Potassium Iodide Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Potassium Iodide Price Trend, Index and Forecast

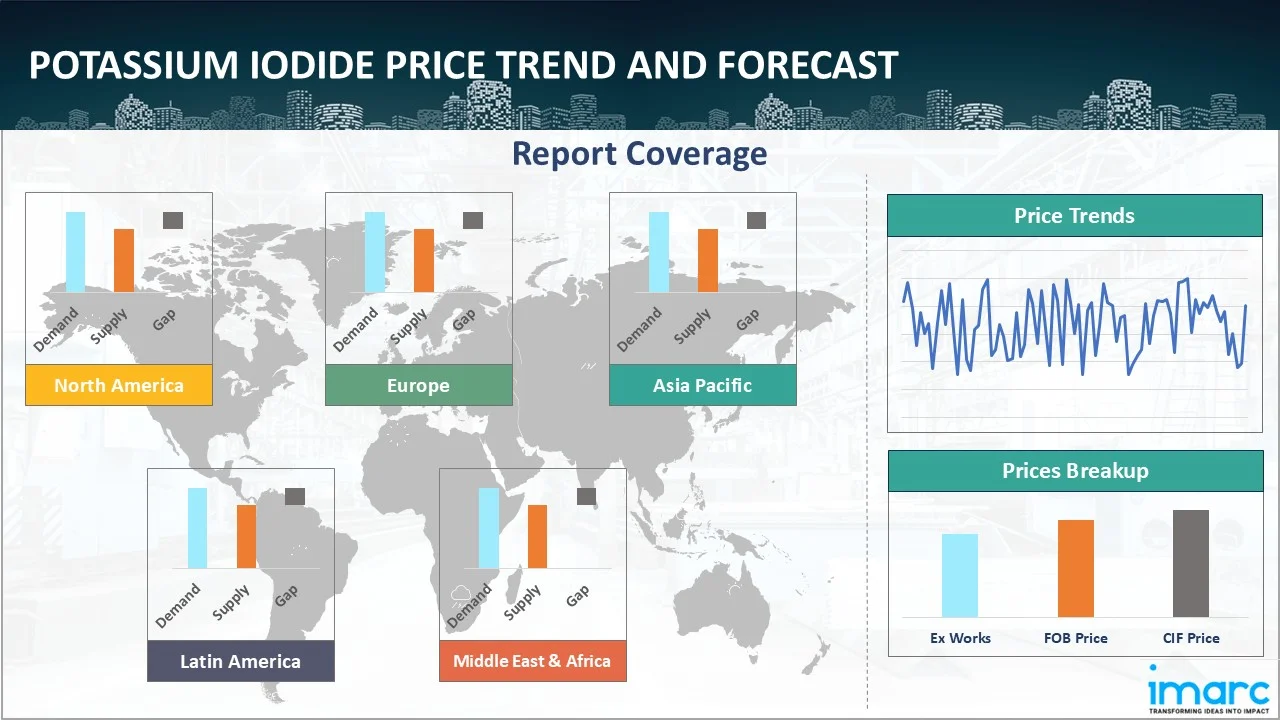

Track the latest insights on potassium iodide price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Potassium Iodide Prices Outlook Q4 2025

- USA: USD 59115/MT

- India: USD 66203/MT

- Germany: USD 72176/MT

- United Kingdom: USD 57673/MT

- China: USD 66490/MT

Potassium Iodide Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the fourth quarter of 2025, the potassium iodide prices in the USA reached 59115 USD/MT in December. The upward price movement was primarily supported by steady downstream demand from the pharmaceutical and nutrition sectors, where potassium iodide is widely used. Supply-side constraints stemming from controlled iodine availability and cautious inventory management by producers also contributed to firmer pricing conditions. Additionally, higher production costs associated with compliance requirements and energy procurement exerted upward pressure on prices.

During the fourth quarter of 2025, the potassium iodide prices in India reached 66203 USD/MT in December. The market experienced firm pricing driven by consistent demand from the pharmaceutical manufacturing and food fortification industries. Domestic production remained aligned with demand levels, but reliance on imported iodine inputs exposed the market to international supply fluctuations.

During the fourth quarter of 2025, the potassium iodide prices in Germany reached 72176 USD/MT in December. The market reflected strong pricing due to robust demand from pharmaceutical formulation and laboratory reagent sectors. Producers faced elevated operational costs related to energy sourcing and environmental compliance, which were gradually passed through the value chain. Limited availability of iodine derivatives in the European region further constrained supply.

During the fourth quarter of 2025, the potassium iodide prices in the United Kingdom reached 57673 USD/MT in December. The market observed price appreciation supported by demand from healthcare and specialty chemical applications. Import dependence for potassium iodide and its feedstocks exposed the market to global supply tightness. Transportation inefficiencies and extended lead times influenced supplier pricing strategies. Market participants adopted conservative inventory approaches, which limited immediate availability in the spot market.

During the fourth quarter of 2025, the potassium iodide prices in China reached 66490 USD/MT in December. The market experienced notable price strength driven by active domestic demand from pharmaceutical and industrial users. Export-oriented supply commitments reduced material availability for local buyers. Environmental oversight and controlled production rates limited output flexibility, while higher input costs influenced producer pricing decisions.

Potassium Iodide Prices Outlook Q3 2025

- USA: USD 58127/MT

- India: USD 64841/MT

- Germany: USD 70900/MT

- United Kingdom: USD 56820/MT

- UAE: USD 63864/MT

During the third quarter of 2025, the potassium iodide prices in the USA reached 58127 USD/MT in September. Price trends during this period were shaped by steady demand from pharmaceutical, nutrition, and industrial processing sectors. Market activity remained influenced by procurement cycles for iodine derivatives, which heightened spot demand for potassium iodide. Supply related pressures were driven by tightened global iodine availability and elevated costs of iodine extraction in major producing countries, which affected downstream pricing.

During the third quarter of 2025, the potassium iodide prices in India reached 64841 USD/MT in September. Market sentiment was shaped primarily by strong consumption from pharmaceutical manufacturers and iodized salt processors. Supply side conditions were impacted by fluctuations in iodine availability from key exporting nations, influencing procurement strategies for domestic producers. Port handling costs and container related freight charges added to overall input costs, particularly for industries reliant on imported iodine.

During the third quarter of 2025, the potassium iodide prices in Germany reached 70900 USD/MT in September. Demand trends were supported by steady activity in chemical processing, healthcare, and additive based industrial applications. Supply dynamics reflected restricted global iodine flow, which continued to influence raw material sourcing costs for domestic producers. Import linked charges, including customs clearances and inland freight, contributed to overall cost pressures.

During the third quarter of 2025, the potassium iodide prices in the United Kingdom reached 56820 USD/MT in September. Market performance was shaped by stable demand from the medical, nutritional supplement, and industrial sectors. Supply dynamics were influenced by procurement challenges due to fluctuating iodine availability in the global market. Import related handling, inland logistics, and warehousing charges added to the delivered cost structures.

During the third quarter of 2025, the potassium iodide prices in the UAE reached 63864 USD/MT in September. Demand conditions were shaped by the industrial chemical, nutrition, and feed additive segments. Supply factors were influenced by dependence on imported iodine, with buyers facing cost adjustments related to freight bookings, port handling charges, and customs processes. Market participants experienced additional price sensitivity due to currency linked cost effects on inbound raw material procurement.

Potassium Iodide Prices Outlook Q2 2025

- USA: USD 56325/MT

- India: USD 63510/MT

- Germany: USD 68635/MT

- United Kingdom: USD 55870/MT

- UAE: USD 61650/MT

During the second quarter of 2025, the potassium iodide prices in the USA reached 56325 USD/MT in June. In the USA, potassium iodide prices were influenced by steady pharmaceutical sector demand, especially from the radiopharmaceutical manufacturing segment. Imports faced logistical bottlenecks due to port congestion, while fluctuations in the iodine feedstock market impacted production costs. Regulatory compliance expenses associated with pharmaceutical-grade certifications added cost pressures. Additionally, procurement from limited domestic suppliers increased competition among buyers, while shifts in industrial usage patterns in the healthcare and chemical processing sectors shaped overall market sentiment.

During the second quarter of 2025, potassium iodide prices in India reached 63510 USD/MT in June. In India, potassium iodide prices were shaped by sustained demand from the pharmaceutical industry, particularly for formulations related to thyroid treatment and radiological protection. Imports were affected by currency volatility, influencing landed costs. Supply chain constraints emerged due to extended lead times from iodine-exporting countries. Seasonal variations in industrial consumption, coupled with competitive sourcing strategies from both domestic manufacturers and traders, further affected price movements. Compliance with updated pharmaceutical-grade standards also influenced production and procurement costs during the quarter.

During the second quarter of 2025, the potassium iodide prices in Germany reached 68635 USD/MT in June. In Germany, potassium iodide prices were impacted by steady orders from the pharmaceutical and chemical sectors, alongside strict adherence to European Union quality and safety regulations. The dependency on iodine imports exposed the market to cost variations linked to changes in global iodine supply conditions. Energy costs, influenced by fluctuations in the regional electricity and natural gas markets, affected manufacturing expenses. Additionally, inventory management strategies among distributors and end users played a role in determining market availability and procurement timelines.

During the second quarter of 2025, the potassium iodide prices in the United Kingdom reached 55870 USD/MT in June. In the United Kingdom, potassium iodide prices were influenced by consistent demand from the pharmaceutical sector and targeted government procurement programs for emergency preparedness. Import costs were sensitive to exchange rate fluctuations and freight charges, particularly from iodine-exporting nations. Regulatory inspection schedules for pharmaceutical manufacturing facilities added to operational costs. The limited number of specialized suppliers heightened market competition, while varying demand patterns in industrial applications also contributed to shifts in procurement strategies.

During the second quarter of 2025, the potassium iodide prices in the UAE reached 61650 USD/MT in June. In the UAE, potassium iodide prices were shaped by demand from the healthcare sector, particularly for emergency stockpiling and diagnostic applications. The market was largely dependent on imports, making prices sensitive to changes in international iodine feedstock availability and global freight rates. Customs clearance procedures and quality certification requirements affected lead times and procurement costs. Additionally, seasonal adjustments in consumption patterns, coupled with strategic buying by major distributors, influenced supply planning and price negotiations in the domestic market.

Potassium Iodide Prices Outlook Q1 2025

- USA: USD 62100/Ton

- India: USD 66500/Ton

- Germany: USD 74200/Ton

- United Kingdom: USD 59500/Ton

- Brazil: USD 65100/Ton

During the first quarter of 2025, potassium iodide prices in the USA reached 62100 USD/Ton in March. Potassium Iodide prices exhibited a dynamic trend driven by tight supply conditions and steady pharmaceutical demand. Logistical disruptions, elevated import costs, and increased procurement activity contributed to the pricing strength observed in the early quarter. Regulatory concerns and tariff-related costs on Asian imports also factored into pricing decisions. Toward the end of the quarter, softening freight rates and easing inventory pressure moderated the upward momentum. Overall, the market reflected cautious optimism amid fluctuating input costs and shifting demand dynamics.

During the first quarter of 2025, potassium iodide prices in India reached 66500 USD/Ton in March. Potassium iodide prices in India remained relatively firm, supported by steady demand from the pharmaceutical and nutraceutical industries. While fluctuations in feedstock availability and transportation costs introduced periodic volatility, domestic production helped maintain supply consistency. Regulatory compliance and environmental controls added to operational expenses, yet pricing remained resilient. Imports faced cost pressures due to currency variations and global freight trends, but strong local consumption provided price support, keeping the market aligned with broader regional dynamics.

During the first quarter of 2025, potassium iodide prices in Germany reached 74200 USD/Ton in March. Potassium iodide prices in Germany experienced moderate fluctuations shaped by rising energy costs and variable pricing of imported raw materials. Demand remained steady from the pharmaceutical and healthcare sectors, which helped offset the impact of global supply chain adjustments. Environmental regulations and compliance costs contributed to production expenses, while currency fluctuations and freight charges influenced overall procurement costs. Despite these pressures, the market maintained relative pricing stability, closely aligned with broader European input cost movements and sustained end-user demand.

During the first quarter of 2025, potassium iodide prices in the United Kingdom reached 59500 USD/Ton in March. Potassium iodide prices in the region exhibited modest fluctuations, primarily driven by variable import costs and fluctuations in global raw material prices. Rising energy and transportation expenses exerted upward pressure on production, while stable demand from pharmaceutical and nutritional supplement sectors supported market stability. Exchange rate fluctuations and shifts in sourcing strategies impacted procurement dynamics. Overall, the market maintained a balanced pricing environment, with rates reflecting a cautious alignment to global input trends and consistent domestic consumption patterns.

During the first quarter of 2025, potassium iodide prices in Brazil reached 65100 USD/Ton in March. Potassium iodide prices in Brazil experienced moderate fluctuations during the first quarter of 2025, influenced by shifts in global raw material costs and changes in international trade dynamics. Rising energy and transportation expenses added to production costs, while demand from the pharmaceutical and food industries remained stable. Currency depreciation and import dependency contributed to periodic price volatility, particularly amid changes in supply routes. Despite these challenges, the domestic market exhibited a cautiously firm outlook, with pricing largely tracking global trends and steady local consumption.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing potassium iodide prices.

Europe Potassium Iodide Price Trend

Q4 2025:

The potassium iodide price index in Europe reflected bullish market conditions supported by structurally tight supply and resilient end-use demand. Pharmaceutical and healthcare sectors continued to procure steadily, ensuring consistent baseline consumption across the region. Limited regional production capacity restricted the ability of suppliers to respond flexibly to demand fluctuations, reinforcing price stability. Stringent environmental regulations and elevated compliance obligations increased operational complexity for manufacturers, further constraining output adjustments.

Q3 2025:

During the third quarter of 2025, the potassium iodide price index in Europe reflected high pricing levels driven by supply constraints and strong downstream requirements. Demand was primarily supported by pharmaceutical, food additive, and industrial chemical applications across major economies. Raw material availability remained influenced by global iodine supply cycles, affecting procurement timelines. Import linked costs, including customs processing, cross-border logistics, and inland distribution, contributed to regional pricing trends.

Q2 2025:

As per the potassium iodide price index, European prices this quarter were influenced by changes in raw material sourcing, particularly in iodine procurement from both domestic and overseas suppliers. The performance of the chemical manufacturing sector shaped overall production volumes, while higher operating costs due to energy market fluctuations added pressure on supply economics. Regulatory compliance costs related to food-grade and pharmaceutical-grade applications also factored into pricing structures. Demand from the pharmaceutical, animal feed, and nutrition supplement sectors was steady, but logistical constraints in certain inland transport corridors affected distribution timelines. Seasonal variations in agricultural demand, especially for iodine-based supplements, also played a role in consumption patterns.

Q1 2025:

In Europe, potassium iodide prices experienced moderate volatility, influenced by varying demand across the pharmaceutical and food sectors, shifting import dynamics, and changes in procurement strategies. Elevated production and freight costs from Asian suppliers added pressure on buyers, while strong export activity and currency fluctuations impacted trade sentiment. Despite short-term inventory adjustments and regional supply chain disruptions, the overall pricing environment remained relatively stable, reflecting a balance between input cost movements and consistent demand from key end-use industries.

This analysis can be extended to include detailed potassium iodide price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Potassium Iodide Price Trend

Q4 2025:

The potassium iodide price index in North America remained strong driven by steady demand from healthcare, pharmaceutical, and diagnostic applications. Consumption levels remained consistent as buyers prioritized supply continuity for regulated end uses. Controlled supply availability, shaped by disciplined production planning and limited excess inventories, contributed to a balanced yet firm market environment. Import dependency for iodine derivatives increased the region’s sensitivity to global sourcing conditions, amplifying the impact of upstream supply tightness on domestic pricing.

Q3 2025:

During the third quarter of 2025, the potassium iodide price index in North America experienced high price levels supported by consistent demand from pharmaceutical and fortified food industries. Supply side pressures were influenced by fluctuating iodine availability in global markets and reliance on imported material. Logistics costs, including port handling fees, inland freight, and warehousing, played a significant role in shaping overall pricing. Buyers also accounted for regulatory compliance requirements for high-purity grades used in sensitive applications. Energy-related operational costs and currency linked variations affected procurement strategies.

Q2 2025:

As per the potassium iodide price index, in North America, potassium iodide prices were impacted by fluctuations in iodine supply from key producing nations, which affected the availability for domestic processing plants. The performance of the pharmaceutical and healthcare sectors remained a significant driver, supported by stable requirements for medical and nutritional uses. Rising freight costs, particularly for containerized imports from Asia and South America, affected landed costs for distributors. Additionally, seasonal procurement patterns from the agricultural and livestock industries influenced demand cycles. Environmental regulations surrounding waste disposal from potassium iodide manufacturing operations added compliance expenses, and weather-related port delays in certain coastal areas temporarily slowed inbound shipments.

Q1 2025:

In North America, potassium iodide prices exhibited notable volatility, driven by a tight supply, strong pharmaceutical demand, and rising freight and import costs. Early quarter gains were supported by a 10% tariff on Chinese imports and higher production costs, fueling bullish sentiment. However, by March, increased supply availability, falling logistics costs, and subdued industrial demand triggered mild price corrections. Despite early strength, the market settled into a cautious outlook, influenced by reduced consumer spending and inventory stabilization across key sectors.

Specific potassium iodide historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Potassium Iodide Price Trend

Q4 2025:

The report explores the potassium iodide trends and potassium iodide price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q3 2025:

Potassium iodide prices in the Middle East and Africa during Q3 2025 were shaped by reliance on imported iodine and strong industrial consumption. Demand remained supported by nutrition, chemical processing, and feed additive industries. Supply conditions were influenced by shipping schedules, freight availability, and customs processes. Logistics costs, including inland trucking and warehousing, played a significant role in delivered pricing. Currency related variations affected import cost management for several countries.

Q2 2025:

As per the potassium iodide price chart, in the Middle East and Africa, with a particular focus on the UAE, potassium iodide pricing was shaped by reliance on imports from Asia and Europe, making landed costs sensitive to freight market dynamics. The food and pharmaceutical sectors were consistent demand drivers, supported by health supplementation programs in the region. Currency exchange shifts against major trading currencies affected import expenses for distributors. In the UAE, strong re-export activity through regional trade hubs maintained a steady flow of product, though delivery schedules were occasionally disrupted by container availability issues. Additionally, storage and warehousing costs in free zones contributed to overall supply chain expenses.

In addition to region-wise data, information on potassium iodide prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Potassium Iodide Price Trend

Q4 2025:

Asia Pacific markets observed upward pricing momentum for potassium iodide, supported by strong demand from pharmaceutical manufacturing, specialty chemicals, and industrial applications. Several producing countries maintained controlled production rates, limiting supply growth despite sustained consumption. Export commitments to international markets further tightened domestic availability, particularly for high-purity grades. Logistical inefficiencies, including regional transportation constraints and distribution bottlenecks, affected supply flow and reinforced price firmness.

Q3 2025:

During Q3 2025, potassium iodide prices in the Asia Pacific were shaped by steady consumption from pharmaceutical, nutrition, and industrial chemical sectors. Supply conditions varied across the region due to differences in iodine procurement channels. Import-related freight rates, port congestion in certain economies, and inland logistics contributed to cost structures. Currency movements against the USD affected import dependent markets. These elements supported stable to firm pricing across the Asia Pacific throughout the quarter.

Q2 2025:

In the Asia Pacific region, potassium iodide prices were influenced by variations in iodine extraction output, particularly from major producers in Northeast Asia. The pharmaceutical manufacturing sector maintained high purchasing activity, while expanding food fortification programs in certain countries supported additional demand. Currency movements against the US dollar affected the cost of imports for non-producing nations. Port congestion in select Southeast Asian hubs and rising domestic trucking charges influenced distribution costs. Furthermore, increased competition for iodine from industrial chemical applications constrained raw material availability for potassium iodide production. Seasonal procurement cycles in livestock feed and aquaculture also added short-term demand fluctuations.

Q1 2025:

In the Asia-Pacific region, potassium iodide prices displayed moderate fluctuations, influenced by shifting trade policies, seasonal production slowdowns, and elevated input costs. Strong U.S. procurement early in the quarter supported prices, while rising freight and logistical delays added further pressure. However, by quarter-end, softening demand, higher production activity, and inventory buildup led to price corrections. Despite short-term volatility, prices largely reflected regional imbalances between constrained early supply and later surplus, amid subdued momentum in pharmaceutical and nutraceutical exports.

This potassium iodide price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Potassium Iodide Price Trend

Q4 2025:

Latin America's potassium iodide market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in potassium iodide prices.

Q3 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the potassium iodide price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing potassium iodide pricing trends in this region.

Q1 2025:

In Latin America, potassium iodide prices remained relatively stable, supported by steady demand from the pharmaceutical and food sectors. Market activity remained consistent in countries like Brazil and Argentina, with limited supply-side disruptions. Minor fluctuations were noted due to changes in global iodine availability and import-related costs. Energy and logistics expenses had a slight impact on pricing, but overall sentiment remained firm. The regional pricing environment reflected stable consumption patterns aligned with public health initiatives and pharmaceutical manufacturing requirements.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Potassium Iodide Pricing Report, Market Analysis, and News

IMARC's latest publication, “Potassium Iodide Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the potassium iodide market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of potassium iodide at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed potassium iodide prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting potassium iodide pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Potassium Iodide Industry Analysis

The global potassium iodide market size reached USD 1,087.84 Million in 2025. By 2034, IMARC Group expects the market to reach USD 1,837.89 Million, at a projected CAGR of 6.00% during 2026-2034. The market is primarily driven by the expanding pharmaceutical applications, rising demand for nutritional fortification, growing utilization in industrial chemical processes, increasing need for iodine-based health supplements, and steady consumption from food and feed additive sectors.

Latest News and Developments:

- October 2025: The Delaware Emergency Management Agency (DEMA), along with the Delaware Division of Public Health (DPH, launched a public safety initiative to distribute free potassium iodide (KI) tablets to residents living within a 10-mile radius of the Salem/Hope Creek nuclear facilities. This move is part of the state’s proactive emergency preparedness plan aimed at protecting public health in the event of a radiological incident. The KI tablets, which help block radioactive iodine from being absorbed by the thyroid gland, were available at designated pickup locations across the state.

Product Description

Potassium iodide (KI) is an inorganic compound composed of potassium (K) and iodine (I), typically appearing as a white, crystalline salt. It is highly soluble in water and commonly used in a wide range of pharmaceutical, industrial, and nutritional applications. In the medical field, potassium iodide is used as a thyroid-protective agent during nuclear radiation emergencies by blocking radioactive iodine uptake.

It is also prescribed for treating overactive thyroid conditions and as an expectorant in respiratory treatments. In nutrition, it serves as a key source of iodine in iodized salt. Industrially, potassium iodide finds use in photographic processing, chemical synthesis, and analytical chemistry. Its stability, ease of storage, and effectiveness make it a vital compound across multiple sectors.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Potassium Iodide |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Potassium Iodide Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of potassium iodide pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting potassium iodide price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The potassium iodide price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)