Philippines Wood Pellet Market Size, Share, Trends and Forecast by Feedstock Type, Application, and Region, 2026-2034

Philippines Wood Pellet Market Summary:

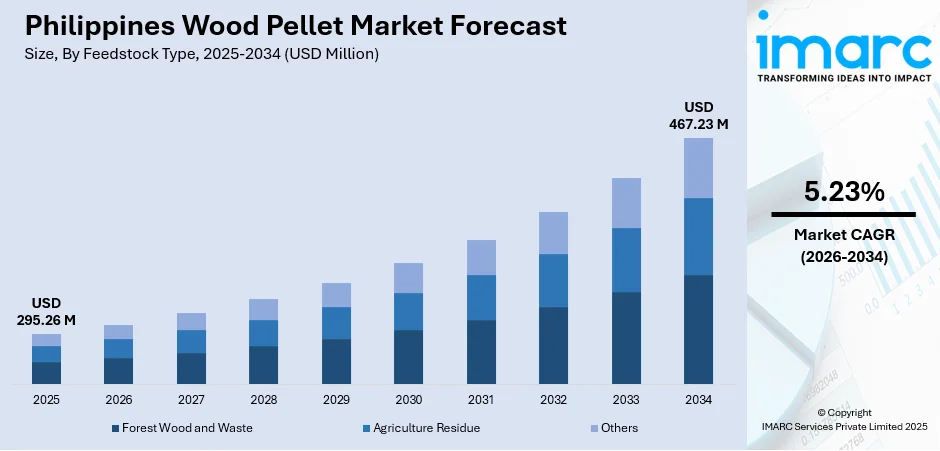

The Philippines wood pellet market size was valued at USD 295.26 Million in 2025 and is projected to reach USD 467.23 Million by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

The Philippines wood pellet market is experiencing robust growth as the country accelerates its renewable energy transition and seeks alternatives to fossil fuel dependency. Rising industrial demand from power generation facilities and manufacturing plants drives consumption of biomass fuels as cost-effective and environmentally sustainable solutions. Government initiatives promoting clean energy adoption and supportive policy frameworks encourage domestic production while expanding export potential to regional markets in Japan and South Korea seeking certified sustainable biomass sources.

Key Takeaways and Insights:

-

By Feedstock Type: Forest wood and waste dominates the market with a share of 60% in 2025, driven by abundant forestry residues from furniture manufacturing clusters and sustainable plantation harvests across the archipelago.

-

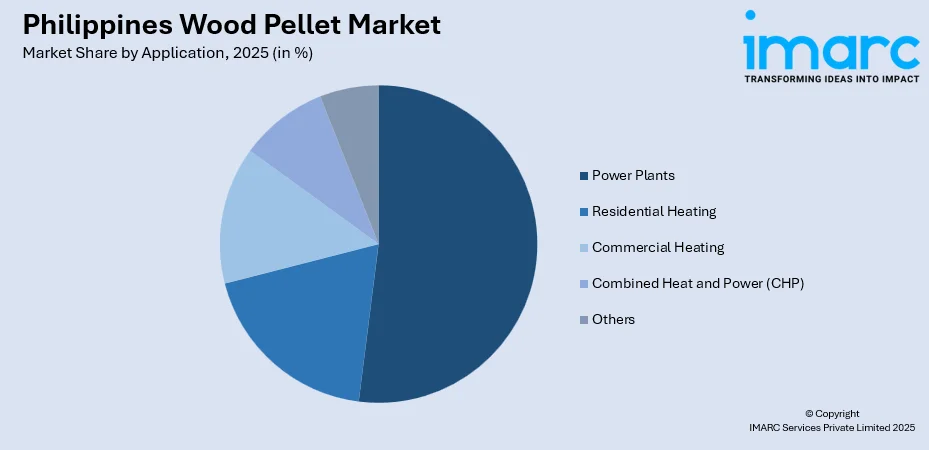

By Application: Power plants lead the market with a share of 52% in 2025, supported by biomass energy integration into the national grid and coal-to-biomass conversion programs at existing thermal facilities.

-

By Region: Luzon represents the largest region with a market share of 64% in 2025, attributed to concentrated industrial activity, major power generation infrastructure, and proximity to key furniture manufacturing hubs.

-

Key Players: The Philippines wood pellet market exhibits a fragmented competitive structure characterized by a mix of domestic producers, agricultural cooperatives, and emerging industrial manufacturers. Regional players leverage proximity to feedstock sources and established relationships with biomass power facilities, while new market entrants focus on quality certification and export-oriented production capabilities.

To get more information on this market Request Sample

The Philippines wood pellet industry benefits from the nation's abundant biomass resources, including agricultural residues from rice, coconut, and sugarcane processing alongside sustainable forestry yields. The Department of Energy has approved 18 biomass projects with over 182 MW in potential capacity as of 2023, reflecting governmental commitment to expanding renewable generation infrastructure. Industrial adoption continues accelerating as manufacturers recognize wood pellets as economically viable alternatives to conventional fossil fuels for boiler operations and process heating requirements. The country's strategic geographic position enhances export competitiveness, particularly serving growing Asian markets where Japan aims to increase biomass contributions to its energy supply through 2040. Technological advancements in pellet processing equipment improve production efficiency while quality assurance investments enable Philippine producers to meet international sustainability certification requirements. The convergence of favorable policy frameworks, abundant feedstock availability, and expanding domestic and export demand creates substantial growth momentum across the forecast period.

Philippines Wood Pellet Market Trends:

Integration of Alternative Feedstock Materials

The Philippine wood pellet industry is actively diversifying beyond traditional forest resources to incorporate agricultural residues and fast-growing energy crops as viable alternative feedstocks. Producers are exploring materials including rice husks, coconut shells, sugarcane bagasse, and napier grass to effectively supplement conventional wood sources. This strategic feedstock diversification addresses seasonal availability challenges while reducing dependency on forest resources and creating valuable additional revenue streams for agricultural communities throughout the archipelago. The approach also enhances supply chain resilience by enabling year-round production regardless of timber harvesting cycles.

Coal-to-Biomass Conversion Initiatives

Power generation facilities across the Philippines are increasingly implementing coal-to-biomass conversion strategies to reduce carbon emissions while maintaining baseload capacity. The country's wide coal utilization infrastructure enables relatively straightforward blending or full conversion of coal furnaces and boilers to biomass with minor technical adjustments. This transition pathway allows utilities to leverage existing plant infrastructure while progressively decarbonizing their generation portfolios in alignment with national renewable energy targets. Industrial operators benefit from reduced fuel costs and improved environmental compliance while supporting domestic biomass fuel suppliers.

Export Market Development and Quality Certification

Philippine wood pellet producers are investing in quality certification systems to access lucrative export markets in Japan and South Korea, where biomass sustainability reporting has become mandatory. Local manufacturers are upgrading pellet processing machinery and implementing rigorous quality assurance protocols to meet international standards and environmental compliance requirements. These strategic investments position the Philippines as a competitive regional supplier within the rapidly expanding Asian biomass trade. Enhanced export competitiveness and improved market access opportunities enable producers to capture premium pricing while diversifying revenue beyond domestic consumption channels.

Market Outlook 2026-2034:

The Philippines wood pellet market outlook remains positive as renewable energy mandates drive sustained demand growth through the forecast period. Strategic investments in pellet production facilities near furniture manufacturing clusters and agricultural processing zones will enhance feedstock utilization efficiency and cost competitiveness. In order to attain energy security, the Philippine government plans to develop emerging technologies, encourage energy efficiency and conservation, and raise the country's percentage of renewable energy (RE) in the supply mix to 35% by 2030 and 50% by 2050. This policy certainty encourages continued investment in production capacity expansion and technology upgrades. The market generated a revenue of USD 295.26 Million in 2025 and is projected to reach a revenue of USD 467.23 Million by 2034, growing at a compound annual growth rate of 5.23% from 2026-2034.

Philippines Wood Pellet Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Feedstock Type |

Forest Wood and Waste |

60% |

|

Application |

Power Plants |

52% |

|

Region |

Luzon |

64% |

Feedstock Type Insights:

- Forest Wood and Waste

- Agriculture Residue

- Others

The forest wood and waste dominates with a market share of 60% of the total Philippines wood pellet market in 2025.

Forest wood and waste materials constitute the primary feedstock source for Philippine wood pellet production, benefiting from the nation's extensive timber processing infrastructure and furniture manufacturing activities. The Philippines has more than 1.5 million hectares under bamboo cultivation, providing substantial raw material availability for pellet production alongside traditional wood residues. Sawmill byproducts, logging residues, and furniture manufacturing waste streams supply consistent feedstock volumes, enabling producers to maintain stable operations throughout the year without significant seasonal variations.

The abundance of forest resources across major island groups provides geographic distribution advantages for pellet manufacturing facilities seeking to minimize transportation costs and ensure reliable feedstock access. Sustainable forestry practices under the National Greening Program support long-term resource availability while meeting international certification requirements demanded by export markets. The CARAGA region stands as the country's biggest lumber producer with extensive forestlands spanning across Surigao del Sur, Surigao del Norte, Agusan del Sur, and Agusan del Norte, representing a substantial feedstock reservoir for regional wood pellet production expansion and supporting market growth.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Power Plants

- Residential Heating

- Commercial Heating

- Combined Heat and Power (CHP)

- Others

The power plants lead with a share of 52% of the total Philippines wood pellet market in 2025.

Power generation facilities represent the dominant application segment for wood pellet consumption in the Philippines, driven by national renewable energy mandates and grid decarbonization objectives. The Department of Energy has set a goal to add at least an additional 277 MW of biomass capacity by 2027, creating substantial demand for pellet fuel supplies across the country. Multiple biomass power plants also demonstrate successful commercial-scale wood pellet utilization for electricity generation to meet growing energy requirements.

The compatibility of wood pellets with existing coal-fired infrastructure enables utilities to implement blending strategies that progressively reduce fossil fuel dependency without requiring complete plant replacements. Industrial boilers at manufacturing facilities are increasingly adopting biomass fuels to reduce energy costs while meeting corporate sustainability commitments. The government's Philippine Energy Plan targets renewable energy share in the generation mix by 2030, providing long-term policy certainty that encourages continued investment in biomass power capacity expansion and supporting wood pellet demand.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits a clear dominance with a 64% share of the total Philippines wood pellet market in 2025.

Luzon's market leadership reflects its concentration of industrial activity, power generation infrastructure, and proximity to major furniture manufacturing clusters in Metro Manila, Pampanga, and CALABARZON regions. The island accounts for the majority of national gross power generation, creating the substantial baseline demand for biomass fuel sources. Growing electricity consumption during peak summer months drives urgency for renewable capacity additions including biomass generation, positioning wood pellets as essential alternative fuel supplies.

The region's established industrial base, sophisticated logistics networks, and access to multiple timber import and export ports enhance its competitive position as the primary wood pellet consumption and production hub within the Philippine market. Manufacturing facilities across Luzon increasingly adopt biomass fuels for industrial boiler operations and process heating applications. This convergence of energy demand, infrastructure availability, and feedstock accessibility reinforces Luzon's dominance in driving overall market expansion throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Philippines Wood Pellet Market Growing?

Government Renewable Energy Targets and Policy Support

The Philippine government's ambitious renewable energy objectives create sustained demand drivers for wood pellet consumption across power generation and industrial applications. The National Renewable Energy Program establishes clear long-term policy direction for biomass fuel investment, demonstrating concrete regulatory support for biomass energy development. Feed-in tariff mechanisms and renewable portfolio standards provide financial incentives that improve project economics for biomass power facilities relying on wood pellet fuel supplies. These supportive policy frameworks encourage continued private sector investment in pellet production capacity and biomass power generation infrastructure throughout the country.

Abundant Feedstock Availability and Agricultural Integration

The Philippines possesses extensive biomass resources including agricultural residues, forestry waste, and industrial byproducts that provide reliable and cost-effective feedstock supplies for wood pellet production. The agricultural sector generates substantial biomass annually including rice husks, coconut shells, corn cobs, and sugarcane bagasse, offering diverse raw material sources for pellet manufacturing. This feedstock abundance enables producers to maintain competitive production costs while creating additional income streams for farming communities through agricultural residue sales. Integration with existing wood processing industries around furniture manufacturing clusters provides consistent sawmill residue supplies supporting year-round production operations.

Export Market Opportunities in Asia-Pacific Region

Growing demand for wood pellets across Asian markets creates substantial export opportunities for Philippine producers meeting international quality and sustainability certification standards. Japan has established biomass power targets requiring significant import volumes, creating substantial requirements that regional suppliers can effectively address. The Philippines' geographic proximity to these major consuming markets provides logistical advantages over distant competitors while regional trade agreements facilitate cross-border biomass commerce. Philippine producers investing in quality certification systems gain access to premium-priced export channels that improve overall market profitability and enhance long-term competitiveness.

Market Restraints:

What Challenges the Philippines Wood Pellet Market is Facing?

Infrastructure and Logistics Constraints

The archipelagic geography of the Philippines creates transportation challenges that increase distribution costs and complicate feedstock aggregation from dispersed agricultural areas. Inter-island shipping requirements add logistical complexity and expense to supply chain operations, particularly for producers seeking to consolidate feedstock from multiple sources across different island groups, limiting operational efficiency and market reach.

Limited Domestic Production Capacity

Current wood pellet production capacity in the Philippines remains insufficient to meet growing domestic demand while capturing export market opportunities. Capital-intensive pellet manufacturing equipment requirements and technical expertise needs create significant barriers for new market entrants seeking to expand production volumes, achieve economies of scale, and compete effectively in regional markets.

Competition from Alternative Energy Sources

Wood pellets face competition from solar photovoltaic, wind, and other renewable technologies that offer declining cost trajectories and simpler deployment requirements. Large-scale solar and offshore wind investments receiving substantial policy attention and foreign investment may divert resources, government focus, and financing availability from biomass energy development priorities across the country.

Competitive Landscape:

The Philippines wood pellet market exhibits a fragmented competitive structure with participation from domestic agricultural processors, timber industry participants, and emerging dedicated biomass fuel manufacturers. Regional players leverage established relationships with local feedstock suppliers and proximity to consumption centers to maintain competitive advantages in specific geographic markets. Market consolidation trends are emerging as larger industrial groups recognize biomass fuel opportunities and pursue vertical integration strategies. Quality certification investments and export market development capabilities increasingly differentiate leading producers from smaller operators focused solely on domestic distribution channels.

Philippines Wood Pellet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstock Types Covered | Forest Wood and Waste, Agriculture Residue, Others |

| Applications Covered | Power Plants, Residential Heating, Commercial Heating, Combined Heat and Power (CHP), Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines wood pellet market size was valued at USD 295.26 Million in 2025.

The Philippines wood pellet market is expected to grow at a compound annual growth rate of 5.23% from 2026-2034 to reach USD 467.23 Million by 2034.

Forest wood and waste dominated the market with 60% share in 2025, driven by abundant forestry residues from furniture manufacturing clusters and sustainable plantation harvests across the archipelago.

Key factors driving the Philippines wood pellet market include government renewable energy targets, abundant agricultural and forestry feedstock availability, and growing export opportunities.

Major challenges include infrastructure and logistics constraints due to archipelagic geography, limited domestic production capacity requiring capital-intensive investments, and competition from alternative renewable energy sources attracting policy attention.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)