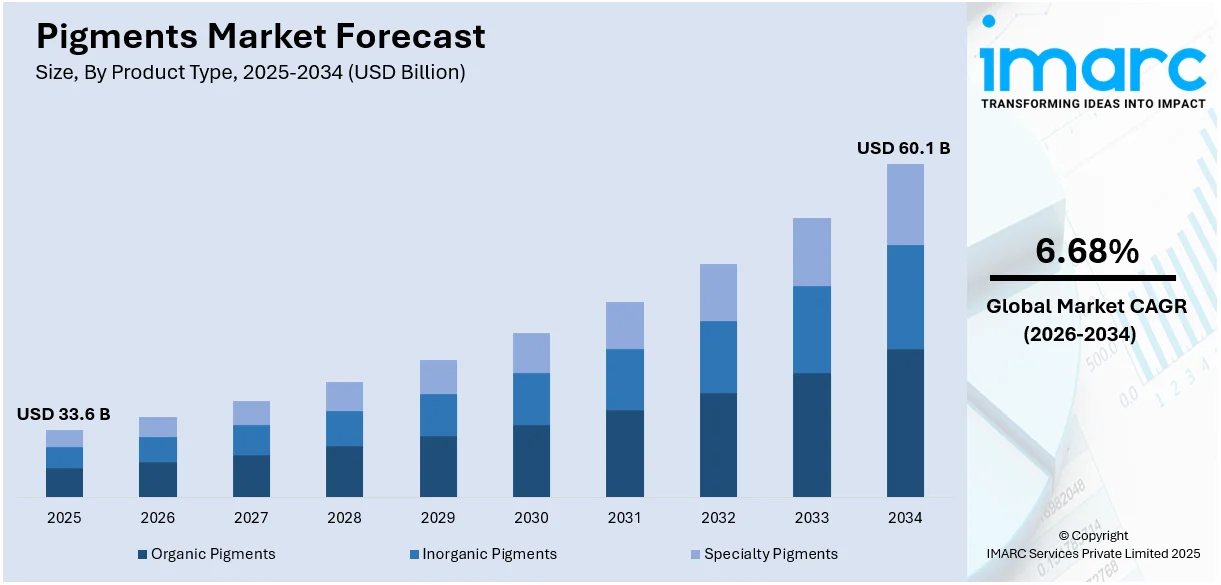

Pigments Market Report by Product Type (Organic Pigments, Inorganic Pigments, Specialty Pigments), Color Index (Reds, Orange, Yellows, Blue, Green, Brown, and Others), Application (Paints and Coatings, Plastics, Printing Inks, Construction Materials, and Others), and Region 2026-2034

Global Pigments Market:

The global pigments market size reached USD 33.6 Billion in 2025. Looking forward, the market is expected to reach USD 60.1 Billion by 2034, exhibiting a growth rate (CAGR) of 6.68% during 2026-2034. The increasing demand for high-quality paints with metallic luster is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 33.6 Billion |

| Market Forecast in 2034 | USD 60.1 Billion |

| Market Growth Rate 2026-2034 | 6.68% |

Pigments Market Analysis:

- Major Market Drivers: The rising consumer awareness regarding the various benefits offered by these compounds, including ultraviolet (UV) radiation, blowing sand, acid rain, protection against high temperature, corrosive materials, etc., is one of the key factors propelling the market. Moreover, the increasing construction activities are also acting as significant growth-inducing factors.

- Key Market Trends: The growing preference for organic and eco-friendly high-performance pigments (HPP), owing to the elevating environmental consciousness, is stimulating the market. Besides this, extensive investments in R&D activities to produce digital inks are further positively influencing the global market.

- Competitive Landscape: Some of the prominent companies in the global market include BASF Corporation, Dainichiseika Color & Chemicals Mfg. Co. Ltd., DIC Corporation, DuPont de Nemours, Inc., Heubach GmbH, Kronos Worldwide Inc., Lanxess, Merck KGaA, Pidilite Industries Limited, Shepherd Color, and Sudarshan Chemical Industries Limited, among many others.

- Geographical Trends: Asia Pacific exhibits a clear dominance in the market, owing to the inflating levels of industrialization. Additionally, the widespread adoption of high-performance pigments in packaging and textile industries will continue to fuel the regional market in the coming year.

- Challenges and Opportunities: One of the primary challenges hindering the market is the growing concerns about the environmental impact of pigment production. However, the launch of sustainable manufacturing practices is anticipated to bolster the market over the forecasted period.

To get more information on this market Request Sample

Pigments Market Trends:

Shift Towards Eco-Friendly Variants

Stringent regulations by government bodies are prompting leading manufacturers to create pigments with lower toxicity and minimal environmental impact. This, in turn, is propelling the market. For instance, in May 2024, the Color Pigments Manufacturers Association (CPMA) announced the launch of its Sustainability and Innovation Committee to provide a forum to promote and advance color solutions that find a wide range of applications, such as plastics, paints and coatings, building materials, printing inks, packaging, personal care products, etc. Additionally, in April 2024, Former Wall Street trader Ada Hsieh introduced Fluency Beauty, which is commonly available in biodegradable packaging with pigments made 100% from plants. Apart from this, prominent companies are extensively investing in the production of water-based pigments as alternatives to solvent-based ones, which emit volatile organic compounds (VOCs). For example, BASF, one of the leading chemical companies, offers a wide array of eco-friendly pigments that comply with global environmental standards. Similarly, in April 2024, Nature Coatings unveiled a novel bio-based pigment called BioBlack that transformed the coatings industry. Furthermore, it is a high-performing and carbon-negative alternative to the traditional petroleum-derived carbon black pigment. It is made from recycled pre-consumer and FSC-certified wood waste by using a closed-loop, circular manufacturing process.

Various Novel Advancements

The inflating popularity of advanced technologies, including nano-pigments, in production and application processes contributes to overall market growth. In July 2023, graphene technology development and commercialization company Zentek Ltd was given a research and development contract to test their nano-pigment ZenARMOR for chromate-free, military-grade, and corrosion-protection aerospace paint systems. Moreover, as per the pigments market overview, the advent of digital printing technology is also acting as a significant growth-inducing factor. For example, in June 2024, MS Printing Solutions and JK Group displayed their digital pigment solutions, including the Kiian Pigment 4K patent-pending digital pigment inks, MS JP7 scanning printing machine, and Color Pack color management software at the ITM. Similarly, in June 2024, DS Smith, one of the providers of sustainable fiber-based packaging solutions, expanded its high-end digital printing offering and led the industry with the installation of a Nozomi 14000 AQ single-pass water-based digital inkjet printer. It is a pioneering printer from the technology manufacturer Electronics For Imaging (EFI). Apart from this, the rising demand for high-quality pigments that can produce vivid and precise colors is further strengthening the market. For instance, in May 2023, Mexar Ltd launched water-based pigment inks for textile printing applications.

Demand for HPPs

There is an increasing popularity of high-performance pigments (HPPs) that offer color fastness, enhanced durability, chemical resistance, etc., which is stimulating the market. For example, in May 2023, U.S. Silica Holdings, Inc. announced the introduction of EverWhite® Pigment, a newly engineered high-white pigment for building products, coatings, and other applications. This highly specialized product can be used to partially replace or complement other inorganic white pigments like aluminum trihydrate (ATH) and titanium dioxide (TiO2). It also finds extensive applications, including cementitious items, quartz countertops, fillers for plastics, coating formulations, etc. Besides this, the elevating requirement for pigments in the aerospace industry that can withstand harsh environmental conditions and extreme temperatures is further bolstering the market. Companies like Clariant are generally focusing on creating HPPs that meet stringent performance criteria. Moreover, in January 2024, Evonik developed VISIOMER HEMA-P 100, a phosphate methacrylate monomer that provides transparent flame retardancy, enhances adhesion, reduces corrosion, etc. In addition, it acts as an effective adhesion promoter and anti-corrosive agent.

Global Pigments Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the market forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on the product type, color index, and application.

Breakup by Product Type:

- Organic Pigments

- Azo Pigments

- Phthalocyanine Pigment

- Quinacridone Pigment

- Other Organic Pigments

- Inorganic Pigments

- Titanium Dioxide Pigments

- Iron Oxide Pigments

- Cadmium Pigments

- Carbon Black Pigments

- Chromium Oxide Pigments

- Complex Inorganic Pigments

- Others

- Specialty Pigments

- Classic Organic Pigments

- Metallic Pigments

- High-Performance Pigments

- Light Interference Pigments

- Fluorescent Pigment

- Luminescent Pigments

- Thermo-Chromic Pigments

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic pigments (azo pigments, phthalocyanine pigment, quinacridone pigment, and other organic pigments), inorganic pigments (titanium dioxide pigments, iron oxide pigments, cadmium pigments, carbon black pigments, chromium oxide pigments, complex inorganic pigments, and others), specialty pigments (classic organic pigments, metallic pigments, high-performance pigments, light interference pigments, fluorescent pigment, luminescent pigments, and thermo-chromic pigments).

Organic pigments, inorganic pigments, and specialty pigments each play distinct roles in the market, catering to various industrial and consumer needs. Organic pigments, derived from carbon-based molecules, are known for their vibrant colors and are widely used in applications requiring bright and varied hues, such as printing inks, plastics, and textiles. In contrast, inorganic pigments, typically metal oxides or other mineral compounds, provide superior durability, opacity, and lightfastness, making them ideal for use in construction materials, automotive coatings, and industrial applications. Titanium dioxide, iron oxide, and ultramarine blue are common inorganic pigments valued for their stability and resistance to environmental factors. For example, in May 2023, Chemours, one of the providers of titanium technologies, specialized solutions, and advanced performance materials, introduced Ti-Pure TS-6700, a high-performance, TMP- and TME-free TiO2 grade pigments designed for waterborne architectural coatings applications. Specialty pigments, on the other hand, are tailored for specific high-performance applications and often have unique properties like fluorescence, phosphorescence, or thermochromism.

Breakup by Color Index:

- Reds

- Orange

- Yellows

- Blue

- Green

- Brown

- Others

The report has provided a detailed breakup and analysis of the market based on the color index. This includes reds, orange, yellows, blue, green, brown, and others.

Each color index caters to specific applications and industries, driven by its unique properties and performance characteristics. Red pigments, for instance, are extensively used in automotive coatings, plastics, and printing inks due to their vibrant hue and excellent opacity. Cadmium red and iron oxide red are popular choices in this segment. Orange and yellow pigments, such as chrome yellow and azo pigments, find significant applications in the construction industry for road markings and safety equipment due to their high visibility and durability. Blue and green pigments, including ultramarine blue and phthalocyanine green, are favored in the paint and coatings industry for their stability and color fastness. Brown pigments, such as iron oxide brown, are commonly used in construction and industrial coatings for their earthy tones and robustness. For example, in March 2023, the Heubach Group developed its product line Ultrazur™ at PlastIndia 2023. A range of ultramarine blue pigments in four shades, from green to red, is manufactured in Heubach's site in Dahej, India, in a brand-new production facility.

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Paints and Coatings

- Plastics

- Printing Inks

- Construction Materials

- Others

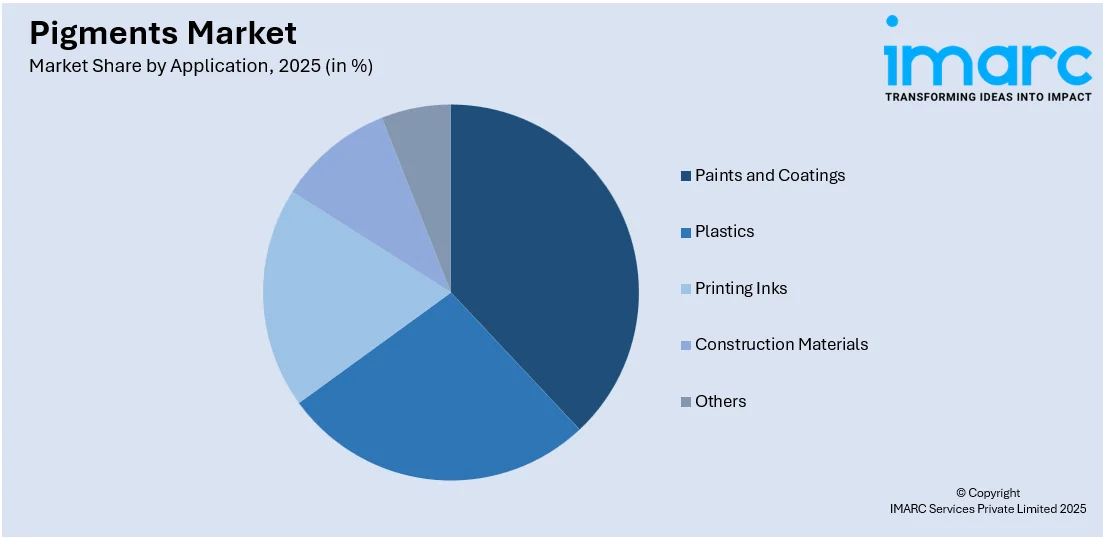

Paints and coatings accounted for the largest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes paints and coatings, plastics, printing inks, construction materials, and others. According to the report, paints and coatings represented the largest market segmentation.

Global pigments manufacturers are producing enhanced product variants for the paints and coatings industry. In residential and commercial settings, decorative paints utilize a wide array of organic and inorganic pigments to offer a vast palette of colors, catering to diverse consumer preferences and interior design trends. Specialty coatings, including those used in industrial applications, benefit from high-performance pigments that provide enhanced resistance to chemicals, heat, and UV radiation, ensuring the longevity and durability of coated surfaces. The extensive use of pigments in these various applications highlights their integral role in the paints and coatings industry, driving continuous innovation and substantial market growth in this segment. For example, in July 2023, Terra Firma, a DKSH company, and Brilliant Group partnered to allow Terra Firma to sell Brilliant Group's industry-leading fluorescent and phosphorescent pigments.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Rapid industrialization and urbanization levels in countries, such as China and India, are propelling the regional market. According to European Coatings, approximately 10,000 coatings manufacturers are located in China. Moreover, in July 2022, BASF Coatings expanded the production capacity of automotive refinish coatings at its coatings site in Jiangmen, Guangdong Province, in South China. Apart from this, the increasing number of dyes and pigments is also acting as another significant growth-inducing factor. For example, India’s production volume of dyes and pigments in the financial year of 2023 stood at about 398,000 metric tons, almost a 22% increase from 2022. Companies like DIC Corporation and Toyo Ink are leading the way in producing advanced pigments that cater to the evolving needs of various end-use industries, which is projected to fuel the market in Asia Pacific over the forecasted period.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- BASF Corporation

- Dainichiseika Color & Chemicals Mfg. Co. Ltd.

- DIC Corporation

- DuPont de Nemours, Inc.

- Heubach GmbH

- Kronos Worldwide Inc.

- Lanxess

- Merck KGaA

- Pidilite Industries Limited

- Shepherd Color

- Sudarshan Chemical Industries Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Pigments Market Recent Developments:

- June 2024: JK Group and MS Printing Solutions displayed their digital pigment solutions, including the Kiian Pigment 4K patent-pending digital pigment inks, MS JP7 scanning printing machine, and Color Pack color management software at the ITM.

- April 2024: Nature Coatings introduced a novel bio-based pigment called BioBlack that transformed the coatings industry.

- April 2024: Former Wall Street trader Ada Hsieh launched Fluency Beauty, which is commonly available in biodegradable packaging with pigments made 100% from plants.

Pigments Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Color Indexs Covered | Reds, Orange, Yellows, Blue, Green, Brown, Others |

| Applications Covered | Paints and Coatings, Plastics, Printing Inks, Construction Materials, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF Corporation, Dainichiseika Color & Chemicals Mfg. Co. Ltd., DIC Corporation, DuPont de Nemours, Inc., Heubach GmbH, Kronos Worldwide Inc., Lanxess, Merck KGaA, Pidilite Industries Limited, Shepherd Color, Sudarshan Chemical Industries Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pigments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pigments market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pigments industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global pigments market was valued at USD 33.6 Billion in 2025.

We expect the global pigments market to exhibit a CAGR of 6.68% during 2026-2034.

The rising demand for pigments, particularly across the construction industry, as they provide protection against high temperature, UV radiation, blowing sand, acid rain, corrosive materials, etc., is primarily driving the global pigments market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for pigments.

Based on the application, the global pigments market can be segmented into paints and coatings, plastics, printing inks, construction materials, and others. Currently, paints and coatings hold the majority of the global market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global pigments market include BASF Corporation, Dainichiseika Color & Chemicals Mfg. Co. Ltd., DIC Corporation, DuPont de Nemours, Inc., Heubach GmbH, Kronos Worldwide Inc., Lanxess, Merck KGaA, Pidilite Industries Limited, Shepherd Color, and Sudarshan Chemical Industries Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)