Philippines Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2025-2033

Philippines Watch Market Size and Share:

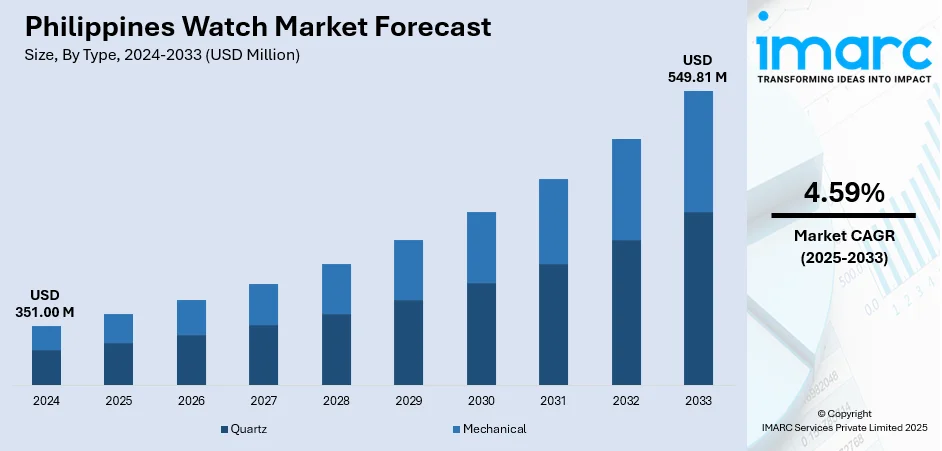

The Philippines watch market size reached USD 351.00 Million in 2024. The market is projected to reach USD 549.81 Million by 2033, exhibiting a growth rate (CAGR) of 4.59% during 2025-2033. The market is evolving steadily, driven by growing interest in both classic timepieces and modern smartwatches. With a mix of affordability, brand variety, and expanding digital retail, the market caters to a wide consumer base from fashion-conscious buyers to tech-oriented users. Shifting lifestyle preferences and increased online accessibility are influencing purchasing behavior, especially among younger consumers. As demand diversifies across regions and categories, there is a notable upward trend in the Philippines watch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 351.00 Million |

| Market Forecast in 2033 | USD 549.81 Million |

| Market Growth Rate 2025-2033 | 4.59% |

Key Trends of Philippines Watch Market:

E-commerce Driving Market Expansion

As of June 2024, the Philippine e-commerce sector recorded significant growth in consumer transactions, directly influencing the watches market. This digital expansion has shifted consumer behavior towards online watch purchases, where shoppers access diverse collections ranging from affordable quartz to mid-tier mechanical models. Mobile wallets and digital payment systems facilitate seamless transactions, increasing confidence and convenience. Social media platforms such as TikTok and Instagram have amplified marketing reach, enabling watch brands to engage directly with younger demographics through influencer collaborations and live streaming. Brick-and-mortar retailers are responding by integrating omni-channel experiences like click-and-collect and virtual try-ons, merging physical and digital shopping. The result is enhanced accessibility, especially for buyers beyond Metro Manila, expanding watch ownership across income groups. This evolving ecosystem is a key driver behind the sustained Philippines watch market growth. Retailers continuously innovate by leveraging digital tools and data analytics to tailor offerings, maintaing relevance amid rising competition. E-commerce is thus central to redefining consumer interactions and accelerating market penetration.

To get more information on this market, Request Sample

Acceleration of Smartwatch Adoption

In early 2024, studies highlighted rising smartwatch adoption in the Philippines, driven by health-conscious Millennials and Gen Z. Consumers increasingly seek devices that combine fitness tracking, heart rate monitoring, and smartphone connectivity, integrating wellness into everyday life. Smartwatches are no longer just functional gadgets but fashion accessories, with customizable watch faces and bands appealing to diverse tastes. Government wellness campaigns and mobile health apps have boosted awareness of wearables’ benefits, especially for preventive health monitoring. Hybrid watches blending analog design with digital functionality have gained popularity, offering the best of both worlds. Retailers are expanding their product ranges, in response, often including product demonstrations and user education to increase acceptance across age groups. This shift marks a fundamental change in consumer preferences and purchase criteria. As smartwatches become essential lifestyle tools, the Philippines watch market trends are evolving towards connected, health-oriented wearables, broadening the market beyond traditional timepieces and driving category growth.

Growing Popularity of Filipino Microbrands

Since early 2024, Filipino watch microbrands have gained increasing attention, driven by a rising appreciation for locally inspired, artisanal timepieces. Brands such as Makina have been recognised for blending traditional Filipino craftsmanship with modern aesthetics. One notable example is the Uriel model, designed to commemorate the Philippines’ participation in the Olympics, showcasing national themes through thoughtful design. These microbrands focus on sustainability, limited production runs, and strong cultural narratives, which appeal to buyers seeking emotional connection and design uniqueness. The use of indigenous materials and motifs further reinforces local identity. Collectors and enthusiasts are supporting these movements through dedicated forums and watch fairs, helping grow awareness and value within niche circles. The secondary market for such pieces is also expanding, reflecting trust in their craftsmanship and long-term appeal. This trend is not just aesthetic it signifies deeper cultural pride and a shift away from mass-produced global options. As a result, Filipino watchmakers are establishing a distinct space in the industry, contributing substantively.

Growth Drivers of Philippines Watch Market:

Rising Disposable Incomes and Growing Middle Class

The Philippines has experienced sustained economic growth, leading to a burgeoning middle class with higher disposable incomes. This permits additional Filipinos to make investments in discretionary materials such as watches, which are presented as a status symbol and fashion accessory. With an increase in the level of financial stability, consumers are moving towards more aspirational and truly premium products. The shift in consumer behavior is evident with watches being regarded as a symbol of personal fashion and success rather than just a tool. The need to possess finely made and branded watches as a personal delight or as a gift propels the demand at different price levels. High rates of urbanization during this period make the lifestyles to changes since more Filipinos are adopting modern consumer behavior. Urban dwellers, with their busy schedules and greater exposure to global trends, are more inclined to purchase watches as part of their everyday ensemble or for specific occasions, further driving Philippines watch market demand.

Strong Appreciation for Luxury and Collectible Timepieces

Luxury watches hold significant cultural importance in the Philippines as symbols of prestige and achievement. The luxury Rolex and Patek brands are especially so, and people buy them not only because of how they look on their wrists but also because they feel that they are making an investment since some models can gain value over time on the secondary market. This fuels initial sales as well as recreational cost-effective pre-owned markets. The Philippines is developing into a community of avid watch wearers and collectors. Such people have an interest in horology and are willing to buy specific designs, complex mechanisms, and exclusive editions. Their exquisite taste and readiness to spend on a variety of assortments enable them to play a role in the premium end. The strong presence of renowned international watch brands in the Philippines, coupled with the influence of global fashion and luxury trends, impacts local consumer preferences. Filipinos are increasingly exposed to a wider array of designs and innovations, encouraging them to explore both established luxury brands and emerging independent watchmakers.

Expanding Retail Landscape and Accessibility

The continuous development of high-end shopping malls and dedicated luxury watch boutiques in major cities like Manila and Cebu provides consumers with greater access to a diverse range of watch brands. According to the Philippines watch market analysis, these physical retail spaces offer an immersive shopping experience, allowing customers to try on watches and receive personalized service. Beyond luxury, the market is also driven by the availability of watches across various price points, catering to different consumer segments. From affordable fashion watches to mid-range automatic timepieces, the broad spectrum of choices ensures that there is a watch for every budget, expanding the overall consumer base. Watch brands, both international and local, are actively engaging Filipino consumers through targeted marketing campaigns, collaborations, and community events. These efforts raise brand awareness, educate consumers about horology, and create a stronger connection with potential buyers, stimulating demand.

Philippines Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, price range, distribution channel, and end user.

Type Insights:

- Quartz

- Mechanical

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury.

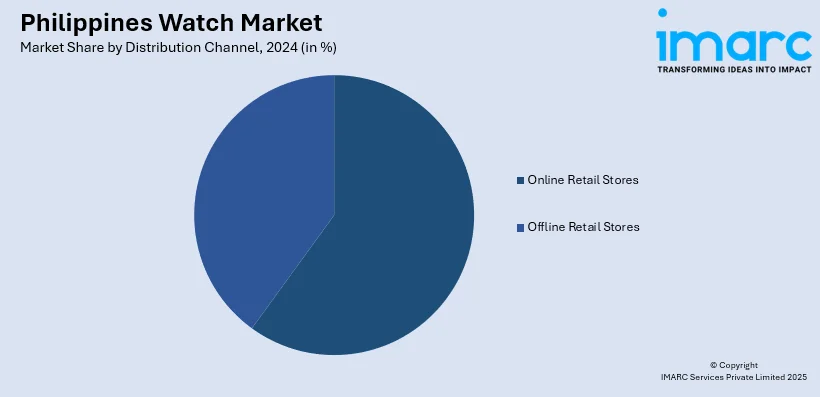

Distribution Channel Insights:

- Online Retail Stores

- Offline Retail Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail stores and offline retail stores.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and unisex.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Watch Market News:

- May 2025: Danish watchmaker Bering has opened its first independent boutique in the Philippines at SM City North Edsa. The boutique showcases Bering's Scandinavian design ethos, including watches made with long-lasting materials like sapphire crystal, titanium, and ocean plastic recycled into a material that can be reused as water-resistant plastic. The launch of the store was accompanied by a Scandinavian-themed celebration of the brand's design roots. This growth underscores Bering's dedication to quality and sustainability as it solidifies its position in the Philippine market.

- October 2024: Argos Watches Philippines is a Filipino microbrand founded by Ivan Jeff Soberano and Gregory Yu. Emerging from a shared passion for horology, the brand aims to create globally competitive Filipino timepieces. Combining modern design with reliable Japanese mechanical movements, Argos offers collections like the Odyssey and Asteri that highlight craftsmanship and innovation. The company collaborates with other local watchmakers, including De Guzman & Co. and Ibarra Watches, contributing to the growth and recognition of the Philippine watchmaking industry.

Philippines Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines watch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines watch market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The watch market in the Philippines was valued at USD 351.00 Million in 2024.

The Philippines watch market is projected to exhibit a CAGR of 4.59% during 2025-2033.

The Philippines watch market is projected to reach a value of USD 549.81 Million by 2033.

The Philippines watch market is witnessing trends driven by rising demand for smartwatches, growing interest in luxury timepieces, and the popularity of affordable fashion watches among younger consumers. Online retail channels and brand collaborations are further shaping buying behavior, reflecting a blend of technology, style, and status in consumer preferences.

The Philippines watch market is driven by increasing disposable incomes, a rising preference for smart and connected devices, and growing fashion consciousness among younger consumers. Expanding e-commerce platforms and wider brand availability further enhance accessibility, fueling demand for both luxury and affordable watches nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)