Polybutadiene Rubber Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2025-2033

Polybutadiene Rubber Market Size and Share:

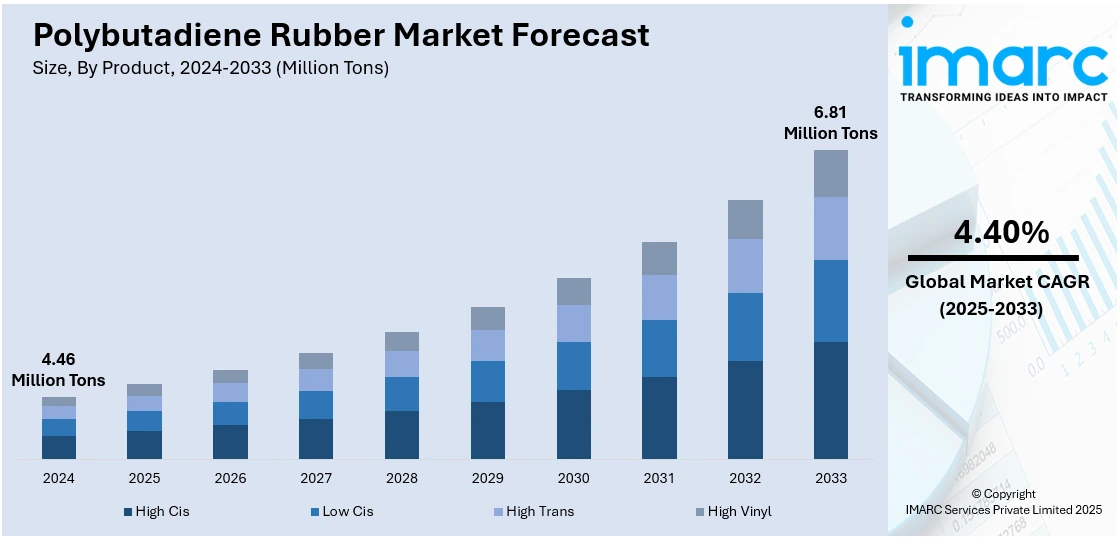

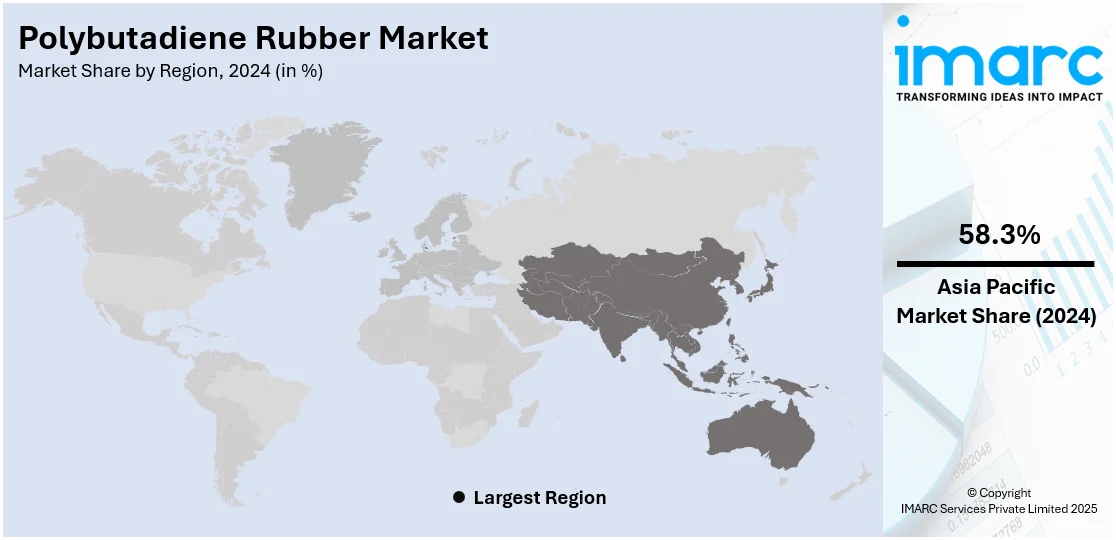

The global polybutadiene rubber market size was valued at 4.46 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 6.81 Million Tons by 2033, exhibiting a CAGR of 4.40% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of around 58.3% in 2024. The market is primarily driven by the increasing demand from the automotive industry, particularly for tire manufacturing, due to its superior wear resistance and high-performance qualities. Additionally, growing industrial applications in the manufacturing of seals, gaskets, and conveyor belts are contributing to market expansion. Moreover, the rising focus on sustainable and eco-friendly products, along with advancements in production technologies, is further augmenting the polybutadiene rubber market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 4.46 Million Tons |

| Market Forecast in 2033 | 6.81 Million Tons |

| Market Growth Rate 2025-2033 | 4.40% |

The market is majorly influenced by rising demand in automotive applications, particularly in tire production, due to PBR's excellent wear resistance, low rolling resistance, and high durability. Furthermore, the growing construction and industrial sectors are also fueling market growth as PBR finds applications in a wide range of products such as adhesives, seals, and gaskets. For example, the Indian Union Budget 2025-26 has raised the outlay for capital investment on infrastructure to INR 11.21 Lakh Crore (around USD 128.64 Billion), or 3.1% of India's GDP. This investment in infrastructure expenditure will likely boost demand for PBR and other durable products, which are critical in road, building, and industrial machinery construction. Additionally, ongoing improvements in manufacturing technology and the growing emphasis on green products are fueling production efficiency and the greenness of PBR.

In the United States, the market is primarily driven by robust automotive production, with increasing tire demand propelled by rising vehicle sales and maintenance requirements. According to industry reports, the United States' sales of electric vehicles (EVs) rose 15.2% year on year in Q4 of 2024 to a new volume record of 365,824 units. Such growth is an indicator of the continued push toward green transportation, which has a positive effect on demand for sophisticated rubber materials like polybutadiene rubber (PBR). In addition to this, the application of PBR in manufacturing industrial goods like footwear and hoses also boosts demand. Moreover, the growing emphasis on sustainability among the U.S. manufacturing and automotive industries is driving the use of sustainable alternatives like PBR, which makes it a top choice among green-savvy manufacturers.

Polybutadiene Rubber Market Trends:

Rapid Industrialization

The rapid industrialization, particularly in emerging markets like China, India, and Southeast Asia, is playing a crucial role in driving the demand for polybutadiene rubber. In November 2024, India’s Index of Industrial Production (IIP) grew by 5.2%, up from 3.5% in October. Sector-wise growth stood at 1.9% for mining, 5.8% for manufacturing, and 4.4% for electricity. The IIP index rose to 148.4 from 141.1 in November 2023. The increasing number of manufacturing plants, infrastructure projects, and industrial goods production is creating a need for various rubber-based products. PBR, known for its strength and flexibility, is used in a range of industrial applications, including conveyor belts, seals, gaskets, and hoses. As industries expand in these regions, the requirement for high-quality, durable rubber compounds, such as PBR, is increasing. Furthermore, with industrial automation on the rise, the demand for PBR in the production of machinery parts and equipment is growing, contributing significantly to the polybutadiene rubber market growth.

Demand for Eco-Friendly and Natural Products

Environmental concerns are pushing the demand for more sustainable and eco-friendly materials in the rubber industry. The growing awareness about sustainability and carbon footprint reduction is prompting industries, particularly the automotive and manufacturing sectors, to adopt eco-friendly alternatives. Additionally, companies are investing in research and development (R&D) to produce bio-based polybutadiene rubbers that minimize the reliance on petroleum-based feedstocks. Moreover, the increasing demand for chemical-resistant materials and advanced rubbers is providing a thrust to the market growth. Liquid polybutadiene rubber is widely used for the manufacturing of elastomers, hoses, belts, rubber bands, shoes, coatings, and adhesives. According to an industry report, 13.77 Million tons of natural rubber were used in 2021 as the main material for products like tires, conveyor belts, vibration dampers, and other applications. Consumers and industries alike are increasingly seeking sustainable solutions that meet performance criteria while contributing to a lower environmental impact, which is creating a positive polybutadiene rubber market outlook.

Growth in the Automotive Industry

The market is experiencing significant growth, primarily driven by the expanding automotive industry. In 2024, global car sales rose to 74.6 million units, reflecting a 2.5% increase from 2023, according to ACEA. Polybutadiene rubber is a key material in the manufacturing of tires due to its excellent wear resistance, low rolling resistance, and high tensile strength. As the global demand for vehicles rises, particularly in emerging economies, tire manufacturers are increasingly relying on polybutadiene rubber to enhance the performance and durability of their products. Additionally, the shift toward electric vehicles (EVs) is further fueling the demand for high-performance tires, which incorporate PBR to improve energy efficiency and overall vehicle performance. As automotive production levels continue to grow, particularly in regions like Asia-Pacific, the demand for PBR is expected to witness substantial growth.

Polybutadiene Rubber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global polybutadiene rubber market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, distribution channel, and application.

Analysis by Product:

- High Cis

- Low Cis

- High Trans

- High Vinyl

High cis leads the market with around 64.4% of market share in 2024. The segment is known for its exceptional properties that render it extremely appropriate for different industrial uses. The high cis structure, in which the majority of double bonds along the polymer backbone are on the same side, imparts high wear resistance, minimal rolling resistance, and improved aging stability to the product. These properties make it a perfect option for the manufacturing of tires, especially in the automotive industry, where durability and performance are paramount. High cis polybutadiene is also employed in the production of synthetic rubbers, enhancing the elasticity and toughness of items such as footwear, automobile components, and other industrial products. Its demand is predicted to keep growing, fueled by higher production in developing markets and technological advancements in the automotive and manufacturing industries. Consequently, High cis continues to be a pillar of the synthetic rubber market, essential for both performance and durability in end-use applications.

Analysis by Distribution Channel:

- Online

- Offline

The online distribution channel is acquiring vast significance in the market due to the increasing trend towards digital media for procurement in the industrial sector. Through the online channel, buyers have greater access to numerous polybutadiene rubber suppliers, product specifics, and competitive prices. This ease cuts down purchase time and expenses for makers and improves worldwide access, allowing small firms to procure high-quality materials easily. Also, the option to compare items, read reviews, and place bulk orders using online stores is further enhancing the offline distribution channel's position in extending the market for polybutadiene rubber, particularly in developing nations.

The offline distribution channel is still a key element in the market, particularly in those markets where physical contact and long-term relationships govern business. Offline channels are controlled by traditional distributors, wholesalers, and suppliers, providing direct sales, after-sales service, and customized services to customers. In industries such as automotive and manufacturing, product specifications and quality requirements are essential, and offline channels provide improved personal contact and trust formation. Also, offline channels offer customers the chance to see products in person, which is crucial with high-value materials such as polybutadiene rubber. Direct interaction creates strong business relationships and supply chain reliability.

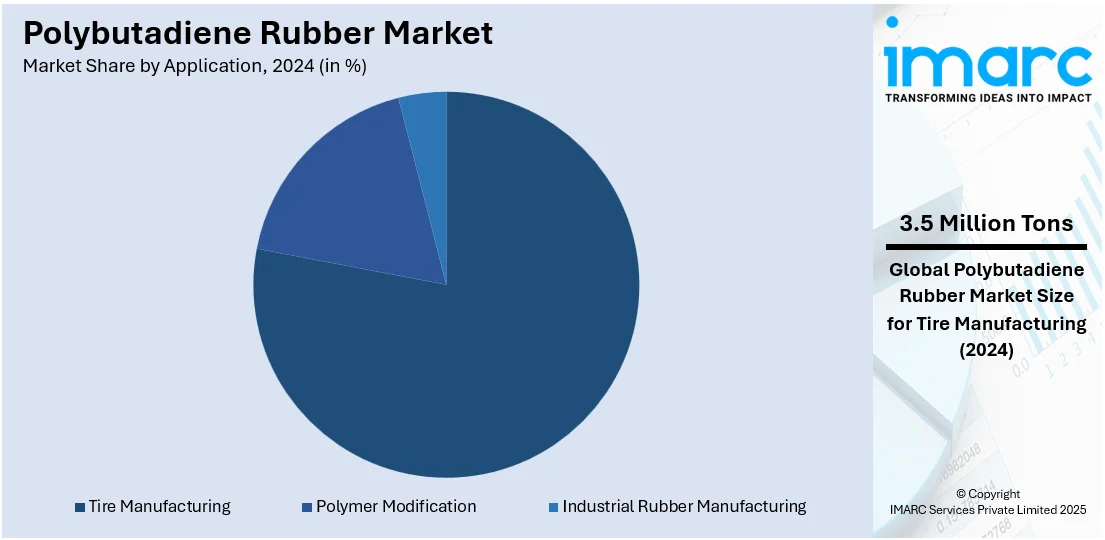

Analysis by Application:

- Tire Manufacturing

- Polymer Modification

- Industrial Rubber Manufacturing

Tire manufacturing leads the market with around 77.7% of market share in 2024. Polybutadiene, especially the high cis form, is preferred in tire manufacturing due to its superior wear resistance, low rolling resistance, and increased durability. These benefits lead to better fuel efficiency and more tire life, making polybutadiene a critical component in the automotive sector. The rising need for fuel-efficient, high-performance tires in passenger and commercial vehicles is an added stimulus to the use of polybutadiene rubber in the manufacture of tires. Moreover, the growing focus on sustainability and eco-friendly technologies in the automotive sector is spurring innovations in tire design, where polybutadiene plays a pivotal role in meeting regulatory standards and consumer expectations for performance. The ongoing growth in automotive manufacturing, especially in developing nations, makes polybutadiene rubber a vital component for the tire industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 58.3%. The market is propelled by increased industrialization and tremendous demand from major industries like automotive, manufacturing, and construction. China, Japan, and India are among the largest consumers of polybutadiene, especially in tire production, where the consumption of long-lasting and high-performance rubber is on a continuous rise. The automotive manufacturing in the region, coupled with increasing consumer markets, significantly drives the consumption of polybutadiene rubber. Major manufacturers and suppliers have bases within the Asia-Pacific region, ensuring that the region is still a significant producer and distributor of polybutadiene. In addition, the continuous capital inflows in infrastructure development, as well as the automotive sector's growing size in the region, are set to contribute to increased growth in polybutadiene rubber demand. Consequently, Asia-Pacific is still the largest and fastest-growing market for polybutadiene rubber, with tremendous potential for ongoing growth in the next few years.

Key Regional Takeaways:

United States Polybutadiene Rubber Market Analysis

In 2024, the United States holds a substantial share of around 88.10% of the market share in North America. The market is primarily driven by increasing use in aerospace and defense applications due to its high durability and impact resistance. According to the Aerospace Industry Association, the U.S. aerospace and defense industry recorded over USD 955 Billion in sales in 2023, which reflects a 7.1% growth in relation to the previous year. In line with this, the ongoing shift toward lightweight vehicle manufacturing is encouraging the adoption of synthetic rubbers with superior strength-to-weight ratios. Similarly, the expanding use of polymer modification for engineering plastics such as ABS and HIPS is further contributing to market expansion. The growth of tire retreading activities in the commercial vehicle sector is also reinforcing demand for polybutadiene rubber, given its exceptional abrasion resistance. Moreover, continual advancements in additive technologies are enhancing the performance of rubber under extreme conditions, augmenting industrial adoption. The rapid integration of rubber components in high-speed rail infrastructure is driving long-term market demand. Additionally, rising interest in low-maintenance, high-durability mechanical parts is stimulating market appeal. Furthermore, supportive regulatory frameworks promoting synthetic material research and development (R&D) are stimulating innovation and market development.

Europe Polybutadiene Rubber Market Analysis

The market in Europe is experiencing growth due to the region’s strong premium and electric vehicle segment driving demand for high-performance synthetic rubber in tires. According to Eurostat, in 2023, nine EU countries saw hybrid and electric vehicles make up over 50% of new car registrations. Across the EU, hybrids and battery-electric cars collectively accounted for 48.3%, nearly matching the 48.8% share of petrol and diesel vehicles. In accordance with this, rising investments in sustainable mobility and energy-efficient tire technologies are strengthening the market demand. Similarly, the EU’s heightened focus on circular economy practices is encouraging the use of recyclable, long-lasting rubber materials. The expansion of advanced manufacturing centers across countries like Germany, France, and Poland is sustaining industrial consumption. The growing use of polybutadiene rubber in modifying plastics for electronics and appliances is reinforcing its industrial relevance. Furthermore, increased adoption of green building materials, driving the use of rubber-based sealants and insulation, is enhancing market appeal. Besides this, strict EU regulations on quality and safety are supporting the demand for high-grade synthetic rubbers. Moreover, collaborative R&D in bio-based rubber synthesis is opening new pathways for sustainable market growth.

Asia-Pacific Polybutadiene Rubber Market Analysis

The market is majorly propelled by the rapid growth of automotive manufacturing hubs in countries like China, India, and Thailand. In addition to this, increased investments in industrial infrastructure are driving consumption in machinery, gaskets, and sealing systems. As such, India aims to boost exports to USD 2 Trillion by 2030 through a “golden quadrilateral” of 100 industrial parks. These fully equipped, investor-ready parks will be developed near major cities in partnership with state governments and private enterprises. Similarly, the rise in electronics and appliance manufacturing across the region, supporting the use of rubber-modified plastics, is impelling the market. Furthermore, expanding footwear exports, particularly from Vietnam and Indonesia, stimulating demand in performance soles and cushioning materials, is bolstering market development. Moreover, continual advancements in low-emission production technologies aligned with national sustainability targets are reinforcing the market’s environmental compatibility. Apart from this, supportive trade policies and competitive manufacturing costs are encouraging international players to establish or scale up rubber production facilities in the Asia Pacific.

Latin America Polybutadiene Rubber Market Analysis

The market in Latin America is gaining momentum due to rising commercial vehicle demand in Brazil, Mexico, and Argentina, driving tire production and replacements. Furthermore, expanding petrochemical activities in the region are supporting local availability of raw materials like butadiene, improving supply chain efficiency. Accordingly, Braskem planned to augment its Rio de Janeiro plant’s capacity by 220,000 t/yr each of ethylene and polyethylene under its "switch to gas" initiative. Additionally, rising investment in the construction and mining sectors, driving the use of durable rubber components in heavy machinery, is enhancing the market appeal. Furthermore, favorable government initiatives aimed at industrial growth and export promotion are encouraging synthetic rubber production and regional market expansion.

Middle East and Africa Polybutadiene Rubber Market Analysis

The market in the Middle East and Africa is significantly driven by expanding automotive assembly in South Africa, Morocco, and the UAE, driving demand for tires and components. According to NAAMSA, South Africa's vehicle production rose by 13.9% in 2023 to 633,332 units, up from 555,885 units in 2022, outpacing the global vehicle production growth rate of 10.3% for the same year. Similarly, large-scale infrastructure and industrial development projects across the GCC are promoting the use of durable rubber materials in machinery and construction applications, which is enhancing market accessibility. Additionally, rising consumer electronics and home appliance manufacturing are supporting the integration of rubber-modified plastics across product categories. Besides this, strategic petrochemical investments, particularly in Saudi Arabia, are stimulating regional feedstock availability and supporting downstream synthetic rubber production, thereby reinforcing market stability.

Competitive Landscape:

The market is highly competitive, with a combination of international and regional players supplying a range of grades customized for automotive, industrial, and consumer markets. The rising demand in the automotive industry for tire manufacturing and the heightened need from other sectors, such as adhesives, coatings, and elastomers, fuel the industry. Businesses compete on product quality, pricing strategies, and geographic reach. Moreover, strong emphasis is laid on innovations to create sustainable and green products, enhance the performance and cost-effectiveness of PBR grades. Strategic partnerships, joint ventures, and alliances are prevalent as firms seek to increase their production capacity and improve their distribution channels. According to the polybutadiene rubber market forecast, the market is anticipated to expand steadily with the continuous investments in product innovation, particularly in regions such as Asia Pacific, where demand for industrial and automotive use continues to grow.

The report provides a comprehensive analysis of the competitive landscape in the polybutadiene rubber market with detailed profiles of all major companies, including:

- Evonik Industries AG

- JSR Corporation

- Kuraray Co. Ltd.

- Lanxess AG

- LG Chem Ltd.

- LyondellBasell Industries Holdings B.V.

- Nippon Soda Co. Ltd.

- Reliance Industries Limited

- Saudi Arabia Basic Industries Corporation (SABIC)

- Synthomer plc

- Synthos (FTF Galleon S.A.)

- The Goodyear Tire & Rubber Company

- UBE Industries Ltd.

Latest News and Developments:

- March 2025: Lotte Chemical agreed to sell a 25% stake in Lotte Chemical Indonesia for USD 449 Million. The move follows the planned liquidation of its Malaysian JV, LUSR, which produces 72,000 tons of polybutadiene rubber annually, as part of its shift away from basic petrochemicals.

- February 2025: Yokohama Rubber and Zeon began building a bench facility at Zeon’s Tokuyama Plant to produce plant-based butadiene from ethanol. Launching in 2026, the project will yield prototype polybutadiene rubber for tires, marking a step toward sustainable synthetic rubber manufacturing and future large-scale production demonstrations.

- November 2024: Synthos signed an MOU with Sumitomo Rubber Industries to promote circular tire production using recycled rubber powder and advanced synthetic rubbers, including high and low cis polybutadiene rubber. The partnership leverages Synthos’ TyreXol technology and ISCC PLUS-certified portfolio to reduce environmental impact without compromising tire performance.

- May 2023: ARLANXEO announced a 140 ktpa rubber plant in Jubail, Saudi Arabia, to produce Ultra High cis Polybutadiene (NdBR) and Lithium Butadiene Rubber (LiBR). Commercial operations are set for 2027, with NdBR production aimed at high-performance tires.

Polybutadiene Rubber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | High Cis, Low Cis, High Trans, High Vinyl |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Tire Manufacturing, Polymer Modification, Industrial Rubber Manufacturing |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Evonik Industries AG, JSR Corporation, Kuraray Co. Ltd., Lanxess AG, LG Chem Ltd., LyondellBasell Industries Holdings B.V., Nippon Soda Co. Ltd., Reliance Industries Limited, Saudi Arabia Basic Industries Corporation (SABIC), Synthomer plc, Synthos (FTF Galleon S.A.), The Goodyear Tire & Rubber Company and UBE Industries Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the polybutadiene rubber market from 2019-2033.

- The polybutadiene rubber market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the polybutadiene rubber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polybutadiene rubber market was valued at 4.46 Million Tons in 2024.

The polybutadiene rubber market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of 6.81 Million Tons by 2033.

The market is driven by increasing demand from the automotive industry, particularly for tire production. The growth in industrial applications, advancements in production technologies, and the rising demand for energy-efficient, durable products further support the market. Additionally, expanding applications in the footwear and consumer goods sectors contribute to growth.

Asia Pacific currently dominates the polybutadiene rubber market with a market share of around 58.3%. The dominance is fueled by the region's robust manufacturing sector, particularly in automotive, which is the largest consumer of polybutadiene rubber. Moreover, favorable government policies and investments in infrastructure have led to a more conducive environment for the growth of industries reliant on polybutadiene.

Some of the major players in the polybutadiene rubber market include Evonik Industries AG, JSR Corporation, Kuraray Co. Ltd., Lanxess AG, LG Chem Ltd., LyondellBasell Industries Holdings B.V., Nippon Soda Co. Ltd., Reliance Industries Limited, Saudi Arabia Basic Industries Corporation (SABIC), Synthomer plc, Synthos (FTF Galleon S.A.), The Goodyear Tire & Rubber Company and UBE Industries Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)