Plastic Caps and Closure Market Report by Product Type (Screw-On Caps, Dispensing Caps, and Others), Raw Material (PET, PP, HDPE, LDPE, and Others), Container Type (Plastic, Glass, and Others), Technology (Injection Molding, Compression Molding, Post-Mold Tamper-Evident Band), End-Use (Beverages, Industrial Chemicals, Food, Cosmetics, Household Chemicals, Pharmaceuticals, and Others), and Region 2025-2033

Market Overview:

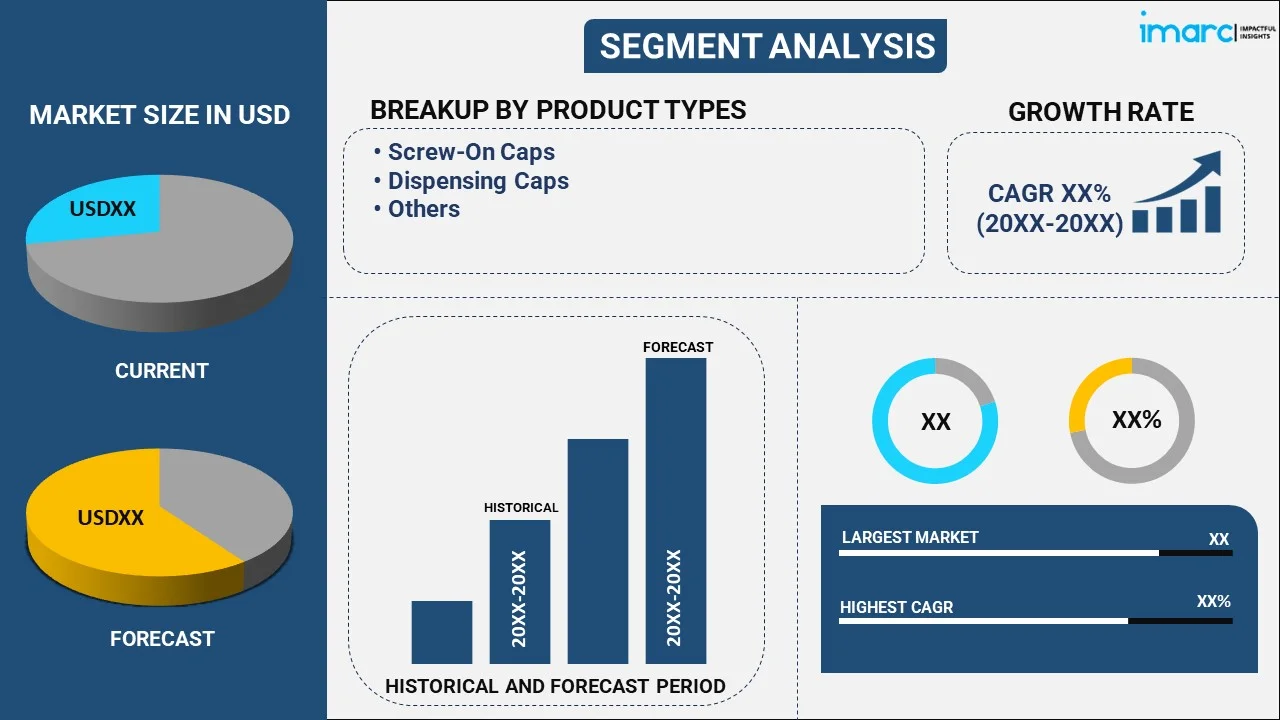

The global plastic caps and closure market size reached USD 50.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 73.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The increasing product utilization in the food and beverage (F&B) industry, widespread product adoption in the pharmaceutical industry, rapid technological advancements, and rising focus on sustainability are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50.2 Billion |

| Market Forecast in 2033 | USD 73.7 Billion |

| Market Growth Rate 2025-2033 | 4.4% |

Plastic caps and closure refer to products designed to seal various containers, ensuring safety and integrity. They are manufactured using various durable and high-strength polymers, such as polypropylene and polyethylene. Plastic caps and closure are widely used in food and beverage (F&B) packaging, pharmaceuticals, cosmetics, household cleaning products, automotive fluids, and agricultural chemicals. They are lightweight, recyclable, and tamper-proof products that offer superior barrier properties, ultraviolet (UV) protection, and chemical resistance. They also provide easy handling for consumers and are cost-effective for businesses due to their low manufacturing cost and ability to be mass-produced.

The widespread product utilization in the e-commerce industry to provide secure and leak-proof packaging for online shipments is propelling the market growth. Furthermore, the growing product demand in the cosmetics and personal care industry to safely pack shampoos, creams, lotions, body wash, hair oil, and other products is contributing to the market growth. Apart from this, the implementation of stringent packaging regulations to ensure consumer safety and high packaging standards is boosting the market growth. Moreover, the introduction of innovative products that offer easy-open, resealable, and tamper-evident features is supporting the market growth. Other factors, including rising demand for on-the-go (OTG) products, increasing investment in developing advanced caps and closures, and the growing demand for customizable and aesthetically pleasing products, are anticipated to drive the market growth.

Plastic Caps and Closure Market Trends/Drivers:

The increasing product utilization in the food and beverage (F&B) industry

The food and beverage (F&B) industry is a major contributor to the growing demand for plastic caps and closures. These components are crucial in maintaining product freshness, preventing contamination, and ensuring ease of transportation. Furthermore, plastic caps and closures play an integral role in extending the shelf life of products, thus reducing food waste and promoting sustainability. Moreover, they offer various advantages, including lightweight nature, cost-effectiveness, and superior barrier properties against moisture, air, and microorganisms, which are critical in preserving the quality of food and beverage items. Apart from this, the recent advancements in technology, which have enabled the production of tamper-evident and child-resistant designs that ensure product safety and provide a sense of trust among consumers, are boosting the market growth. Besides this, the introduction of customizable options, which facilitate branding opportunities and enhance product visibility, is favoring the market growth.

The widespread product adoption in the pharmaceutical industry

The pharmaceutical industry's demand for reliable and secure packaging solutions is a vital driver for the plastic caps and closures market. In addition to this, the widespread product utilization for medications, such as over-the-counter (OTC) drugs and prescriptions, require containers that are tamper-proof, child-resistant, and easy to use, especially for geriatric patients and those with limited dexterity. Plastic caps and closures meet these requirements, as they offer airtight seals to protect medicines from environmental factors and prevent accidental ingestion. Besides this, the increasing geriatric population, coupled with the shifting trend towards home-based healthcare, is facilitating product demand to ensure safety and enhance patients' convenience. Additionally, the introduction of smart closures that are equipped with the Internet of Things (IoT) sensors to track patient compliance, control dosage, enhance patient safety, and increase the efficacy of treatment is contributing to the market growth.

The rising focus on sustainability and technological advancements

The escalating environmental consciousness is facilitating the demand for sustainable packaging solutions. Consumers and businesses are prioritizing recyclable and biodegradable materials to reduce carbon footprint, minimize waste generation, and mitigate the impact on the environment. This trend is prompting the development of innovative caps and closures made from bio-based and post-consumer recycled plastic. Moreover, the recent technological advancements that are enabling the production of sustainable variants on a mass scale, making them a viable option for businesses aiming to reduce their carbon footprint, are propelling the market growth. Apart from this, the evolution of smart caps and closures that are integrated with sensors or connected devices to enhance product security and enable interactive consumer engagement is catalyzing the market growth.

Plastic caps and closure Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plastic caps and closure market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product type, raw materials, container type, technology and end-use.

Breakup by Product Type:

- Screw-On Caps

- Dispensing Caps

- Others

Screw-on caps dominate the market.

The report has provided a detailed breakup and analysis of the market based on the product type. This includes screw-on caps, dispensing caps, and others. According to the report, screw-on caps represented the largest market segment.

Screw-on caps provide a reliable seal and prevent leakage, making them ideal for various packaging needs. They are incredibly versatile products that can be used in multiple industries, including pharmaceuticals, cosmetics, food and beverage (F&B), chemicals, and personal care. Furthermore, screw-on caps can be easily opened and securely resealed, allowing for multiple uses of the packaged product while still maintaining its freshness. Apart from this, they are manufactured using durable and lightweight material that can withstand rough handling during transportation and storage, thus minimizing the chances of product damage.

Breakup by Raw Material:

- PET

- PP

- HDPE

- LDPE

- Others

PP dominates the market.

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes PET, PP, HDPE, LDPE, and others. According to the report, PP represented the largest market segment.

Polypropylene (PP) is known for its high durability and resistance to cracking, making it an ideal material for caps and closures that need to withstand various conditions during transportation, storage, and use. Furthermore, it possesses excellent resistance to chemicals, which is crucial for packaging products, such as cleaning agents, pharmaceuticals, and certain food and beverages (F&B). Apart from this, it can withstand high temperatures, making it suitable for applications requiring sterilization or hot-fill processes. Additionally, PP is a cost-effective and lightweight material that can be easily transformed into various shapes and sizes.

Breakup by Container Type:

- Plastic

- Glass

- Others

Plastic dominates the market.

The report has provided a detailed breakup and analysis of the market based on container type. This includes plastic, glass, and others. According to the report, plastic represented the largest market segment.

Plastic containers are dominating the market as they are versatile and can be utilized for a wide range of products in various industries, such as food and beverages (F&B), personal care, pharmaceuticals, and household products. Furthermore, as compared to other materials, plastic containers are cost-effective and easy to manufacture, making them a popular choice for businesses aiming to reduce costs. Additionally, plastic containers are known for their durability, as they can resist breaking or shattering when dropped, making them safe and practical for consumer use and transportation.

Breakup by Technology:

- Injection Molding

- Compression Molding

- Post-Mold Tamper-Evident Band

Injection molding dominates the market.

The report has provided a detailed breakup and analysis of the market based on technology. This includes injection molding, compression molding, and post-mold tamper-evident band. According to the report, injection molding represented the largest market segment.

Injection molding is dominating the market as it is a highly efficient process, enabling the mass production of caps and closures with high precision and consistency. Furthermore, it can create a wide variety of shapes, sizes, and intricate designs, providing significant flexibility in product design. Additionally, injection molding is compatible with a vast range of thermoplastic materials, including polypropylene (PP) and polyethylene (PE), that are commonly used in the manufacturing of caps and closures. Moreover, it can be integrated with automation technologies to reduce labor costs, minimize human errors, increase productivity, and maintain consistent product quality.

Breakup by End-Use:

- Beverages

- Industrial Chemicals

- Food

- Cosmetics

- Household Chemicals

- Pharmaceuticals

- Others

Beverages dominates the market.

The report has provided a detailed breakup and analysis of the market based on end use. This includes beverages, industrial chemicals, food, cosmetics, household chemicals, pharmaceuticals, and others. According to the report, beverages represented the largest market segment.

The beverage industry is dominating the market owing to the increasing consumption of water, soft drinks, juices, and alcoholic drinks. In line with this, plastic caps and closures provide a secure seal, preserving the quality and freshness of beverages while preventing spillage and contamination. Furthermore, they are lightweight, durable, and highly versatile products that can be used in various types of beverage packaging, such as bottles, cartons, and pouches. Additionally, plastic caps and closures can be customized in various shapes, sizes, and colors to align with brand aesthetics, offering a means of product differentiation in a competitive beverage market.

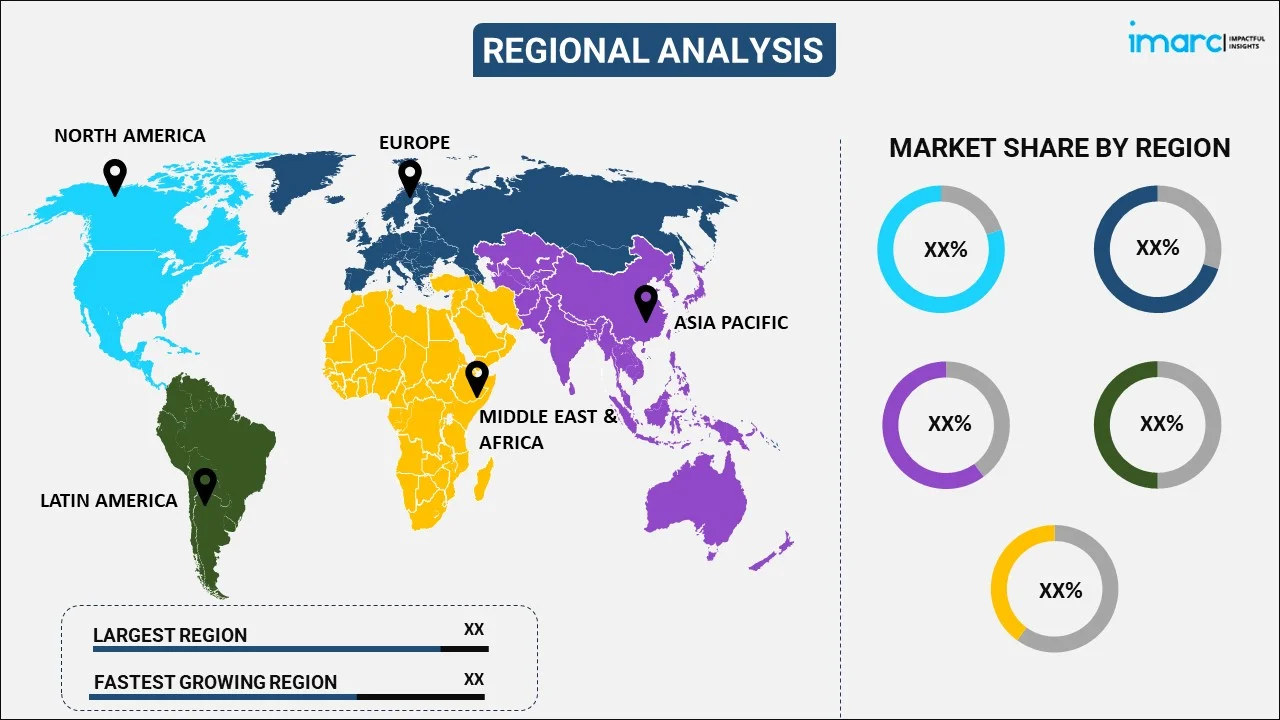

Breakup by Region:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America, Asia Pacific, Europe, Latin America and the Middle East and Africa.

North America has witnessed considerable demand for plastic caps and closure due to the increasing consumption of packaged goods, including food, beverages, personal care, and pharmaceutical products. Furthermore, the region boasts advanced manufacturing capabilities, enabling the production of high-quality and innovative caps and closures. Additionally, North America has stringent regulations related to packaging and product safety, which is driving the need for secure and reliable caps and closures.

Asia Pacific is experiencing significant growth in the market owing to the rapid urbanization activities, which is propelling the demand for packaged products. Furthermore, the widespread utilization of plastic caps and closure due to escalating health consciousness among the masses is boosting the market growth. Besides this, the significant growth in the beverage industry owing to the increasing consumption of alcoholic and non-alcoholic beverages is acting as another growth-inducing factor.

Competitive Landscape:

The key players are investing in research and development (R&B) to innovate new designs and materials for caps and closures that are more functional, safe, and sustainable. Furthermore, the rising environmental concerns and regulations have prompted companies to create caps and closures from recyclable or biodegradable materials. Apart from this, leading companies are offering more customization options in terms of shapes, sizes, colors, and special features to meet diverse customer needs and branding requirements. Moreover, key market players are leveraging automation and advanced technologies to improve manufacturing processes, enhance product quality, and increase efficiency. Apart from this, they are expanding their operations and distribution networks, both domestically and internationally, to reach a broader customer base.

The report has provided a comprehensive analysis of the competitive landscape in the global plastic caps and closure market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Berry Global

- Amcor

- Crown Holdings

- Silgan Holdings

- RPC Group

- Bericap

- AptarGroup, Inc

- Closure Systems International

- Coral Products

- O.Berk Company, LLC

- United Caps

- Caps & Closures Pty Ltd

- Caprite Australia Pty. Ltd

- Pano Cap (Canada) Limited

- Plastic Closures Limited

- Cap & Seal Pvt. Ltd.

- Phoenix Closures

- Alupac India

- Hicap Closures

- MJS Packaging

Recent Developments

- In April 2022, Berry Global announced that it is making strategic investments to expand its production capacity of continuous thread closures.

- In November 2021, Amcor introduced IMPRESSIONS, a new technology developed in collaboration with MGJ that enables companies and brands to customize closure liners.

- In September 2021, Silgan Holdings acquired Gateway Plastics to expand its portfolio of dispensing and specialty closure products.

Plastic caps and closure Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Screw-On Caps, Dispensing Caps, Others |

| Raw Materials Covered | PET, PP, HDPE, LDPE, Others |

| Container Types Covered | Plastic, Glass, Others |

| Technologies Covered | Injection Molding, Compression Molding, Post-Mold Tamper-Evident Band |

| End Uses Covered | Beverages, Industrial Chemicals, Food, Cosmetics, Household Chemicals, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, North America, Europe, Middle East and Africa, and Latin America. |

| Companies Covered | Berry Global, Amcor, Crown Holdings, Silgan Holdings, RPC Group, Bericap, AptarGroup, Inc, Closure Systems International, Coral Products, O.Berk Company, LLC, United Caps, Caps & Closures Pty Ltd, Caprite Australia Pty. Ltd, Pano Cap (Canada) Limited, Plastic Closures Limited, Cap & Seal Pvt. Ltd., Phoenix Closures, Alupac India, Hicap Closures, MJS Packaging, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plastic caps and closure market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global plastic caps and closure market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plastic caps and closure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global plastic caps and closure market was valued at USD 50.2 Billion in 2024.

We expect the global plastic caps and closure market to exhibit a CAGR of 4.4% during 2025-2033.

The extensive demand for plastic caps and closures in the beverage industry, owing to their cost- effectiveness, durability, customizability, etc., is primarily catalyzing the global plastic caps and closure market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of various end-use industries, such as food and beverages, chemicals, pharmaceuticals, etc., for plastic caps and closures.

Based on the product type, the global plastic caps and closure market can be segmented into screw-on caps, dispensing caps, and others. Among these, screw-on caps hold the largest market share.

Based on the raw material, the global plastic caps and closure market has been divided into PET, PP, HDPE, LDPE, and others. Currently, PP-based caps and closure exhibit a clear dominance in the market.

Based on the container type, the global plastic caps and closure market can be segregated into plastic, glass, and others. Among these, plastic container currently accounts for the majority of the total market share.

Based on the technology, the global plastic caps and closure market has been bifurcated into injection molding, compression molding, and post-mold tamper-evident band. Currently, injection molding technology exhibits a clear dominance in the market.

Based on the end-use, the global plastic caps and closure market can be categorized into beverages, industrial chemicals, food, cosmetics, household chemicals, pharmaceuticals, and others. Among these, the beverages sector holds the largest market share.

On a regional level, the market has been classified into Asia Pacific, North America, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global plastic caps and closure market include Berry Global, Amcor, Crown Holdings, Silgan Holdings, RPC Group, Bericap, AptarGroup, Inc, Closure Systems International, Coral Products, O.Berk Company, LLC, United Caps, Caps & Closures Pty Ltd, Caprite Australia Pty. Ltd, Pano Cap (Canada) Limited, Plastic Closures Limited, Cap & Seal Pvt. Ltd., Phoenix Closures, Alupac India, Hicap Closures, and MJS Packaging.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)