Portugal EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2026-2034

Portugal EdTech Market Summary:

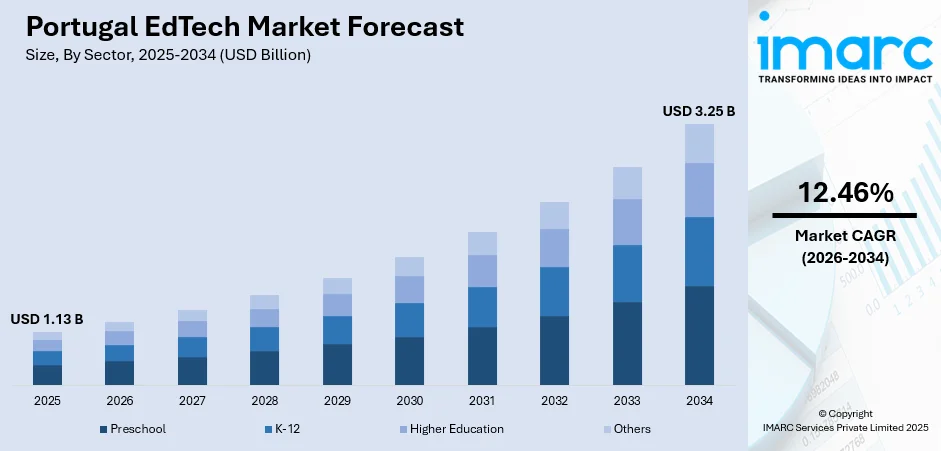

The Portugal EdTech market size was valued at USD 1.13 Billion in 2025 and is projected to reach USD 3.25 Billion by 2034, growing at a compound annual growth rate of 12.46% from 2026-2034.

The Portugal EdTech market is witnessing robust growth driven by accelerating digital transformation initiatives across the education sector. The country's commitment to modernizing its educational infrastructure, coupled with strong government support through national digital strategies, is fostering widespread adoption of educational technologies. Increasing internet penetration, rising demand for personalized learning solutions, and the integration of advanced technologies in classrooms are propelling the Portugal EdTech market share.

Key Takeaways and Insights:

- By Sector: K-12 dominates the market with a share of 52% in 2025, driven by extensive government investment in digital learning tools and the nationwide implementation of digital education programs targeting primary and secondary schools across Portugal.

- By Type: Software leads the market with a share of 60% in 2025, owing to the rising adoption of learning management systems, virtual classroom applications, and interactive educational platforms that enhance teaching and learning experiences.

- By Deployment Mode: Cloud-based represents the largest segment with a market share of 85% in 2025, attributed to cost-effectiveness, scalability, remote accessibility, and seamless integration capabilities that support hybrid and distance learning models.

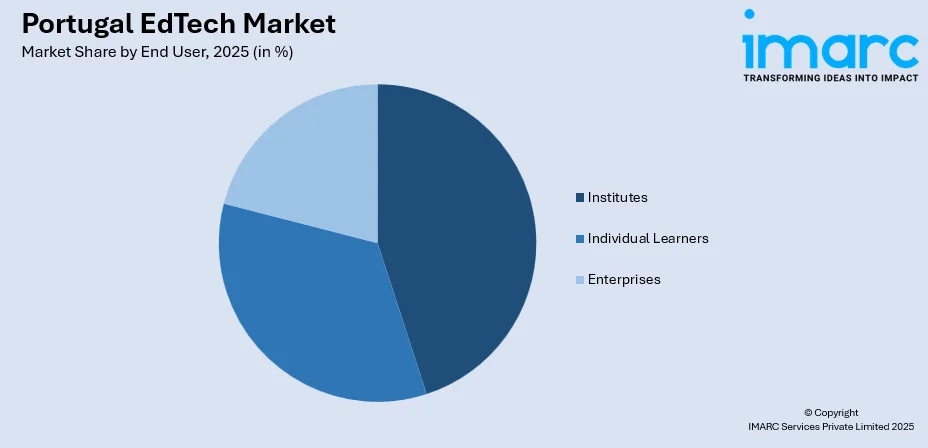

- By End User: Institutes accounts for the largest share of 45% in 2025, propelled by educational institutions' increasing investments in digital infrastructure, teacher training programs, and technology-enabled pedagogical approaches.

- Key Players: The Portugal EdTech market exhibits a moderately competitive landscape characterized by the presence of established global technology providers alongside emerging domestic startups. Market participants are focusing on strategic partnerships with educational institutions, product innovation, and expansion of cloud-based offerings to strengthen their market positioning.

To get more information on this market Request Sample

The Portugal EdTech market is undergoing a significant transformation, propelled by the government's comprehensive digital education strategies and substantial EU funding allocations. National digital education transition plans have equipped teachers with digital competencies while democratizing access to technology-enhanced learning environments. In December 2025, the AI-powered learning platform Luca, targeting primary and secondary schools, raised US$8 million in a Series A round and announced plans to establish a tech hub in Portugal. Portugal's digital skills initiatives aim to integrate digital technologies across all curricular areas, ensuring students develop essential skills for the digital economy. Educational institutions are increasingly adopting AI-powered learning platforms that deliver personalized content and real-time progress tracking, while the proliferation of mobile learning solutions enables flexible access to educational resources across the country.

Portugal EdTech Market Trends:

Integration of Artificial Intelligence in Learning Platforms

The Portugal EdTech market is witnessing accelerated adoption of AI-powered educational solutions that personalize learning experiences and enhance student engagement. Adaptive learning technologies analyze individual performance patterns to deliver customized content, while intelligent tutoring systems provide real-time feedback. In March 2025, a report noted that AI‑driven apps are already transforming math education in Portuguese classrooms, with adaptive platforms and interactive applications reshaping how students learn and teachers instruct. Educational institutions are implementing AI-driven assessment tools that automate grading processes and identify learning gaps, enabling educators to focus on targeted interventions and improve overall academic outcomes.

Expansion of Gamification and Immersive Learning Technologies

Gamification strategies are increasingly being integrated into Portuguese educational platforms to boost learner motivation and knowledge retention. Schools and universities are incorporating game-based learning elements, including achievement badges, leaderboards, and interactive simulations that transform traditional curricula into engaging experiences. According to a 2023 review of two leading Portuguese‑language e‑learning platforms, gamified resources (especially quizzes and serious games) are already being used in middle‑school subjects, demonstrating actual adoption of game‑based learning in real educational contexts. The emergence of augmented and virtual reality applications is enabling immersive learning environments where students can conduct virtual experiments and explore complex concepts through experiential learning methodologies.

Rising Demand for Cloud-Based Learning Management Systems

Portuguese educational institutions are rapidly transitioning to cloud-based learning management systems that offer scalability, accessibility, and cost efficiency. These platforms facilitate seamless collaboration between students, teachers, and parents while providing comprehensive analytics for tracking academic progress. In 2024, as part of Portugal’s Digital Transition Strategy for Education, the pilot phase of the digital‑textbook programme expanded to 103 school clusters, covering over 23,000 students and 3,827 teachers across the country. The shift toward hybrid learning models has accelerated cloud adoption, enabling institutions to deliver consistent educational experiences regardless of physical location and supporting the country's broader digital transformation objectives.

Market Outlook 2026-2034:

The Portugal EdTech market is poised for sustained expansion throughout the forecast period, underpinned by robust government commitment to digital education and increasing institutional investments in technology-enabled learning solutions. National digital strategies position the country among the top digitally advanced EU nations, driving substantial investments in educational technology infrastructure. Growing emphasis on STEAM education, workforce reskilling programs, and lifelong learning initiatives will continue to stimulate demand across sectors. The market generated a revenue of USD 1.13 Billion in 2025 and is projected to reach a revenue of USD 3.25 Billion by 2034, growing at a compound annual growth rate of 12.46% from 2026-2034.

Portugal EdTech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Sector | K-12 | 52% |

| Type | Software | 60% |

| Deployment Mode | Cloud-based | 85% |

| End User | Institutes | 45% |

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The K-12 dominates with a market share of 52% of the total Portugal EdTech market in 2025.

The K-12 sector leads the Portugal EdTech market driven by comprehensive government initiatives targeting digital transformation in primary and secondary education. National digital education transition plans have equipped schools with digital infrastructure and trained educators in technology integration, while programs promoting universalization of digital schooling have distributed devices to students from vulnerable backgrounds. In 2024, under the Digital Education Transition Plan (DETP), funding from the European Social Fund supported digital‑skills training for teachers, helping ensure that educators across the country are prepared to leverage digital tools for inclusive, technology‑enhanced learning. Portuguese schools are increasingly adopting learning management systems and interactive content platforms to enhance curriculum delivery and student engagement.

The strong performance of the K-12 segment is further bolstered by Portugal's participation in EU-funded digital education initiatives and alignment with European digital education action plans. Educational institutions across the country are implementing game-based learning solutions and AI-powered assessment tools to improve academic outcomes. National recovery and resilience plans have allocated resources for modernizing vocational education centres, focusing on digital skills development that prepares young learners for future workforce demands in an increasingly technology-driven economy.

Type Insights:

- Hardware

- Software

- Content

The Software leads with a share of 60% of the total Portugal EdTech market in 2025.

The software segment accounts for the largest share of the Portugal EdTech market, reflecting the increasing adoption of learning management systems, virtual classroom platforms, and educational applications across institutions. Portuguese schools and universities are deploying comprehensive software solutions that facilitate course management, student progress tracking, and collaborative learning experiences. In 2024, a study published under the national Digital Education Transition Plan (DETP) showed that by early 2024 nearly 70% of primary and secondary school teachers had completed digital‑skills training through the DETP, equipping them to effectively use cloud‑based and digital learning software in their teaching practice. The growing preference for cloud-based software platforms enables seamless access to educational resources while reducing infrastructure costs for institutions operating across diverse geographic locations.

The dominance of educational software is driven by the integration of artificial intelligence and machine learning capabilities that personalize learning pathways and automate administrative processes. Institutions are implementing adaptive learning platforms that analyze student performance data to deliver customized content recommendations. The emergence of mobile-compatible software solutions supports anytime-anywhere learning, while gamification features enhance student motivation and retention, contributing to improved educational outcomes across the Portuguese education system.

Deployment Mode Insights:

- Cloud-based

- On-premises

The cloud-based dominates with a market share of 85% of the total Portugal EdTech market in 2025.

Cloud-based deployment is driven by its inherent advantages of scalability, cost-effectiveness, and remote accessibility that align with Portugal's digital education objectives. Educational institutions prefer cloud solutions for their minimal upfront infrastructure requirements and ability to support flexible learning models. The nationwide emphasis on hybrid and distance learning following recent educational reforms has accelerated cloud adoption, enabling consistent access to educational resources regardless of student or teacher location.

The preference for cloud-based EdTech solutions is reinforced by their seamless integration capabilities with existing school management systems and third-party applications. Cloud platforms facilitate real-time collaboration, automatic updates, and enhanced data security through centralized management protocols. Portuguese institutions benefit from cloud analytics tools that provide actionable insights into student performance and engagement patterns, supporting evidence-based decision-making and continuous improvement of teaching methodologies across all educational levels.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Individual Learners

- Institutes

- Enterprises

The institutes lead with a share of 45% of the total Portugal EdTech market in 2025.

Educational institutes represent the largest end-user segment, driven by substantial institutional investments in digital infrastructure and technology-enabled learning environments. Portuguese schools, universities, and polytechnic institutions are allocating significant budgets toward learning management systems, digital assessment tools, and interactive content platforms. In 2024, Politécnico de Lisboa (IPL) rolled out the latest version (4.1) of the Moodle learning‑management platform across all its eight schools, upgrading the interface, adding new integrations and tools, and retraining faculty to structure courses and build digital content for remote or blended learning. Government funding programs and EU digital education initiatives have enabled institutions to modernize their technological capabilities while training educators in effective digital pedagogy.

The institutional segment's dominance reflects the emphasis on standardized digital learning frameworks that ensure consistent educational quality across the Portuguese education system. Institutes benefit from enterprise-grade EdTech solutions that support large-scale deployments, centralized administration, and comprehensive reporting capabilities. The focus on preparing students for digital economy workforce requirements drives institutional adoption of coding platforms, STEAM education tools, and career-oriented learning solutions that bridge academic curricula with industry demands.

Regional Insights:

- Norte

- Centro

- A. M. Lisboa

- Alentejo

- Others

The Norte region represents a significant portion of the Portugal EdTech market, driven by its concentration of educational institutions and the country's largest university by student enrollment. The region's strong industrial base and focus on engineering education have accelerated demand for technology-enabled learning solutions and vocational training platforms.

Centro's EdTech market benefits from the presence of historic academic institutions including the country's oldest university. The region demonstrates growing adoption of digital learning technologies, supported by research-driven innovation and partnerships between academic institutions and technology providers focused on educational advancement.

The Lisbon Metropolitan Area commands substantial EdTech market presence, hosting the country's largest concentration of technology startups, international schools, and higher education institutions. The region's vibrant tech ecosystem and access to venture capital funding create favorable conditions for EdTech innovation and digital education entrepreneurship.

The Alentejo region presents emerging opportunities for EdTech expansion, with digital education initiatives addressing rural connectivity challenges and enabling access to quality educational resources. Government programs targeting digital inclusion are extending technology-enabled learning solutions to underserved communities across this predominantly rural region.

Other regions including Algarve and the autonomous island regions demonstrate growing EdTech adoption, supported by national digital education policies and EU cohesion funding. These areas benefit from cloud-based solutions that overcome geographic barriers and deliver consistent educational experiences across diverse locations throughout the country.

Market Dynamics:

Growth Drivers:

Why is the Portugal EdTech Market Growing?

Government Digital Education Initiatives and Policy Support

The Portugal EdTech market is experiencing substantial growth driven by comprehensive government digital education strategies and sustained policy support. National digital strategies position the country among the most digitally advanced EU member states by emphasizing digital literacy, education, and workforce training. In 2024, under Portugal’s Digital Education Transition Plan and ESF support, digital‑skills training reached scale, with 91% of public‑school teachers completing self‑assessments and many undergoing training, boosting nationwide readiness for technology‑enhanced teaching and digital pedagogy. The national digital skills initiative integrates technology across curricular areas from primary to secondary education, ensuring students develop essential competencies for the digital economy. Recovery and resilience plans have allocated substantial resources for modernizing specialized technological centres, creating new courses linked to digital transitions and strategic technology areas. These initiatives collectively establish a supportive ecosystem for EdTech adoption across all educational levels.

Rising Demand for Personalized and Flexible Learning Solutions

The increasing demand for personalized learning experiences is propelling EdTech adoption across Portuguese educational institutions. Students and educators are seeking technology solutions that adapt to individual learning styles, paces, and preferences, driving adoption of AI-powered adaptive learning platforms. In 2024, a study on Portugal’s digital teacher training revealed that many schools strengthened their digital‑pedagogy capacity, showing institutions are increasingly prepared to implement personalized, technology‑enhanced learning tools and improve student engagement across classrooms.The shift toward hybrid and flexible learning models, accelerated by changing educational paradigms, has created sustained demand for digital tools that support anytime-anywhere access to educational content. Learning management systems with comprehensive analytics capabilities enable educators to track student progress and deliver targeted interventions, improving academic outcomes. The growing recognition that technology-enhanced learning delivers superior engagement and retention is motivating institutional investments in sophisticated EdTech solutions.

Expanding Digital Infrastructure and Connectivity

Portugal's expanding digital infrastructure and improving internet connectivity are creating enabling conditions for widespread EdTech adoption. National digital schooling programmes have distributed computing devices to students while enhancing connectivity in schools nationwide. Government investments in broadband expansion are reducing the digital divide between urban and rural areas, enabling cloud-based educational platforms to reach previously underserved communities. The proliferation of mobile devices and increasing smartphone penetration support mobile-first learning applications that complement classroom instruction. These infrastructure improvements, combined with declining technology costs, are democratizing access to quality educational technology solutions across socioeconomic segments and geographic regions throughout Portugal.

Market Restraints:

What Challenges the Portugal EdTech Market is Facing?

Digital Infrastructure Disparities in Rural Areas

Despite ongoing improvements, digital infrastructure disparities persist between urban and rural regions, limiting equitable access to EdTech solutions. Rural areas and economically disadvantaged communities face connectivity challenges that hinder adoption of cloud-based learning platforms. These infrastructure gaps create barriers to consistent educational technology deployment and require continued investment in broadband expansion.

Teacher Digital Competency and Training Requirements

The effective implementation of EdTech solutions requires comprehensive teacher training and ongoing professional development in digital pedagogies. Many educators require additional support to confidently integrate technology tools into their teaching practices. Bridging digital competency gaps among teaching staff demands sustained investment in training programs and creates temporary barriers to widespread technology adoption.

Integration Challenges with Legacy Educational Systems

Educational institutions face challenges integrating new EdTech solutions with existing legacy systems and administrative processes. The transition from traditional platforms to modern learning management systems requires significant organizational adjustments and resource allocation. Interoperability concerns and data migration complexities can delay implementation timelines and increase adoption costs for institutions.

Competitive Landscape:

The Portugal EdTech market exhibits a moderately competitive landscape characterized by the participation of global technology providers, European EdTech platforms, and emerging domestic startups. Market participants are focusing on strategic partnerships with educational institutions, government agencies, and technology providers to expand their market presence. The competitive environment is shaped by innovation in AI-powered learning solutions, cloud-based platform offerings, and mobile-first applications. Vendors differentiate through localized content development, multilingual support, and alignment with Portuguese curriculum requirements. The market is witnessing increasing investment activity, with EdTech startups attracting funding for product development and geographic expansion.

Recent Developments:

- In October 2025, UMinhoExec, the executive‑education arm of the University of Minho, began transforming Braga’s historic “Edifício do Castelo” with €9 million in funding. Scheduled for completion by 2028, the project will create a modern hub for executive education, research, hybrid learning, and business‑academia collaboration, blending heritage restoration with innovative lifelong learning initiatives.

Portugal EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Norte, Centro, A. M. Lisboa, Alentejo, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Portugal EdTech market size was valued at USD 1.13 Billion in 2025.

The Portugal EdTech market is expected to grow at a compound annual growth rate of 12.46% from 2026-2034 to reach USD 3.25 Billion by 2034.

The K-12 sector dominated the market with a 52% share in 2025, driven by government digital education initiatives targeting primary and secondary schools, implementation of learning management systems, and nationwide distribution of digital devices to students through national digital schooling programs.

Key factors driving the Portugal EdTech market include comprehensive government digital education strategies, EU-funded digital transformation initiatives, increasing demand for personalized learning solutions, expanding digital infrastructure, rising adoption of cloud-based platforms, and integration of AI-powered educational technologies.

Major challenges include digital infrastructure disparities between urban and rural areas, teacher training requirements for effective technology integration, legacy system integration complexities, data privacy and security concerns, and the need for sustained investment in professional development programs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)