Precious Metals Market Size, Share, Trends and Forecast by Metal Type, Application, and Region, 2025-2033

Precious Metals Market 2024, Size and Trends:

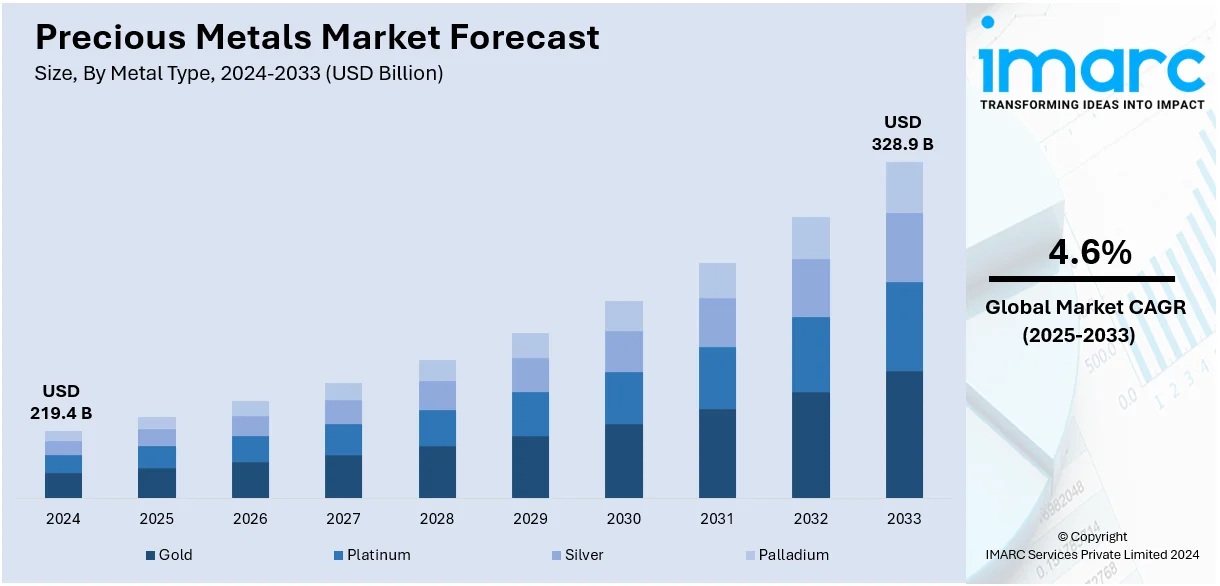

The global precious metals market size was valued at USD 219.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 328.9 Billion by 2033, exhibiting a CAGR of 4.6% from 2025-2033. Asia Pacific currently dominates the precious metals market share, due to the inflating investments in precious metals, increasing utilization of precious metals in a variety of industrial applications, and the extensive utilization of these metals for minting coins.

Precious Metals Market Insights:

- Investment demand increases as safe-haven assets become a favorite among investors across the world.

- Asia Pacific dominates market owing to jewelry and industrial applications demand.

- Gold leads sector, aided by ETFs and central bank reserves.

- Jewelry industry leads growth due to cultural significance and increased disposable incomes.

- Industrial consumption rises in electronics, automobile, and renewable energy industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 219.4 Billion |

|

Market Forecast in 2033

|

USD 328.9 Billion |

| Market Growth Rate (2025-2033) | 4.6% |

A major driver in the precious metals market is the increasing demand for investment, particularly during times of economic uncertainty. Precious metals, like gold and silver, are considered safe-haven assets that investors flock to when there are concerns about inflation, currency devaluation, or global instability. With the volatility in traditional markets, precious metals provide a hedge against market fluctuations. This trend is further amplified by the rising popularity of exchange-traded funds (ETFs) and other investment vehicles that make it easier for investors to gain exposure to these metals, boosting their market demand.

To get more information on this market, Request Sample

The U.S. plays a pivotal role in the precious metals market as both a major consumer and investor. Gold and silver are popular investment assets, commonly utilized to hedge against inflation and economic downturns. In recent weeks, gold prices have been affected by the Federal Reserve's stance on its monetary policy-easing cycle. As of December 20, spot gold was priced at $2,596.89 per ounce, marking a 2% decline for the week. Meanwhile, U.S. gold futures rose 0.1% to $2,611.30, with market focus shifting to the upcoming U.S. Personal Consumption Expenditure (PCE) data. The U.S. precious metals market trends are driven by strong demand for physical metals like coins and bars, as well as financial products such as ETFs and futures, alongside significant mining operations that influence global supply. Federal Reserve policies continue to significantly impact precious metals prices.

Precious Metals Market Trends:

Inflating investments in precious metals

The inflating investments in precious metals, including gold and silver, due to their scarcity and ability to maintain their value for a long time, are impacting the precious metals market statistics. Moreover, the increasing adoption of gold among major investors as a safe haven in times of geopolitical tensions and economic uncertainty is expected to further support the growth of the market in the near future. It gave an example of the release made by Barrick Gold regarding the extended period of mine life for the project of gold in Tongon, Côte d'Ivoire. The continued positive results from exploration and mining activities of gold, within the Nielle permit area, led to making a decision. The mine project that was opened in 2010 and was scheduled for its closure in 2021, filed a document that allowed the mine to run from 2021 up to 2026.

More usage in jewelry and decorative items

The increasing usage of precious metals in the manufacture of different forms of jewelry and ornaments, including rings, bracelets, necklaces, etc., due to their beauty and durability is fueling the precious metals market revenue. In addition to this, the changing consumer preferences towards the latest trends in designs and styles are also enhancing the precious metals market growth further. Besides, inflating disposable incomes of individuals, especially from emerging economies, and the emergence of new and advanced jewelry developed by the leading players in the market are driving up the demand for precious metals. For instance, the import of precious metals sharply increased as per the reports of the U.S. Census Bureau. Apart from this, the gold and silver alloys are heavily used in the plated jewelry sector to create intermediate coatings that provide good corrosion resistance. In addition, the U.S. consumer disposable income has grown at a high rate from USD 16.54 Trillion to USD 17.26 Trillion.

Supply and demand trends

Demand and supply are constantly fluctuating with a variety of factors including recycling rates, mining outputs, central bank buying, investment and jewelry demand driving precious metals market demand very positively. As a result of these factors, trends in the mining sector are impacted by concerns of the environment and sustainability. For example, the statistics published by the United States Geological Survey (USGS) had estimated the total production of precious metals in the U.S. to be at around 1,195.6 tons. Among that, gold production was achieved at nearly 200 tons and some 15.6 tons of platinum group metals were produced. PGM was mined in Montana by Sibanye-Stillwater, which is the only company producing PGM in the U.S. Moreover, according to the United States Geological Survey, Mexico’s silver production was 6,300 metric tons, followed by Peru at 3,100 metric tons.

Precious Metals Market Opportunities:

The precious metals market presents promising opportunities as global investors seek for safe-haven assets in times of economic uncertainty, inflationary pressures, and currency volatility. Gold and silver are especially favored for their value-preservation ability, with both institutional and retail investors targeting the two metals. The advent of financial products like gold-backed exchange-traded funds and digital platforms has further enhanced accessibility and liquidity. Furthermore, increasing industrial usage of precious metals across industries—such as electronics, automotive, and clean energy— which offer long-term growth opportunities. With sustainability gaining prominence, advances in recycling and sustainable mining techniques could similarly further market credibility and create new streams of revenue. Additionally, enhanced disposable incomes and culture-driven demand in emerging markets sustain strong jewelry industry demand. As central banks and governments build strategic metal stockpiles, especially in the Asia Pacific, the market can gain from a continued and diversified demand by sectors and geographies.

Precious Metals Market Challenges:

Despite recent gains, the precious metals market is confronted with a number of challenges that can affect its growth path. Price uncertainty, which is usually fueled by geopolitical developments, exchange rate movements, and interest rate changes, may discourage end-users as well as investors. Besides that, regulatory environments pertaining to mining activities are tightening as a result of environmental issues, which may disrupt supply chains and drive up the cost of production. In addition, the market is responsive to monetary policy, particularly from large economies such as the United States; actions by central banks can have a direct effect on investment into precious metals. Technological alternatives and innovations, particularly in industry, can also diminish reliance on classical precious metals. In addition, high barriers to entry and supply chain complicacies can restrict participation in emerging markets. Although the new investment vehicles promote access, they could also be an impetus to speculative trading activity that is destabilizing to prices. Meeting these issues on transparency, sustainability, and regulatory compliance will be critical to ensuring long-term market viability.

Precious Metals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global precious metals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on metal type and application.

Analysis by Metal Type:

- Gold

- Jewelry

- Investment

- Technology

- Others

- Platinum

- Auto-catalyst

- Jewelry

- Chemical

- Petroleum

- Medical

- Others

- Silver

- Industrial Application

- Jewelry

- Coins and Bars

- Silverware

- Others

- Palladium

- Auto-catalyst

- Electrical

- Dental

- Chemical

- Jewelry

- Others

Gold stands as the largest component in 2024, due to its enduring status as a safe-haven asset. Economic uncertainties, such as inflationary pressures, geopolitical tensions, and fluctuating financial markets, drive investors toward gold as a store of value. As a safeguard against currency devaluation, central banks, especially in emerging markets, are steadily increasing their gold reserves. Furthermore, the rise of gold-backed financial products, including exchange-traded funds (ETFs), has enhanced its accessibility for retail investors. The ongoing demand for gold in jewelry, electronics, and other industries also contributes to its dominant position. As a result, gold’s resilience amid market volatility ensures it remains the key player in the precious metals sector throughout 2024.

Analysis by Application:

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

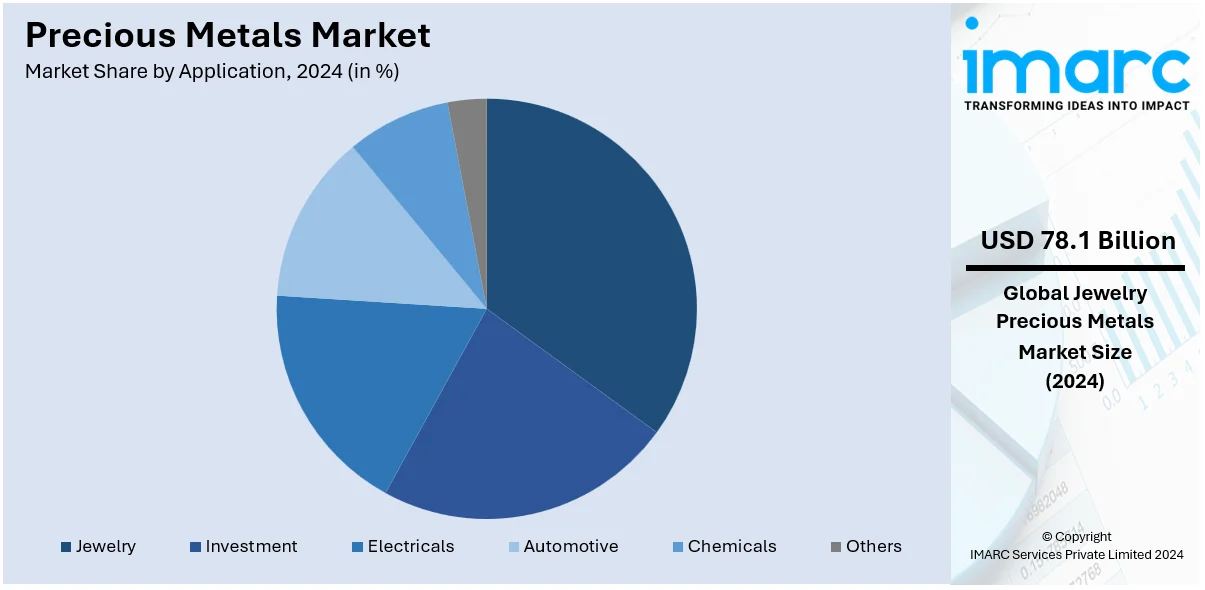

Jewelry leads the precious metals market outlook in 2024, driven by cultural significance, rising disposable incomes, and growing demand in emerging markets. Gold, silver, and platinum are preferred metals for crafting jewelry, as they symbolize wealth, prestige, and tradition. In regions like India and China, where jewelry holds strong cultural value, the demand is particularly robust. The global middle class's expansion has also fueled consumption, with more consumers seeking luxury and fashion-forward jewelry. The sector has also been further fueled by technological advancements in jewelry design and the growing demand for personalized pieces. The sustained growth of the jewelry segment continues to drive the demand for precious metals, positioning it as the dominant force in the market.

Analysis by Region:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share, driven by strong demand across key sectors such as jewelry, investment, and industrial applications. Countries like China and India are major consumers of gold and silver, particularly in jewelry, where cultural significance and rising disposable incomes contribute to high consumption rates. The growing APAC middle class also places a growing demand on precious metals, as more people within this demographic invest in the yellow metal as a hedge against increasing economic uncertainty. Industrial-related applications in electronics, auto, and renewable energy further grow the demand for precious metals. Central banks in APAC are also building their gold reserves, further cementing the region in the global market.

Key Regional Takeaways:

North America Precious Metals Market Analysis

In 2024, North America holds a significant share in the precious metals market, driven primarily by the U.S., which is a major consumer and investor in gold, silver, and platinum. Gold remains the dominant precious metal in the region, particularly as a safe-haven investment during economic uncertainty and inflationary pressures. Rising interest in gold-backed financial products like ETFs further boosts demand. Additionally, the U.S. jewelry market continues to be a key driver, with both luxury and fashion segments increasing their consumption of gold and platinum. The industrial demand for silver also plays a vital role, with its applications in electronics, solar energy, and automotive sectors contributing to market growth. Central banks, especially in the U.S., continue to hold substantial reserves, influencing the precious metals market. The region’s regulatory environment, stable financial systems, and affluent population solidify North America's pivotal position in the global precious metals market in 2024.

United States Precious Metals Market Analysis

There is a convergence of industrial, investment, and economic drivers pushing the U.S. precious metals market. Of course, since well over half of the market, gold is highly sought after as a safe haven for investment during times of tough economic realities. According to statistics provided by the World Gold Council, the United States has been ranked as the third largest country in terms of gold consumption as of 2023. The average demand stands at more than 235 metric tons. The country also consumes 0.77 grammes of gold per capita, which is mainly for investment and jewelry purposes. Industrial applications are important to support the surge of photovoltaic industries in utilizing silver. Additionally, in response to stringent pollution requirements, the consumption of palladium and platinum has risen for catalytic converters. According to an industrial report, jewellery still accounts for around 35% of demand, which is increasingly being met with products made from materials that are sourced in an ethical and sustainable manner. Domestic mineral and metal exports from the US rose USD 29.2 Billion (28.9%) to USD 130.2 Billion in 2021, according to data from the US International Trade Commission, and demand is also driven by the push for strategic metal reserves.

Europe Precious Metals Market Analysis

Demand for the precious metals industry in Europe comes from investments, industrial purposes, and sustainability needs. There was a huge demand for gold in Europe in 2023 due to changes in the economy and rising geo-political tensions, mainly because Germany was the biggest consumer. Germany consumes, according to World Gold Council, an average of 178.5 metric tonnes of gold per year or 2.36 grams per person. Programs such as the Green Deal in the European Union supported a rise of 15% in the use of silver in electronics and renewable energy. Over 60% of the consumption of palladium and platinum is in catalytic converters; thus, PGMs are critical to the automobile industry. Demand for jewelry is high in luxury good-producing countries like France and Italy, especially in the forms of gold and platinum. The region is also witnessing an increased demand for recycled precious metals due to a significant market supply coming from recycling programs, hence sustainability.

Asia Pacific Precious Metals Market Analysis

In 2023, the Asia-Pacific region will account for more than half of the world's demand for precious metals, hence making it the largest market, as per an industrial report. India and China remain two of the top most significant consumers of gold. Between these two countries, it remains an ongoing trend from way back in 2010 as well as continuing well through 2022 as highlighted in the World Gold Council; Indians and Chinese also used 824.9 and 774 metric tonnes of gold, respectively to either invest or for their various jewelleries. Jewelry sales in India are growing 20% per year, driven by an expanding middle class and the nation's cultural affinity for gold. Industrial use of silver has grown 25% over the past three years, particularly in the electronics industries of South Korea and Japan. Platinum demand in China is high and related to its use in hydrogen fuel cells, supporting the nation's renewable energy ambitions. Such gold reserves and imports in countries such as Vietnam and Indonesia create the support for the market.

Latin America Precious Metals Market Analysis

High mining output and ever-increasing local demand are mainly contributing to the precious metal business in Latin America. This region accounts for well over 40% of global silver production, as per an industry report. Mexican is the world's highest silver producer, according to statistics. The country produced 5,600 metric tonnes in 2021. Sources indicate that Brazil's gold mine production in 2022 accounted for around 57 metric tonnes of metal content. Peru is another significant mining country in the region. There has been a very high local demand for gold jewelry and investment in recent times, especially in the metropolitan markets. With growing solar energy throughout the region, particularly in Chile and Brazil, industrial usage of silver for photovoltaic cells is increasing. Government support to extract and refine precious metals is another driver to increase industry output.

Middle East and Africa Precious Metals Market Analysis

Mining activity in the Middle East and Africa is highly intense, along with an equally high demand for gold jewellery. Saudi Arabia consumes the most gold in the Middle East, averaging 220 metric tonnes per year, according to figures from the World Gold Council. With an average gold consumption of 39.8 metric tonnes, the United Arab Emirates is another major Middle Eastern gold consumer. More significant, however, is that the UAE consumes 5.24 grammes of gold per person, which is the second-highest amount in the world. South Africa, producing 75% of the world's platinum, is the biggest producer of platinum group metals, which are required in industry. The rising infrastructures and disposable incomes among the people of Gulf Cooperation Council (GCC) countries also increase the demand for precious metals in luxury goods and construction.

Competitive Landscape:

The competitive landscape of the precious metals market in 2024 is characterized by several key players, including mining companies, refiners, and financial institutions. Leading mining corporations invest heavily in exploration and advanced mining technologies to maintain their market share. Additionally, precious metals refining firms play a crucial role in processing and distributing metals globally. Financial institutions contribute significantly to market dynamics by offering easy access to precious metal investments. Competition is further heightened by rising demand in emerging markets, driving innovation in both physical and digital investment products. Strategic partnerships, mergers, and acquisitions are common as companies seek to expand production and enhance their market presence amid fluctuating commodity prices.

The report provides a comprehensive analysis of the competitive landscape in the precious metals market with detailed profiles of all major companies, including:

- Anglo American Platinum Limited

- AngloGold Ashanti

- Barrick Mining Corporation

- First Majestic Silver Corp

- Freeport-McMoRan

- Fresnillo Plc

- Gold Fields Limited

- Harmony Gold Mining Company Limited

- Kinross Gold Corporation

- Newmont Corporation

- Pan American Silver Corp.

- PJSC Polyus

- Randgold & Exploration Company Limited

Latest News and Developments:

- In December 2024, Delaware Depository, a provider of precious metals and securities custody services, has announced the expansion of its operations with the opening of a new facility in Pennsylvania. This calculated action attempts to increase its service capacity by providing safe storage options and meeting the rising demand for custody services for precious metals.

- In March 2024, the upcoming FOMC meeting with new dot plots for U.S. interest rates and Iranian parliamentary elections made March a pivotal month for the yellow metal, according to the latest gold market commentary from the World Gold Council (WGC).

- In November 2023, Sibanye-Stillwater signed an agreement with the Reldan, a U.S. metal recycler, as part of an acquisition plan. Reldan is a Pennsylvania recycling group, which reprocesses diverse waste streams ranging from industrial and electronic to extract precious green metals such as platinum and palladium.

- In October 2023, Anglo-American collaborated with BMW Group South Africa and Sasol South Africa Limited. Under the collaboration agreements, BMW will provide the hydrogen fuel-cell electric vehicles (FCEVs), Sasol will supply the green hydrogen and mobile refueler, and Anglo American will provide platinum group metals (PGMs) used in FCEVs.Anglo-American.

Precious Metals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Metal Types Covered |

|

| Applications Covered | Jewelry, Investment, Electricals, Automotive, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anglo American Platinum Limited, AngloGold Ashanti, Barrick Mining Corporation, First Majestic Silver Corp, Freeport-McMoRan, Fresnillo Plc, Gold Fields Limited, Harmony Gold Mining Company Limited, Kinross Gold Corporation, Newmont Corporation, Pan American Silver Corp., PJSC Polyus, Randgold & Exploration Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the precious metals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global precious metals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the precious metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Precious metals are rare, valuable metals typically used for investment, jewelry, and industrial purposes. The most well-known precious metals include gold, silver, platinum, and palladium. They are prized for their scarcity, durability, and unique properties, making them essential in various sectors, including finance, manufacturing, and technology.

The precious metals market was valued at USD 219.4 Billion in 2024.

IMARC estimates the global precious metals market to exhibit a CAGR of 4.6% during 2025-2033, reaching a value of USD 328.9 Billion by 2033.

Key factors driving the global precious metals market include economic uncertainty, inflation hedging, rising investment demand, cultural significance in jewelry, industrial applications in electronics and renewable energy, and central bank purchases.

In 2024, gold represented the largest segment by metal type, driven by its investment demand, cultural value, and industrial applications.

Jewelry leads the market by application owing to high demand, cultural significance, and luxury consumption, particularly in regions like Asia.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global precious metals market include Anglo American Platinum Limited, AngloGold Ashanti, Barrick Mining Corporation, First Majestic Silver Corp, Freeport-McMoRan, Fresnillo Plc, Gold Fields Limited, Harmony Gold Mining Company Limited, Kinross Gold Corporation, Newmont Corporation, Pan American Silver Corp., PJSC Polyus, Randgold & Exploration Company Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)