Philippines Wound Care Market Report by Product Type (Advance Wound Care Products, Surgical Wound Care Products, Traditional Wound Care Products, Active Wound Care Products, Wound Therapy Devices Products), Wound Type (Chronic Wounds, Acute Wounds), End User (Hospitals and Clinics, Long-Term Care Facilities, Home Care Setting, and Others), and Region 2025-2033

Philippines Wound Care Market Overview:

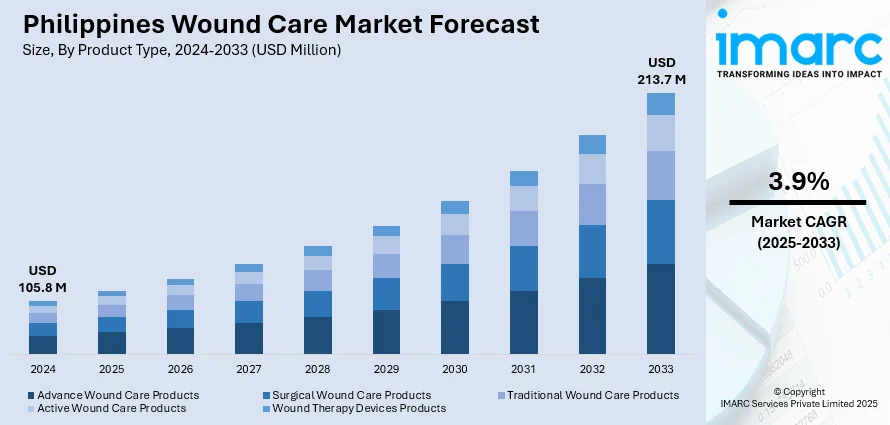

The Philippines wound care market size reached USD 105.8 Million in 2024. Looking forward, the market is expected to reach USD 213.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.9% during 2025-2033. The market is expanding due to rising awareness of advanced treatments, greater healthcare access, and demand for innovative products such as hydrocolloid dressings and antimicrobial solutions. Growing hospital investments, home healthcare adoption, and focus on faster healing drive industry development, strengthening overall competitiveness in the Philippines wound care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 105.8 Million |

| Market Forecast in 2033 | USD 213.7 Million |

| Market Growth Rate 2025-2033 | 3.9% |

Key Trends of Philippines Wound Care Market:

Increasing prevalence of chronic wounds

Chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, are a growing concern due to factors like diabetes, obesity, and the aging population. In line with this, in the Philippines, diabetic foot ulcers are prevalent, constituting 16-20% of annual emergency room admissions at the Philippine General Hospital (PGH). Moreover, in 2021, the total adult population in the Philippines was 66,754,400, with a 7.5% prevalence of diabetes among adults, resulting in a total of 4,303,899 cases of diabetes in adults. Consequently, this high prevalence of diabetes that frequently results in complications like diabetic foot ulcers is bolstering the demand for sophisticated wound care techniques, creating a positive outlook for market expansion.

To get more information of this market, Request Sample

Rising geriatric population

As per the Philippine Statistics Authority (PSA) data, the Commission on Population and Development (Popcom) reports a notable increase in the Filipino elderly population, rising from 5.9% in 2000 to 8.5% in 2020. This significant expansion over two decades highlights shifting demographic trends, which, in turn, has heightened the importance of addressing elderly care needs. The elderly people are more prone to chronic illnesses, reduced mobility, and impaired wound healing, making them a significant demographic for wound care products and services. Age-related wounds like pressure ulcers and venous leg ulcers are becoming more common among the expanding population of elderly people, spurring the need for advanced wound care solutions tailored to the specific needs of the elderly population, thereby impelling the Philippines wound care market growth.

Advancements in wound care products and technologies

Continuous technological innovations, such as advanced dressings, negative pressure wound therapy, and bioengineered skin substitutes, are enhancing the efficacy and efficiency of wound healing processes. These innovations offer benefits such as faster healing, reduced risk of infections, and improved patient comfort. Furthermore, remote wound assessment and management are becoming easier with the use of telemedicine and digital wound monitoring technologies, especially in rural areas with poor access to medical facilities. In addition to this, the growing awareness among healthcare professionals about the importance of evidence-based wound care practices and the availability of innovative wound care products improve patient outcomes and reduce healthcare costs associated with wound management. This synergy between technological advancements and healthcare expertise is fostering the expansion of the wound care market, ensuring better care delivery and outcomes for patients across diverse healthcare settings.

Growth Drivers of Philippines Wound Care Market:

Expanding Healthcare Infrastructure and Digital Health Integration

The Philippines is experiencing significant healthcare infrastructure development, with government initiatives prioritizing primary and emergency care systems to ensure universal healthcare access. The 2024 agenda of the Department of Health to enhance the performance of healthcare provision by increasing the number of healthcare facilities and enhancing the quality of medical care provision is generating significant prospects in the adoption of wound care products. Electronic transformation of health, such as the use of telemedicine and remote monitoring, patients are increasing access to wound care, especially in rural regions where health care facilities are limited. This Philippines wound care market analysis reveals that healthcare infrastructure modernization is driving demand for advanced wound management solutions. The integration of digital wound monitoring technologies and telemedicine consultations enables better patient outcomes while reducing healthcare costs associated with wound complications.

Rising Chronic Disease Prevalence and Aging Demographics

The Philippines faces an increasing prevalence of chronic diseases, particularly diabetes, which affects 7.5% of the adult population, resulting in approximately 4.3 million diabetes cases. Diabetic foot ulcers constitute 16-20% of annual emergency room admissions at major hospitals, creating substantial demand for specialized wound care products. The aging population has grown from 5.9% in 2000 to 8.5% in 2020, representing significant demographic shifts that increase wound care requirements. Elderly populations are more susceptible to pressure ulcers, venous leg ulcers, and impaired wound healing, driving demand for age-appropriate wound management solutions. This demographic transition, combined with lifestyle-related chronic conditions, is generating sustained Philippines wound care market demand across diverse healthcare settings and patient populations.

Technological Advancements and Evidence-Based Care Adoption

Continuous innovation in wound care technologies, including advanced dressings, negative pressure wound therapy, and bioengineered skin substitutes, is revolutionizing treatment efficacy and patient comfort. Healthcare professionals are increasingly adopting evidence-based wound care practices, recognizing the importance of advanced technologies in improving patient outcomes and reducing treatment costs. Telemedicine and digital wound monitoring systems are enabling remote assessment and management capabilities, particularly beneficial for patients in geographically isolated areas. Smart dressings, AI-driven diagnostic tools, and bioengineered tissue solutions are becoming standard treatment options in progressive healthcare facilities. These technological advancements are enhancing healing rates, reducing infection risks, and improving overall treatment efficiency, thereby driving the market share expansion across multiple product categories.

Philippines Wound Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, wound type, and end user.

Product Type Insights:

- Advance Wound Care Products

- Foam Dressing

- Hydrocolloid Dressing

- Film Dressing

- Alginate Dressing

- Hydrogel Dressing

- Collagen Dressing

- Others

- Surgical Wound Care Products

- Sutures

- Staplers

- Tissue Adhesive, Sealants and Hemostats

- Anti-effective Dressing

- Traditional Wound Care Products

- Medical Tapes

- Cleansing Agent

- Active Wound Care Products

- Biological Skin Substitutes

- Topical Agents

- Wound Therapy Devices Products

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Wound Assessment and Monitoring Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes advance wound care products (foam dressing, hydrocolloid dressing, film dressing, alginate dressing, hydrogel dressing, collagen dressing, and others), surgical wound care products (sutures, staplers, tissue adhesive, sealants and hemostats, and anti-effective dressing), traditional wound care products (medical tapes and cleansing agent), active wound care products (biological skin substitutes and topical agents), and wound therapy devices products (negative pressure wound therapy, oxygen and hyperbaric oxygen equipment, electric stimulation devices, pressure relief devices, wound assessment and monitoring devices, and others).

Wound Type Insights:

- Chronic Wounds

- Diabetics Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Others

- Acute Wounds

- Surgical Traumatic Wounds

- Burns

A detailed breakup and analysis of the market based on the wound type have also been provided in the report. This includes chronic wounds (diabetics ulcers, pressure ulcers, venous leg ulcers, and others) and acute wounds (surgical traumatic wounds and burns).

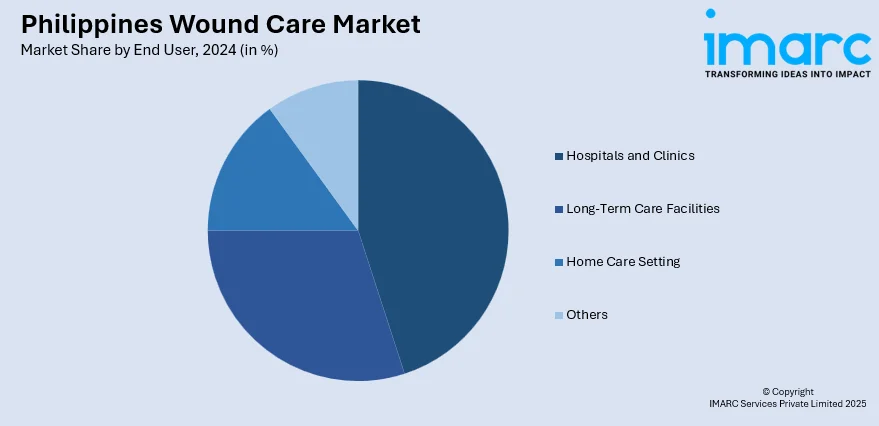

End User Insights:

- Hospitals and Clinics

- Long-Term Care Facilities

- Home Care Setting

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, long-term care facilities, home care setting, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Wound Care Market News:

- In December 2023, The Wound Pros, a trailblazer in advanced wound care solutions, proudly unveiled its "Wound Care Without Walls" program in the Philippines. Reflecting its global healthcare dedication, this initiative extends services beyond the US, demonstrating the company's commitment to improving healthcare accessibility worldwide.

Philippines Wound Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Wound Types Covered |

|

| End Users Covered | Hospitals and Clinics, Long-Term Care Facilities, Home Care Setting, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines wound care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines wound care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines wound care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines wound care market was valued at USD 105.8 Million in 2024.

The Philippines wound care market is projected to exhibit a CAGR of 3.9% during 2025-2033.

The Philippines wound care market is projected to reach a value of USD 213.7 Million by 2033.

The market experiences steady growth driven by chronic wound prevalence, aging demographics, and technological advancement adoption. Digital health integration through telemedicine enables remote wound monitoring, while evidence-based care practices also improve treatment outcomes and operational efficiency.

The Philippines wound care market analysis indicates growth driven by expanding healthcare infrastructure, rising chronic disease prevalence, and technological innovations. Digital health integration, aging population demographics, and evidence-based care adoption further accelerate market expansion across healthcare facilities nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)