Portable Generator Market Size, Share, Trends and Forecast by Fuel Type, Application, Power Output, and Region, 2025-2033

Portable Generator Market Size and Share:

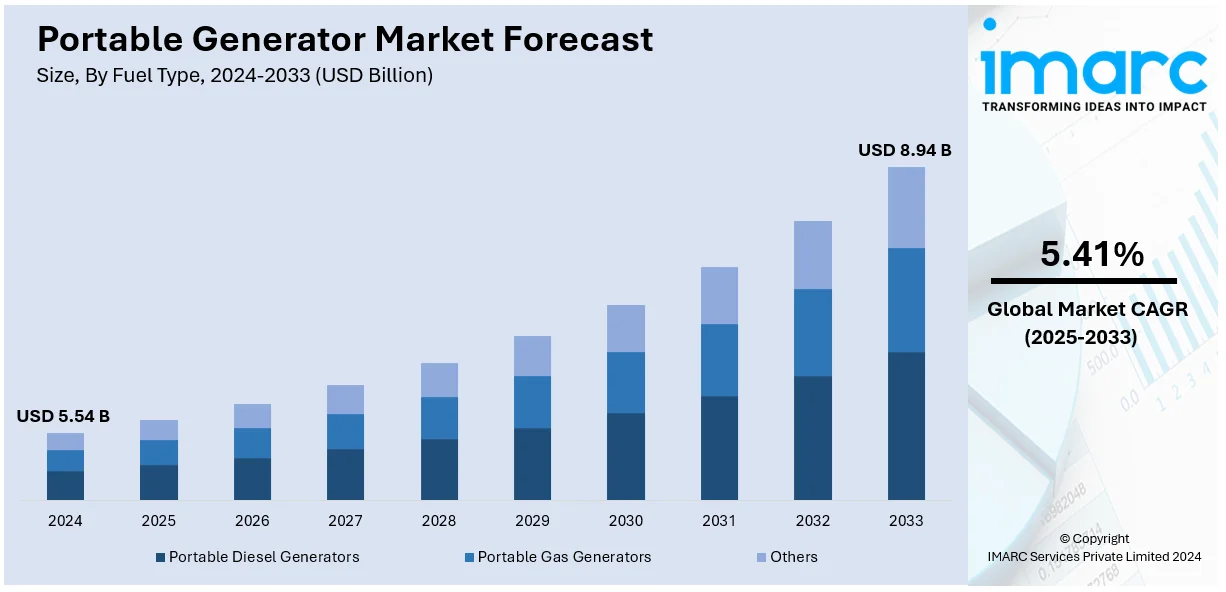

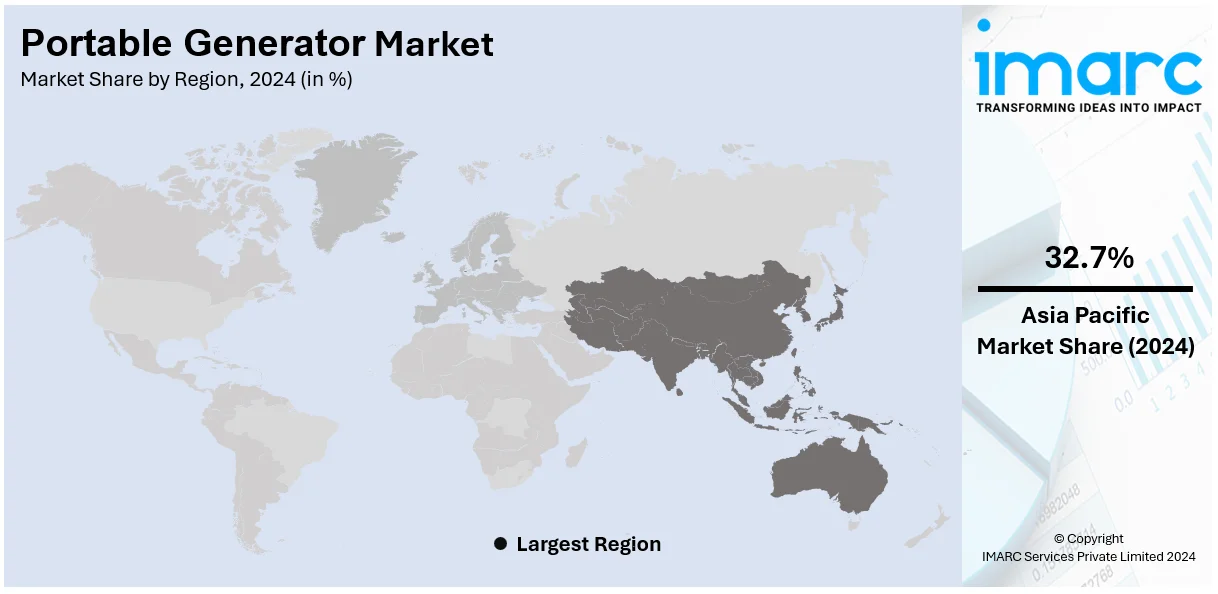

The global portable generator market size reached USD 5.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.94 Billion by 2033, exhibiting a growth rate (CAGR) of 5.41% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 32.7% in 2024. The higher frequency of natural disasters and power outages, growing popularity of outdoor recreational activities, and rising trend of remote working and mobile lifestyles are some of the major factors increasing the portable generator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.54 Billion |

|

Market Forecast in 2033

|

USD 8.94 Billion |

| Market Growth Rate (2025-2033) | 5.41% |

In many parts of the world, power grids are aging and unable to keep up with growing electricity demand. Moreover, natural disasters like hurricanes, snowstorms, and floods also frequently damage infrastructure, leaving households and businesses without electricity for days. Alongside this, people have become more dependent on electronic devices for work, entertainment, and daily life, making even short power outages inconvenient. As per an industry report, there were 16.6 billion connected Internet of Things (IoT) devices by the end of 2023. This number is said to grow 13% to 18.8 billion by the end of 2024. In areas with unreliable electricity or frequent blackouts, portable generators have become an essential backup solution. They provide immediate power to keep appliances running, ensuring comfort and productivity. This rising demand for reliable energy access is a significant driver for the portable generators market.

United States is a major market disruptor with a share of 88.10% in North America. The U.S. has been experiencing a rise in power outages, majorly because of severe weather events. In the first nine months of 2024, the country recorded 1.2 billion outage hours, the highest since tracking began in 2010. This growing instability in the power grid has led to a surge in demand for portable generators as reliable backup power sources. Also, the shift towards remote work and home-based businesses in the country has increased the need for uninterrupted power supply. It has been found that about a third or 35% of workers with jobs that can be done remotely are working from home. Some are also opting for hybrid settings with about six-in-ten hybrid workers or 59% work from home three or more days in a typical week, while 41% say they do so two days or fewer. This has directly increased the need for portable generators to supply uninterrupted power for proper conduction of businesses.

Portable Generator Market Trends:

Increasing Incidences of Power Outages

The major influential reason behind the increasing market size of portable generators is the increased instances of power outages due to extreme weather events and outdated power infrastructure. As per US Energy Information Administration, the electricity customers experienced more than 5 hours of electricity interruptions in 2022. Recent natural disasters like hurricanes, floods, and wildfires increasingly cause mass blackouts. This, in turn, has prompted residential as well as commercial consumers to start purchasing portable generators to avoid their critical services coming to a halt during emergencies. Portable generators are the lifeline equipment for regions prone to power disruptions to maintain day-to-day activities and protect homes and businesses from the impacts of such prolonged disruptions. The more frequent the disruptions, the further up the scale the requirement for reliable backup power solutions, such as portable generators, will rise.

Escalating Demand for Backup Power

The rising demand for uninterruptible power in residential and commercial sectors is another critical factor driving the portable generator market. According to the IEA's Electricity Mid-Year Update, the world's electricity demand is expected to increase by approximately 4% in 2024, up from 2.5% in 2023. Portable generators have become an essential supply of power in homes, where appliances ranging from refrigerators and air conditioners to medical appliances continue to function during blackouts. The demand for backup power is significantly high in rural areas and regions where the power grid provides no reliance. Portable generators act as a strong system for commercial sectors in which the critical operations do not get hampered in construction, healthcare, and hospitality segments. Now, SMES is increasingly utilizing portable generators as an efficient weapon against downtime, protection of data, and the continuity of productivity, which are driving the market forward.

Surge in Construction and Industrial Activities

The growth of construction and industrial activities worldwide is also contributing to the expansion of the portable generator market. As per US Department of Treasury, real non-residential construction spending has increased by nearly 15% between November 2021, when the President signed the IIJA. Construction sites often require temporary power sources for tools, lighting, and machinery, particularly in remote or undeveloped areas where there is no access to the main power grid. Portable generators provide a convenient and efficient solution to meet the energy needs of these projects, supporting uninterrupted work even in challenging environments. Similarly, industrial applications, including mining and oil and gas exploration, depend on portable generators for critical power supply. The portable generator market forecast anticipates growth, driven by increasing infrastructure investments, rising demand for backup power solutions, and advancements in fuel efficiency and hybrid generator technology.

Portable Generator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global portable generator market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fuel type, application, and power output.

Analysis by Fuel Type:

- Portable Diesel Generators

- Portable Gas Generators

- Others

Portable diesel generators lead the market with around 42.0% of market share in 2024. Portable diesel generators offer great versatility, power, and diverse applications compared with the traditional types. These generators are widely selected as they are strong, durable, and long-lasting, as well as relatively efficient in the consumption of fuel. Portable diesel generators offer higher power output than other fuels. Thus, they can handle heavy loads easily and drive demanding equipment without much hassle. This is very helpful in the remote areas or in the case of prolonged power cuts. Moreover, these generators operate on diesel that is easily available in most locations, hence making them much more convenient and reliable for the consumers. High performance, fuel efficiency, and wide-ranging applications make portable diesel generators the driving force in the market. They appeal to both commercial and residential customers looking for dependable, powerful on-the-go power solutions.

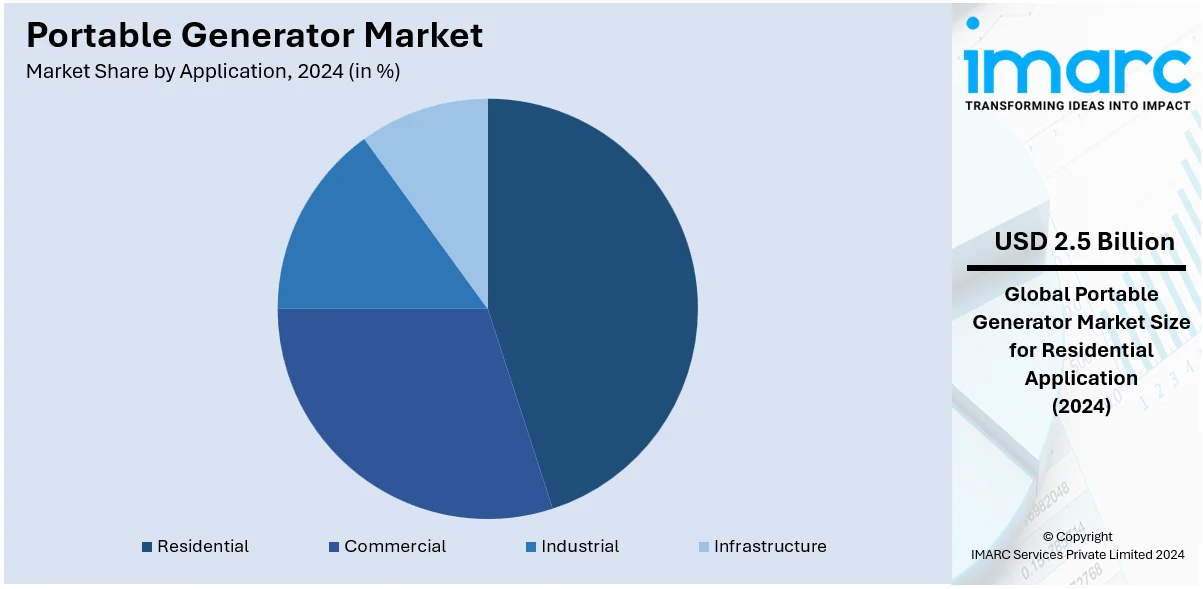

Analysis by Application:

- Residential

- Commercial

- Industrial

- Infrastructure

Residential leads the market with around 45.0% of market share in 2024. Portable generators find a very significant market application in residential applications. As households increasingly require backup power solutions, the demand to access power supplies reliably and conveniently is on the rise, especially with the frequency of extreme weather events, natural disasters, and power outages. Portable generators can serve as practical solutions for homeowners to provide electricity to operate critical appliances, including lighting, heating, and communication devices, during an interrupted supply from the main source. The convenience, mobility, and time-saving facilities make portable generators in very high demand among residential users for peace of mind in times of unexpected occurrences. Growing remote working habits and increased use of digital appliances make a constant supply of power a need of the hour, further increasing usage of portable generators in residential areas. With the residential portable generator contributing to the increase in development of the overall market due to more house owners' concerns toward safety and preparedness, these portable generators are fast becoming an integral component of modern household emergency planning.

Analysis by Power Output:

- Less than 3 kW

- 3-10kW

- More than 10kW

Less than 3kW power output leads the market in 2024. The portable generators with power outputs less than 3 kW are very compact and lightweight, hence allowing them to be portable and friendly to users. They are useful for smaller appliances and lighting in camping trips and outdoor events and other recreational activities because their capacity is lower. In addition, these generators are perfect for household use: they provide backup power in case of a power outage and keep household essentials running, such as refrigerators, lights, and communication devices. With its lower power output, this is also used in gaining better fuel efficiency and lower noise levels, thus appealing to environmentally conscious consumers and those requiring quiet operation. The convenience and wide application prospects of portable generators with less than 3 kW power output are highly driving the market, catering to diverse consumer needs and preferences.

Regional Analysis

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 32.7%. Asia Pacific led the market with the largest share because of its rapid industrialization, growing infrastructure development, and increasing demand for reliable power solutions in the region. According to Asian Development Bank, the People's Republic of China, India, and Southeast Asia will account for more than 70% of the increase in world electricity demand over the next three years. Asia alone is expected to consume half of the world's electricity by 2025. China, India, Japan, and South Korea are on the fast lane to economic boom, thus requiring more energy both in urban and rural settings. Portable generators have become an essential backup source in areas where the electric grid is poor or unstable. For several industries, construction sites, and emergency preparedness, backup power is a must. Besides that, the area's vulnerability to typhoons and earthquakes boosts the need for portable generators for service continuity and the relief process during emergency times. Growing outdoor recreational activities and tourism in Asia Pacific also establish some demand for portable generators to provide power in remote locations. Dynamic and diversified market conditions in Asia Pacific will further fuel the growth and increased dominance of the portable generators market in the region.

Key Regional Takeaways:

North America Portable Generator Market Analysis

The portable generator market in North America is experiencing robust growth, driven by increasing power outages caused by severe weather events, aging grid infrastructure, and rising energy demands. The growing frequency of hurricanes, wildfires, and snowstorms has led to a surge in demand for reliable backup power solutions for homes and businesses. Additionally, the expanding construction and outdoor recreational industries have significantly contributed to the adoption of portable generators. Technological advancements, such as inverter generators offering quieter operation and clean energy for sensitive devices, have further fueled the market growth. With a heightened focus on disaster preparedness and increasing rural electrification efforts, the North American portable generator market is due for continued expansion.

United States Portable Generator Market Analysis

United States is leading the portable generator market in North America with a share of 88.10%. The market for portable generators in the United States is driven by an increase in demand for backup power brought on by an increase in hurricane and winter storm frequency. The requirement for reliable backup power solutions is underscored by the fact that hurricanes cause billions of dollars in damages each year, FEMA claims. Short-term power for blackouts is provided through portable generators by nearly 70% of residential users.

Market demand is also dependent on the growth of the construction industry. Non-residential commercial investment has grown more than 7% this year compared to last year, 2023, according to Census Bureau statistics. In addition, according to the Census Bureau statistics, industrial project investment increased by 23% this year, 2024. Portable generators are widely used in construction sites as they provide power for hand tools and equipment. Demand is further fueled by hybrid and inverter-based portable generators that provide quieter operation and improved fuel efficiency. More than 40 million Americans camp every year, which has helped to fuel the rise in outdoor leisure activities and demand for portable, reliable sources of power. The industry is also fueled by technological advancement such as longer runtimes and lower emissions and rising awareness of sustainable energy options.

Europe Portable Generator Market Analysis

The European market for portable generators benefits from increasing infrastructural and renewable energy investments. While they occur less frequently than in other regions, power cuts are still a common issue in rural areas and thus enhance the demand for backup alternatives. According to the European Union report, construction industry accounted for 5.6% of GDP in the EU in 2021. The percentage differed from 7.6% in Cyprus to 7.2% in Germany and Finland depending on the Member State. The expanding construction industry depends more on portable generators to supply electricity at remote locations.

The usage of environmentally friendly generators also increased due to the change in greener energy sources. Many manufacturers are producing types that meet EU emissions standards, such as Stage V standards that encourage low-emission engines. Outdoor events and festivals-the very heart of European cultural life-also contribute to the demand for portable generators. Growth is also helped by the shift to hybrid working patterns, which require backups for remote offices. Adoption is growing in countries like Germany and the UK, driven by extreme weather and the growing importance of energy independence.

Asia Pacific Portable Generator Market Analysis

The major driving factors of the portable generator market in Asia-Pacific are rapid industrialization and urbanization. In countries like China and India, power cuts are common, especially in the rural areas. This creates a huge demand for portable generators both in the home and commercial sectors.

Earthquakes and typhoons frequently strike this region, leading to an urgent demand for emergency power. According to industry reports, the Asia-Pacific construction industry is estimated to be more than USD 4.5 Trillion in value, relying heavily on portable generators in isolated and underdeveloped areas. Furthermore, the increasing popularity of outdoor recreation in Southeast Asia is boosting the demand for lightweight, portable generators. Growth in the industry is also assisted by the growing use of inverter-based devices, which are quieter and consume less fuel.

Latin America Portable Generator Market Analysis

The demand for portable generators is bolstering in Latin America due to frequent power outages and unstable grid infrastructure. Brazil and Mexico are some of the major markets used in the commercial, residential, and construction industries. The Economic Commission for Latin America and the Caribbean estimates that 16 million Latin Americans do not have electricity. More people in rural regions, such as Honduras and Peru, do not have electricity. The agriculture sector, which forms a major share of the region's GDP, is increasingly resorting to portable generators to support their remote irrigation and processing operations. Natural catastrophes such as earthquakes and hurricanes only serve to strengthen the argument for reliable backup power systems. Portable generators are also required to power the equipment used in the mines that are now being extracted in distant areas, as in Chile and Peru. The availability of affordable generator models and increasing awareness of energy efficiency are further factors driving market expansion.

Middle East and Africa Portable Generator Market Analysis

The frequent power outages caused by poor grid infrastructure drive the market for portable generators throughout the Middle East and Africa. There is a significant need for backup solutions both in the household and the commercial sector due to acute electricity shortages in countries such as South Africa and Nigeria. Portable generators are important for off-grid operations during the construction boom in the Gulf countries, which includes developments such as Saudi Arabia's NEOM city with investments in excess of USD 500 Billion. Also, the off-grid locations by the oil and gas sector of the region use portable generators. Infrastructural investment and urbanization are factors that support the portable generator market growth in the region.

Competitive Landscape:

The market is experiencing a lower-than-anticipated demand compared to pre-pandemic levels. However, this is likely to witness a paradigm shift over the next decade with advancements in technology, improved fuel efficiency, and enhanced user experience. Manufacturers are increasingly integrating smart features, such as Wi-Fi connectivity and mobile app controls, allowing users to monitor and manage their generators remotely. Moreover, growing focus of key players on eco-friendly solutions, with the development of hybrid and solar-powered portable generators, catering to environmentally conscious consumers. They are also incorporating noise-reduction technologies to provide quieter operation, enabling comfortable use in noise-sensitive environments. We expect the market to witness new entrants, consolidation of portfolio and increased collaborations to drive healthy competition within the portable generators industry.

The report provides a comprehensive analysis of the competitive landscape in the portable generator market with detailed profiles of all major companies, including:

- Briggs & Stratton Corporation

- Cummins Inc.

- Honda Motor Co., Ltd.

- Eaton Corporation PLC

- Generac Power Systems Inc.

Latest News and Developments:

- February 2025: Cal State LA received a $345,000 grant to collaborate with RockeTruck, Inc. to develop a portable mobile fuel cell generator. This generator will provide clean power during grid outages, especially in emergency situations. The project aims to create a compact version, the MFCG Mini, which can be transported in a pickup truck and used for hydrogen fueling stations.

- October 2024: Keysight Technologies expanded its signal generator portfolio with two new portable RF and microwave analog signal generators. These tools offer a wide power range, minimal phase noise, rapid changing speeds, and broad modulation abilities, catering to RF engineers in wireless, radar, and digital design.

- September 2024: Worksport initiated the Alpha launch of its innovative SOLIS solar array and COR mobile battery power generator. This new nano-grid system stores over 4,000Wh of clean energy daily, providing portable power solutions for vehicles, jobsites, first responders, and outdoor enthusiasts.

- September 2024: A portable generator laboratory has been established in North America by UL Solutions with the goal of improving safety protocols and averting carbon monoxide (CO) poisoning. This facility is intended to verify that portable generators meet the most recent safety regulations by testing and certifying them. The program supports initiatives aimed at lowering the dangers of CO emissions, a significant safety issue related to using generators, especially in emergency and household situations.

- April 2024: Panasonic Corporation has announced the creation of a new division dedicated to hydrogen energy. Panasonic's larger commitment to sustainability and carbon neutrality includes this program. The division will be in charge of developing technology connected to hydrogen, such as energy management systems and hydrogen fuel cells.

- February 2023: Caterpillar Inc. today announced the introduction of the Cat® XQ330 mobile diesel generator set, a new power solution for standby and prime power applications that meets U.S. EPA Tier 4 Final emission standards. The XQ330 is equipped with the EMCP 4.4 digital control panel, which provides all generator set controls and system indicators in a single, easy-to-access interface, as well as a programmable logic controller (PLC) functionality that improves reliability and flexibility for accommodating changes in processes or application requirements.

Portable Generator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Portable Diesel Generators, Portable Gas Generators, Others |

| Applications Covered | Residential, Commercial, Industrial, Infrastructure |

| Power Outputs Covered | Less than 3 kW, 3-10kW, More than 10kW |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Briggs & Stratton Corporation, Cummins Inc., Honda Motor Co., Ltd., Eaton Corporation PLC, Generac Power Systems Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the portable generator market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global portable generator market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the portable generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A portable generator is a compact, movable device that converts mechanical energy into electrical power. It provides temporary electricity during outages or in off-grid locations, making it useful for homes, construction sites, outdoor activities, and emergency situations. These generators typically run on gasoline, diesel, or propane.

The portable generator market was valued at USD 5.54 Billion in 2024.

IMARC estimates the global Portable Generator market to exhibit a CAGR of 5.41% during 2025-2033.

The key factors driving the global portable generator market include the increasing power outages due to extreme weather, growing demand in construction and outdoor activities, advancements in generator technology, rising awareness of emergency preparedness, expansion of off-grid applications, and heightened energy needs from remote work and home-based businesses.

According to the report, portable diesel generators represented the largest segment by fuel type, driven by their durability, fuel efficiency, and ability to handle heavy loads.

Residential leads the market by application due to the increasing need for backup power during outages and natural disasters.

Less than 3 Kw is the leading segment by power output, as they are popular for powering small appliances and electronics, especially in residential and recreational settings.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Portable Generator market include Briggs & Stratton Corporation, Cummins Inc., Honda Motor Co., Ltd., Eaton Corporation PLC, Generac Power Systems Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)