Player Tracking Market Size, Share, Trends and Forecast by Component, Type, Application, End User, and Region, 2025-2033

Player Tracking Market Overview:

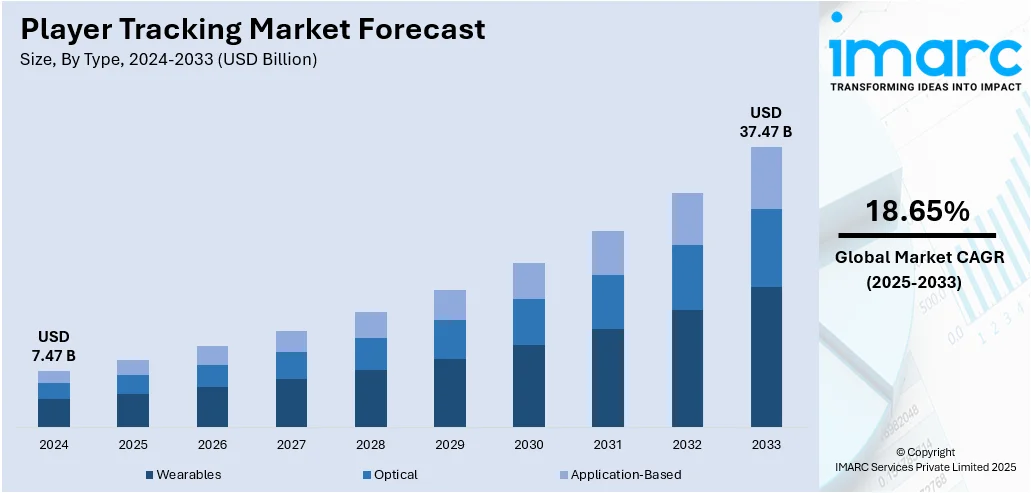

The global player tracking market size was valued at USD 7.47 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.47 Billion by 2033, exhibiting a CAGR of 18.65% during 2025-2033. North America dominated the market, holding a significant market share of over 36.2% in 2024. Advanced sports tech adoption, major leagues, strong infrastructure, and heavy investments represent some of the factors contributing to the player tracking market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.47 Billion |

|

Market Forecast in 2033

|

USD 37.47 Billion |

| Market Growth Rate 2025-2033 | 18.65% |

The market is gaining momentum due to the growing need for real-time performance data in professional sports. Teams and coaches rely on wearable sensors, GPS devices, and optical tracking systems to analyze player movements, monitor physical load, and reduce injury risks. The integration of AI and machine learning enhances the accuracy and depth of insights, making it easier to assess individual and team performance. Broadcast networks and digital platforms use this data to create immersive experiences for fans, boosting engagement. Additionally, leagues and sports organizations are investing in analytics platforms to support training and tactical decisions. The market is also fueled by the increasing commercialization of sports, where data-driven insights offer a competitive edge. This combination of technology, performance needs, and audience expectations is encouraging player tracking market growth.

To get more information on this market, Request Sample

In the United States, clinical research backing real-time health monitoring is boosting confidence in wearables for sports. Continuous data collection used in medical settings is now informing player tracking approaches, with a focus on early warning signs, recovery, and workload balance. This crossover supports smarter training decisions grounded in proven health-tracking applications. For instance, in June 2025, researchers at UCSF and UC Berkeley had piloted wearable health devices for tracking conditions like diabetes and high blood pressure. These trackers had monitored health metrics in real time and supported early detection of risks through continuous data tracking.

Player Tracking Market Trends:

Government Push Boosting Sports Tech Demand in India

Player tracking market trends reflect that India’s rising public investment in sports is reshaping demand across athlete performance technologies. The record FY 2025–26 budget directed toward youth and sports development is prompting wider use of real-time player tracking systems at training academies, national camps, and league infrastructure. Stakeholders in football, hockey, athletics, and kabaddi are prioritizing motion analytics and biometric monitoring tools for talent development and injury prevention. With federations and private leagues aligning with this momentum, adoption is no longer limited to elite-level teams. Local suppliers and international vendors are expected to ramp up their offerings, particularly in wearable sensors, AI-based video analysis, and 3D tracking software. This signals a broader shift from manual coaching methods toward more data-guided decision-making. For example, in a move to fuel India’s sporting future, the government has made a record allocation of USD 457.23 Million to the Ministry of Youth Affairs and Sports for FY 2025–26.

Wearables Driving Shift in Player Performance Monitoring

Widespread use of smartwatches is changing how athletes and coaches think about performance tracking. As per the player tracking market forecast, with more people using wearables in daily life, there’s a growing expectation for constant feedback and personalized data, even in sports. This shift is pushing the adoption of advanced player monitoring tools that go beyond basic metrics. Teams and training centers are incorporating systems that combine biometric data with GPS and video analytics, aiming for deeper insights into movement, workload, and recovery. The comfort and familiarity with wrist-worn tech are making it easier to introduce more complex tracking setups, especially in youth and amateur segments. As boundaries blur between consumer and professional devices, developers are building flexible tools that serve both ends. This ongoing change is expanding access to data-driven performance systems across levels and disciplines. For instance, as of 2025, there are 454.69 Million smartwatch users worldwide.

Screen-Free Wearables Gain Ground in Athletic Monitoring

The move toward screen-free wearables is changing how athletes engage with performance data, shaping the player tracking market outlook. Devices that operate quietly in the background, without the need for constant visual interaction, are becoming more appealing in high-focus training environments. These tools allow for passive tracking of metrics like movement, sleep quality, and recovery, offering athletes and coaches clean, uninterrupted insights. With no reliance on subscriptions or screen-based prompts, they reduce distractions and simplify data collection. This design approach supports more natural integration into training routines and daily life, especially in sports where continuous focus and minimal gear interference are key. As wearable technology becomes more invisible and intuitive, adoption across both amateur and elite sports settings is expected to grow quickly, reinforcing performance strategies that rely on steady, unobtrusive data flow. For example, in June 2025, Polar announced it would launch a new screen-free wearable device this September that enables effortless health and fitness tracking without constant visual engagement. The product redefined user interaction by allowing background tracking of sleep, activity, and wellness without subscriptions.

Player Tracking Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global player tracking market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, type, application, and end user.

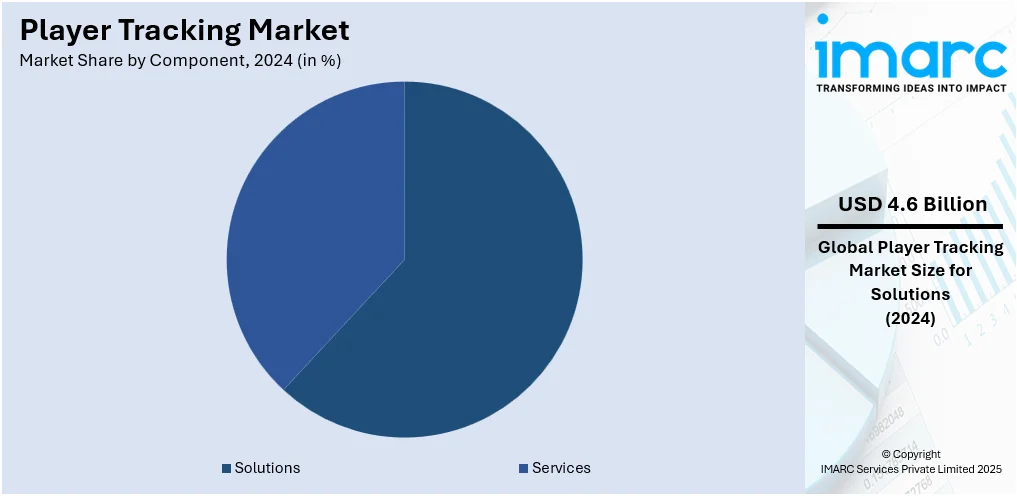

Analysis by Component:

- Solutions

- Services

Solutions stood as the largest component in 2024, holding around 61.8% of the market. These solutions include advanced software platforms and analytics tools that interpret real-time tracking data into actionable performance metrics for teams, coaches, and broadcasters. They're in demand because they provide more than just raw data; they deliver game insights like player speed, heatmaps, fatigue levels, and movement patterns, which influence coaching decisions, training intensity, and player health management. As teams and leagues become more data-focused, they invest in complete solutions that integrate hardware with software, offer real-time visualization, and support post-game analysis. Broadcasters also rely on these solutions to enhance fan engagement with dynamic visual overlays. The result is a growing preference for comprehensive solutions over standalone hardware, making this segment the key force behind overall market momentum.

Analysis by Type:

- Wearables

- Optical

- Application-Based

Wearables led the market in 2024. Devices like GPS vests, smart patches, and sensor-equipped clothing are widely adopted across sports for their ability to capture precise, real-time data on movement, heart rate, acceleration, and workload. Teams rely on this information to monitor player performance, prevent injuries, and optimize training loads. The compact size and comfort of modern wearables allow athletes to use them during practice and live games without affecting performance. As technology improves, wearables offer better battery life, connectivity, and data accuracy, making them more valuable to teams, leagues, and performance analysts. Their growing role in performance optimization and recovery planning has turned wearables into essential tools, especially in professional and elite sports, where even slight performance gains can have a measurable impact.

Analysis by Application:

- Fitness Tracking

- Performance Tracking

- Fraud Detection

- Player Safety

Fitness tracking led the market in 2024 due to the rising demand for detailed physiological data in sports. Devices that monitor heart rate, calories burned, distance covered, and recovery time help coaches and performance staff assess player fitness levels and readiness. This data supports tailored training programs and helps identify fatigue or overtraining risks early, reducing injuries and improving performance. Fitness tracking is especially important in endurance-based sports where continuous monitoring guides pacing strategies and recovery routines. As the pressure to maintain peak athletic condition increases, teams invest in fitness tracking systems that provide both real-time monitoring and long-term performance trends. The segment’s growth is also supported by advancements in sensor accuracy and integration with broader analytics platforms, making fitness tracking essential to modern player development.

Analysis by End User:

- Team Sport

- Individual Sport

Team sport led the market in 2024 because of the high demand for detailed performance analysis across multiple players simultaneously. Sports like football, basketball, soccer, and rugby require constant coordination and tactical planning. Player tracking systems help coaches evaluate positioning, spacing, speed, and in-game decisions across the entire team. This enables more informed strategy adjustments, better substitution management, and deeper post-game breakdowns. With team success relying on synchronized movements and collective effort, tracking technologies provide a competitive advantage by highlighting both individual and group dynamics. Professional leagues and clubs are increasingly adopting these systems to gain a data-backed edge. The complexity and fluidity of team sports make tracking tools indispensable, fueling steady investment and expanding use across training grounds and live match scenarios.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.2% due to its early adoption of advanced sports technologies and strong presence of major professional leagues like the NFL, NBA, MLB, and NHL. These organizations invest heavily in performance analytics, injury prevention, and fan engagement, driving demand for tracking solutions. The region also benefits from a mature sports infrastructure, high athlete salaries, and widespread media coverage, encouraging the use of data-driven tools to gain a competitive edge. Key tech companies and sports analytics firms are headquartered in the U.S., further accelerating innovation and deployment. Partnerships between leagues, broadcasters, and tech providers have helped integrate tracking data into live broadcasts and digital platforms, increasing audience engagement. Government and private sector funding for sports tech startups also contributes to North America’s dominant position in this growing market.

Key Regional Takeaways:

United States Player Tracking Market Analysis

In 2024, the United States accounted for 91.2% of the market share in North America. United States has witnessed increasing player tracking adoption due to growing participation in sporting events and tournaments. According to research, the participatory sports market size has grown strongly in recent years. It will grow from USD 298.95 Billion in 2024 to USD 316.86 Billion in 2025. As more organized competitions emerge across different sports categories, demand for precise tracking tools has surged to enhance performance, prevent injuries, and optimize team strategies. Sports teams and organizations are integrating player tracking systems into training and competitive environments to gain real-time analytics and behavioural insights. This trend is further strengthened by the rising emphasis on athlete monitoring and data-driven performance assessments in both amateur and professional levels. Growing interest in youth and collegiate sports has also contributed to higher utilization of tracking technologies, creating a dynamic market for innovations in this domain.

Asia Pacific Player Tracking Market Analysis

Asia Pacific is experiencing increasing player tracking adoption due to growing fitness tracking wearable devices, such as smartwatches and fitness bands. For instance, in 2025, India has a 29.1% smartwatch adoption rate, which translates to 201.4 Million users. The surge in personal health awareness has led to widespread use of wearable technology that monitors physical activity, which is now influencing how player tracking tools are perceived and adopted across sports and fitness industries. As wearable devices evolve to offer more advanced metrics, individuals and sports institutions are leveraging their features for performance evaluation. Integration of these devices into sports training is promoting more detailed insights into movement patterns, stamina, and recovery. Fitness bands and smartwatches are also making it easier to track amateur and professional athletes continuously,

Europe Player Tracking Market Analysis

Europe is seeing accelerated player tracking adoption due to growing launching of customizable player tracking applications. The regional sports technology landscape is evolving with a focus on personalization and flexibility, driving innovation in tracking systems tailored for individual teams, sports, and training needs. These applications are enabling coaches and trainers to monitor metrics such as speed, agility, and fatigue levels with high precision. For instance, UEFA tapped Genius Sports to provide player-tracking data for select club matches, including the Europa League, Nations League, and European qualifiers. The partnership, signed on June 15, 2024, covered approximately 1,350 matches, according to a regulatory filing by Genius Sports (NYSE: GENI). As part of the agreement, Genius Sports installed AI-enabled cameras in more than 140 stadiums to collect advanced performance data. As more applications are launched with features that cater to specific sporting demands, their acceptance in leagues and clubs has grown. These customizable tools enhance training efficiency by offering unique performance insights, supporting both elite athletes and grassroots programs.

Latin America Player Tracking Market Analysis

Latin America has observed rising player tracking adoption due to growing urbanization and disposable income. For instance, in 2025, Latin America is one of the most urbanized regions in the world, with over 80% of its population living in cities. Expanding urban centers are providing better access to modern sports facilities and technologies, while improved financial capacity among individuals and clubs is encouraging investment in advanced tracking tools. This progress is creating opportunities for both amateur and professional teams to adopt player tracking solutions that enhance training outcomes and athletic performance. As urban infrastructure develops, sports programs are integrating data-based monitoring to improve results.

Middle East and Africa Player Tracking Market Analysis

The Middle East and Africa region is experiencing a rise in the adoption of player tracking technologies, driven by the expansion of sports clubs and increased sporting activities. For example, in preparation for the 2034 FIFA World Cup, Saudi Arabia developed 15 stadiums comprising 11 new constructions and 4 major renovations. As organized sports gain traction across communities, there is a growing demand for real-time analytics and performance monitoring tools. The establishment of new sports clubs and academies is further accelerating the adoption of digital tracking solutions, enabling athletes and coaches to leverage data-driven insights for skill development and strategic optimization.

Competitive Landscape:

The current player tracking market is seeing steady growth through new product launches, strategic partnerships, and collaborations between sports teams and technology providers. Companies are investing in wearable devices, optical tracking systems, and AI-driven analytics tools to enhance player performance and fan engagement. Research and development remain active, with firms aiming to improve data accuracy and usability. Some startups have also secured funding to expand their technology offerings and scale operations. Government initiatives are limited but present, mostly focused on sports innovation programs. Among these trends, partnerships and product launches are the most common practices, as they allow quicker adoption and integration of advanced tracking solutions across various sports leagues and organizations. This reflects a broader shift toward data-driven decision-making in sports.

The report provides a comprehensive analysis of the competitive landscape in the player tracking market with detailed profiles of all major companies, including:

- Catapult Group International Limited

- KINEXON Sports & Media

- PlayGineering

- Polar Electro

- SPT Group Pty Ltd.

- Stats Perform

- STATSports Group

- The Chyron Corporation

- Zebra Technologies

Latest News and Developments:

- July 2025: A new algorithm improved fitness tracking by enabling smartwatches to more accurately estimate energy use in individuals with obesity. It was tested over 15,800 minutes and outperformed most existing tracking methods with over 95% accuracy.

- June 2025: Apple previewed watchOS 26 at WWDC 2025, which featured a redesigned interface with Liquid Glass and introduced Workout Buddy for real-time fitness tracking powered by Apple Intelligence. The update enhanced Smart Stack, Control Center, and notification tracking, with a public beta set for next month and full release expected this fall.

- May 2025: Whoop on launched two new wearable devices, Whoop 5.0 and Whoop MG, with enhanced tracking features and 14-day battery life. The wearables offered sleeker designs and deeper health tracking insights, and CNBC had tested the Whoop MG recently.

Player Tracking Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solutions, Services |

| Types Covered | Wearables, Optical, Application-Based |

| Applications Covered | Fitness Tracking, Performance Tracking, Fraud Detection, Player Safety |

| End Users Covered | Team Sport, Individual Sport |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Catapult Group International Limited, KINEXON Sports & Media, PlayGineering, Polar Electro, SPT Group Pty Ltd., Stats Perform, STATSports Group, The Chyron Corporation, Zebra Technologies, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the player tracking market from 2019-2033.

- The player tracking market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the player tracking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The player tracking market was valued at USD 7.47 Billion in 2024.

The player tracking market is projected to exhibit a CAGR of 18.65% during 2025-2033, reaching a value of USD 37.47 Billion by 2033.

The player tracking market is driven by increased demand for data analytics in sports, rising use of wearable and GPS devices, advancements in AI and computer vision, and growing fan engagement through real-time stats. Teams seek performance optimization, injury prevention, and strategic insights, pushing adoption across professional leagues and sports tech firms.

North America dominated the player tracking market in 2024, accounting for a share of 36.2% due to high adoption of advanced sports technologies, strong presence of major leagues, and increased investment in athlete performance analytics and fan engagement tools.

Some of the major players in the player tracking market include Catapult Group International Limited, KINEXON Sports & Media, PlayGineering, Polar Electro, SPT Group Pty Ltd., Stats Perform, STATSports Group, The Chyron Corporation, Zebra Technologies, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)