Polyethylene Terephthalate (PET) Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Polyethylene Terephthalate Price Trend, Index and Forecast

Track real-time and historical polyethylene terephthalate (PET) prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Polyethylene Terephthalate (PET) Prices October 2025

| Region | Price (USD/Kg) | Latest Movement |

|---|---|---|

| Africa | 1.13 | 27.8% ↑ Up |

| Northeast Asia | 0.85 | Unchanged |

| Europe | 1.38 | 8.1% ↑ Up |

| India | 1.21 | -4.8% ↓ Down |

| South America | 1.06 | 4.9% ↑ Up |

| Southeast Asia | 1.04 | -4.4% ↓ Down |

| North America | 1.41 | -2.4% ↓ Down |

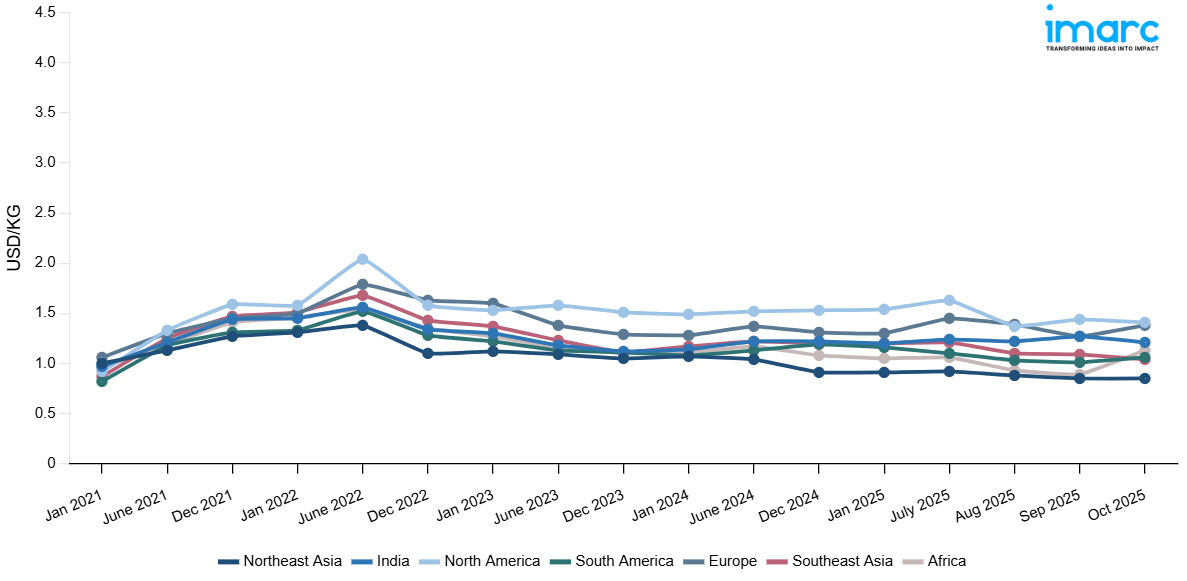

Polyethylene Terephthalate (PET) Price Index (USD/KG):

The chart below highlights monthly polyethylene terephthalate (PET) prices across different regions.

Get Access to Monthly/Quaterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Africa: In Africa, PET prices weakened as limited beverage and packaging demand, combined with subdued downstream purchasing, pressured the market. The keyword price index moved lower as steady import arrivals created oversupply conditions, particularly in coastal regions. While raw material availability remained balanced, sluggish consumer-driven consumption failed to support higher procurement, resulting in bearish sentiment across distributors and processors during this quarter.

Northeast Asia: In Northeast Asia, PET prices declined as muted buying interest from packaging converters weighed on market activity. The keyword price index reflected a slowdown in exports due to weaker international orders, while domestic demand in food and beverage applications offered limited cushioning. Operating rates among producers remained high, but the presence of adequate inventories and cautious procurement kept overall pricing under pressure.

Europe: In Europe, PET prices fell sharply, led by sluggish seasonal demand from the packaging and bottling industries. The keyword price index dropped as oversupply concerns grew, with distributors reporting elevated stock levels and reduced contract purchases. Lower feedstock costs, along with competitive import availability from Asia, further eroded price sentiment. Despite marginal support from recycling activity, demand from converters remained insufficient to stabilize values.

India: In India, PET prices increased on the back of firm demand from packaging and bottling industries, particularly as consumer goods and beverage sectors showed stronger procurement momentum. The keyword price index reflected heightened seasonal orders, with converters stepping up purchases to replenish inventories. Stable feedstock supply supported production levels, while resilient domestic demand provided additional traction to regional prices. Export opportunities remained modest but did not detract from the bullish trend locally.

South America: In South America, PET prices edged lower amid cautious procurement by downstream packaging and consumer goods manufacturers. The keyword price index moved downward as supply remained steady, yet demand from converters was insufficient to absorb available volumes. Imports from Asia added competitive pressure, limiting suppliers’ ability to raise prices despite some recovery signals in domestic consumption.

Southeast Asia: In Southeast Asia, PET prices declined moderately as demand from packaging converters and bottling companies remained subdued. The keyword price index was influenced by weak international trade flows and cautious buying behavior among distributors. Although feedstock PTA and MEG supplies remained balanced, abundant regional availability created oversupply conditions that capped any upward price potential.

North America: In North America, PET prices strengthened due to robust demand from beverage and packaging sectors, which improved procurement activity across the quarter. The keyword price index showed gains, supported by higher consumption during the peak season and improved downstream processing activity. While feedstock availability remained steady, supply tightness in certain areas amplified upward momentum, helping regional suppliers secure stronger margins despite global bearish trends.

Polyethylene Terephthalate (PET) Price Trend, Market Analysis, and News

IMARC's latest publication, “Polyethylene Terephthalate (PET) Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the polyethylene terephthalate (PET) market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of polyethylene terephthalate (PET) at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed polyethylene terephthalate (PET) prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting polyethylene terephthalate (PET) pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

.webp)

Polyethylene Terephthalate (PET) Industry Analysis

The global polyethylene terephthalate (PET) industry size reached USD 35.68 Billion in 2024. By 2033, IMARC Group expects the market to reach USD 56.40 Billion, at a projected CAGR of 4.96% during 2025-2033. Growth is primarily driven by rising demand for PET bottles and packaging materials, increasing use in the food and beverage industry, expanding applications in textiles and industrial fibers, and growing sustainability initiatives with PET recycling and rPET adoption.

Latest developments in the Polyethylene Terephthalate (PET) Industry:

- September 2025: Eastman and Doloop unveiled a 100% recycled PET (rPET) beverage bottle at Drinktec 2025 in Munich. The bottle uses Eastman’s chemically recycled PET, delivering performance equivalent to virgin resin, thus offering a real-world scalable solution for full circularity in beverage packaging.

- April 2023: Sonoco announced that its high-barrier paper-based structure, EnviroFlex Paper Ultimate (ULT) 1.0, had received How2Recycle free qualification and met all requirements of the Fiber Box Association’s Voluntary Standard for Repulping and Recycling. This recognition supports Sonoco’s ongoing efforts in innovative and sustainable packaging.

- February 2022: Alpha Packaging introduced a new Eco-line of its popular PET packers. These packers use lighter weight and recyclable materials, offering a more sustainable solution while maintaining performance.

Product Description

Polyethylene Terephthalate (PET) is a thermoplastic polyester resin formed by the polycondensation of terephthalic acid (PTA) and monoethylene glycol (MEG). It is characterized by high tensile strength, clarity, lightweight properties, and excellent barrier performance against gases and moisture, making it highly suitable for packaging. PET is widely used in producing bottles, containers, films, and fibers, with key applications in the food and beverage industry, textiles, and industrial products. It offers recyclability, allowing conversion into recycled PET (rPET), which is increasingly utilized to support circular economy initiatives. PET can be processed via injection molding, blow molding, and extrusion, making it versatile across packaging, consumer goods, and industrial applications. Its chemical resistance, durability, and adaptability with additives and reinforcements further enhance its role as a preferred material in global manufacturing.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Polyethylene Terephthalate (PET) |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Polyethylene Terephthalate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of polyethylene terephthalate pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting polyethylene terephthalate price volatility, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights, ensuring they remain at the forefront of the polyethylene terephthalate industry.

Key Questions Answered in This Report

The polyethylene terephthalate (PET) prices in October 2025 were 1.13 USD/Kg in Africa, 0.85 USD/Kg in Northeast Asia, 1.38 USD/Kg in Europe, 1.21 USD/Kg in India, 1.06 USD/Kg in South America, 1.04 USD/Kg in Southeast Asia, and 1.41 USD/Kg in North America.

The polyethylene terephthalate (PET) pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for polyethylene terephthalate (PET) prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)