Plant Genotyping Equipment Market Report by Equipment (SNP Genotyping Equipment, Real-time PCR Instrument, DNA Analyzer, Liquid Handler, and Others), Application (Plant Research, Breeding, Product Development, Quality Assessment), End Use (Greenhouse, Field, Laboratory), and Region 2025-2033

Market Overview:

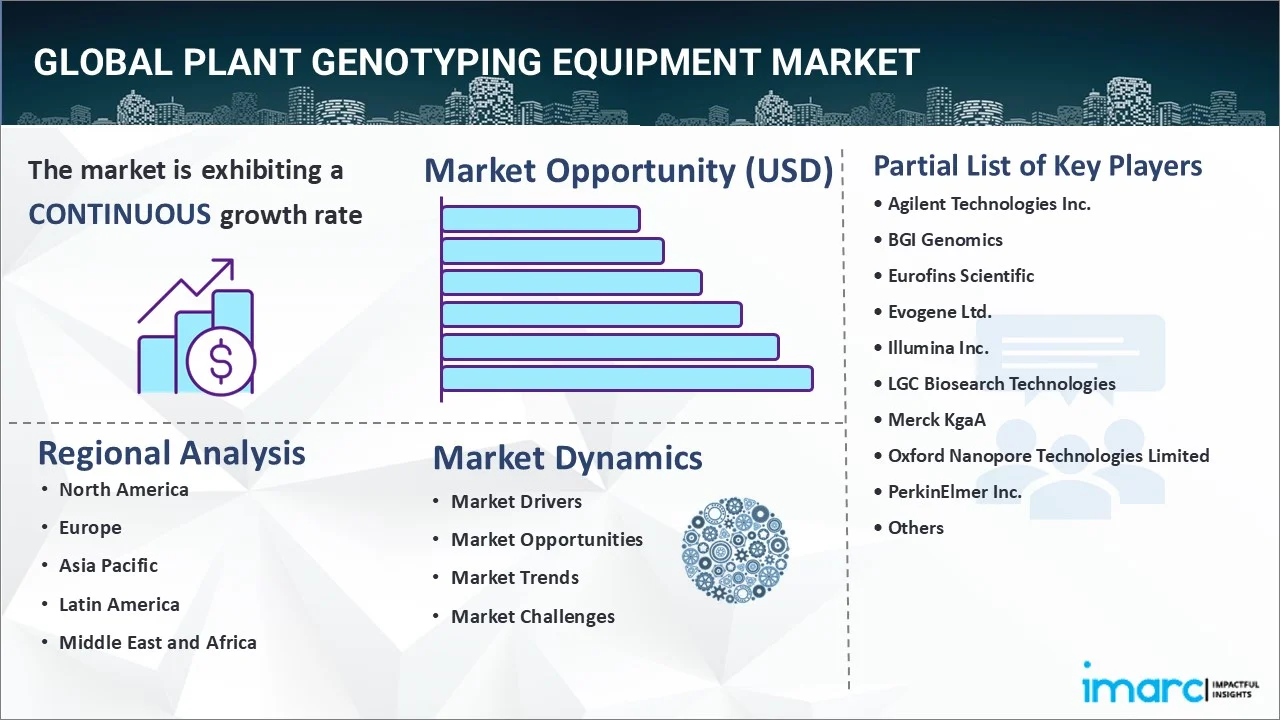

The global plant genotyping equipment market size reached USD 816.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,658.6 Million by 2033, exhibiting a growth rate (CAGR) of 7.79% during 2025-2033. The rising demand for high yielding crops, increasing need to improve the tolerance and adaptability of plants, and the thriving agriculture industry represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 816.3 Million |

|

Market Forecast in 2033

|

USD 1,658.6 Million |

| Market Growth Rate (2025-2033) | 7.79% |

Plant genotyping is the process of identifying the differences in genetic comprehension by analyzing the deoxyribonucleic acid (DNA) sequence with a sample or reference. It relies on next-generation sequencing (NGS) technology to develop plants with high nutritional content and resistance to illnesses and environmental stress. It assists in studying the diversity and evolution of different species, germplasm characterization and seed purity, and marker-assisted selection (MAS). It is used in various fields of agricultural research, such as crop trait development and seed quality control. It can be achieved through various equipment, such as single nucleotide polymorphism (SNP) genotyping equipment, real-time polymerase chain reaction (PCR) instruments, DNA analyzer, and liquid handler. Plant genotyping equipment is used to analyze, identify, and assess genetic markers in the plant. It also promotes crop yield by changing or integrating the genes of plants at the molecular level and during the breeding process.

Plant Genotyping Equipment Market Trends:

At present, there is a rise in the demand for high-yielding crops due to the growing population across the globe. This, along with the thriving agriculture industry, represents one of the key factors supporting the growth of the market. Moreover, the increasing need to improve the tolerance and adaptability of plants to various adverse environments for assuring stable and higher crop production is propelling the growth of the market. Besides this, the growing demand for plant genotyping equipment to understand the genetic characteristics associated with complex plant traits and the effects of various environmental factors on these traits is positively influencing the market. In addition, there is an increase in the utilization of plant genotyping equipment to identify variants associated with desired phenotypic traits around the world. This, coupled with the rising adoption of modern farming practices, is offering lucrative growth opportunities to industry investors. Apart from this, the escalating demand for plant genotyping equipment to understand the genotype behavior of plants, such as yield, tolerance, and resistance against biotic and abiotic stress, is strengthening the growth of the market. Additionally, the growing demand for SNP genotyping equipment and quantitative trait locus (QTL) for enhancing various plant characteristics, such as high pest resistance, more yield, and improved stress tolerance, is offering a favorable market outlook.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plant genotyping equipment market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on equipment, application and end use.

Equipment Insights:

- SNP Genotyping Equipment

- Real-time PCR Instrument

- DNA Analyzer

- Liquid Handler

- Others

The report has provided a detailed breakup and analysis of the plant genotyping equipment market based on the equipment. This includes SNP genotyping equipment, real-time PCR instrument, DNA analyzer, liquid handler, and others. According to the report, SNP genotyping equipment represented the largest segment.

Application Insights:

- Plant Research

- Breeding

- Product Development

- Quality Assessment

A detailed breakup and analysis of the plant genotyping equipment market based on the application has also been provided in the report. This includes plant research, breeding, product development, and quality assessment. According to the report, breeding accounted for the largest market share.

End Use Insights:

- Greenhouse

- Field

- Laboratory

A detailed breakup and analysis of the plant genotyping equipment market based on the end use has also been provided in the report. This includes greenhouse, field, and laboratory. According to the report, laboratory accounted for the largest market share.

Regional Insights:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe was the largest market for plant genotyping equipment. Some of the factors driving the Europe plant genotyping equipment market included the growing research and development (R&D) activities in agriculture, development of advanced plant genotyping equipment, increasing food security concerns, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global plant genotyping equipment market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Agilent Technologies Inc., BGI Genomics, Eurofins Scientific, Evogene Ltd., Illumina Inc., LGC Biosearch Technologies, Merck KgaA, Oxford Nanopore Technologies Limited, PerkinElmer Inc., Promega Corporation, Thermo Fisher Scientific, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Equipment, Application, End Use, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., BGI Genomics, Eurofins Scientific, Evogene Ltd., Illumina Inc., LGC Biosearch Technologies, Merck KgaA, Oxford Nanopore Technologies Limited, PerkinElmer Inc., Promega Corporation and Thermo Fisher Scientific, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plant genotyping equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global plant genotyping equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plant genotyping equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global plant genotyping equipment market was valued at USD 816.3 Million in 2024.

We expect the global plant genotyping equipment market to exhibit a CAGR of 7.79% during 2025-2033.

The rising food security concerns, along with the growing adoption of modern farming practices, such as plant genotyping for sustainable and stable crop production, are currently driving the global plant genotyping equipment market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary halt in various agricultural activities and shortage of skilled labors, thereby negatively impacting the overall product demand.

Based on the equipment, the global plant genotyping equipment market can be segmented into SNP genotyping equipment, real-time PCR instrument, DNA analyzer, liquid handler, and others. Among these, SNP genotyping equipment holds the majority of the total market share.

Based on the application, the global plant genotyping equipment market has been divided into plant research, breeding, product development, and quality assessment. Currently, breeding exhibits a clear dominance in the market.

Based on the end use, the global plant genotyping equipment market can be categorized into greenhouse, field, and laboratory. Among these, laboratory currently accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global plant genotyping equipment market include Agilent Technologies Inc., BGI Genomics, Eurofins Scientific, Evogene Ltd., Illumina Inc., LGC Biosearch Technologies, Merck KgaA, Oxford Nanopore Technologies Limited, PerkinElmer Inc., Promega Corporation, and Thermo Fisher Scientific.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)