Postal Automation System Market Report by Technology (Culler Facer Canceller, Letter Sorter, Flat Sorter, Mixed Mail Sorter, Parcel Sorter), Component (Hardware, Software, Services), Application (Commercial Postal, Government Postal), and Region 2025-2033

Market Overview:

The global postal automation system market size reached USD 922.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,480.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The bolstering growth of the e-commerce industry, the increasing consumer demand for quick and reliable deliveries, and the expanding shift towards smart and connected automated postal operations are some of the major factors propelling the market. At present, North America holds the largest market share, driven by the rapid growth of the e-commerce industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 922.0 Million |

| Market Forecast in 2033 | USD 1,480.0 Million |

| Market Growth Rate 2025-2033 |

5.13%

|

A postal automation system is a technological solution implemented in the postal industry to streamline and enhance the efficiency of mail sorting and processing operations. It encompasses a range of hardware and software components designed to automate various tasks involved in the handling of mail, including sorting, routing, and tracking. Postal automation systems employ machine vision, barcode scanning, robotics, and artificial intelligence (AI) to achieve faster processing times, improve accuracy, reduce manual labor, and enhance overall productivity. As a result, it is widely used across postal services, courier companies, and logistics providers.

The flourishing growth of the e-commerce sector has led to a significant surge in parcel volumes, which is primarily driving the need for postal automation systems to handle large volumes of mail and parcels with speed, accuracy, and precision. In confluence with this, the rising need to optimize operational costs and reduce manual labor has driven postal organizations to invest in the automation of labor-intensive tasks, such as sorting and labeling, further minimizing errors, eliminating bottlenecks, and achieving greater operational efficiency. Moreover, ongoing technological innovations, such as machine learning (ML), AI, and robotics, have led to the development of more advanced postal automation systems that can provide real-time tracking and tracing capabilities, ensuring improved visibility and transparency in postal operations. Besides this, the increasing globalization and cross-border trade have necessitated the implementation of advanced postal automation systems to handle the complexities associated with international mail processing, thus propelling the postal automation system market growth.

Postal Automation System Market Trends/Drivers:

Growth in the e-commerce industry

The bolstering growth of the e-commerce industry and the surging demand for online shopping has led to a surge in the number of packages that need to be sorted and delivered, which has created a need for automated sorting and delivery processes in the postal industry. Moreover, the escalating concerns about accuracy and precision are prompting postal organizations to employ automated postal systems for sorting and processing mail at high speeds while ensuring accuracy and precision. Furthermore, the rising consumer demands for quick and reliable delivery are contributing to the market growth as automated postal systems streamline the entire mail processing workflow, enabling postal organizations to meet customer expectations.

Ongoing technological advancements in the industry

Continuous advancements in technology play a pivotal role in driving the growth of the global postal automation system market. The growing integration of innovative technologies, such as ML, AI, robotics, and machine vision, has enhanced the capabilities of postal automation systems, further creating a positive outlook for the market. Besides this, the expanding incorporation of machine learning algorithms to enable intelligent decision-making and adaptive learning, ensuring accurate mail sorting and routing, is aiding in market expansion. In addition to this, the surging use of robotics that automate various manual tasks and reduce labor costs is transforming the postal automation system market outlook.

Rising focus on optimizing operational costs

Postal organizations face the challenge of minimizing operational costs while meeting the increasing demands for timely and accurate mail processing. Manual, labor-intensive tasks involved in mail sorting and processing can be time-consuming, prone to errors, and require a significant workforce. This, in turn, is impelling the demand for postal automation systems that offer a cost-effective alternative by automating labor-intensive tasks and reducing the reliance on manual labor. Moreover, the large-scale use of advanced technologies to streamline workflows, minimize errors, eliminate bottlenecks, and optimize operational costs is presenting remunerative opportunities for market growth. Concurrent with this, the increasing integration of automation to address the challenge of labor shortages in some regions, ensuring uninterrupted mail processing operations, is acting as another significant growth-inducing factor.

Postal Automation System Segmentation:

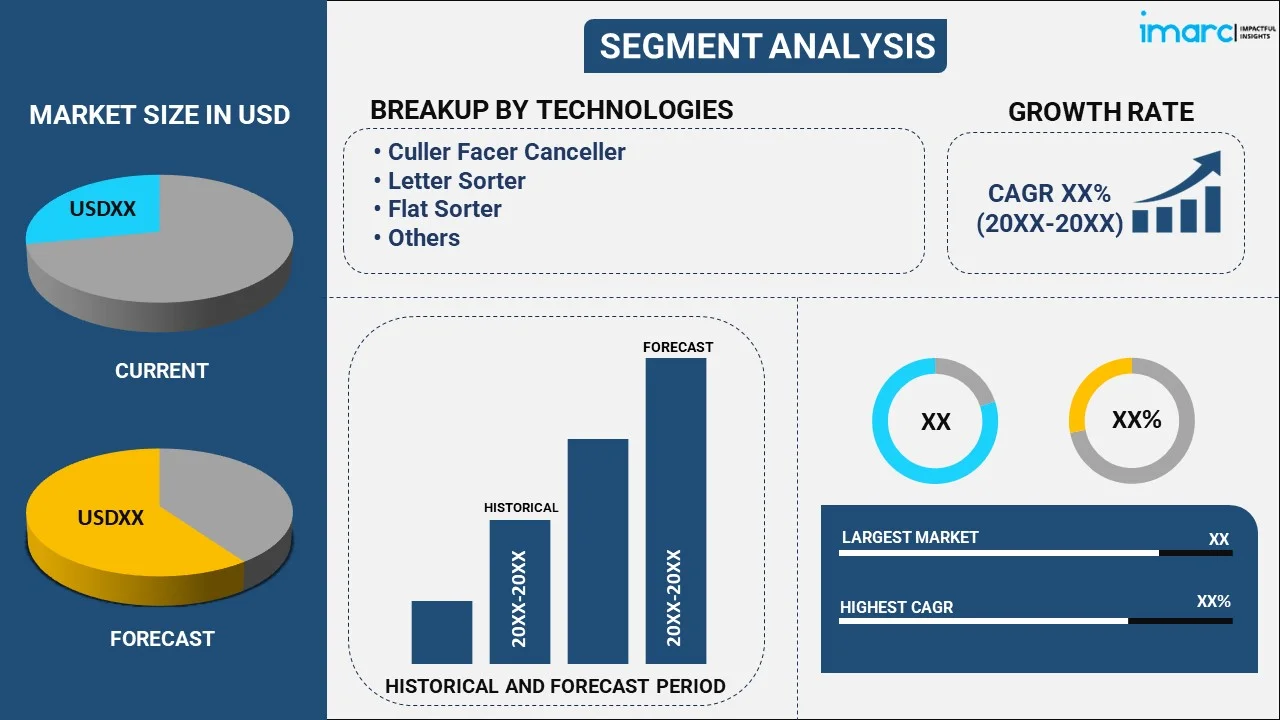

IMARC Group provides an analysis of the key trends in each segment of the global postal automation system market research report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on technology, component, and application.

Breakup by Technology:

- Culler Facer Canceller

- Letter Sorter

- Flat Sorter

- Mixed Mail Sorter

- Parcel Sorter

Parcel sorter is dominating the market

The report has provided a detailed breakup and analysis of the market based on technology. This includes culler facer canceller, letter sorter, flat sorter, mixed mail sorter, and parcel sorter. According to the report, parcel sorter represented the largest segment.

The rapid expansion of the e-commerce sector, along with the increasing volume of parcels being processed by postal organizations worldwide, is driving the demand for parcel sorters. These systems enable efficient sorting and routing of parcels based on size, weight, destination, and other criteria, ensuring timely delivery and improving operational productivity. In addition to this, the high volume of letters and documents that pass through postal networks necessitates the use of letter sorters that utilize advanced technologies, such as optical character recognition (OCR), to automatically read and sort letters based on destination addresses, increasing the accuracy and speed of mail processing. Furthermore, the surging demand for parcel, letter, flat, and mixed mail sorters in postal automation systems is driven by the need for efficient sorting, accurate routing, improved operational productivity, and the ability to handle diverse types of mail.

Breakup by Component:

- Hardware

- Software

- Services

Hardware holds a larger share in the market

A detailed breakup and analysis of the market based on the component has also been provided in the report. This includes hardware, software, and services. According to the report, hardware accounted for the largest market share.

The increasing adoption of postal automation systems worldwide is driving the demand for hardware components. Postal organizations require robust and reliable hardware infrastructure, such as sorting machines, conveyor systems, barcode scanners, and robotic arms, to automate mail processing operations, which is primarily driving the market growth. These hardware components enable efficient sorting, routing, and tracking of mail, enhancing overall productivity and accuracy. In addition to this, the surging need for intelligent algorithms, data analytics, and real-time tracking capabilities is impelling the need for postal automation software solutions to enable address recognition, machine learning-based sorting algorithms, and route optimization, ensuring efficient and accurate mail handling. Furthermore, postal organizations require installation, maintenance, training, and support services to effectively implement and operate these automation solutions, thus creating an increasing demand for service providers that offer expertise in system integration, customization, and ongoing technical assistance.

Breakup by Application:

- Commercial Postal

- Government Postal

Commercial postal is dominating the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial and government postal. According to the report, commercial postal represented the largest segment.

In the commercial postal sector, postal organizations rely on automation systems to streamline mail processing operations which allow commercial postal organizations to handle high mail volumes with speed, accuracy, and improved productivity. Moreover, the rise in customer expectations for timely and reliable delivery, thereby enhancing customer satisfaction and loyalty, is presenting remunerative growth opportunities for the market. In addition to this, widespread product utilization across the government postal sector to facilitate real-time tracking capabilities and ensure the secure and efficient delivery of critical mail items is acting as another significant growth-inducing factor. These systems play a crucial role in the efficient functioning of postal services in various sectors by streamlining mail processing operations, enhancing productivity, improving accuracy, and meeting the evolving demands of customers.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market, accounting for the largest postal automation system market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

The rapid growth of e-commerce in North America has resulted in a significant increase in parcel volumes. As more consumers turn to online shopping, an increasing number of postal organizations are employing advanced postal systems to efficiently process and deliver these parcels. Moreover, the rising focus on staying technologically competitive in North America is prompting postal organizations to invest in automation solutions to optimize their operations. In addition to this, the growing emphasis on customer experience and satisfaction is contributing to the market growth. Concurrently, customers expect speedy and reliable delivery of their packages, along with real-time tracking and visibility. Postal automation systems enable postal organizations to meet these expectations by providing accurate tracking information, ensuring timely delivery, and enhancing overall customer satisfaction, further aiding in market expansion.

Competitive Landscape:

The market is characterized by a highly competitive landscape, with several key players vying for market share. These companies are actively developing advanced automation solutions and technologies to cater to the evolving needs of postal organizations worldwide. Prominent players in the market are investing heavily in research and development (R&D) activities to innovate and introduce new products. They are also enhancing the capabilities of their automation systems by integrating technologies such as ML, AI, robotics, and machine vision. The competitive landscape is further shaped by factors such as pricing strategies, product differentiation, and customer support services.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- BEUMER Group

- Dematic (Kion Group AG)

- Eurosort

- Fives

- Fluence Automation LLC

- Leonardo S.p.A.

- NEC Philippines, Inc.

- Pitney Bowes Inc.

- Solystic SAS

- Toshiba Corporation

- Vanderlande Industries (Toyota Industries)

Postal Automation System Market News:

- In May 2023, BEUMER Group announced the acquisition of the Hendrik Group Inc. and the expansion of its portfolio in the field of environmentally friendly bulk material transport.

- In June 2023, Toshiba Corporation launched motor driver ICs for consumer and industrial equipment that need fewer external parts and that are housed in a small, highly versatile, space-saving package.

- In June 2023, Toshiba Corporation released a 600V Super Junction Structure N-Channel Power MOSFET that is expected to improve the efficiency of power supplies.

Postal Automation System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Culler Facer Canceller, Letter Sorter, Flat Sorter, Mixed Mail Sorter, Parcel Sorter |

| Components Covered | Hardware, Software, Services |

| Applications Covered | Commercial Postal, Government Postal |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BEUMER Group, Dematic (Kion Group AG), Eurosort, Fives, Fluence Automation LLC, Leonardo S.p.A., NEC Philippines, Inc., Pitney Bowes Inc., Solystic SAS, Toshiba Corporation, Vanderlande Industries (Toyota Industries), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global postal automation system market performed so far, and how will it perform in the coming years?

- What is the size of the postal automation system market?

- What are the drivers, restraints, and opportunities in the global postal automation system market?

- What is the impact of each driver, restraint, and opportunity on the global postal automation system market?

- What are the key regional markets?

- Which countries represent the most attractive postal automation system market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the postal automation system market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the postal automation system market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the postal automation system market?

- What is the competitive structure of the global postal automation system market?

- Who are the key players/companies in the global postal automation system market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, postal automation system market forecast, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global postal automation system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the postal automation system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)