Portable EV Charger Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Portable EV Charger Market Size and Share:

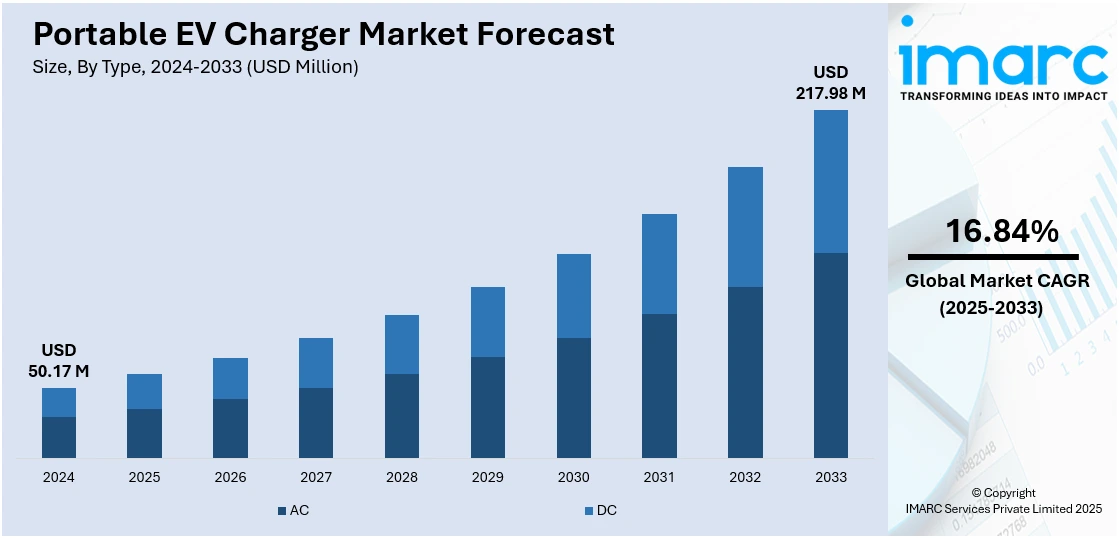

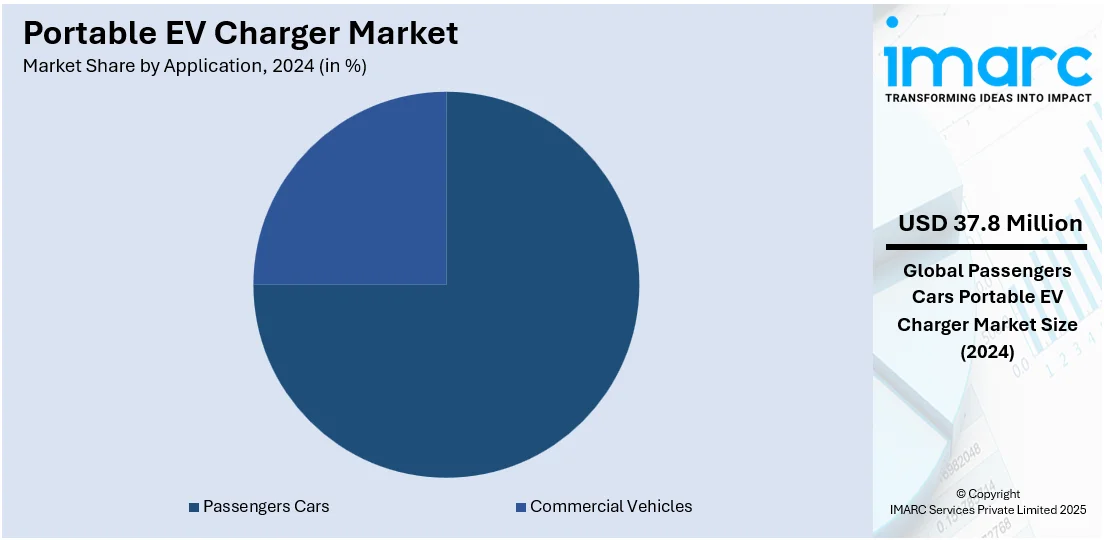

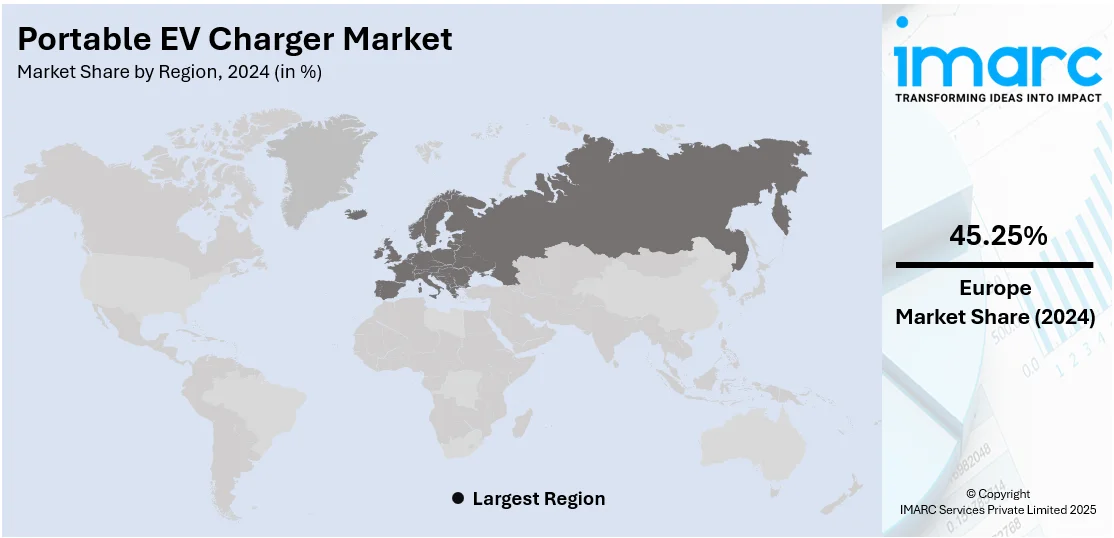

The global portable EV charger market size was valued at USD 50.17 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 217.98 Million by 2033, exhibiting a CAGR of 16.84% from 2025-2033. Europe currently dominates the market, holding a market share of over 45.25% in 2024. The market is powered by accelerating adoption of electric vehicles (EVs), flexible charging requirements, and government policies supporting the sector. Segments like AC chargers and passenger cars are driving demand because they are affordable, user-friendly, and suit consumer mobility patterns. Innovations, such as smaller sizes and quick charging ability are further driving product attractiveness to individual and fleet customers, contributing to substantial portable EV charger market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 50.17 Million |

|

Market Forecast in 2033

|

USD 217.98 Million |

| Market Growth Rate 2025-2033 | 16.84% |

The worldwide market for portable electric vehicle (EV) chargers is being driven by boosting penetration of electric vehicles in markets with poor access to fixed charging infrastructure. In most of Asia, Africa, and Latin America, the build-out of fixed charging networks is lagging the growth of EV adoption. Consequently, plug-in EV chargers are coming to be an efficient answer to the infrastructure shortfall, providing trusted charging alternatives wherever traditional stations do not exist. International travelers and commercial fleets also increasingly need compact, transportable, and variable-environment operation-friendly charging solutions. According to the sources, in May 2023, Polar Power released advance orders for new mobile CCS EV chargers, with quick roadside charging solutions for electric vehicles low on power, improving emergency support and fleet services. Moreover, portable charging devices further aid in emergency preparedness and energy resilience, becoming critical considerations as climate-driven interruptions occur. Their convenience enables EV drivers to enjoy mobility independent of grid infrastructure, building more confidence in electric transport. With the spread of electrification taking place around the world, technology for portable charging will play a key role in enabling mass use of EVs.

In the US, the heightening popularity of outdoor living and of electric cars with adventurous and environmentally friendly consumers is greatly increasing demand for portable EV chargers contributing to an estimated 80.85% market share in 2024. Americans who undertake pursuits like cross-country road travel, boondocking, and off-grid camping demand mobile charging technology that accommodates their mobile lifestyle. The products provide the versatility to recharge in locations that do not have well-established charging networks, thereby maximizing the practical use of EVs beyond cities. For instance, in May 2025, U.S.-headquartered Beam Global introduced a 14.3 kW solar-powered, portable EV ARC charging station in Europe, allowing off-grid, rapid deployment EV charging without grid extension. Furthermore, residential adoption is also increasing as more households search for cost-effective solutions over wired charging units. Portable chargers provide a plug-and-play solution, especially for renters or those who might move more often. Growing access to renewable energy sources such as solar panels also support the use of portable EV chargers, promoting self-sustaining and sustainable charging habits. Paired with federal and state-level incentives for EV infrastructure, these residential and lifestyle trends are driving adoption in the U.S. market.

Portable EV Charger Market Trends:

Increased EV Adoption and Charging Flexibility

Increasing adoption of electric vehicles (EVs) is a major influence on the market for portable EV chargers. During the first quarter of 2025, alone, about 300,000 new EVs were retailed in the U.S., representing a 11.4% increase compared to the previous year. Such growth represents part of an industry-wide movement towards sustainable transport and consumers demanding sensible charging alternatives corresponding to mobile ways of life. Portable EV chargers provide a convenient option, allowing users to charge their cars without relying on fixed installations. This is particularly useful in outlying regions, while on the move, or in emergency situations where use of conventional stations is not available. With the EV market becoming more diversified in terms of the types of vehicles and user choice, demand for easy-to-use, flexible portable charging options is growing. These portable chargers also fit with other nascent mobility patterns like car sharing and electric fleet markets. The development of the portable charger segment is being heavily driven by the correlation between EV growth and on-the-go charging demands.

Increased Public Charging Networks and Advancements in Technology

The fast growth of public EV charging networks globally is further supporting the portable EV charger market outlook. Global public charging stations amounted to 2.7 million as of the end of 2022, with more than 900,000 installed that same year—a growth of 55% from 2021. This trend indicates robust institutional backing for EV charging infrastructure and enhances general consumer confidence in electric mobility. At the same time, innovation in handheld charging technologies is gaining momentum. Manufacturers are launching quicker, lighter, and more intelligent solutions, such as models with wireless functionality and enhanced energy efficiency. These features enhance portable chargers to be more attractive, consistent, and versatile in meeting various users' demands. With EV drivers demanding quicker charging times and better handling, business houses are putting a significant amount of money into R&D to enhance performance and ease of use. Such technological advancements not only increase the competitiveness of products but also facilitate higher EV integration into everyday life, further driving market demand for high-performance, mobile charging hardware.

Government Incentives and Increased Environmental Consciousness

Government initiatives to reduce greenhouse gas emissions are themselves substantially boosting the portable EV charger market growth. Laws encouraging EV adoption—tax credits, rebates, and investments in infrastructure—are making electric vehicles more affordable for consumers. These incentives indirectly increase demand for portable chargers, which are convenient accessories for new EV buyers. Increased environmental consciousness among the masses is also causing a cultural change in transport options. With increasing numbers of people realizing the environmental cost of fossil fuels, they are switching towards electric vehicles as a greener option. This change is not limited to urban areas but is seen in suburban and rural regions as well, where portable chargers offer critical support in areas that do not have extensive charging networks. The combination of supportive policy environments and heightened consumer awareness of sustainability is promoting wider EV ownership and, by extension, wider adoption of portable charging solutions. As environmental responsibility goes mainstream, the place of mobile, easy-to-use EV chargers in everyday commuting continues to grow.

Portable EV Charger Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global portable EV charger market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- AC

- DC

The AC segment currently leads the market in 2024, for portable EV chargers because of its universal compatibility with most electric vehicles as well as being versatile for use in everyday charging. AC chargers are generally more compact and affordable than DC equivalents, which makes them highly suitable for home and personal use. Their compatibility with common household outlets makes them even more attractive for use by users concerned with convenience and portability. The market is favored by universal infrastructure preparation and suits well overnight or prolonged charging situations that match typical vehicle usage cases. With their efficiency increasing in batteries and owners of vehicles looking for versatile home or mobile charging solutions, demand for portable AC chargers is increasing. Additionally, recent advances in technology have also enhanced AC charging speeds and safety measures, further enhancing user confidence. This market is anticipated to continue dominating as it directly caters to major consumer concerns including affordability, convenience, and accessibility.

Analysis by Application:

- Passengers Cars

- Commercial Vehicles

Passenger cars are the leading vehicle type with 75.4% share in 2024, fueling demand in the on-the-go EV charger market. Increased ownership of electric passenger cars, such as compact vehicles, sedans, and SUVs, has been a huge source of demand for mobile charging technologies that suit busy lifestyles and changing travel patterns. Portable EV chargers provide an efficient means for private car owners to have constant access to power, especially when fixed infrastructure is not present or is not convenient. This market gains from increased consumer demand for clean personal transportation and the increasing number of EV models available in all price categories. Besides, the popularity of flexible charging is also supported by the requirements of urban residents, long-distance travelers, and tourists who appreciate autonomy from public charging points. Producers are adapting product features and designs to suit the unique charging needs of passenger cars, further supporting the dominance of this segment. With personal EV usage speeding up, portable charging for passenger vehicles is likely to experience steady and considerable growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe is central to the world market for portable EV chargers with 45.25% share in 2024, due to its firm regulatory drive towards lowering carbon emissions and electric mobility promotion. Governments in the continent have put in place facilitating policies, including incentives for vehicle electrification, low-emission zones, and green infrastructure investments, which all stimulate the use of EVs. These are added to by a dense population of urban dwellers and an advanced transport infrastructure, helping drive an increasing demand for flexible charging options. Portable EV chargers are especially prized in Europe because they can deliver charging convenience in densely populated city settings, aged residential neighbourhoods with no attendant parking, and during cross-border travel. The market is further fueled by an environment of innovation and high consumer awareness of sustainability. As the region makes its way into clean energy transport, portable charging technologies are becoming a key part of Europe's overall EV plan, addressing the requirements of both private and commercial consumers.

Key Regional Takeaways:

North America Portable EV charger Market Analysis

The North America portable EV charger market forecast is experiencing robust momentum, driven by the increasing trend toward electric mobility and consumer appetite for efficient charging alternatives. With rising electric vehicle adoption in the United States, Canada, and Mexico, demand for mobile and convenient charging solutions has grown. Portable EV chargers provide an effective alternative to immovable infrastructure, serving residential consumers, fleet operators, and recreational users as well. Government incentives from clean energy plans and transportation electrification programs add further support to market growth. The region is also seeing explosive growth in charging technology, with faster and more compact designs improving user experience and accessibility. Urban areas, suburban communities, and rural regions are all driving demand, underscoring the adaptable appeal of portable charging solutions. Strong innovation culture and widespread public favor toward sustainable transport place North America as a prime driver in the transformation of mobile EV charging, ensuring sustained market expansion.

United States Portable EV Charger Market Analysis

The United States is witnessing a significant increase in portable EV charger adoption due to the rising number of public EV charging stations across urban and semi-urban areas. For instance, in Q3 of 2023, there was a 7.7% increase in the number of EV charging ports in the Station Locator, including an 8.4% increase in public ports and a 2.8% increase in private ports. As public charging infrastructure expands, EV owners are increasingly seeking flexible and accessible charging alternatives, boosting demand for portable EV chargers. This trend is fueled by the need for on-the-go solutions that complement public station availability. With more EV users relying on widespread networks, portable chargers serve as reliable backups, ensuring continuous vehicle operation. The growing focus on personal mobility, convenience, and backup charging support has further strengthened consumer interest. Automakers and accessory providers are aligning their offerings with this shift, integrating compatible technologies.

Asia Pacific Portable EV Charger Market Analysis

Asia-Pacific is experiencing a surge in portable EV charger adoption driven by the growing implementation of government initiatives supporting EV infrastructure and sustainable transportation. For instance, in India, the GST on EVs was reduced from 12% to 5%, and the GST on chargers/charging stations for EVs was reduced from 18% to 5%, as per the FAME India Scheme Phase-II. Regional governments are launching programs to incentivize electric vehicle usage, providing subsidies and infrastructure development plans that stimulate interest in mobile charging alternatives. These initiatives aim to reduce dependence on traditional fuel and promote clean energy mobility. In parallel, incentives for manufacturers to develop portable charging solutions are also being rolled out. As public infrastructure matures, users seek added convenience, making portable EV chargers a preferred choice. Government-backed campaigns to raise awareness and accessibility are key accelerators. As such, the growing implementation of government initiatives is proving instrumental in the widespread adoption of portable EV chargers in Asia-Pacific.

Europe Portable EV Charger Market Analysis

Europe is advancing in portable EV charger adoption supported by a growing focus on reduction in greenhouse gas emissions. For instance, the EU has a set target for 2030 of a 55% net reduction in greenhouse gas emissions. Regulatory frameworks and environmental goals across the region are encouraging the transition to electric mobility, where portable charging solutions play a pivotal role. As nations pursue aggressive emission targets, individuals and fleets are investing in electric vehicles, prompting demand for supplementary charging options. Portable EV chargers provide emission-free, mobile solutions that enhance user independence from grid constraints. The alignment of climate policies with sustainable technologies promotes innovation and the production of cleaner energy products. Public and private stakeholders are investing in mobile charging infrastructure, reinforcing eco-conscious practices. Thus, the growing focus on reduction in greenhouse gas emissions continues to drive portable EV charger demand across European markets.

Latin America Portable EV Charger Market Analysis

Latin America is seeing increased portable EV charger adoption due to the growing development of public EV charging stations in key urban centers. Between January and August 2023, data from the Brazilian Electric Vehicle Association (ABVE) indicates a significant 28% rise in the number of public charging stations, reaching a total of 3,800. As infrastructure investments rise, the need for auxiliary charging devices grows, enhancing mobility for EV owners. Portable EV chargers support users to bridge gaps between station access, especially in expanding but uneven networks.

Middle East and Africa Portable EV Charger Market Analysis

Middle East and Africa are witnessing portable EV charger adoption growth owing to the increasing adoption of electric vehicles across various sectors. According to the UAE Ministry of Energy and Infrastructure, in 2024, there were approximately 8,000 electric vehicles registered in the country. As electric mobility gains traction, portable charging solutions are becoming essential for uninterrupted vehicle usage. The increasing adoption of electric vehicles has created demand for flexible, accessible chargers that align with emerging mobility trends, especially in regions with limited fixed infrastructure.

Competitive Landscape:

The market competition for portable EV chargers is marked by high-speed innovation, varied product portfolios, and strategic forays into new markets. Companies are concentrating on developing product performance by creating compact solutions, higher speeds of charging, and compatibility with smart technologies, such as app control and energy consumption monitoring. Differentiation comes through personalized features that address residential and commercial usage. Firms are reaching deeper into the global market by aligning their strategies with sustainability initiatives and country-level policies on regional electrification, allowing them to tap demand in both developed and developing markets. Joint ventures with power companies, automobile manufacturers, and transport infrastructure planners are becoming more frequent, designed to integrate portable charging technology into end-to-end EV solutions. Charging options that are modular and applicable to multiple vehicles are also on the upswing, adding to competition. With growing consumer demand for convenience, reliability, and eco-friendliness, companies are focusing on user-driven innovations and optimized manufacturing processes to stay competitive and establish a larger stake in this emerging market.

The report provides a comprehensive analysis of the competitive landscape in the portable EV charger market with detailed profiles of all major companies, including:

- Blink Charging Co.

- Evteq Mobility Private Limited

- Freewire Technologies Inc.

- Guangzhou Electway Technology Co. Ltd.

- Heliox Energy Ltd.

- JTM Power Limited

- Power-Sonic Corporation

- Shenzhen Setec Power Co. Ltd.

- Sparkcharge Inc.

Latest News and Developments:

- May 2025: Schumacher Electric launched the SEV1670 12-Amp Level 1 Portable EV Charger, providing up to 12 amps of power through a standard household outlet. The portable EV charger featured a universal J1772 connector, ensuring compatibility with most US electric vehicles.

- May 2025: EVDANCE launched the FLUX 40A Smart EV Charger. The portable EV charger supports 240V Level 2 charging and delivers up to 9.6 kW, significantly reducing charge times for electric vehicles.

- April 2025: Volvo Energy launched the portable PU500 battery energy storage system (BESS) for EV charging, capable of charging heavy-duty trucks in about 90 minutes. The system, with a capacity of 450-540kWh, features a 240kW DC fast charger and supports up to three trucks or 20 cars daily.

- March 2025: Tayniu launched the Infinity 7kW Portable EV Charger. The charger, compatible with Type 1, Type 2, and GB/T standards, features intelligent current regulation, portability, and multi-layer safety protections for home, travel, and commercial use.

- February 2025: Fellten launched the Charge Qube, a portable EV charger that repurposes EV batteries into a mobile energy storage and charging solution. The device offers rapid deployment, flexibility for various use cases, and supports businesses in reducing costs and emissions.

Portable EV Charger Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | AC, DC |

| Applications Covered | Passengers Cars, Commercial Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blink Charging Co., Evteq Mobility Private Limited, Freewire Technologies Inc., Guangzhou Electway Technology Co. Ltd., Heliox Energy Ltd., JTM Power Limited, Power-Sonic Corporation, Shenzhen Setec Power Co. Ltd., and Sparkcharge Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the portable EV charger market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global portable EV charger market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the portable EV charger industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The portable EV charger market was valued at USD 50.17 Million in 2024.

The portable EV charger market is projected to exhibit a CAGR of 16.84% during 2025-2033, reaching a value of USD 217.98 Million by 2033.

The main drivers for the portable EV charger market are the amplifying usage of EVs globally, growth in public and private charging infrastructure, and the development of faster and wireless charging technologies. Moreover, government subsidies supporting clean energy transport and increased consumer environmental awareness are fueling demand for efficient, flexible, and convenient portable charging solutions.

Europe currently dominates the portable EV charger market, accounting for a share of 45.25%. Th market is fueled by robust government initiatives driving EV uptake, high levels of investment in charging infrastructure, and increasing environmental conscience among consumers. The region's thrust towards curtailing carbon emissions and enhancing sustainable transport fuels demand for flexible and convenient charging.

Some of the major players in the portable EV charger market include Blink Charging Co., Evteq Mobility Private Limited, Freewire Technologies Inc., Guangzhou Electway Technology Co. Ltd., Heliox Energy Ltd., JTM Power Limited, Power-Sonic Corporation, Shenzhen Setec Power Co. Ltd., and Sparkcharge Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)