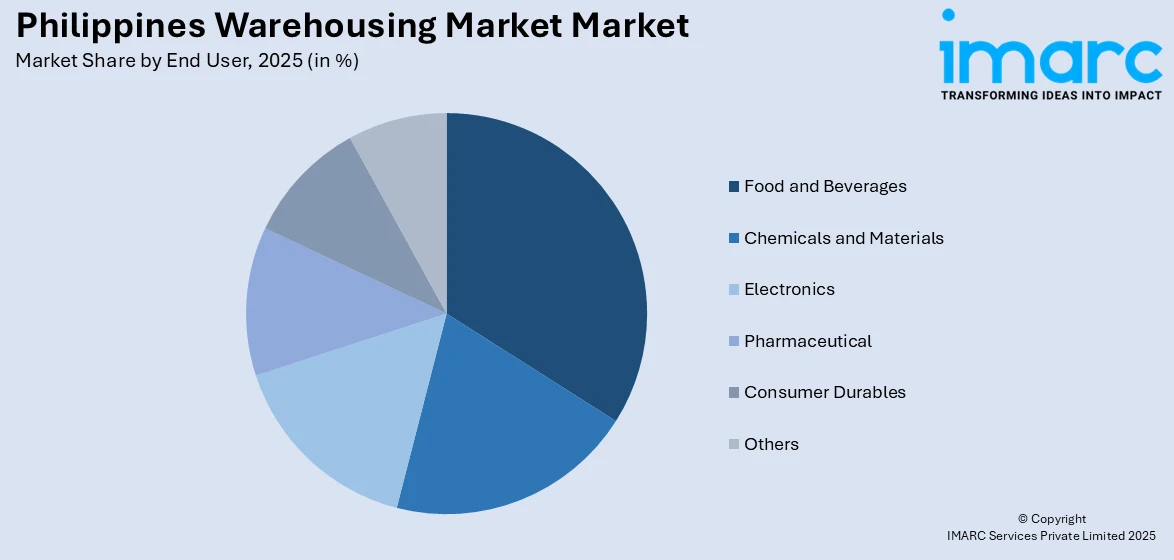

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Chemicals and Materials

- Electronics

- Pharmaceutical

- Consumer Durables

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverages, chemicals and materials, electronics, pharmaceutical, consumer durables, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Warehousing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | General Warehousing, Container Freight, Cold Storage, Agriculture, Others |

| End Users Covered | Food and Beverages, Chemicals and Materials, Electronics, Pharmaceutical, Consumer Durables, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines warehousing market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Philippines warehousing market?

- What is the breakup of the Philippines warehousing market on the basis of type?

- What is the breakup of the Philippines warehousing market on the basis of end user?

- What are the various stages in the value chain of the Philippines warehousing market?

- What are the key driving factors and challenges in the Philippines warehousing?

- What is the structure of the Philippines warehousing market and who are the key players?

- What is the degree of competition in the Philippines warehousing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines warehousing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines warehousing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines warehousing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)